Bridgeport Connecticut Mortgage Deed is a legal document that establishes a mortgage over a property located in Bridgeport, Connecticut. It outlines the terms and conditions agreed upon between a borrower and a lender, securing the loan with the property as collateral. This document is crucial in the mortgage process, providing assurance to the lender that they have a legal claim on the property in the event of default. The Bridgeport Connecticut Mortgage Deed typically includes essential information such as the property address, borrower and lender details, loan amount, interest rate, repayment terms, and any additional provisions or conditions agreed upon. It also contains a legal description of the property, which accurately defines its boundaries and ensures no ambiguity. In Bridgeport, Connecticut, several types of mortgage deeds are commonly used: 1. Fixed-rate Mortgage Deed: This type of mortgage deed offers borrowers a fixed interest rate throughout the loan term, providing predictability and stability in monthly payments. 2. Adjustable-rate Mortgage (ARM) Deed: An ARM Deed has an interest rate that may fluctuate after an initial fixed-rate period. It usually adjusts according to market conditions, which can result in changing monthly payments. 3. FHA Insured Mortgage Deed: This type of mortgage deed is insured by the Federal Housing Administration (FHA), which allows borrowers with lower credit scores or down payments to qualify for mortgage loans more easily. 4. VA Guaranteed Mortgage Deed: Available to eligible veterans, this mortgage deed is guaranteed by the Department of Veterans Affairs (VA) and often offers favorable terms and conditions. 5. Balloon Mortgage Deed: A balloon mortgage deed involves making smaller monthly payments for a specific period, typically 5 to 7 years, followed by a large payment (balloon payment) due at the end of the term. It is crucial for both borrowers and lenders to thoroughly understand the terms and conditions outlined in the Bridgeport Connecticut Mortgage Deed. Compliance with the deed's provisions and timely repayment of the loan are essential to avoid any legal complications or foreclosure proceedings. Seeking legal advice or assistance from a knowledgeable mortgage professional is highly recommended for anyone involved in the mortgage process in Bridgeport, Connecticut.

Bridgeport Connecticut Mortgage Deed

State:

Connecticut

City:

Bridgeport

Control #:

CT-0326BG

Format:

Word;

Rich Text

Instant download

Description

An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (lender). Two characteristics of a mortgage are (a) the mortgagee's interest terminates upon the performance of the obligation secured by the mortgage such as payment of the note secured by the mortgage; and (b) the mortgagee has the right to enforce the mortgage by foreclosure if the mortgagor fails to perform the obligation (such as defaulting on the note payments).

Bridgeport Connecticut Mortgage Deed is a legal document that establishes a mortgage over a property located in Bridgeport, Connecticut. It outlines the terms and conditions agreed upon between a borrower and a lender, securing the loan with the property as collateral. This document is crucial in the mortgage process, providing assurance to the lender that they have a legal claim on the property in the event of default. The Bridgeport Connecticut Mortgage Deed typically includes essential information such as the property address, borrower and lender details, loan amount, interest rate, repayment terms, and any additional provisions or conditions agreed upon. It also contains a legal description of the property, which accurately defines its boundaries and ensures no ambiguity. In Bridgeport, Connecticut, several types of mortgage deeds are commonly used: 1. Fixed-rate Mortgage Deed: This type of mortgage deed offers borrowers a fixed interest rate throughout the loan term, providing predictability and stability in monthly payments. 2. Adjustable-rate Mortgage (ARM) Deed: An ARM Deed has an interest rate that may fluctuate after an initial fixed-rate period. It usually adjusts according to market conditions, which can result in changing monthly payments. 3. FHA Insured Mortgage Deed: This type of mortgage deed is insured by the Federal Housing Administration (FHA), which allows borrowers with lower credit scores or down payments to qualify for mortgage loans more easily. 4. VA Guaranteed Mortgage Deed: Available to eligible veterans, this mortgage deed is guaranteed by the Department of Veterans Affairs (VA) and often offers favorable terms and conditions. 5. Balloon Mortgage Deed: A balloon mortgage deed involves making smaller monthly payments for a specific period, typically 5 to 7 years, followed by a large payment (balloon payment) due at the end of the term. It is crucial for both borrowers and lenders to thoroughly understand the terms and conditions outlined in the Bridgeport Connecticut Mortgage Deed. Compliance with the deed's provisions and timely repayment of the loan are essential to avoid any legal complications or foreclosure proceedings. Seeking legal advice or assistance from a knowledgeable mortgage professional is highly recommended for anyone involved in the mortgage process in Bridgeport, Connecticut.

