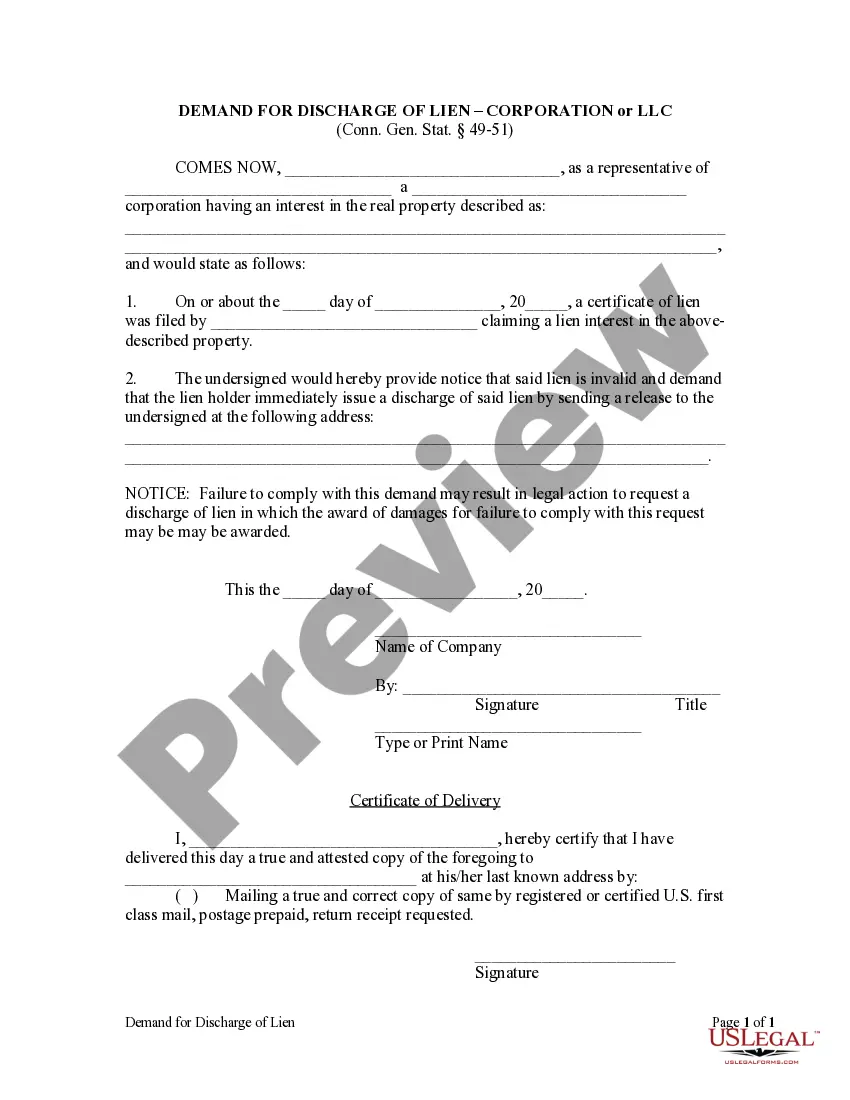

Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Stamford Connecticut Demand for Discharge by Corporation or LLC A Stamford Connecticut Demand for Discharge by Corporation or Limited Liability Company (LLC) is a legal process in which a business entity seeks to terminate its existence or dissolve its operations in Stamford, Connecticut. It is important for corporations and LCS to follow specific procedures to ensure a smooth discharge and compliance with state laws. The demand for discharge can be related to various situations, including when a corporation or LLC decides to cease operations, merge with another entity, or undergo a change in ownership. In Stamford, Connecticut, there are several types of Demand for Discharge by Corporation or LLC, each with its own specific requirements and procedures. These types include: 1. Voluntary Dissolution: This type of discharge occurs when a corporation or LLC voluntarily decides to terminate its operations in Stamford, Connecticut. It usually involves obtaining approval from the shareholders or members before filing the necessary documents with the Connecticut Secretary of the State. 2. Administrative Dissolution: This form of discharge is initiated by the state government when a corporation or LLC fails to comply with certain legal requirements, such as failure to pay taxes or file annual reports. An administrative dissolution can have severe consequences for the business, including the loss of legal protections, so it is crucial to address any compliance issues promptly. 3. Involuntary Dissolution: This type of discharge is typically initiated by court order due to serious legal violations or misconduct committed by the corporation or LLC. It may occur when there is evidence of fraud, illegal activities, or breached fiduciary duties. In such cases, the state may intervene and force the dissolution of the business entity. The process of initiating a Demand for Discharge by Corporation or LLC in Stamford, Connecticut typically involves several essential steps. These steps may include: 1. Approval by Shareholders or Members: Depending on the type of discharge, corporations may require approval from shareholders, while LCS may require member consent. This step ensures that the decision to terminate is made collectively and in accordance with the organization's bylaws or operating agreement. 2. Drafting and Filing Certificate of Dissolution: After obtaining the necessary approvals, the corporation or LLC must prepare and file a Certificate of Dissolution with the Connecticut Secretary of the State. This document officially notifies the state and the public about the intent to dissolve the business entity. 3. Settling Debts and Obligations: Before discharging, the corporation or LLC must settle all outstanding debts, obligations, and liabilities. This includes paying creditors, resolving pending legal disputes, and fulfilling contractual commitments. Failure to address these obligations adequately may result in personal liability for directors, officers, or members. 4. Distribution of Assets: Another crucial aspect of the discharge process is the proper distribution of remaining assets to shareholders or members. Businesses must adhere to the laws and regulations governing asset distribution, ensuring equitable treatment and compliance with applicable tax laws. It is essential for businesses seeking a Demand for Discharge by Corporation or LLC in Stamford, Connecticut, to consult with an experienced attorney who specializes in corporate law. They can provide guidance and ensure compliance with all relevant legal requirements and procedures, minimizing potential risks and liabilities. In summary, a Demand for Discharge by Corporation or LLC in Stamford, Connecticut is a formal process through which a business entity terminates its operations or existence. Whether it is a voluntary, administrative, or involuntary dissolution, corporations and LCS must follow specific steps, including obtaining approvals, filing appropriate documents, settling obligations, and distributing assets. Professional legal assistance is essential to navigate these