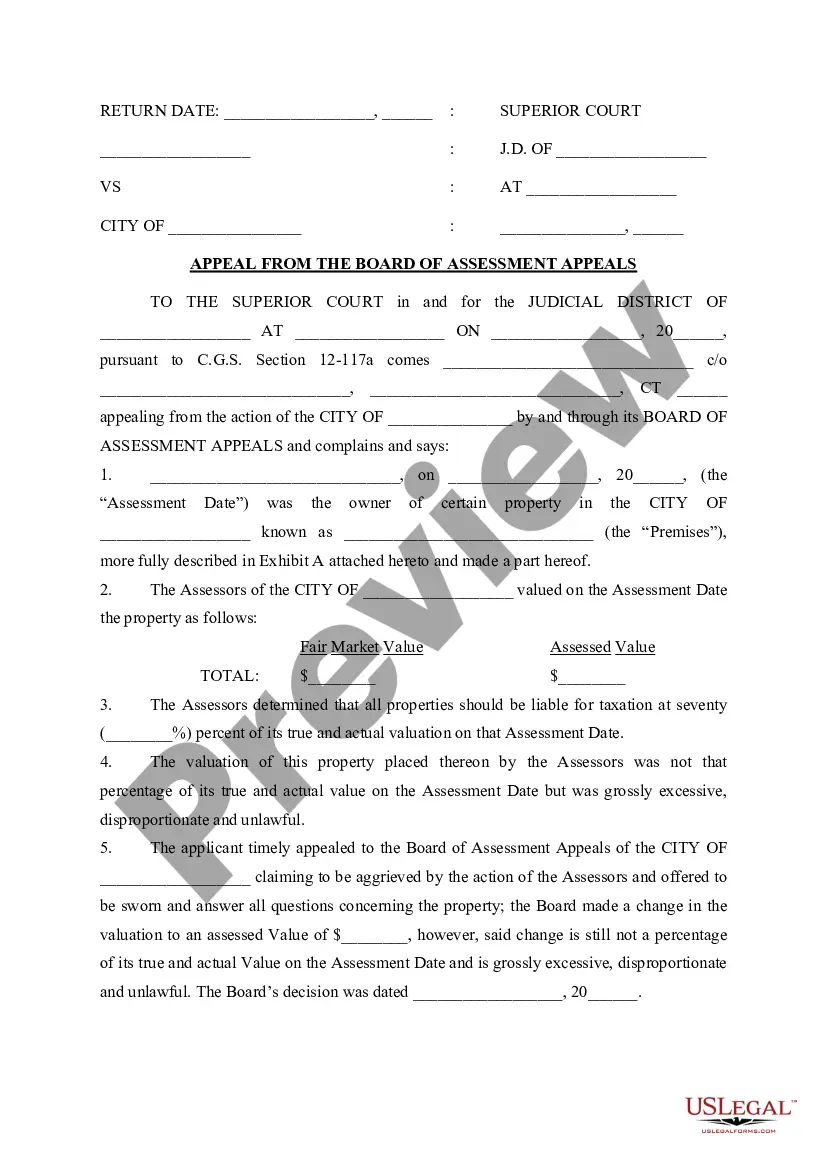

Waterbury Connecticut Appeal from the Board of Assessment Appeals: A Comprehensive Guide Keyword: Waterbury Connecticut Appeal, Board of Assessment Appeals, property assessment, property tax, filing process, types of appeals, residential appeal, commercial appeal Introduction: The Waterbury Connecticut Appeal from the Board of Assessment Appeals provides property owners with a mechanism to challenge their property assessment and potentially reduce their property taxes. Understanding the appeal process and the different types of appeals available is essential for property owners seeking to exercise their rights and ensure fair assessments. 1. Board of Assessment Appeals in Waterbury, Connecticut: The Board of Assessment Appeals is a local governmental body established to hear appeals from property owners dissatisfied with their property assessments made by the local tax assessor's office. The board consists of appointed members who are knowledgeable about property assessments and tax laws. 2. Filing an Appeal: Property owners who believe their property has been inaccurately assessed have the right to file an appeal with the Board of Assessment Appeals. The appeal must be filed within a specific timeframe, usually within one month of the mailing date of the assessment notice. It is crucial to adhere to this deadline to ensure the appeal is considered. 3. Types of Waterbury Connecticut Appeals from the Board of Assessment Appeals: a. Residential Appeal: This type of appeal is specific to homeowners who believe their residential property has been overvalued or improperly assessed. Homeowners can present evidence such as recent comparable sales or property appraisals to support their claim for a reduced assessment. Keyword: Waterbury Connecticut Residential Appeal, property value, comparable sales, property appraisal. b. Commercial Appeal: Businesses and commercial property owners can also file appeals with the Board of Assessment Appeals. This type of appeal is targeted towards significantly reducing the assessed value of commercial properties based on factors like market conditions, income potential, and other relevant criteria. Keyword: Waterbury Connecticut Commercial Appeal, commercial property assessment, market conditions, income potential. 4. Evidence and Documentation: Regardless of the type of appeal, providing substantial evidence and documentation is crucial to strengthening the case. Property owners should consider obtaining recent property appraisals, comparative sales data, income statements for commercial properties, or any other relevant data supporting their claim for a lower property assessment. 5. Review Process: Once the appeal has been filed, the Board of Assessment Appeals will review the evidence provided by the property owner and evaluate the assessor's assessment. The board may conduct hearings to allow property owners to present their case and provide additional information. It is important to prepare thoroughly for these hearings, as they can significantly impact the outcome of the appeal. 6. Decision and Potential Outcomes: After careful review and consideration, the Board of Assessment Appeals will render a decision on each appeal. Property owners should be prepared for a range of potential outcomes, including a reduction in the assessment, no change, or even an increase in the assessment. Understanding the decision-making process is crucial, and property owners should be aware of their rights to further appeal if unsatisfied with the board's decision. In conclusion, property owners in Waterbury, Connecticut, have the opportunity to appeal their property assessments through the Board of Assessment Appeals. By understanding the process, preparing substantial evidence, and participating in hearings, property owners stand a better chance to achieve fair and accurate property assessments. Whether residential or commercial, these appeals are vital in ensuring a just and equitable tax system.

