Bridgeport Connecticut Appeal from the Board of Assessment Appeals: A Comprehensive Guide Keywords: Bridgeport Connecticut, Appeal, Board of Assessment Appeals, property tax, assessment, process, guidelines, types. Introduction: In Bridgeport, Connecticut, property owners have the right to file an appeal with the Board of Assessment Appeals if they believe their property has been incorrectly assessed for tax purposes. This thorough guide will provide a detailed explanation of the Bridgeport Connecticut Appeal from the Board of Assessment Appeals process, including its types, regulations, and significant keywords associated with the subject. 1. Understanding the Board of Assessment Appeals: The Bridgeport Board of Assessment Appeals is a local government body responsible for reviewing property tax assessments requested by property owners. Its primary objective is to ensure fair and accurate property valuation, offering a transparent platform for property owners to address any discrepancies and seek redress if necessary. 2. The Appeal Process: a) Initiation: To initiate a Bridgeport Connecticut Appeal from the Board of Assessment Appeals, property owners must file an application within the specified timeframe, usually in the early part of the assessment year. It is crucial to adhere to the designated deadlines to avoid a potential denial of the appeal. b) Grounds for Appeal: Property owners can appeal their assessment based on several legitimate grounds such as incorrect property valuation, inappropriate use of assessment methods, failure to consider relevant factors, or errors in the assessment process. c) Supporting Documentation: While filing an appeal, it is vital to provide comprehensive supporting documentation such as property records, recent sales data of comparable properties, evidence of property damage, or any other information that supports the claim of an inaccurate assessment. d) Review by the Board: Once the appeal application is submitted, the Board of Assessment Appeals diligently reviews the case, taking into consideration all the provided documents and any additional evidence presented during the appeal hearing. e) The Appeal Hearing: The Board of Assessment Appeals schedules an appeal hearing where property owners can present their case in person or through representation. During the hearing, property owners can elaborate on their claim, provide additional evidence, and answer any questions raised by the Board. f) Board's Decision: After carefully evaluating the evidence and considering all relevant factors, the Board of Assessment Appeals makes a decision regarding the property's reassessment. Property owners are then informed of the final decision, which may either affirm or adjust the original assessment. 3. Types of Bridgeport Connecticut Appeals from the Board of Assessment Appeals: a) Formal Appeal: This type of appeal is filed when property owners firmly believe there has been a significant error in their property's assessment that requires a thorough review by the Board. Supporting evidence and the presentation of the case during the appeal hearing are essential to achieving a favorable outcome. b) Informal Appeal: An informal appeal is an option available for property owners who believe their assessment is mildly inaccurate or simply requires clarification. This type allows property owners and assessors to communicate and resolve the issue before filing a formal appeal. c) Failed Informal Appeal Review: If property owners are dissatisfied with the outcome of an informal appeal, they may opt to file a formal appeal with more substantial evidence and argumentation. Conclusion: Understanding the Bridgeport Connecticut Appeal from the Board of Assessment Appeals process is crucial for property owners seeking to address any discrepancies in property tax assessments. By adhering to the guidelines outlined above and providing accurate supporting documentation, property owners can navigate the appeal process effectively and strive for a fair reassessment by the Board.

Bridgeport Connecticut Appeal from the Board of Assessment Appeals

Category:

State:

Connecticut

City:

Bridgeport

Control #:

CT-0276

Format:

Word;

