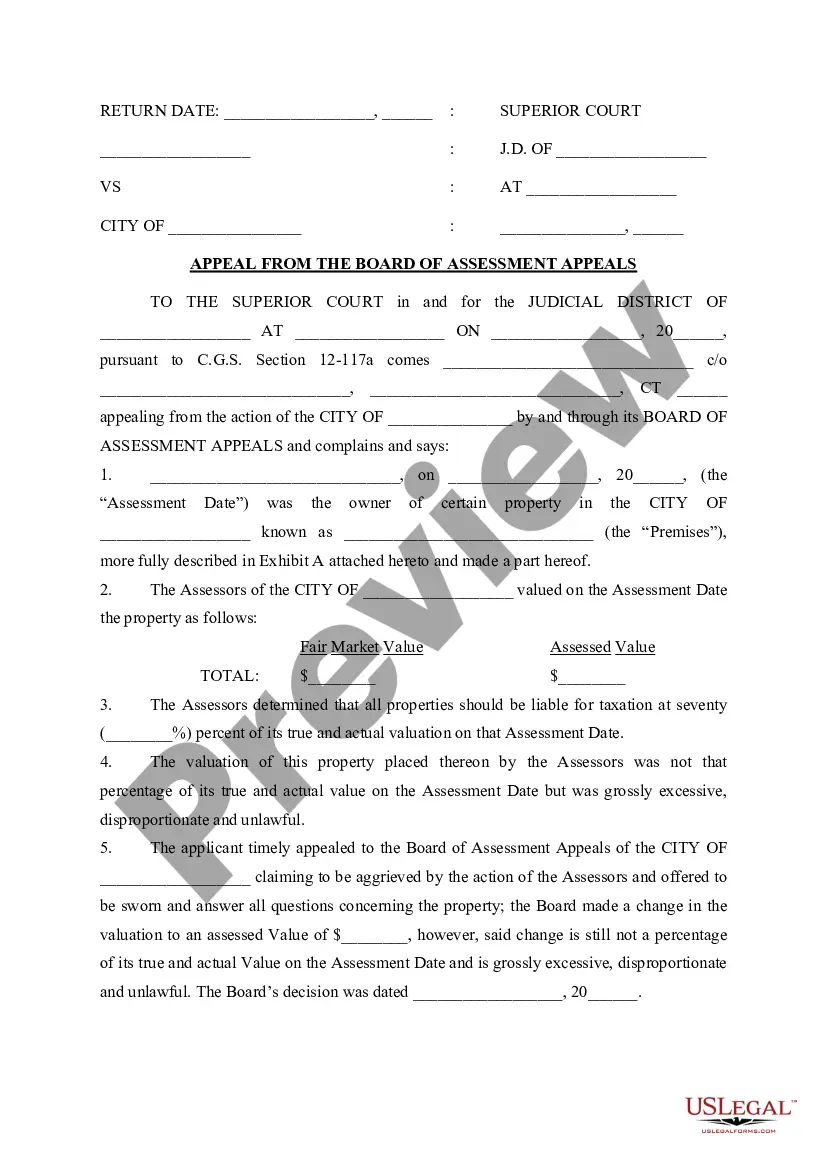

Stamford Connecticut Appeal from the Board of Assessment Appeals refers to the process of challenging property tax assessments in Stamford, Connecticut. The Board of Assessment Appeals is an independent body responsible for reviewing property tax assessments and determining their accuracy. Property owners can file an appeal with the board if they believe their property has been over-assessed, resulting in higher taxes than warranted. When filing a Stamford Connecticut Appeal from the Board of Assessment Appeals, property owners must carefully adhere to the established guidelines and deadlines to ensure their appeal is considered. It is essential to gather all relevant documentation and evidence to support the claim of over-assessment. This may include recent property appraisals, comparable sales data, or any other relevant information. There are several types of Stamford Connecticut Appeals from the Board of Assessment Appeals, categorized based on the specific reason for filing the appeal: 1. Over-Assessment: This type of appeal is filed when property owners believe that their property has been assessed at a value higher than its fair market value. Property owners must gather evidence demonstrating that the assessed value exceeds the actual value of similar properties in the area. 2. Incorrect Property Classification: Sometimes, the Board of Assessment may mistakenly classify a property into an inappropriate category, resulting in a higher tax rate. Property owners can appeal to correct this misclassification, potentially leading to a reduction in property taxes. 3. Significant Property Damage: In cases where a property has suffered significant physical damage, such as due to fire, flood, or natural disasters, property owners can appeal to have the assessment reduced based on the property's diminished value. 4. Exemptions and Abatement: Property owners may file an appeal if they believe they qualify for certain exemptions or abatement, such as those for seniors, veterans, or individuals with disabilities. These appeals require providing supporting documentation and demonstrating eligibility for the exemption or abatement. To initiate a Stamford Connecticut Appeal from the Board of Assessment Appeals, property owners must complete the appropriate forms, available on the city's official website. It is advisable to consult with a professional, such as a real estate attorney or an appraiser, to ensure a strong appeal case. Once the appeal is filed, the Board of Assessment Appeals will review the documentation and evidence provided by the property owner. It is important to note that the decision of the board is final, and property owners must abide by the outcome of the appeal process. In summary, the Stamford Connecticut Appeal from the Board of Assessment Appeals is a process through which property owners can challenge property tax assessments if they feel their property has been over-assessed or if they believe they qualify for certain exemptions or abatement. It is crucial to follow the specified guidelines and deadlines and gather supporting evidence to make a strong appeal case.

Stamford Connecticut Appeal from the Board of Assessment Appeals

Description

How to fill out Stamford Connecticut Appeal From The Board Of Assessment Appeals?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Stamford Connecticut Appeal from the Board of Assessment Appeals gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Stamford Connecticut Appeal from the Board of Assessment Appeals takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Stamford Connecticut Appeal from the Board of Assessment Appeals. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!