Waterbury Connecticut Appeal from the Board of Assessment Appeals

Description

How to fill out Waterbury Connecticut Appeal From The Board Of Assessment Appeals?

Take advantage of the US Legal Forms and get instant access to any form you need. Our helpful website with a huge number of documents simplifies the way to find and obtain virtually any document sample you need. It is possible to save, fill, and sign the Waterbury Connecticut Appeal from the Board of Assessment Appeals in just a few minutes instead of surfing the Net for many hours trying to find an appropriate template.

Using our collection is a superb way to raise the safety of your form submissions. Our professional legal professionals regularly check all the documents to make sure that the forms are appropriate for a particular region and compliant with new acts and polices.

How do you obtain the Waterbury Connecticut Appeal from the Board of Assessment Appeals? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. Moreover, you can find all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the tips below:

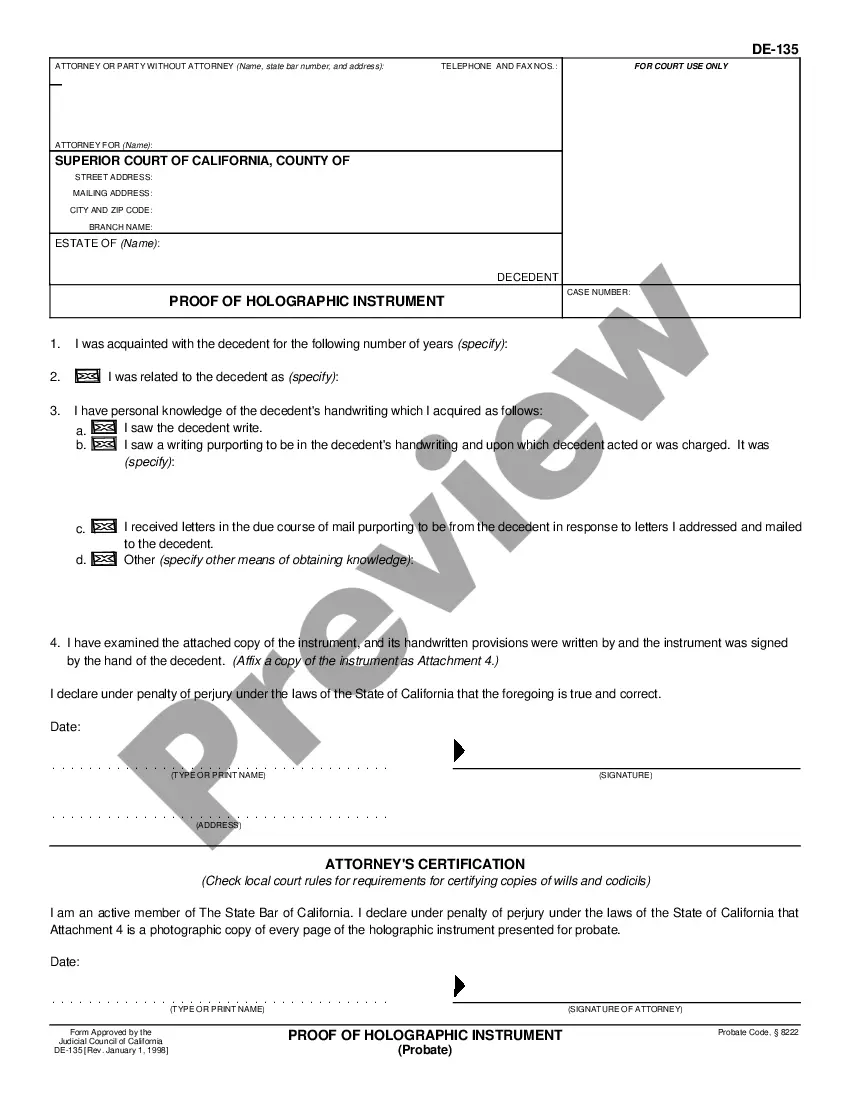

- Open the page with the form you need. Make certain that it is the form you were hoping to find: verify its name and description, and utilize the Preview option if it is available. Otherwise, use the Search field to find the needed one.

- Start the saving process. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Choose the format to obtain the Waterbury Connecticut Appeal from the Board of Assessment Appeals and modify and fill, or sign it according to your requirements.

US Legal Forms is probably the most considerable and trustworthy form libraries on the internet. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Waterbury Connecticut Appeal from the Board of Assessment Appeals.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!