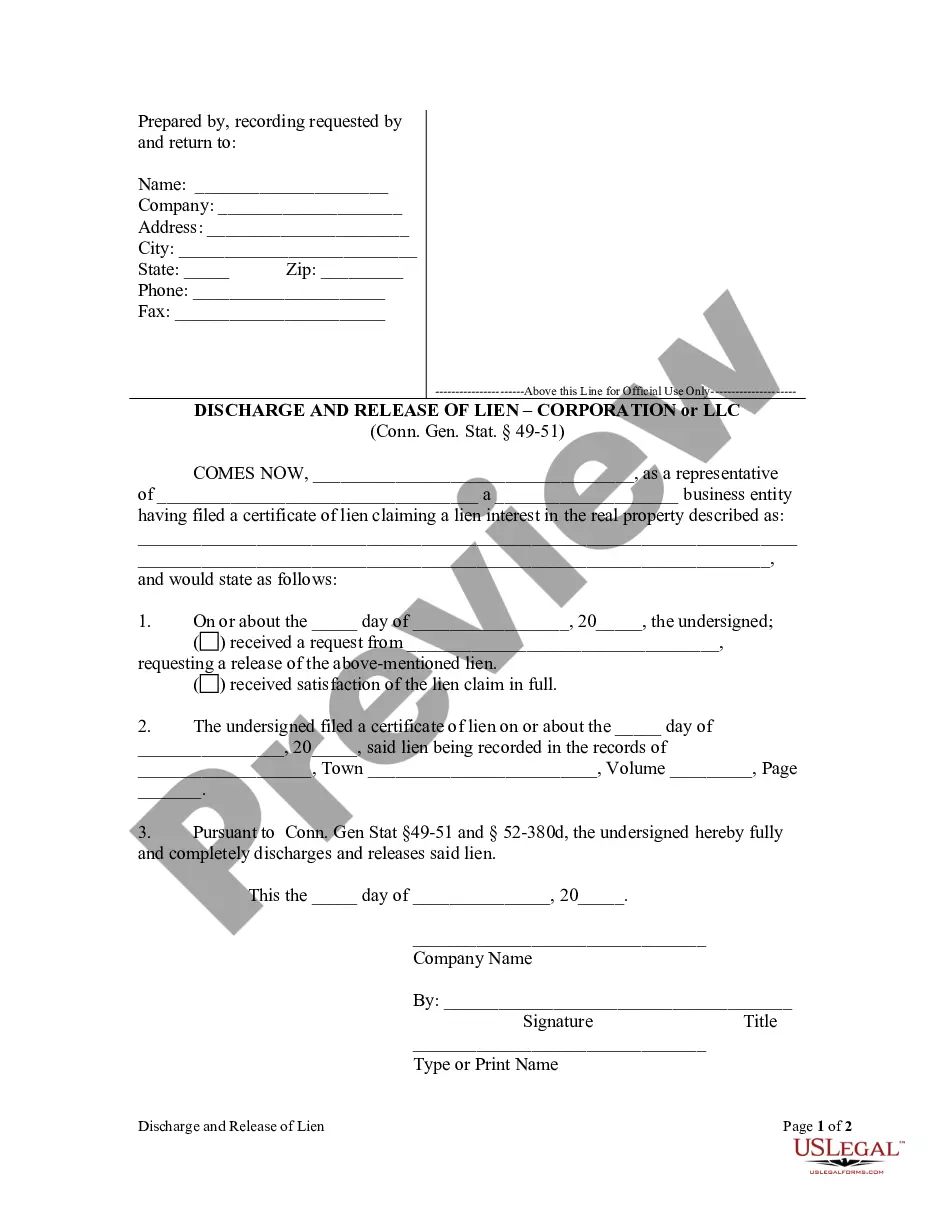

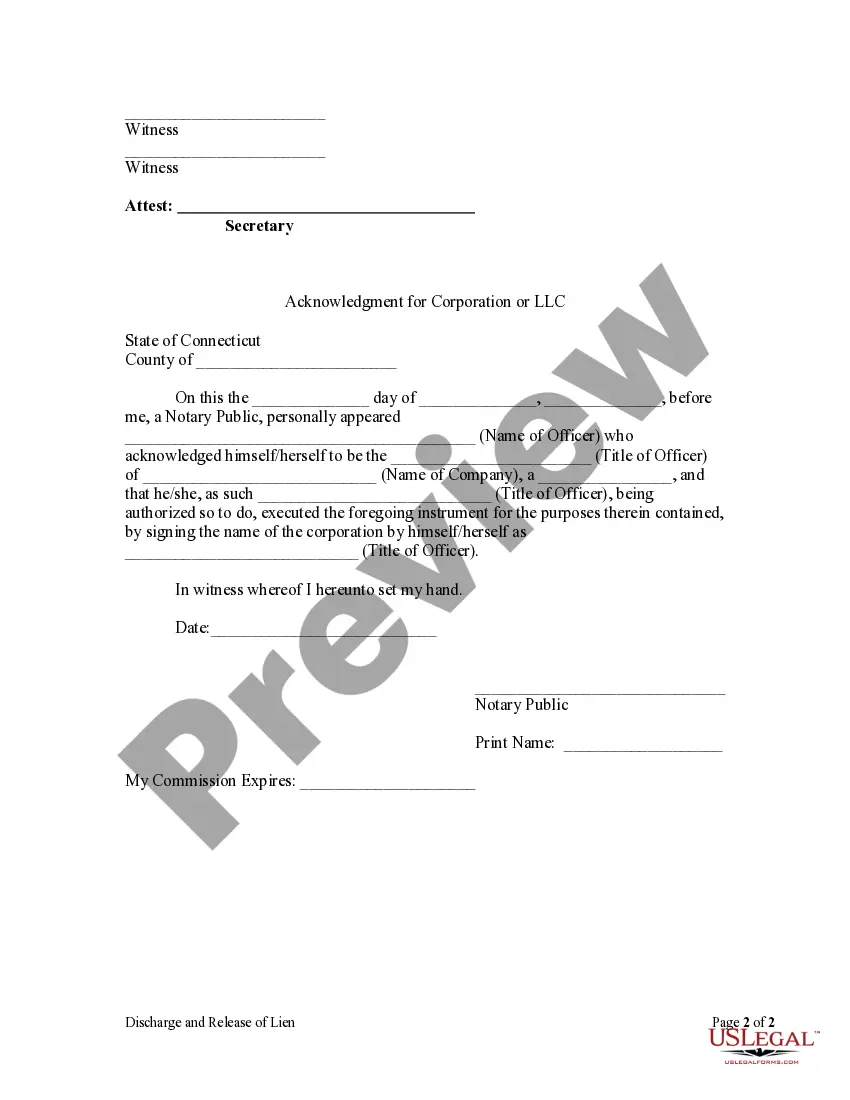

Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

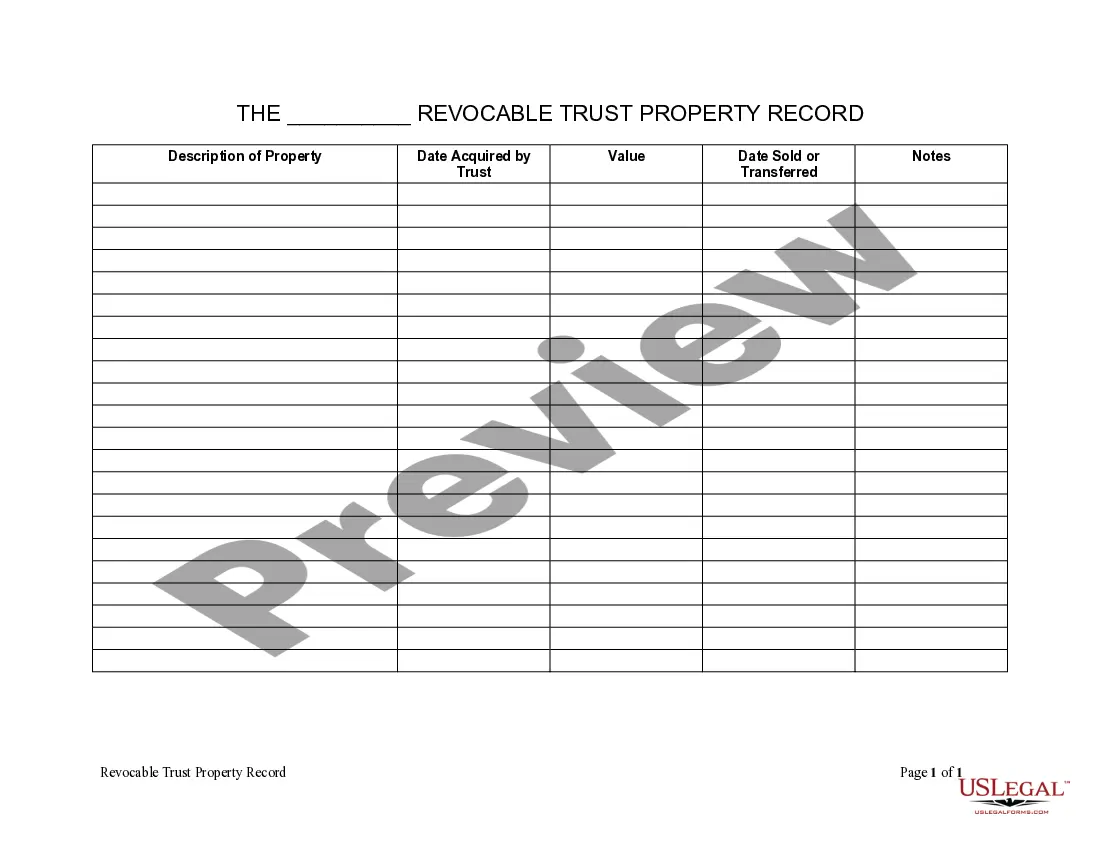

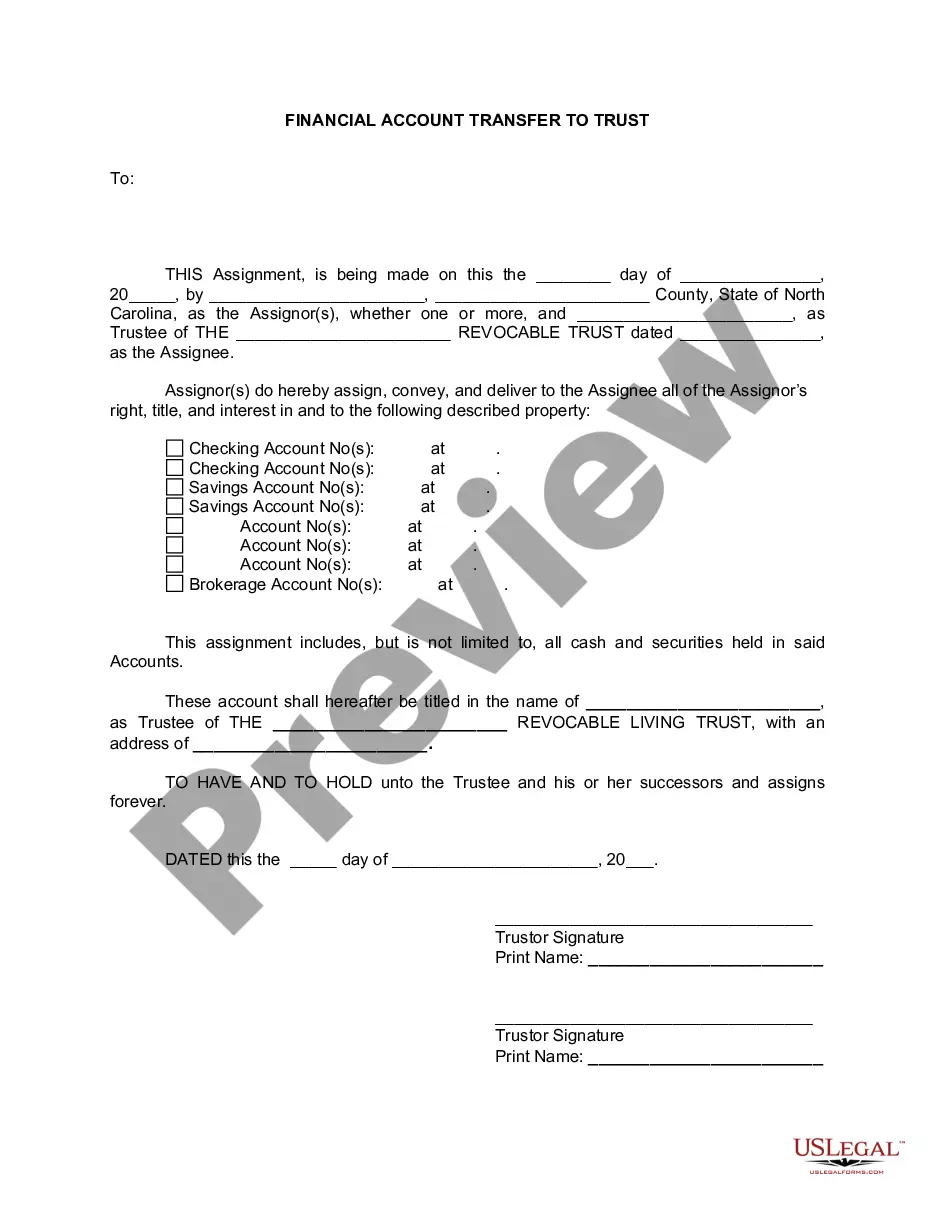

Stamford Connecticut Discharge and Release of Lien by Corporation or LLC is a legal process whereby a corporation or limited liability company (LLC) releases a previously imposed lien on a property or asset. This discharge and release is typically granted once the underlying obligation or debt secured by the lien has been satisfied or resolved. In Stamford, there are several types of Discharge and Release of Lien by Corporation