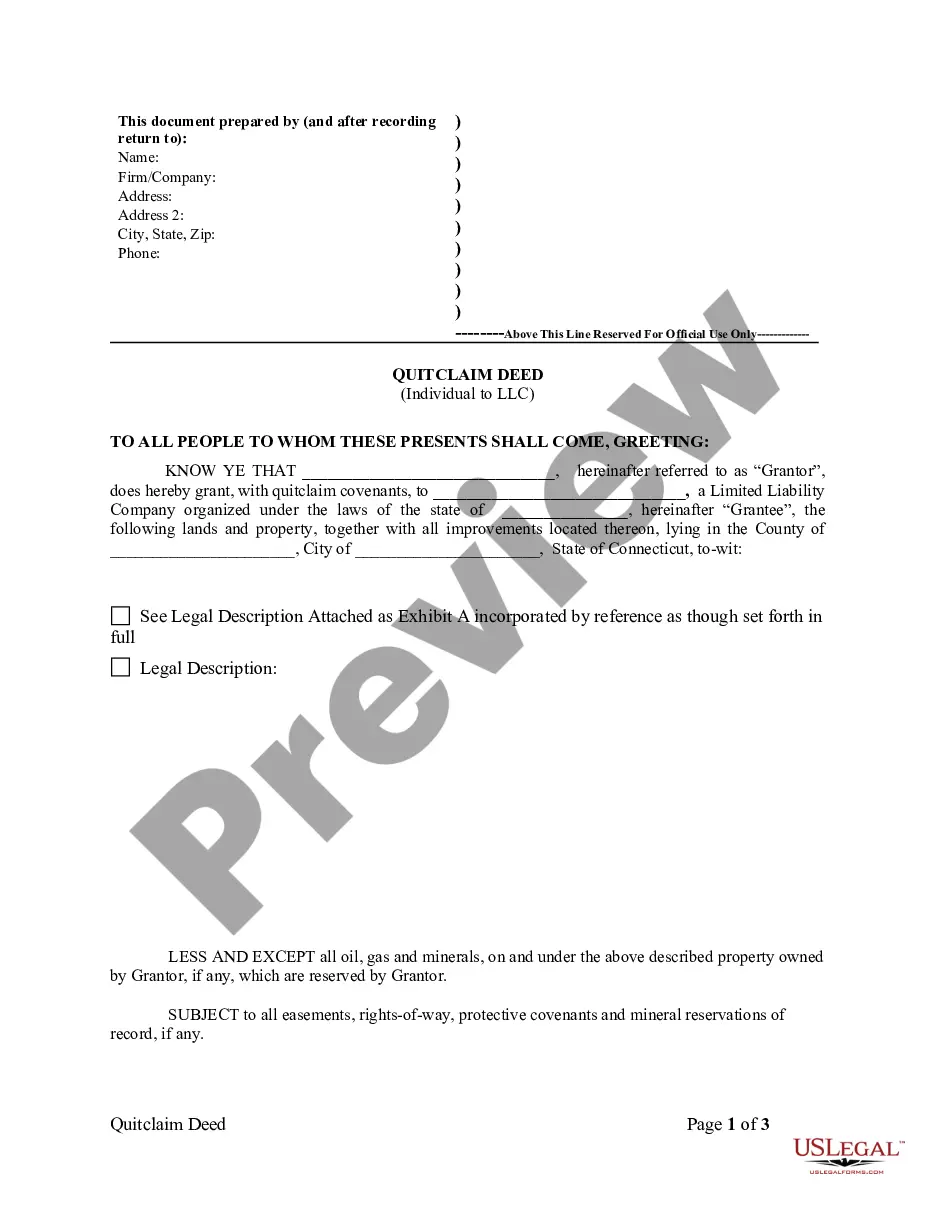

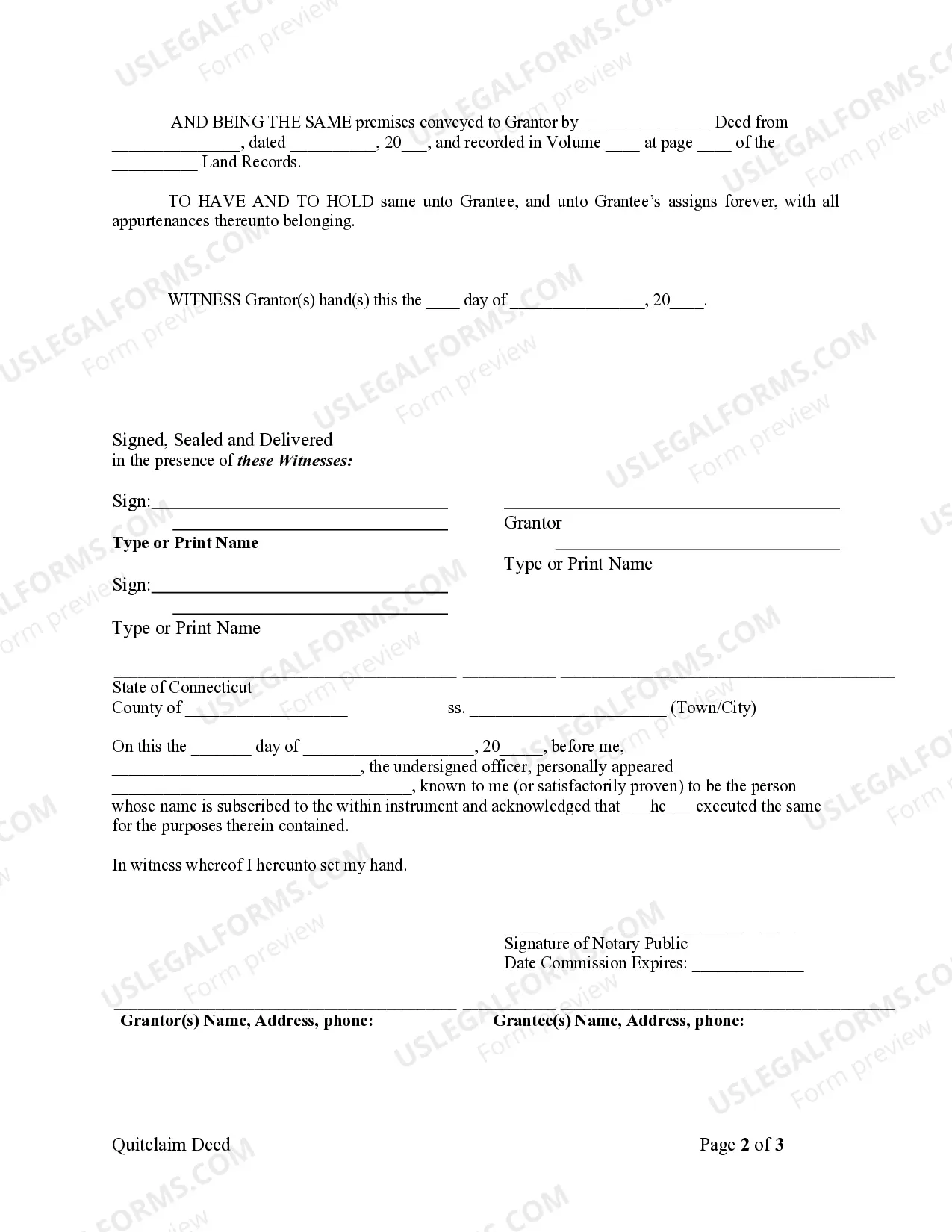

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Stamford Connecticut Quitclaim Deed from Individual to LLC is a legal document used to transfer real property ownership from an individual to a limited liability company (LLC). This type of deed is common in Stamford, Connecticut, and is an essential step when restructuring property ownership or establishing an LLC for investment purposes. Understanding the process and various types of quitclaim deeds is crucial to ensure a smooth and legally sound transfer. A Stamford Connecticut Quitclaim Deed from Individual to LLC essentially conveys the individual's interest in a property to the LLC without providing any warranties or guarantees regarding the property's title. It serves to establish the LLC as the new owner, protecting both parties involved in the transaction. There are several types of Stamford Connecticut Quitclaim Deeds from Individual to LLC, each serving different purposes based on the specific circumstances of the transfer: 1. Interfamily Transfer Quitclaim Deed: This type of quitclaim deed is used when a property is being transferred from an individual to an LLC owned by family members. It may be employed to restructure asset ownership within a family or for estate planning purposes. 2. Investment Property Transfer Quitclaim Deed: This quitclaim deed is employed when transferring ownership of an investment property from an individual to an LLC. It helps separate personal assets from business assets and offers liability protection to the individual by creating a legal distinction between personal and business liabilities. 3. Partnership Reorganization Quitclaim Deed: In situations where a partnership is converting into an LLC, this type of quitclaim deed facilitates the transfer of property ownership from the individual partners to the newly formed LLC. It helps streamline the transition process and clearly defines the new ownership structure. 