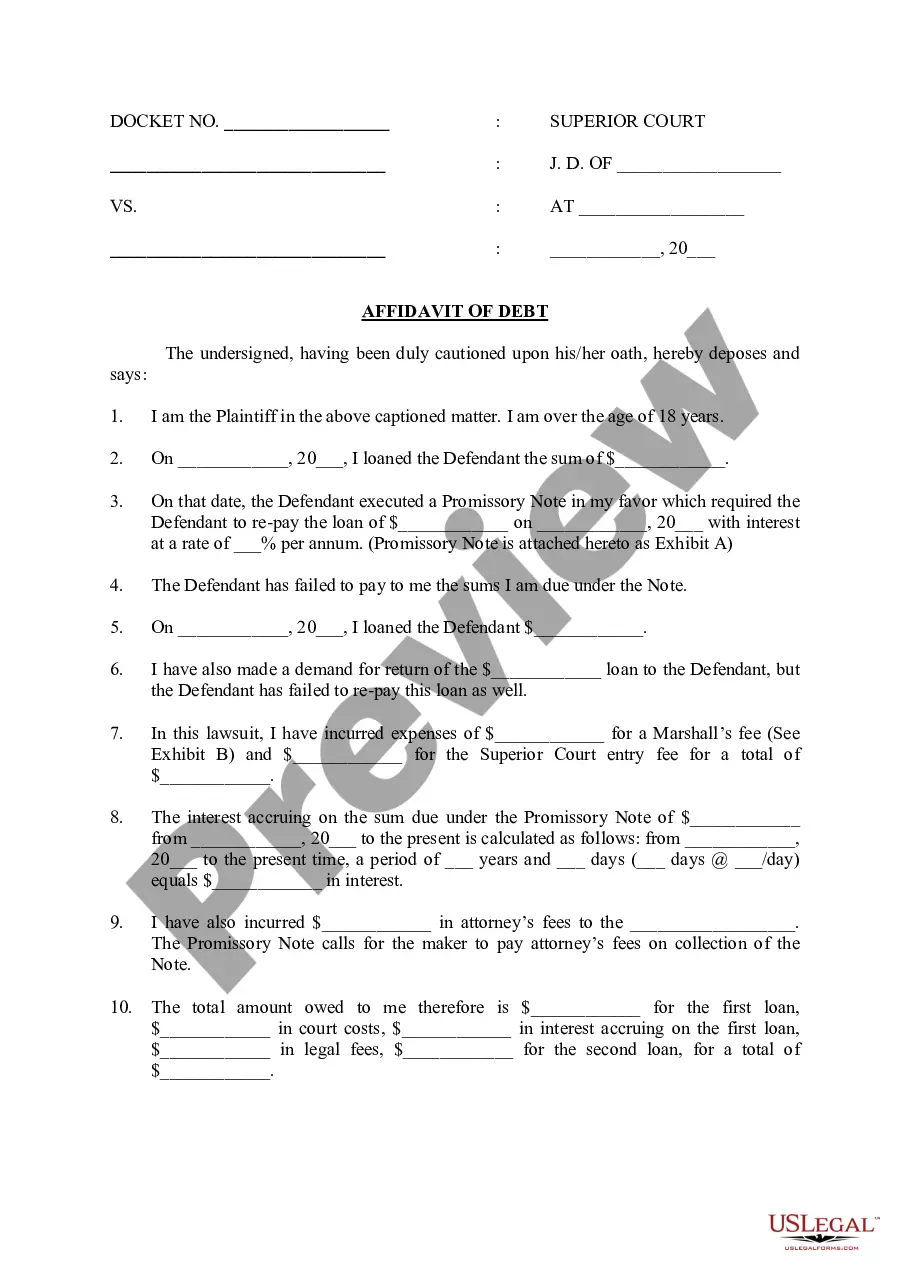

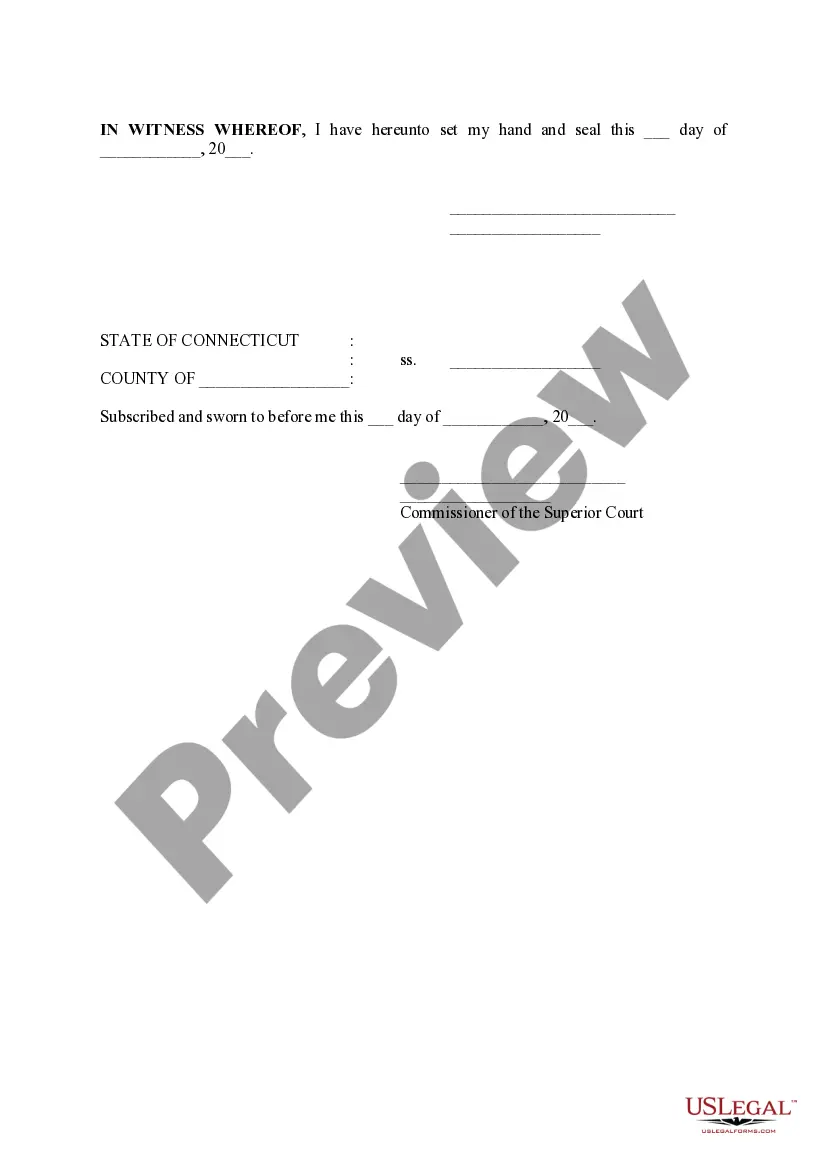

The Bridgeport Connecticut Affidavit of Debt is a legal document used in the state of Connecticut to establish and provide evidence of a debt owed by an individual or entity. This affidavit is an important tool in debt collection processes, providing concrete details regarding the owed amount and the debtor's information. It is crucial to understand the different types of Bridgeport Connecticut Affidavits of Debt to best navigate the legal system. Here are some key types: 1. Personal Debt Affidavit: This type of affidavit is used when an individual owes money to another individual or organization. It includes details such as the debtor's name, contact information, amount owed, and any supporting evidence to validate the claim. 2. Business Debt Affidavit: In cases where a business entity is involved, this affidavit serves as proof of debt owed by one business to another or by an individual to a business. It includes the debtor's information, the amount owed, relevant invoices, purchase orders, or any other supporting documents. 3. Medical Debt Affidavit: Relevant for medical professionals and patients, this affidavit is used to establish a debt owed for medical services rendered. It contains information such as the patient's name, contact details, treatment provided, medical bills or invoices, and any insurance claims. 4. Student Loan Debt Affidavit: This type of affidavit is specific to student loans and is often used by lenders or loan servicing companies to establish and seek repayment of outstanding student loan debts. It typically includes the borrower's details, loan amount, repayment terms, and any relevant promissory notes. 