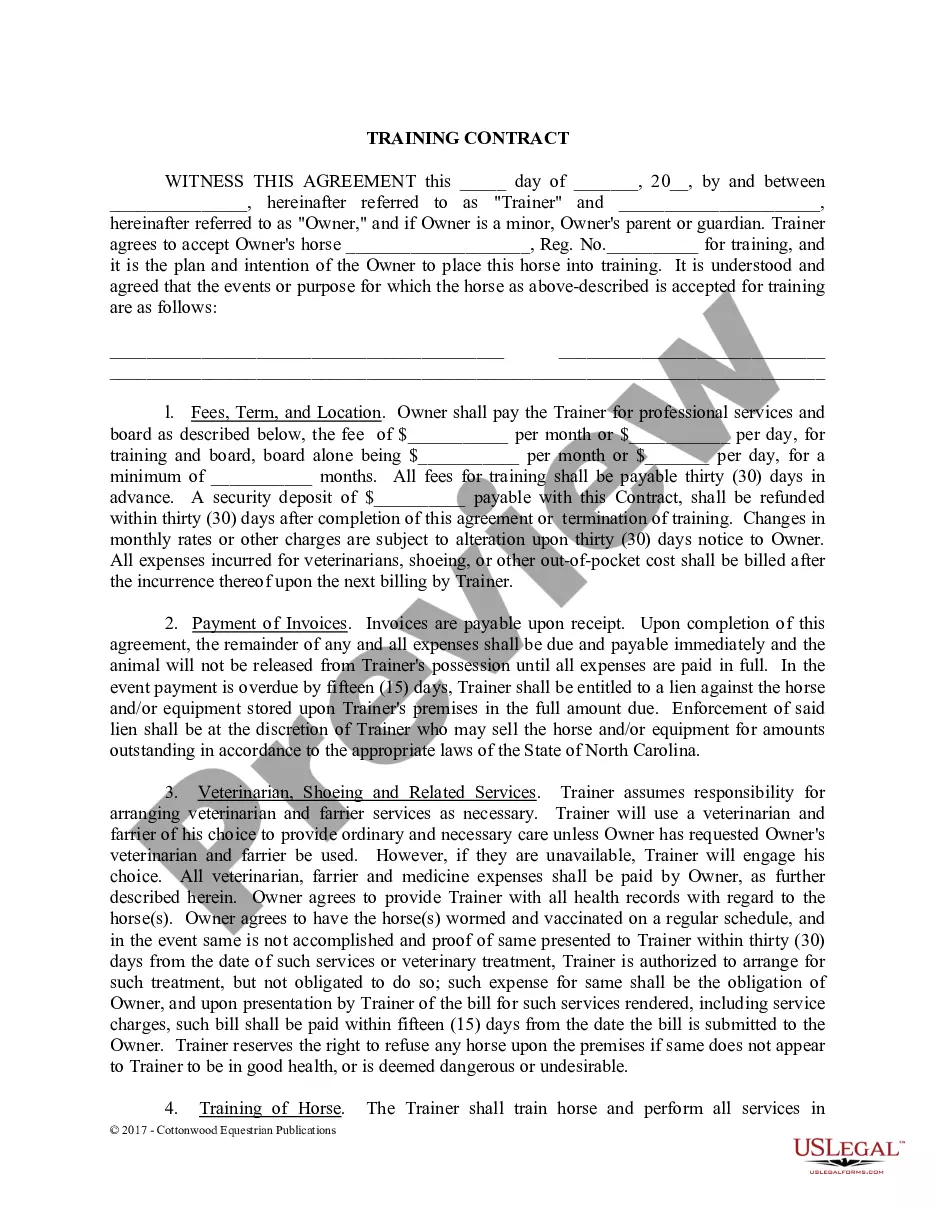

Stamford Connecticut Complaint (Default of Promissory Note) refers to a legal action taken by a lender against a borrower who has failed to meet the terms and conditions of a promissory note. In Stamford, Connecticut, this type of complaint is used when individuals or entities have defaulted on their obligations to repay a loan outlined in a promissory note. A promissory note is a legal document that outlines the terms of a loan, including the amount borrowed, repayment schedule, interest rate, and other relevant information. When a borrower fails to repay the loan as per the agreed-upon terms, the lender can file a Stamford Connecticut Complaint (Default of Promissory Note) to seek legal recourse. The complaint typically includes a detailed account of the borrower's failure to make timely payments, the amount still owed, and any additional charges incurred due to the default. It may also outline the consequences of the default, such as the acceleration of the loan, leading to the immediate repayment of the entire remaining balance. There can be different types of Stamford Connecticut Complaints (Default of Promissory Note) based on the specific circumstances of the case. Some common types include: 1. Individual Borrower Default: This type of complaint is filed when an individual borrower fails to adhere to the terms of a promissory note, leading to their default on the loan. 2. Business Entity Default: When a business entity, such as a corporation or LLC, is unable to fulfill its obligations outlined in a promissory note, the lender can file a complaint against the entity for defaulting on the loan. 3. Student Loan Default: Stamford Connecticut Complaints (Default of Promissory Note) can also pertain to student loans where