Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

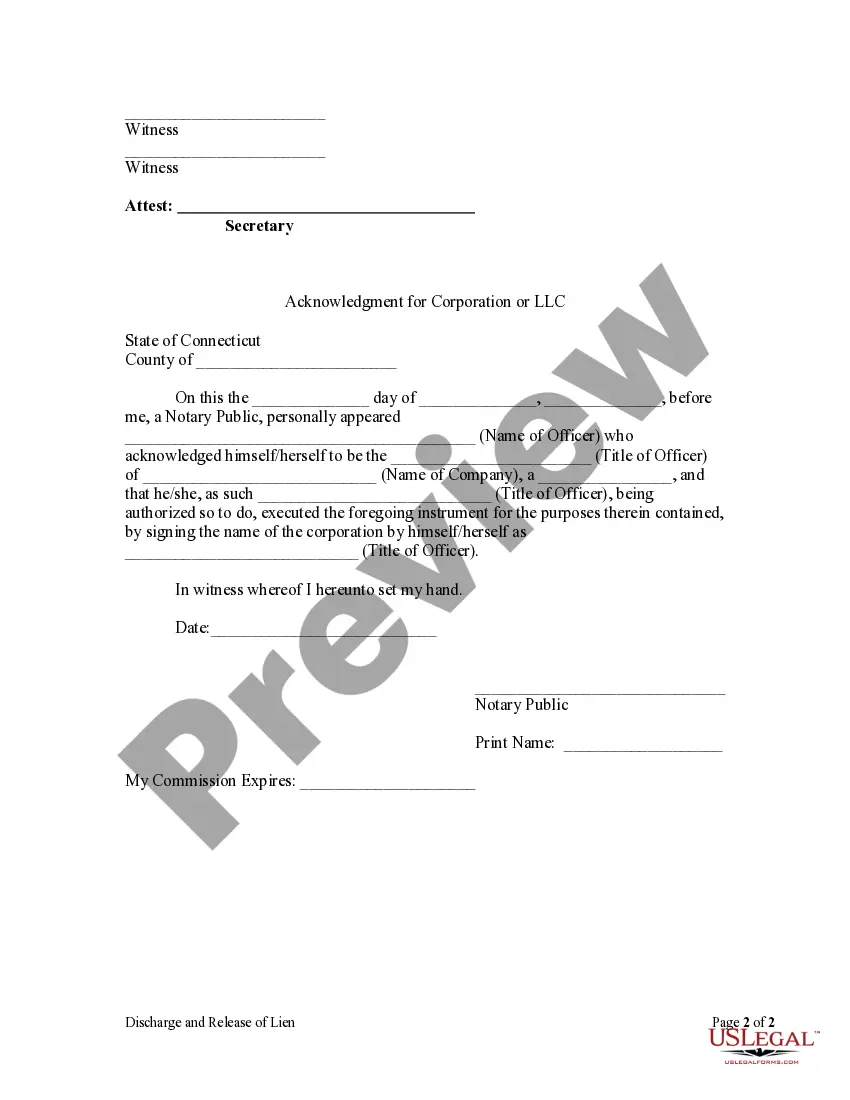

Waterbury Connecticut Discharge and Release of Lien by Corporation or LLC is a legal document that signifies the complete removal and release of a lien placed on a property in Waterbury, Connecticut, by a corporation or limited liability company (LLC). This document is crucial for the property owner as it grants them the freedom to sell, transfer, or refinance the property without any encumbrances. The process of obtaining a Discharge and Release of Lien by a Corporation or LLC involves notifying the relevant parties, such as the lien holder, the property owner, and the local authorities, that the lien has been satisfied and is no longer valid. The Corporation or LLC is responsible for filing this document with the appropriate governmental agency, typically the Waterbury Registry of Deeds, to ensure the public record reflects the lien's release. The Waterbury Connecticut Discharge and Release of Lien by Corporation or LLC is essential for protecting both the property owner's interests and the reputation of the corporation or LLC involved. Failure to comply with the lien release requirements may result in legal complications, including potential lawsuits or disputes over property ownership rights. Different types of Waterbury Connecticut Discharge and Release of Lien by Corporation or LLC may include: 1. Mortgage Lien Release: This type of discharge and release of lien specifically pertains to the release of a mortgage lien held by a corporation or LLC. It frees the property from the mortgage debt and removes any claim the corporation or LLC had on the property due to the mortgage. 2. Mechanic's Lien Release: A mechanic's lien is typically filed by contractors, subcontractors, or suppliers to secure payment for services or materials provided for property improvements or construction projects. When a corporation or LLC holds such a lien, the Discharge and Release of Lien document eliminates the claim against the property, acknowledging that the lien has been satisfied. 3. Tax Lien Release: In cases where a corporation or LLC holds a tax lien on a Waterbury property, a Discharge and Release of Lien is required to release the property from the lien. The release indicates that the outstanding tax obligations have been fulfilled and the corporation or LLC has no further interest in the property. It is crucial for corporations and LCS in Waterbury, Connecticut, to understand the specific requirements and procedures associated with obtaining a Discharge and Release of Lien. Seeking legal advice is highly recommended ensuring proper compliance with state laws and regulations, guaranteeing a smooth and legal release of the lien on the property they hold.Waterbury Connecticut Discharge and Release of Lien by Corporation or LLC is a legal document that signifies the complete removal and release of a lien placed on a property in Waterbury, Connecticut, by a corporation or limited liability company (LLC). This document is crucial for the property owner as it grants them the freedom to sell, transfer, or refinance the property without any encumbrances. The process of obtaining a Discharge and Release of Lien by a Corporation or LLC involves notifying the relevant parties, such as the lien holder, the property owner, and the local authorities, that the lien has been satisfied and is no longer valid. The Corporation or LLC is responsible for filing this document with the appropriate governmental agency, typically the Waterbury Registry of Deeds, to ensure the public record reflects the lien's release. The Waterbury Connecticut Discharge and Release of Lien by Corporation or LLC is essential for protecting both the property owner's interests and the reputation of the corporation or LLC involved. Failure to comply with the lien release requirements may result in legal complications, including potential lawsuits or disputes over property ownership rights. Different types of Waterbury Connecticut Discharge and Release of Lien by Corporation or LLC may include: 1. Mortgage Lien Release: This type of discharge and release of lien specifically pertains to the release of a mortgage lien held by a corporation or LLC. It frees the property from the mortgage debt and removes any claim the corporation or LLC had on the property due to the mortgage. 2. Mechanic's Lien Release: A mechanic's lien is typically filed by contractors, subcontractors, or suppliers to secure payment for services or materials provided for property improvements or construction projects. When a corporation or LLC holds such a lien, the Discharge and Release of Lien document eliminates the claim against the property, acknowledging that the lien has been satisfied. 3. Tax Lien Release: In cases where a corporation or LLC holds a tax lien on a Waterbury property, a Discharge and Release of Lien is required to release the property from the lien. The release indicates that the outstanding tax obligations have been fulfilled and the corporation or LLC has no further interest in the property. It is crucial for corporations and LCS in Waterbury, Connecticut, to understand the specific requirements and procedures associated with obtaining a Discharge and Release of Lien. Seeking legal advice is highly recommended ensuring proper compliance with state laws and regulations, guaranteeing a smooth and legal release of the lien on the property they hold.