5. Mortgage Debt Affidavit: A common type of affidavit is the mortgage debt affidavit used by banks, lending institutions, or mortgage services in cases where a homeowner has defaulted on their mortgage payments. It outlines the amount owed, past due amounts, foreclosure proceedings if applicable, and any relevant loan agreements or mortgage documents. 6. Credit Card Debt Affidavit: When an individual fails to repay their credit card debts, credit card companies or debt collection agencies may utilize this type of affidavit to establish and pursue the outstanding debt. It includes the cardholder's details, accrued balance, interest charges, and supporting credit card statements. 7. Vehicle Loan Debt Affidavit: In situations where an individual or a business entity owes money for a vehicle loan, this affidavit is used to establish the outstanding debt. It typically includes the borrower's information, loan amount, repayment terms, any relevant documents such as loan agreements or vehicle titles, and details of any missed or late payments. Overall, the Bridgeport Connecticut Affidavit of Debt is a crucial legal document used to provide evidence and validate outstanding debts in various contexts. It is essential to consult with legal professionals or debt collection agencies in Bridgeport, Connecticut, to ensure compliance with local laws and procedures when dealing with such affidavits.

Bridgeport Connecticut Afidavit of Debt

Description

How to fill out Bridgeport Connecticut Afidavit Of Debt?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Bridgeport Connecticut Afidavit of Debt gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Bridgeport Connecticut Afidavit of Debt takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Bridgeport Connecticut Afidavit of Debt. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!