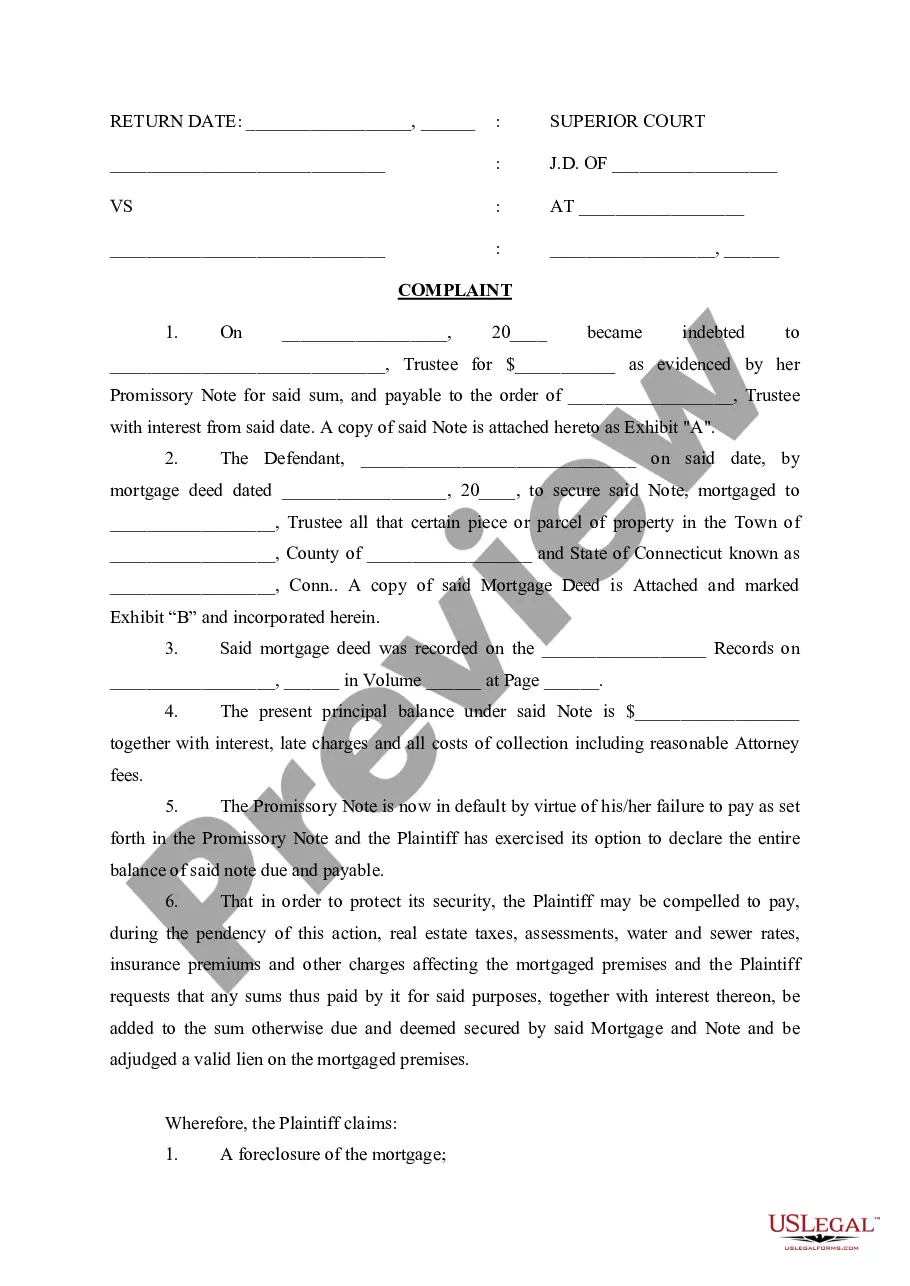

Waterbury, Connecticut Complaint (Default of Promissory Note) refers to a legal action filed by a lender against a borrower who has failed to fulfill their obligations under a promissory note agreement. A promissory note is a binding legal document that outlines the terms, conditions, and repayment schedule of a loan. In Waterbury, Connecticut, there are different types of complaints related to the default of a promissory note. These may include: 1. Civil Complaint for Default of Promissory Note: This type of complaint is filed in the civil court system to initiate legal action against a borrower who has defaulted on their promissory note obligations. The lender seeks remedies, such as repayment of the outstanding loan amount, interest, penalties, and possibly foreclosure on any pledged collateral. 2. Small Claims Complaint for Default of Promissory Note: In cases where the loan amount falls under a specified threshold, typically ranging from $5,000 to $15,000, the lender may choose to file a small claims complaint. This allows for a faster and less formal court process, typically handled without attorneys, to address the default and seek repayment. 3. Complaint for Other Breaches of Promissory Note: While defaulting on payment is the most common reason for filing a complaint, there can be other breaches of the promissory note agreement that may result in legal action. These can include the unauthorized transfer of the loan, failure to maintain adequate insurance, or violating any additional terms agreed upon in the note. When filing a Waterbury, Connecticut Complaint (Default of Promissory Note), the lender must provide relevant details and substantiate their claim. This typically includes documentation such as the original promissory note, payment history, communication records, and any other evidence supporting the allegations of default. It is crucial for both lenders and borrowers involved in a promissory note agreement to understand their rights and obligations. Seeking legal counsel or professional advice is advisable when facing or pursuing a complaint related to defaulting on a promissory note in Waterbury, Connecticut.

Waterbury Connecticut Complaint (Default of Promissory Note)

Description

How to fill out Waterbury Connecticut Complaint (Default Of Promissory Note)?

Do you need a trustworthy and affordable legal forms provider to get the Waterbury Connecticut Complaint (Default of Promissory Note)? US Legal Forms is your go-to option.

No matter if you require a simple agreement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Waterbury Connecticut Complaint (Default of Promissory Note) conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Waterbury Connecticut Complaint (Default of Promissory Note) in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal paperwork online for good.