4. Tax Consideration Quitclaim Deed: This quitclaim deed is used when transferring property to an LLC for tax-related reasons. It can potentially provide tax benefits or advantages, such as transfer tax exemptions or a basis adjustment for tax purposes. When preparing a Stamford Connecticut Quitclaim Deed from Individual to LLC, it is essential to consult with legal professionals experienced in real estate law to ensure compliance with local regulations and to protect the interests of both parties. It is also crucial to conduct a thorough title search and obtain title insurance to verify the property's ownership history and resolve any potential issues that may arise during the transfer process. In summary, a Stamford Connecticut Quitclaim Deed from Individual to LLC is a legal document that enables the transfer of property ownership from an individual to an LLC. It offers liability protection, restructures asset ownership, and aids in estate planning, partnership reorganization, or tax considerations.A Stamford Connecticut Quitclaim Deed from Individual to LLC is a legal document used to transfer real property ownership from an individual to a limited liability company (LLC). This type of deed is common in Stamford, Connecticut, and is an essential step when restructuring property ownership or establishing an LLC for investment purposes. Understanding the process and various types of quitclaim deeds is crucial to ensure a smooth and legally sound transfer. A Stamford Connecticut Quitclaim Deed from Individual to LLC essentially conveys the individual's interest in a property to the LLC without providing any warranties or guarantees regarding the property's title. It serves to establish the LLC as the new owner, protecting both parties involved in the transaction. There are several types of Stamford Connecticut Quitclaim Deeds from Individual to LLC, each serving different purposes based on the specific circumstances of the transfer: 1. Interfamily Transfer Quitclaim Deed: This type of quitclaim deed is used when a property is being transferred from an individual to an LLC owned by family members. It may be employed to restructure asset ownership within a family or for estate planning purposes. 