or LLC, each pertaining to specific scenarios and circumstances. These include: 1. Mortgage Release: This type of discharge and release is common when a property's mortgage loan has been fully paid off, allowing the corporation or LLC, which previously held the lien, to discharge the lien and release any claims it had on the property. 2. Mechanic's Lien Release: When a corporation or LLC has placed a lien on a property due to unpaid services or materials provided for construction or repair work, a Mechanic's Lien Release comes into play once the debt is settled. This allows the corporation or LLC to release the lien on the property, indicating that the required payments have been made. 3. Judgement Lien Release: In the event that a corporation or LLC has obtained a judgement lien on a property or asset due to a lawsuit or court judgement, a Judgment Lien Release is necessary when the judgement has been satisfied. This process liberates the property or asset from the lien and clears any further obligations. 4. Tax Lien Release: If a corporation or LLC has placed a lien on a property or asset to secure payment of outstanding taxes owed to the government, a Tax Lien Release is required upon full settlement of the tax debt. This ensures that the corporation or LLC relinquishes its claim on the property or asset. It is important for corporations and LCS in Stamford, Connecticut, to follow the proper legal protocols and procedures when seeking a Discharge and Release of Lien. This typically involves submitting the necessary documentation to the appropriate authorities and ensuring compliance with state laws and regulations. Professional legal advice is often recommended navigating this process effectively. Note: Please consult with a legal professional or appropriate authority to ensure accuracy and relevance of the information provided above, as laws and regulations may vary over time and can differ between jurisdictions.