Free preview

How to fill out Bridgeport Connecticut Mortgage Deed?

If you’ve already utilized our service before, log in to your account and download the Bridgeport Connecticut Mortgage Deed on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Bridgeport Connecticut Mortgage Deed. Choose the file format for your document and save it to your device.

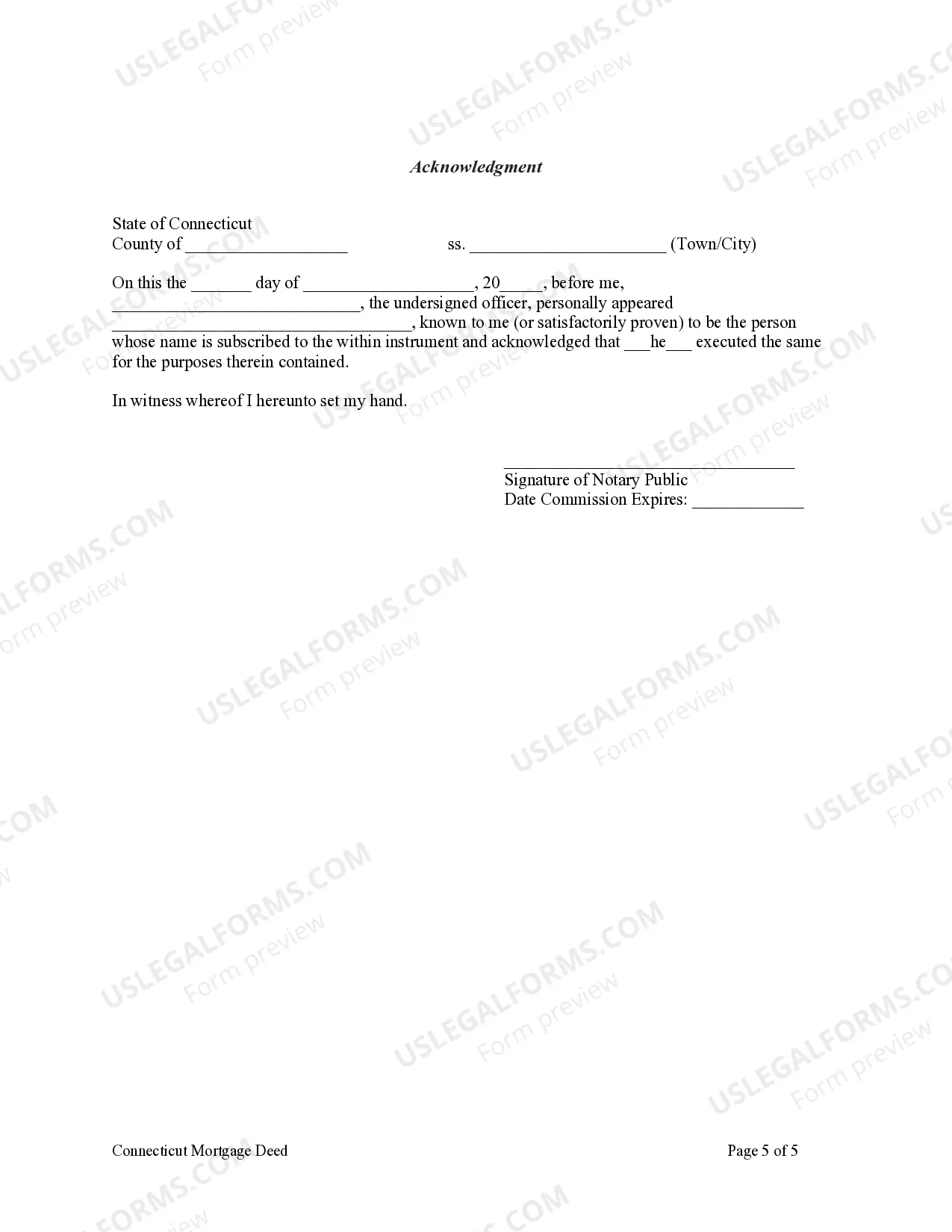

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!