borrowers fail to make the required payments, triggering a default according to the terms of the promissory note. 4. Mortgage Loan Default: In cases where a borrower defaults on a mortgage loan, the lender can file a Stamford Connecticut Complaint to seek legal remedies, including foreclosure proceedings. 5. Personal Guarantee Default: When an individual provides a personal guarantee for a loan, guaranteeing repayment, and subsequently defaults, a complaint can be filed to hold them accountable for their obligations. Regardless of the specific type of Stamford Connecticut Complaint (Default of Promissory Note), it is crucial for lenders and borrowers to seek legal counsel to navigate the complexities of such cases.

Stamford Connecticut Complaint (Default of Promissory Note)

Description

How to fill out Stamford Connecticut Complaint (Default Of Promissory Note)?

If you’ve previously availed yourself of our service, Log In to your account and store the Stamford Connecticut Complaint (Default of Promissory Note) on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have permanent access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to use it again. Leverage the US Legal Forms service to swiftly find and save any template for your personal or professional usage!

- Confirm you’ve located an appropriate document. Browse through the description and use the Preview feature, if available, to verify if it suits your needs. If it doesn’t align with your requirements, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and complete the payment. Use your credit card information or the PayPal method to finish the purchase.

- Receive your Stamford Connecticut Complaint (Default of Promissory Note). Choose the file format for your document and save it to your device.

