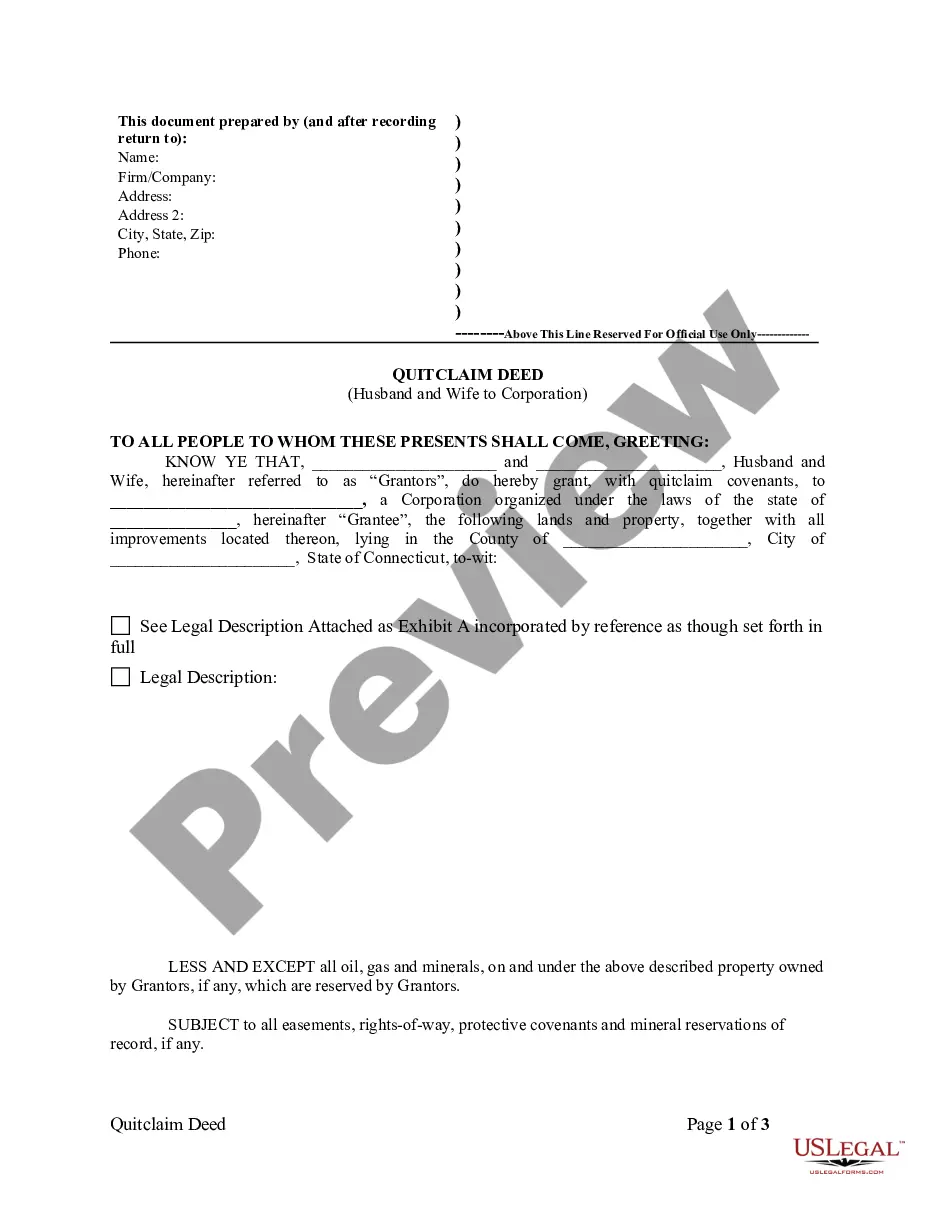

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Waterbury Connecticut Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership interest of a property from a married couple to a corporation. This type of deed is commonly used when a couple wants to transfer their property to a corporation they own or establish, typically for business or asset protection purposes. A Waterbury Connecticut Quitclaim Deed is a specific type of deed that allows an individual or a couple to transfer their interest in a property without making any warranties or guarantees regarding the ownership or condition of the property. It is important to note that a quitclaim deed does not guarantee clear ownership or title to the property, as it only transfers the interest that the granters possess at the time of the transfer. The quitclaim deed includes relevant information about the property, husband, wife, and the corporation involved in the transfer. This information typically includes the property's legal description, the names and addresses of the husband and wife as granters, and the name and address of the corporation as the grantee. Additionally, the deed will need to be notarized and recorded at the appropriate county office in Waterbury, Connecticut. There are different types of Waterbury Connecticut Quitclaim Deed from Husband and Wife to Corporation depending on the specific circumstances of the transfer of the property. These variations include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed and is used to transfer the broadest interest in the property. It does not include any specific guarantees or warranties regarding the property's ownership or condition. 2. Limited or Special Quitclaim Deed: This type of quitclaim deed restricts the transfer of ownership to specific portions or interests in the property. For example, if only a specific portion or percentage of the property is being transferred to the corporation. 3. Tenancy By the Entirety Quitclaim Deed: This type of quitclaim deed is used when the property is owned by a married couple under the tenancy by the entirety form of ownership. It allows the couple to transfer their joint interest in the property to the corporation. 4. Release Deed: Sometimes referred to as a "Quitclaim Release Deed," this type of deed is used when one party, either the husband or wife, wants to release their interest in the property to the other spouse while transferring the remaining interest to the corporation. In summary, a Waterbury Connecticut Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that allows a married couple to transfer their interest in a property to a corporation. However, it is essential to consult with a qualified attorney or real estate professional specializing in deed transfers to ensure the process is executed correctly and meets all legal requirements.