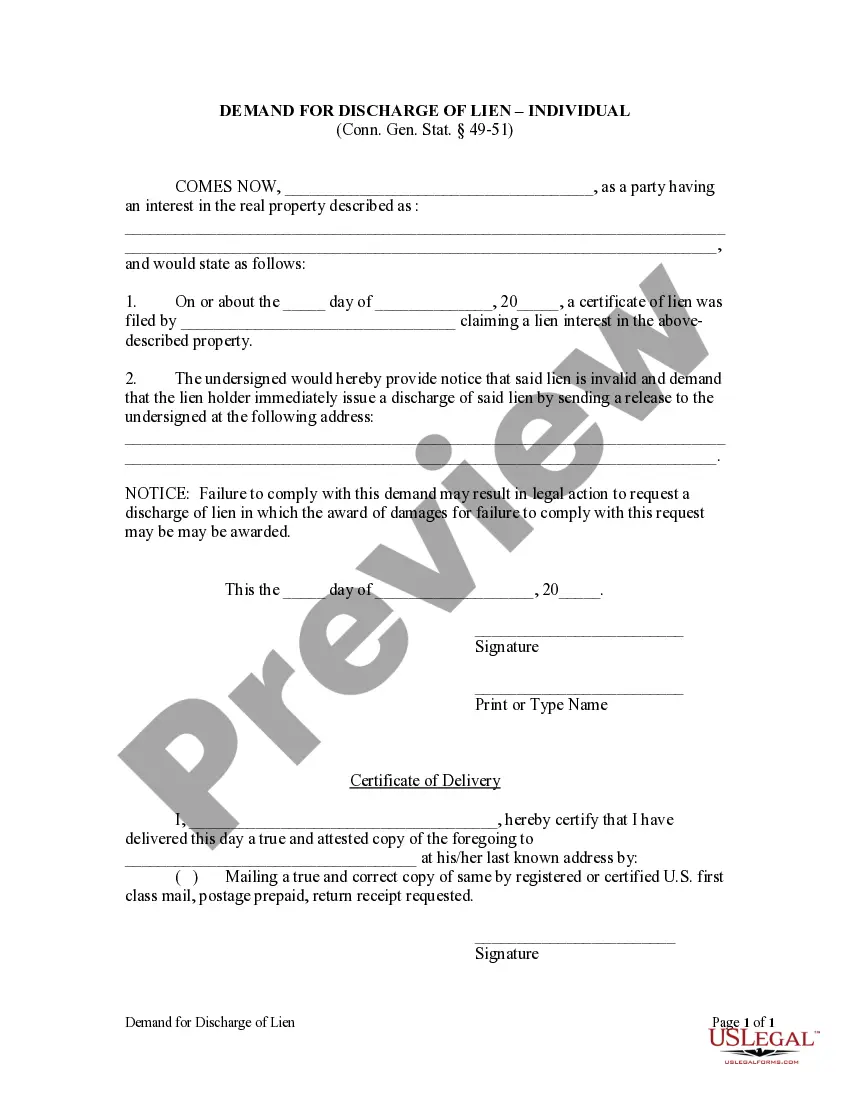

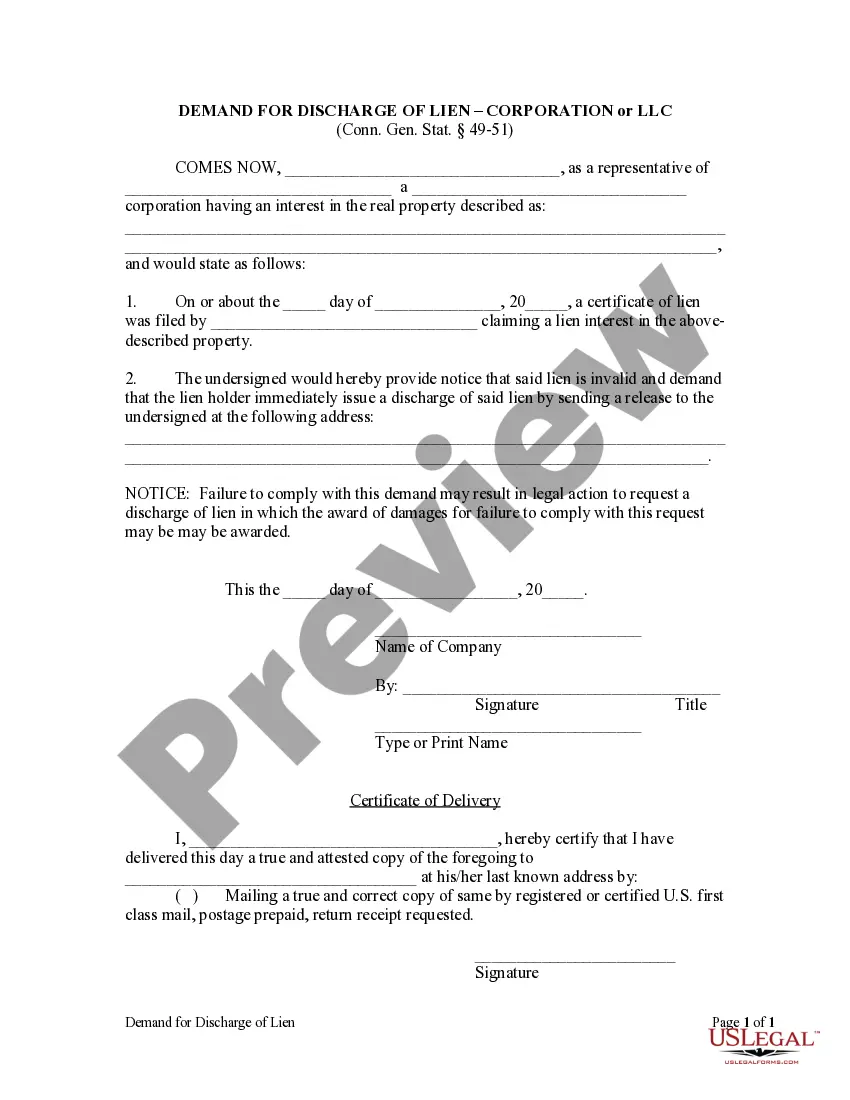

Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Bridgeport Connecticut Demand for Discharge by Corporation or LLC

Description

How to fill out Connecticut Demand For Discharge By Corporation Or LLC?

If you have previously utilized our service, Log In to your account and store the Bridgeport Connecticut Demand for Discharge by Corporation or LLC on your device by clicking the Download button. Ensure your subscription is active. If it is expired, renew it following your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have perpetual access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Confirm you’ve found the appropriate document. Review the description and make use of the Preview feature, if available, to verify if it fulfills your requirements. If it does not meet your specifications, use the Search tab above to locate the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and finalize a payment. Provide your credit card information or opt for the PayPal method to complete the transaction.

- Obtain your Bridgeport Connecticut Demand for Discharge by Corporation or LLC. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To dissolve a corporation in Connecticut, you must file a Certificate of Dissolution with the Secretary of State. This involves settling any outstanding debts and obligations beforehand, as well as notifying applicable parties. After submitting the certificate, ensure you follow through with all corporate records and settle any last details. If your corporation faces a Bridgeport Connecticut Demand for Discharge by Corporation or LLC, navigating the dissolution process correctly is essential.

Yes, you can write your own operating agreement for your LLC. However, it's crucial to ensure that it aligns with both state laws and your business practices. By outlining management roles, ownership percentages, and operational procedures, you create a solid foundation for your LLC. If you're facing issues like a Bridgeport Connecticut Demand for Discharge by Corporation or LLC, having a personalized operating agreement can be particularly beneficial.

Reinstating a forfeited LLC in Connecticut involves several steps, including filing the necessary paperwork and paying any back dues. You'll need to complete a Certificate of Reinstatement and submit it to the Secretary of State’s office. To effectively manage this process, especially if a Bridgeport Connecticut Demand for Discharge by Corporation or LLC is involved, using platforms like uslegalforms can simplify your paperwork. Follow-up by ensuring future compliance to prevent forfeiture from occurring again.