- Complete your sample. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

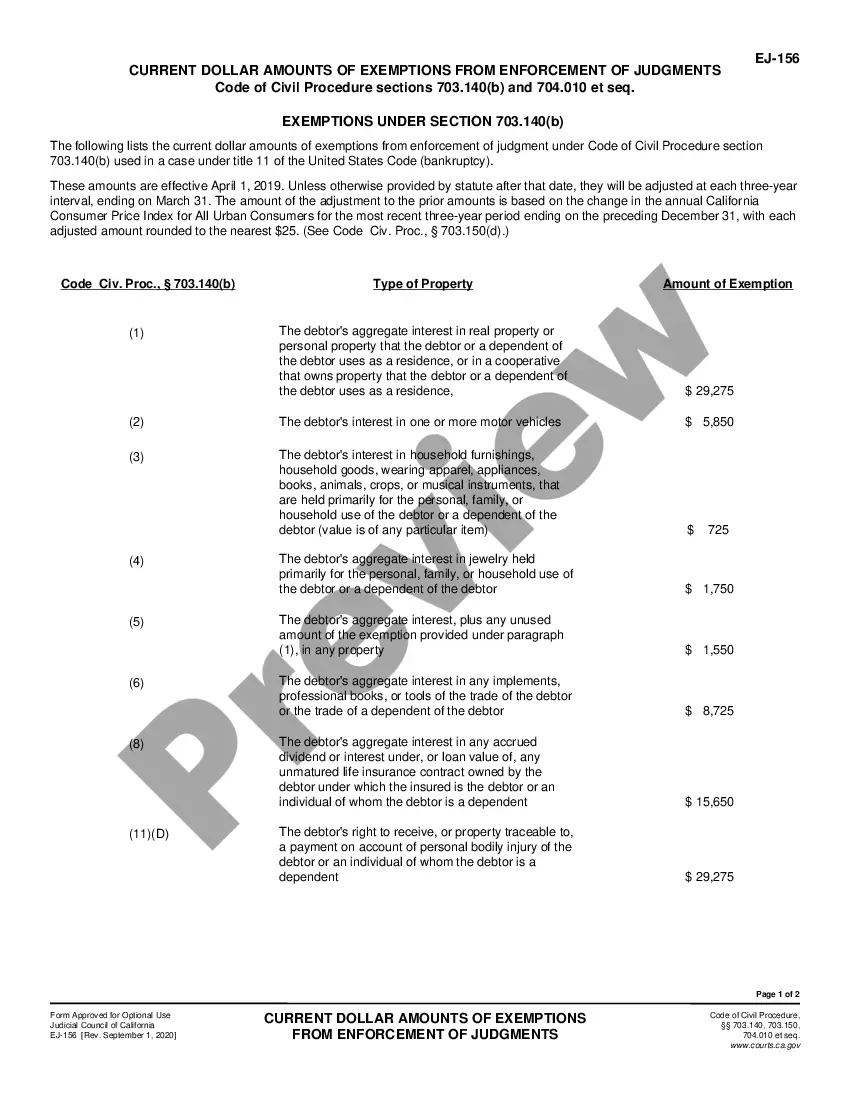

Avoiding payment of a judgment can be challenging but may involve negotiating a payment plan or settlement with the creditor. It's also important to understand any legal options available that could allow you to contest the judgment itself. Addressing concerns regarding a Stamford Connecticut Complaint (Default of Promissory Note) promptly is crucial. Our platform can help you explore potential defenses and find solutions for your situation.

In Connecticut, the maximum claim amount for small claims court is $5,000. This limit allows individuals to resolve disputes without engaging in full-scale litigation. If you're dealing with a Stamford Connecticut Complaint (Default of Promissory Note), small claims court may be a viable option to consider for quick resolution. Our platform provides the forms you need to file your claim easily.

A motion to open default in Connecticut allows a party to request the court to reconsider a default judgment. This can be based on valid reasons like not having received notice of the hearing. Understanding how to file a Stamford Connecticut Complaint (Default of Promissory Note) correctly can significantly impact your case. Legal assistance can guide you through this motion process to increase your chances of success.

A judgment lien in Connecticut is valid for five years from the date it is filed. If you need to maintain it beyond that period, you must file for renewal. Properly managing a Stamford Connecticut Complaint (Default of Promissory Note) ensures you don't accidentally let your lien expire. Legal resources are available to help you navigate this process effectively.

If you neglect to appear in court for a judgment, the court may issue a default judgment against you. This judgment can lead to potential wage garnishment, property liens, or bank levies. It is essential to address any Stamford Connecticut Complaint (Default of Promissory Note) to prevent these further legal complications. Seeking advice on how to respond can make a significant difference.

In Connecticut, a judgment lien typically lasts for five years. This period begins when the judgment is entered. If not renewed through proper legal channels, the lien will expire. Therefore, it is crucial to keep any Stamford Connecticut Complaint (Default of Promissory Note) up to date if you want to maintain rights to the lien.

Warrants in Connecticut are legal documents that authorize law enforcement to arrest an individual or search their property. If you have a pending Stamford Connecticut Complaint (Default of Promissory Note) and fail to appear in court, the court may issue a warrant for your arrest. Understanding how warrants function can help manage your legal risks effectively. Consulting with a legal professional can provide clarity on how to address a warrant and protect your rights.

A motion for order of compliance in Connecticut is a legal request made to the court asking it to enforce a previous order or decree. This could directly relate to a Stamford Connecticut Complaint (Default of Promissory Note) where one party seeks to ensure compliance with payment terms. Presenting this motion often requires specific legal knowledge and documentation to support your case. Legal advice is recommended to navigate this process effectively.

In Connecticut, the statute of limitations for enforcing a promissory note is six years from the date of default. This means that if you fail to repay a note, the lender has six years to file a Stamford Connecticut Complaint (Default of Promissory Note) against you. Understanding this timeline is crucial in defending against claims and addressing any debts you may owe. Utilizing platforms like USLegalForms can help you effectively manage your legal obligations and documentation.

In Connecticut, special defenses refer to specific legal arguments that can be presented in response to a Stamford Connecticut Complaint (Default of Promissory Note). These defenses might include claims of fraud, mistake, or duress, which can affect the enforcement of the note. It’s vital to understand that raising these defenses requires thorough documentation and a clear presentation of the facts. Consulting with a legal expert can bolster your case and help navigate these complex issues.