A Stamford Connecticut Mortgage Deed is a legal document used in real estate transactions to secure a mortgage loan. It serves as a binding agreement between the borrower (mortgagor) and the lender (mortgagee) and is recorded with the local county records office. This document outlines the terms and conditions of the mortgage loan, including the property being used as collateral. Keywords: Stamford Connecticut, Mortgage Deed, real estate transactions, mortgage loan, borrower, lender, collateral. There are various types of mortgage deeds commonly used in Stamford, Connecticut: 1. Traditional Mortgage Deed: This is the standard form of a mortgage deed, where the borrower grants a lien on the property to secure the repayment of the loan. It includes details such as the loan amount, interest rate, repayment terms, and foreclosure procedures. 2. Fixed-Rate Mortgage Deed: This type of mortgage deed specifies a fixed interest rate for the duration of the loan term, providing stability to the borrower's monthly payments. 3. Adjustable-Rate Mortgage Deed: An adjustable-rate mortgage deed contains provisions for an interest rate that can fluctuate over time, typically tied to an index such as the U.S. Treasury or the LIBOR rate. The interest rate can be adjusted periodically, resulting in changes to the borrower's monthly payments. 4. Balloon Mortgage Deed: A balloon mortgage deed allows for smaller monthly payments initially, but a large balloon payment becomes due at the end of the designated term. This type of mortgage deed is suitable for borrowers who anticipate a significant increase in income or plan to sell the property before the balloon payment is due. 5. Reverse Mortgage Deed: Primarily designed for senior citizens, a reverse mortgage deed allows homeowners to borrow against the equity of their homes. Unlike traditional mortgages, repayments are typically deferred until the borrower moves out of the home or passes away. 6. FHA-insured Mortgage Deed: Stamford residents may also opt for an FHA-insured mortgage deed, where the loan is backed by the Federal Housing Administration (FHA). This type of mortgage deed provides added security for lenders and often allows borrowers to qualify for more favorable terms. 7. VA-guaranteed Mortgage Deed: Stamford residents who are active-duty military personnel, veterans, or eligible surviving spouses may choose a VA-guaranteed mortgage deed. This type of mortgage provides benefits such as no down payment, competitive interest rates, and lenient credit requirements. Understanding the types of Stamford Connecticut Mortgage Deeds available can help borrowers make informed decisions when securing financing for their real estate transactions. It is crucial to consult with legal and financial professionals to ensure compliance with local regulations and determine the most suitable mortgage deed for individual circumstances.

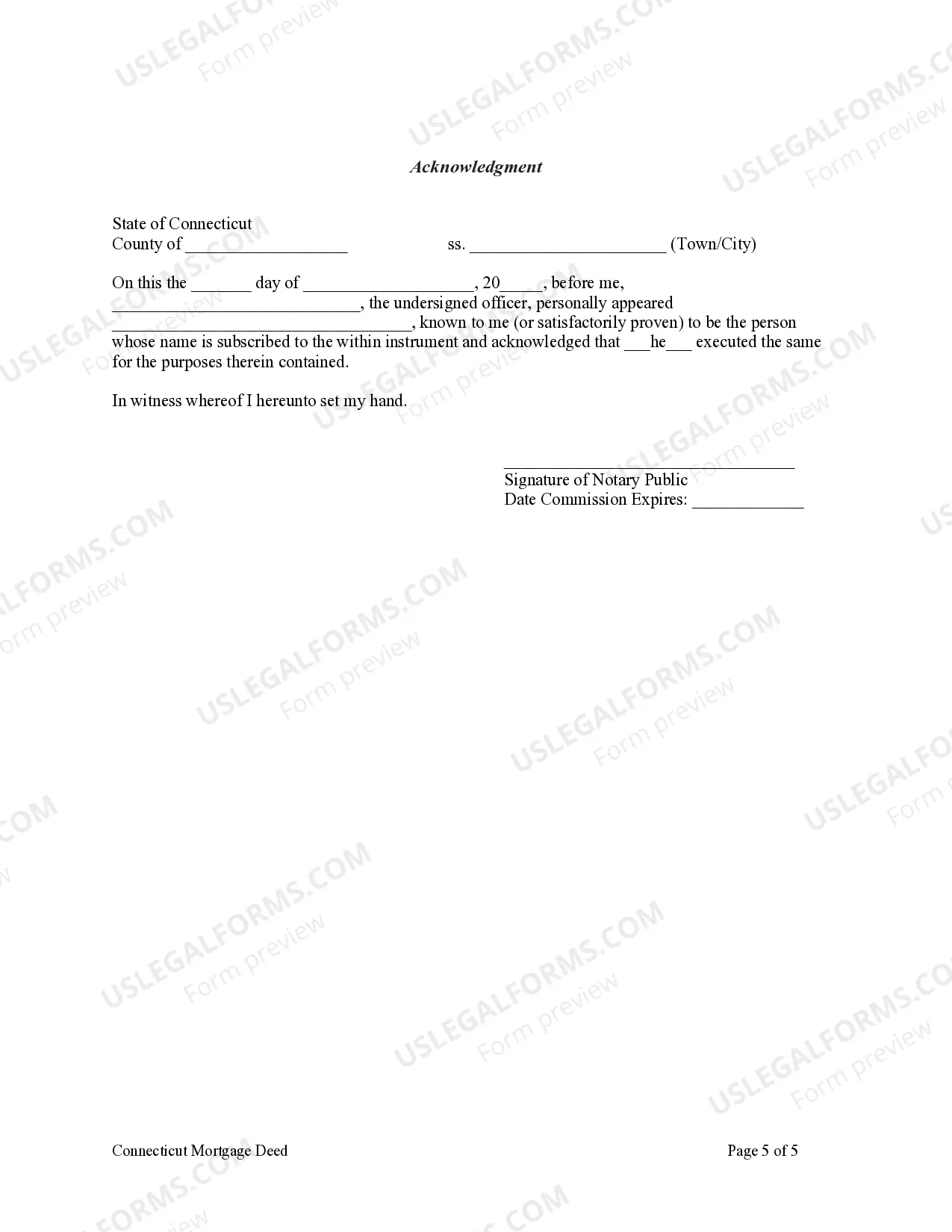

Stamford Connecticut Mortgage Deed

Description

How to fill out Stamford Connecticut Mortgage Deed?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no legal background to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Stamford Connecticut Mortgage Deed or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Stamford Connecticut Mortgage Deed in minutes using our reliable service. In case you are presently an existing customer, you can proceed to log in to your account to get the needed form.

However, in case you are unfamiliar with our platform, make sure to follow these steps before downloading the Stamford Connecticut Mortgage Deed:

- Be sure the template you have chosen is good for your location since the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief description (if available) of scenarios the paper can be used for.

- If the form you picked doesn’t meet your needs, you can start over and look for the suitable form.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Stamford Connecticut Mortgage Deed as soon as the payment is completed.

You’re good to go! Now you can proceed to print out the document or complete it online. Should you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.