2. Investment Property Transfer Quitclaim Deed: This quitclaim deed is employed when transferring ownership of an investment property from an individual to an LLC. It helps separate personal assets from business assets and offers liability protection to the individual by creating a legal distinction between personal and business liabilities. 3. Partnership Reorganization Quitclaim Deed: In situations where a partnership is converting into an LLC, this type of quitclaim deed facilitates the transfer of property ownership from the individual partners to the newly formed LLC. It helps streamline the transition process and clearly defines the new ownership structure. 4. Tax Consideration Quitclaim Deed: This quitclaim deed is used when transferring property to an LLC for tax-related reasons. It can potentially provide tax benefits or advantages, such as transfer tax exemptions or a basis adjustment for tax purposes. When preparing a Stamford Connecticut Quitclaim Deed from Individual to LLC, it is essential to consult with legal professionals experienced in real estate law to ensure compliance with local regulations and to protect the interests of both parties. It is also crucial to conduct a thorough title search and obtain title insurance to verify the property's ownership history and resolve any potential issues that may arise during the transfer process. In summary, a Stamford Connecticut Quitclaim Deed from Individual to LLC is a legal document that enables the transfer of property ownership from an individual to an LLC. It offers liability protection, restructures asset ownership, and aids in estate planning, partnership reorganization, or tax considerations.