procedures and ensure compliance with state laws.Stamford Connecticut Demand for Discharge by Corporation or LLC A Stamford Connecticut Demand for Discharge by Corporation or Limited Liability Company (LLC) is a legal process in which a business entity seeks to terminate its existence or dissolve its operations in Stamford, Connecticut. It is important for corporations and LCS to follow specific procedures to ensure a smooth discharge and compliance with state laws. The demand for discharge can be related to various situations, including when a corporation or LLC decides to cease operations, merge with another entity, or undergo a change in ownership. In Stamford, Connecticut, there are several types of Demand for Discharge by Corporation or LLC, each with its own specific requirements and procedures. These types include: 1. Voluntary Dissolution: This type of discharge occurs when a corporation or LLC voluntarily decides to terminate its operations in Stamford, Connecticut. It usually involves obtaining approval from the shareholders or members before filing the necessary documents with the Connecticut Secretary of the State. 2. Administrative Dissolution: This form of discharge is initiated by the state government when a corporation or LLC fails to comply with certain legal requirements, such as failure to pay taxes or file annual reports. An administrative dissolution can have severe consequences for the business, including the loss of legal protections, so it is crucial to address any compliance issues promptly. 3. Involuntary Dissolution: This type of discharge is typically initiated by court order due to serious legal violations or misconduct committed by the corporation or LLC. It may occur when there is evidence of fraud, illegal activities, or breached fiduciary duties. In such cases, the state may intervene and force the dissolution of the business entity. The process of initiating a Demand for Discharge by Corporation or LLC in Stamford, Connecticut typically involves several essential steps. These steps may include: 1. Approval by Shareholders or Members: Depending on the type of discharge, corporations may require approval from shareholders, while LCS may require member consent. This step ensures that the decision to terminate is made collectively and in accordance with the organization's bylaws or operating agreement. 2. Drafting and Filing Certificate of Dissolution: After obtaining the necessary approvals, the corporation or LLC must prepare and file a Certificate of Dissolution with the Connecticut Secretary of the State. This document officially notifies the state and the public about the intent to dissolve the business entity. 3. Settling Debts and Obligations: Before discharging, the corporation or LLC must settle all outstanding debts, obligations, and liabilities. This includes paying creditors, resolving pending legal disputes, and fulfilling contractual commitments. Failure to address these obligations adequately may result in personal liability for directors, officers, or members. 4. Distribution of Assets: Another crucial aspect of the discharge process is the proper distribution of remaining assets to shareholders or members. Businesses must adhere to the laws and regulations governing asset distribution, ensuring equitable treatment and compliance with applicable tax laws. It is essential for businesses seeking a Demand for Discharge by Corporation or LLC in Stamford, Connecticut, to consult with an experienced attorney who specializes in corporate law. They can provide guidance and ensure compliance with all relevant legal requirements and procedures, minimizing potential risks and liabilities. In summary, a Demand for Discharge by Corporation or LLC in Stamford, Connecticut is a formal process through which a business entity terminates its operations or existence. Whether it is a voluntary, administrative, or involuntary dissolution, corporations and LCS must follow specific steps, including obtaining approvals, filing appropriate documents, settling obligations, and distributing assets. Professional legal assistance is essential to navigate these procedures and ensure compliance with state laws.