Yes, an LLC can operate without an operating agreement, but it is not advisable. Operating without one may leave you vulnerable to disputes among members and can complicate decision-making processes. An LLC that has no agreement will default to state regulations, which may not meet your unique needs. In Bridgeport, Connecticut, an operating agreement can provide crucial guidance during processes like a Demand for Discharge by Corporation or LLC.

In Connecticut, an operating agreement for an LLC is not legally required, but it is highly recommended. Without one, state laws will dictate how your LLC operates, which may not align with your business goals. By creating an operating agreement, you clarify ownership and operational procedures. This clarity can be particularly useful in situations involving a Bridgeport Connecticut Demand for Discharge by Corporation or LLC.

Several states recommend, or even require, an LLC to have an operating agreement. While states like Wyoming and Delaware mandate an operating agreement for LLCs, others like Connecticut allow for operational flexibility. Even if not required, having an operating agreement is vital for defining management structures and protecting your rights. In Bridgeport, Connecticut, a well-structured operating agreement can be essential to address a Bridgeport Connecticut Demand for Discharge by Corporation or LLC.

No, you cannot close your LLC in Connecticut without addressing any outstanding tax obligations. All business taxes must be filed even if your LLC is no longer operational. The Bridgeport Connecticut Demand for Discharge by Corporation or LLC provides guidance to ensure all tax matters are settled before proceeding with closure.

Shutting down an LLC in Connecticut requires filing a Certificate of Dissolution with the state. Before closing, resolve any debts and obligations to ensure a smooth process. Utilize the Bridgeport Connecticut Demand for Discharge by Corporation or LLC to facilitate your understanding and completion of this process.

Yes, you can temporarily close your LLC in Connecticut by officially suspending your business operations. However, you still need to file your business taxes and maintain compliance with state requirements during this period. The Bridgeport Connecticut Demand for Discharge by Corporation or LLC can be valuable for understanding your responsibilities while your LLC is inactive.

Corporations that earn income in Connecticut must file Form CT 1120. This includes both domestic and foreign corporations conducting business within the state. If your entity is a corporation seeking clarity on tax obligations, consider the Bridgeport Connecticut Demand for Discharge by Corporation or LLC for streamlined filing and compliance.