Rich Text

Instant download

Description

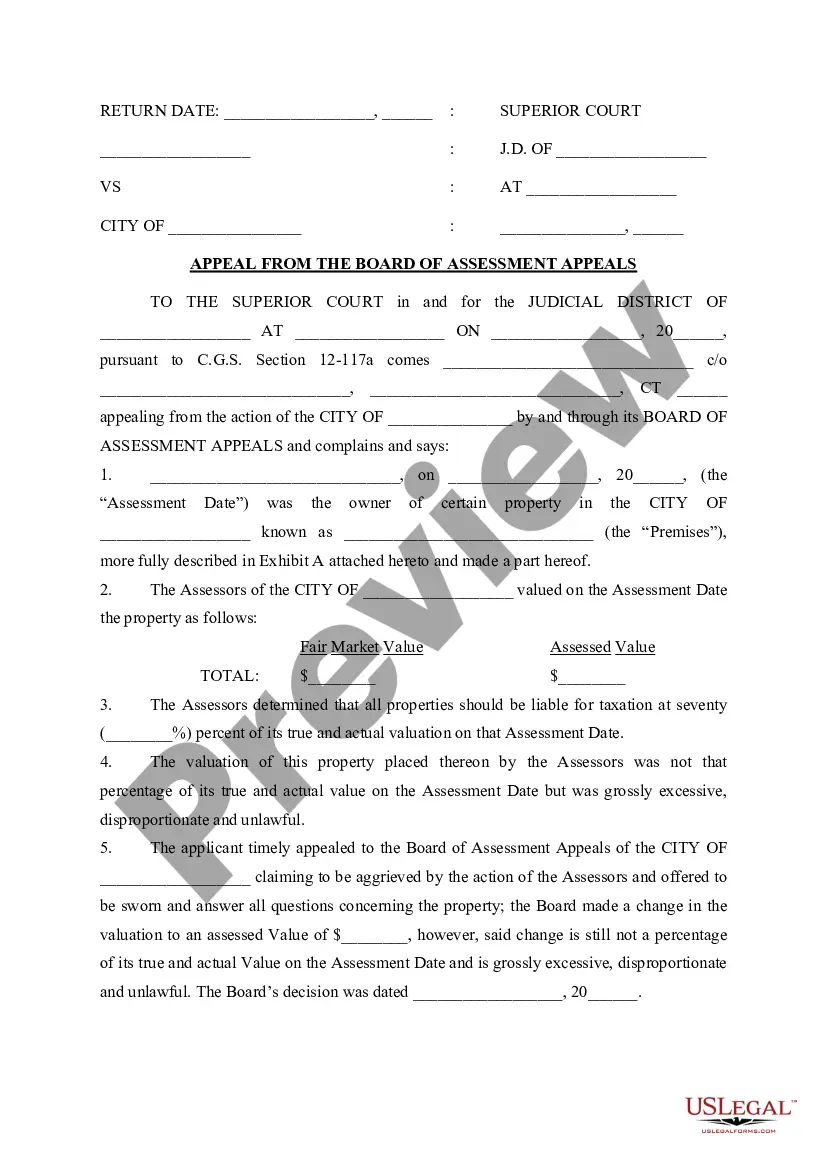

The appeals board is an independent entity whose function is to resolve disputes between the county assessor and taxpayers over values of locally assessed property. The decisions of an appeals board are legally binding and enforceable. The Board of Assessment Appeals (BAA) hears appeals filed by real and personal property owners regarding the valuation placed on their property.

Bridgeport Connecticut Appeal from the Board of Assessment Appeals: A Comprehensive Guide Keywords: Bridgeport Connecticut, Appeal, Board of Assessment Appeals, property tax, assessment, process, guidelines, types. Introduction: In Bridgeport, Connecticut, property owners have the right to file an appeal with the Board of Assessment Appeals if they believe their property has been incorrectly assessed for tax purposes. This thorough guide will provide a detailed explanation of the Bridgeport Connecticut Appeal from the Board of Assessment Appeals process, including its types, regulations, and significant keywords associated with the subject. 1. Understanding the Board of Assessment Appeals: The Bridgeport Board of Assessment Appeals is a local government body responsible for reviewing property tax assessments requested by property owners. Its primary objective is to ensure fair and accurate property valuation, offering a transparent platform for property owners to address any discrepancies and seek redress if necessary. 2. The Appeal Process: a) Initiation: To initiate a Bridgeport Connecticut Appeal from the Board of Assessment Appeals, property owners must file an application within the specified timeframe, usually in the early part of the assessment year. It is crucial to adhere to the designated deadlines to avoid a potential denial of the appeal. b) Grounds for Appeal: Property owners can appeal their assessment based on several legitimate grounds such as incorrect property valuation, inappropriate use of assessment methods, failure to consider relevant factors, or errors in the assessment process. c) Supporting Documentation: While filing an appeal, it is vital to provide comprehensive supporting documentation such as property records, recent sales data of comparable properties, evidence of property damage, or any other information that supports the claim of an inaccurate assessment. d) Review by the Board: Once the appeal application is submitted, the Board of Assessment Appeals diligently reviews the case, taking into consideration all the provided documents and any additional evidence presented during the appeal hearing. e) The Appeal Hearing: The Board of Assessment Appeals schedules an appeal hearing where property owners can present their case in person or through representation. During the hearing, property owners can elaborate on their claim, provide additional evidence, and answer any questions raised by the Board. f) Board's Decision: After carefully evaluating the evidence and considering all relevant factors, the Board of Assessment Appeals makes a decision regarding the property's reassessment. Property owners are then informed of the final decision, which may either affirm or adjust the original assessment. 3. Types of Bridgeport Connecticut Appeals from the Board of Assessment Appeals: a) Formal Appeal: This type of appeal is filed when property owners firmly believe there has been a significant error in their property's assessment that requires a thorough review by the Board. Supporting evidence and the presentation of the case during the appeal hearing are essential to achieving a favorable outcome. b) Informal Appeal: An informal appeal is an option available for property owners who believe their assessment is mildly inaccurate or simply requires clarification. This type allows property owners and assessors to communicate and resolve the issue before filing a formal appeal. c) Failed Informal Appeal Review: If property owners are dissatisfied with the outcome of an informal appeal, they may opt to file a formal appeal with more substantial evidence and argumentation. Conclusion: Understanding the Bridgeport Connecticut Appeal from the Board of Assessment Appeals process is crucial for property owners seeking to address any discrepancies in property tax assessments. By adhering to the guidelines outlined above and providing accurate supporting documentation, property owners can navigate the appeal process effectively and strive for a fair reassessment by the Board.

Free preview

How to fill out Bridgeport Connecticut Appeal From The Board Of Assessment Appeals?

If you’ve already utilized our service before, log in to your account and save the Bridgeport Connecticut Appeal from the Board of Assessment Appeals on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Bridgeport Connecticut Appeal from the Board of Assessment Appeals. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!