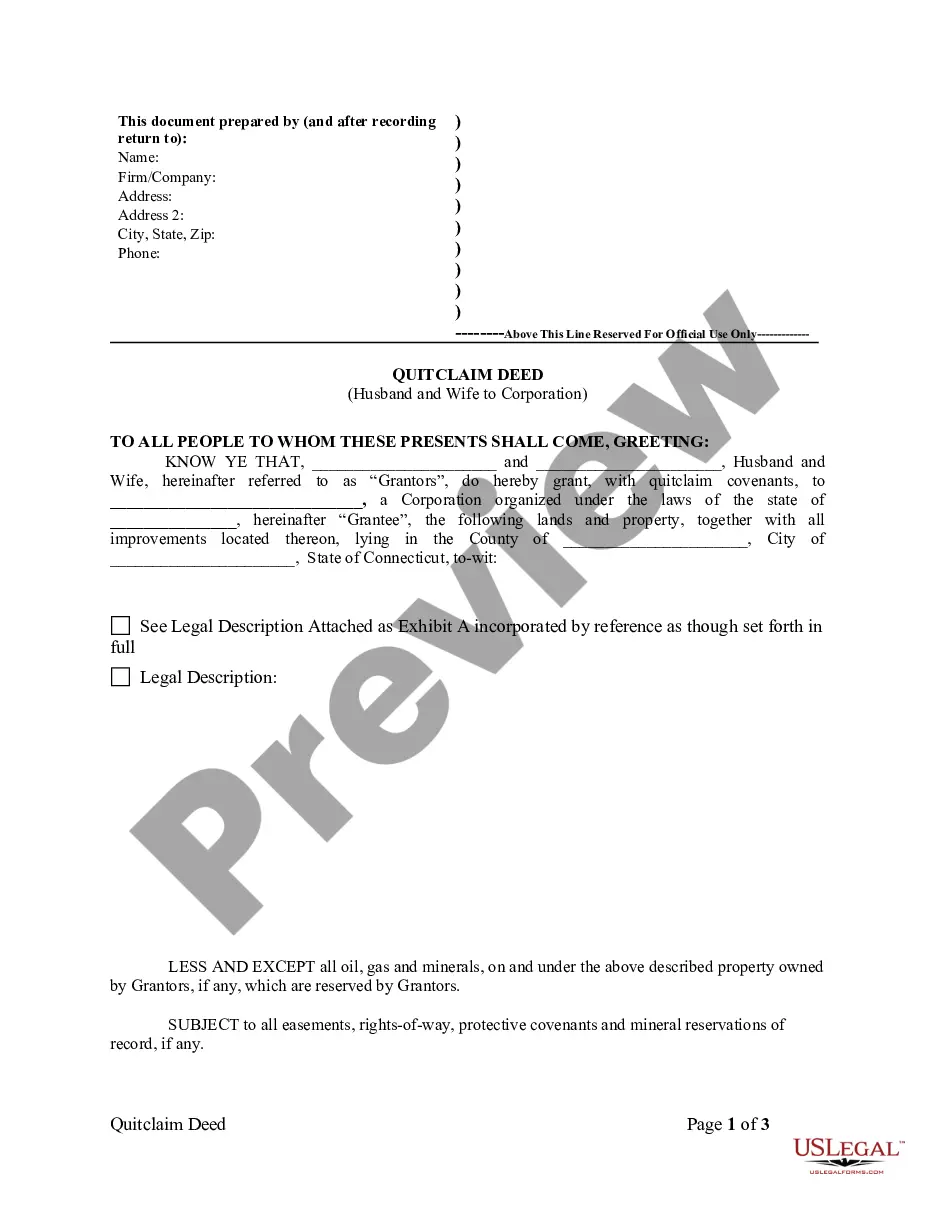

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership rights of a property from a married couple to a corporation, with no warranty regarding the title or any potential encumbrances. This type of deed is commonly used when a couple wants to transfer property ownership to a corporation, such as for tax or liability purposes. The Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation is an important legal instrument that should be executed with careful consideration and the assistance of a qualified attorney. It allows the couple to convey their interests in the property to the corporation, effectively removing their names from the title. There are a few different types of Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation, each catering to specific circumstances or requirements: 1. General Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed used for transferring property ownership from a married couple to a corporation. It transfers all ownership interests, rights, and claims without any warranty. 2. Limited Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: This type of quitclaim deed may include restrictions or limitations on the transferred property. For example, the couple may exclude certain parts of the property or limit the corporation's use for specific purposes. 3. Special Purpose Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: This quitclaim deed is used when the transfer is solely for a particular purpose. It may have specific terms outlined within the deed, such as granting the corporation access to certain amenities or facilities on the property. 4. Non-Corporate Entity Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: Although the term in this type of deed refers to a corporation, it can also be used when transferring property to other types of legal entities, such as limited liability companies (LCS) or partnerships. Before executing a Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation, it is crucial to conduct thorough due diligence on the property's title, assess any potential encumbrances or liens, and verify the compatibility of the intended purpose with local zoning and land use regulations. Seeking professional guidance from a real estate attorney can ensure a smooth and legally compliant transfer of property ownership.A Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership rights of a property from a married couple to a corporation, with no warranty regarding the title or any potential encumbrances. This type of deed is commonly used when a couple wants to transfer property ownership to a corporation, such as for tax or liability purposes. The Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation is an important legal instrument that should be executed with careful consideration and the assistance of a qualified attorney. It allows the couple to convey their interests in the property to the corporation, effectively removing their names from the title. There are a few different types of Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation, each catering to specific circumstances or requirements: 1. General Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed used for transferring property ownership from a married couple to a corporation. It transfers all ownership interests, rights, and claims without any warranty. 2. Limited Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: This type of quitclaim deed may include restrictions or limitations on the transferred property. For example, the couple may exclude certain parts of the property or limit the corporation's use for specific purposes. 3. Special Purpose Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: This quitclaim deed is used when the transfer is solely for a particular purpose. It may have specific terms outlined within the deed, such as granting the corporation access to certain amenities or facilities on the property. 4. Non-Corporate Entity Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation: Although the term in this type of deed refers to a corporation, it can also be used when transferring property to other types of legal entities, such as limited liability companies (LCS) or partnerships. Before executing a Stamford Connecticut Quitclaim Deed from Husband and Wife to Corporation, it is crucial to conduct thorough due diligence on the property's title, assess any potential encumbrances or liens, and verify the compatibility of the intended purpose with local zoning and land use regulations. Seeking professional guidance from a real estate attorney can ensure a smooth and legally compliant transfer of property ownership.