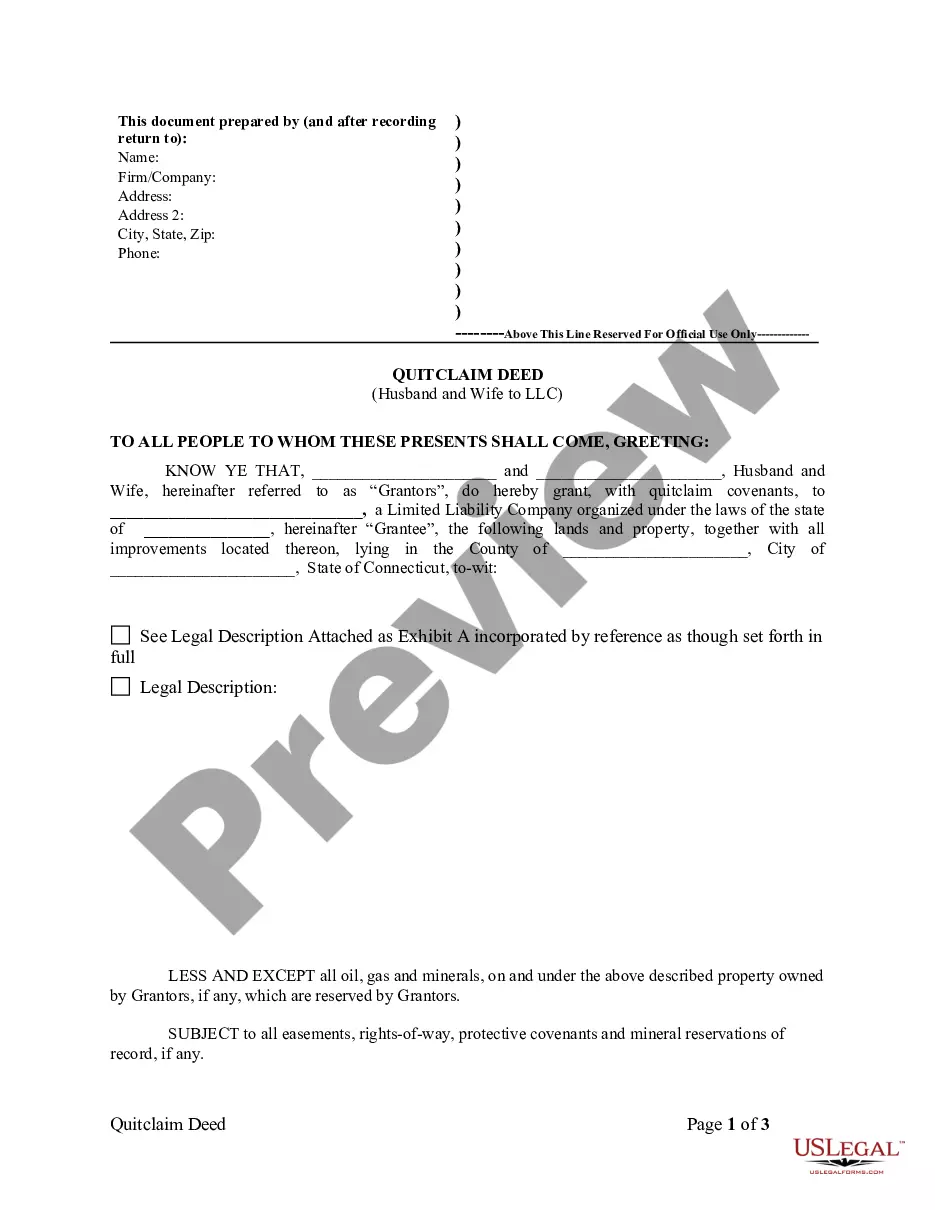

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership of a property from a married couple to a limited liability company (LLC) using a quitclaim deed. This type of deed is commonly used in real estate transactions and allows the couple to transfer their interest in the property to the LLC without making any warranties or guarantees about the property's condition or ownership. There are different types of Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC, based on specific circumstances and preferences. Some of these variations include: 1. Waterbury Connecticut Quitclaim Deed from Husband and Wife to Single-Member LLC: This type of deed is used when the LLC has only one member, and the property is being transferred solely to that individual. 2. Waterbury Connecticut Joint Tenancy Quitclaim Deed from Husband and Wife to Multi-Member LLC: This deed is utilized when the LLC has multiple members, and the property is being transferred to the LLC collectively. 3. Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC Operating Agreement: In certain cases, the transfer of the property via a quitclaim deed is accompanied by an LLC operating agreement. This agreement outlines the management structure, ownership shares, and other important details related to the LLC. When executing a Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC, it is crucial to ensure that the document accurately reflects the intentions of the parties involved. It should contain the legal description of the property, the names of the granters (husband and wife), the name of the LLC as the grantee, and any additional terms or conditions desired by the parties. To finalize the transfer, the deed should be signed and acknowledged by the granters in the presence of a notary public. It is recommended to consult with an experienced real estate attorney or professional to ensure compliance with all legal requirements and to protect the interests of all parties involved. In summary, a Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC allows a married couple to transfer ownership of a property to their LLC. Different variations of this deed exist to accommodate specific circumstances, such as single-member or multi-member LCS. Careful attention to detail and professional guidance are advised when executing such a deed to ensure a smooth and legally sound transfer of property ownership.A Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership of a property from a married couple to a limited liability company (LLC) using a quitclaim deed. This type of deed is commonly used in real estate transactions and allows the couple to transfer their interest in the property to the LLC without making any warranties or guarantees about the property's condition or ownership. There are different types of Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC, based on specific circumstances and preferences. Some of these variations include: 1. Waterbury Connecticut Quitclaim Deed from Husband and Wife to Single-Member LLC: This type of deed is used when the LLC has only one member, and the property is being transferred solely to that individual. 2. Waterbury Connecticut Joint Tenancy Quitclaim Deed from Husband and Wife to Multi-Member LLC: This deed is utilized when the LLC has multiple members, and the property is being transferred to the LLC collectively. 3. Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC Operating Agreement: In certain cases, the transfer of the property via a quitclaim deed is accompanied by an LLC operating agreement. This agreement outlines the management structure, ownership shares, and other important details related to the LLC. When executing a Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC, it is crucial to ensure that the document accurately reflects the intentions of the parties involved. It should contain the legal description of the property, the names of the granters (husband and wife), the name of the LLC as the grantee, and any additional terms or conditions desired by the parties. To finalize the transfer, the deed should be signed and acknowledged by the granters in the presence of a notary public. It is recommended to consult with an experienced real estate attorney or professional to ensure compliance with all legal requirements and to protect the interests of all parties involved. In summary, a Waterbury Connecticut Quitclaim Deed from Husband and Wife to LLC allows a married couple to transfer ownership of a property to their LLC. Different variations of this deed exist to accommodate specific circumstances, such as single-member or multi-member LCS. Careful attention to detail and professional guidance are advised when executing such a deed to ensure a smooth and legally sound transfer of property ownership.