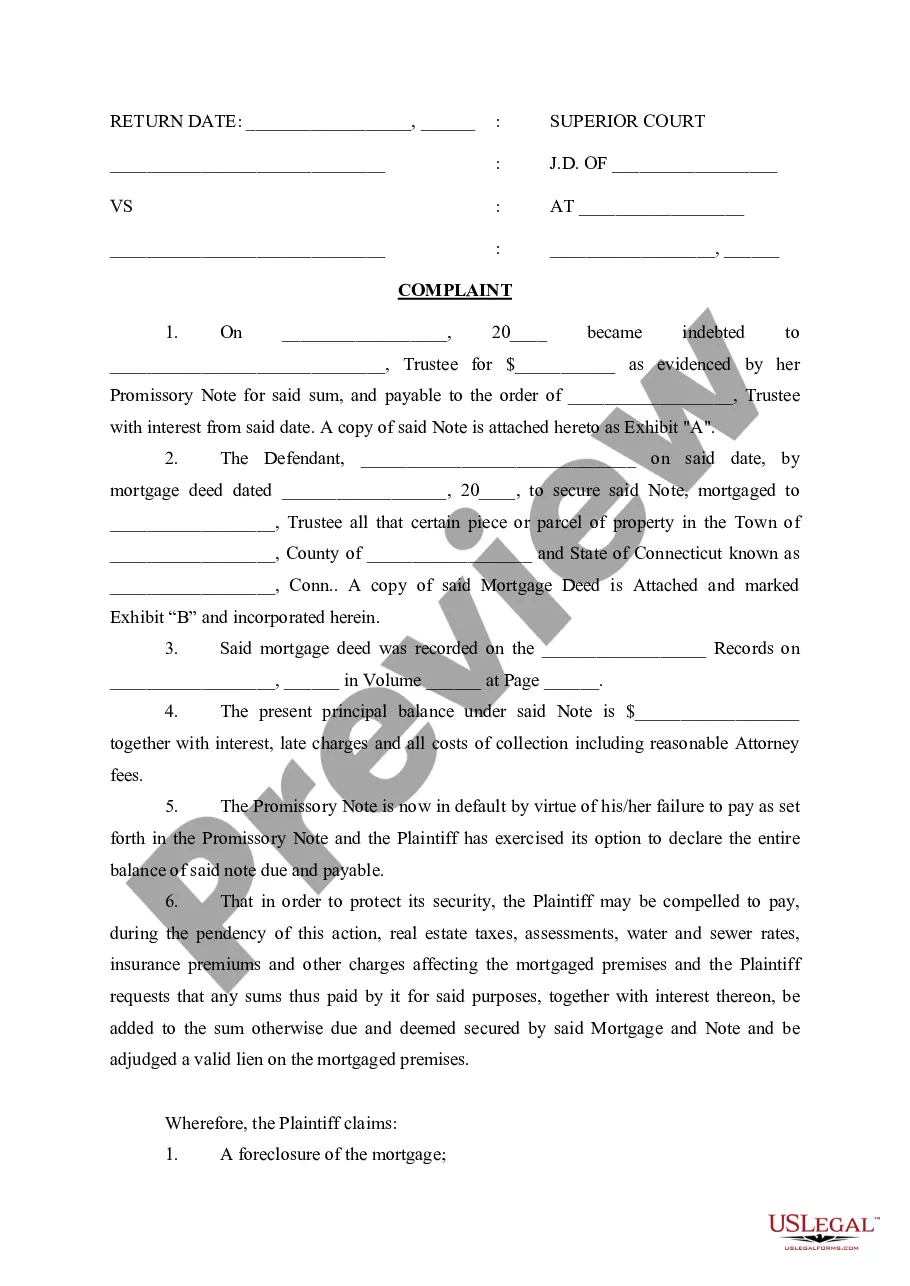

Bridgeport Connecticut Complaint (Default of Promissory Note) is a legal process that occurs when a borrower fails to repay the amount owed under the terms of a promissory note in Bridgeport, Connecticut. This complaint is typically filed by the lender or the holder of the promissory note seeking remedies for the default. A promissory note is a legal document that outlines the terms of a loan, including repayment terms, interest rates, and the consequences of default. When a borrower fails to make timely repayments or completely defaults on the loan, the lender or note holder can initiate legal action in the form of a complaint in the Bridgeport, Connecticut court system. The Bridgeport Connecticut Complaint (Default of Promissory Note) can have various types, depending on the specific circumstances of the default. Some common types of complaints related to default on promissory notes include: 1. Complaint for Breach of Contract: This type of complaint alleges that the borrower's failure to repay the promissory note is a breach of contract. It seeks remedies such as the repayment of the outstanding loan amount, interest, and any associated costs incurred by the lender. 2. Complaint for Money Owed: In this type of complaint, the lender or note holder seeks repayment of the outstanding loan amount, interest, and costs. It focuses on the borrower's obligation to repay the debt incurred through the promissory note. 3. Complaint for Foreclosure: When the promissory note is secured by a mortgage or deed of trust, the lender may file a complaint for foreclosure when the borrower defaults. This complaint aims to force the sale of the property securing the loan in order to recover the outstanding balance. 4. Complaint for Damages: If the borrower's default resulted in additional financial losses for the lender, such as collection costs or attorney fees, the lender may file a complaint seeking damages. This type of complaint aims to recover the additional expenses incurred due to the borrower's default. In Bridgeport, Connecticut, the complaint process typically involves the lender or note holder filing the complaint with the appropriate court and serving the borrower with a copy of the complaint. The borrower then has an opportunity to respond to the complaint and present any defenses or counterclaims. It is important for both parties involved in a Bridgeport Connecticut Complaint (Default of Promissory Note) to seek legal advice from an attorney experienced in debt collection and foreclosure matters. Understanding the specific terms of the promissory note and local laws governing the complaint process is crucial for a successful resolution.

Bridgeport Connecticut Complaint (Default of Promissory Note)

Description

How to fill out Bridgeport Connecticut Complaint (Default Of Promissory Note)?

We always strive to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, as a rule, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Bridgeport Connecticut Complaint (Default of Promissory Note) or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Bridgeport Connecticut Complaint (Default of Promissory Note) complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Bridgeport Connecticut Complaint (Default of Promissory Note) would work for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!