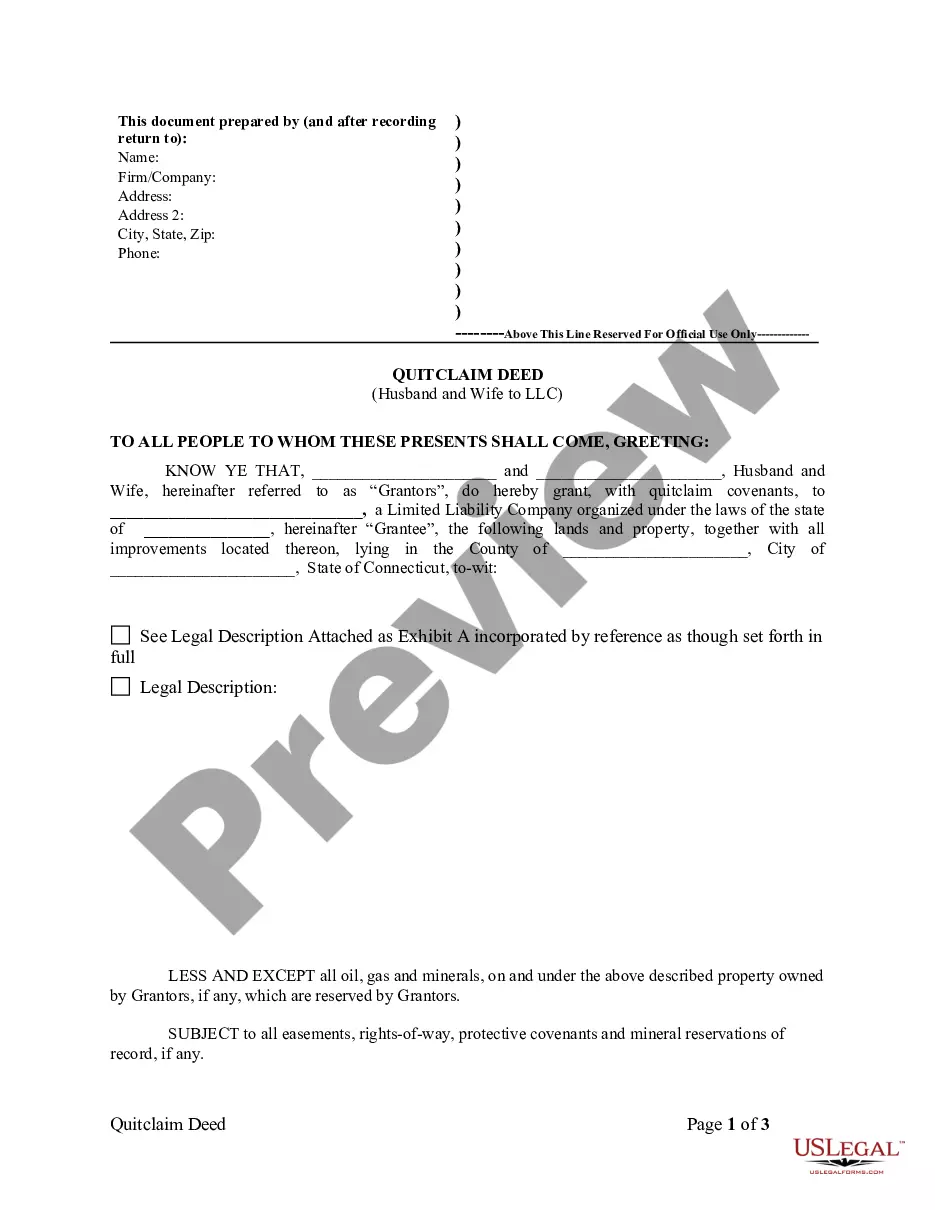

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Stamford Connecticut quitclaim deed from husband and wife to LLC is a legal document that allows a married couple to transfer their ownership interest in a property to a limited liability company (LLC) based in Stamford, Connecticut. This type of deed is commonly used when a couple wants to protect the property's ownership and liability by transferring it to an LLC. The purpose of utilizing a quitclaim deed in this context is to ensure that the rights and interests of the husband and wife are transferred to the LLC without any warranty or guarantee. By executing this deed, the couple effectively conveys all their rights, title, and interest in the property to the LLC, thereby making the LLC the new legal owner. It is important to mention that there are multiple types of Stamford Connecticut Quitclaim Deeds from Husband and Wife to LLC, and they may differ based on various factors. Some notable types include: 1. Statutory Quitclaim Deed: This is the most common type of quitclaim deed used in Stamford, Connecticut. It is governed by the statutory requirements outlined in the state's laws and regulations. 2. Individual LLC Members Quitclaim Deed: In cases where the LLC has multiple members, each member may need to sign a quitclaim deed to transfer their individual ownership interests to the LLC. This type of deed acknowledges the transfer of each member's respective interest. 3. Husband and Wife Transfer as Tenants-in-Common Quitclaim Deed: This type of quitclaim deed can be used if the husband and wife jointly own the property as tenants-in-common. It enables them to transfer their proportional interests to the LLC. 4. Community Property Quitclaim Deed: In the case of a husband and wife owning the property as community property, this type of quitclaim deed allows them to transfer their shared interest to the LLC. 5. Enhanced Life Estate Quitclaim Deed: Sometimes referred to as a "Lady Bird Deed," this deed allows the husband and wife to transfer the property to the LLC while retaining a life estate. This means they maintain the right to occupy and use the property until their death. It is crucial to consult with a qualified attorney or real estate professional to ensure the correct type of quitclaim deed is used and that all legal requirements are met when transferring property ownership from husband and wife to an LLC in Stamford, Connecticut.A Stamford Connecticut quitclaim deed from husband and wife to LLC is a legal document that allows a married couple to transfer their ownership interest in a property to a limited liability company (LLC) based in Stamford, Connecticut. This type of deed is commonly used when a couple wants to protect the property's ownership and liability by transferring it to an LLC. The purpose of utilizing a quitclaim deed in this context is to ensure that the rights and interests of the husband and wife are transferred to the LLC without any warranty or guarantee. By executing this deed, the couple effectively conveys all their rights, title, and interest in the property to the LLC, thereby making the LLC the new legal owner. It is important to mention that there are multiple types of Stamford Connecticut Quitclaim Deeds from Husband and Wife to LLC, and they may differ based on various factors. Some notable types include: 1. Statutory Quitclaim Deed: This is the most common type of quitclaim deed used in Stamford, Connecticut. It is governed by the statutory requirements outlined in the state's laws and regulations. 2. Individual LLC Members Quitclaim Deed: In cases where the LLC has multiple members, each member may need to sign a quitclaim deed to transfer their individual ownership interests to the LLC. This type of deed acknowledges the transfer of each member's respective interest. 3. Husband and Wife Transfer as Tenants-in-Common Quitclaim Deed: This type of quitclaim deed can be used if the husband and wife jointly own the property as tenants-in-common. It enables them to transfer their proportional interests to the LLC. 4. Community Property Quitclaim Deed: In the case of a husband and wife owning the property as community property, this type of quitclaim deed allows them to transfer their shared interest to the LLC. 5. Enhanced Life Estate Quitclaim Deed: Sometimes referred to as a "Lady Bird Deed," this deed allows the husband and wife to transfer the property to the LLC while retaining a life estate. This means they maintain the right to occupy and use the property until their death. It is crucial to consult with a qualified attorney or real estate professional to ensure the correct type of quitclaim deed is used and that all legal requirements are met when transferring property ownership from husband and wife to an LLC in Stamford, Connecticut.