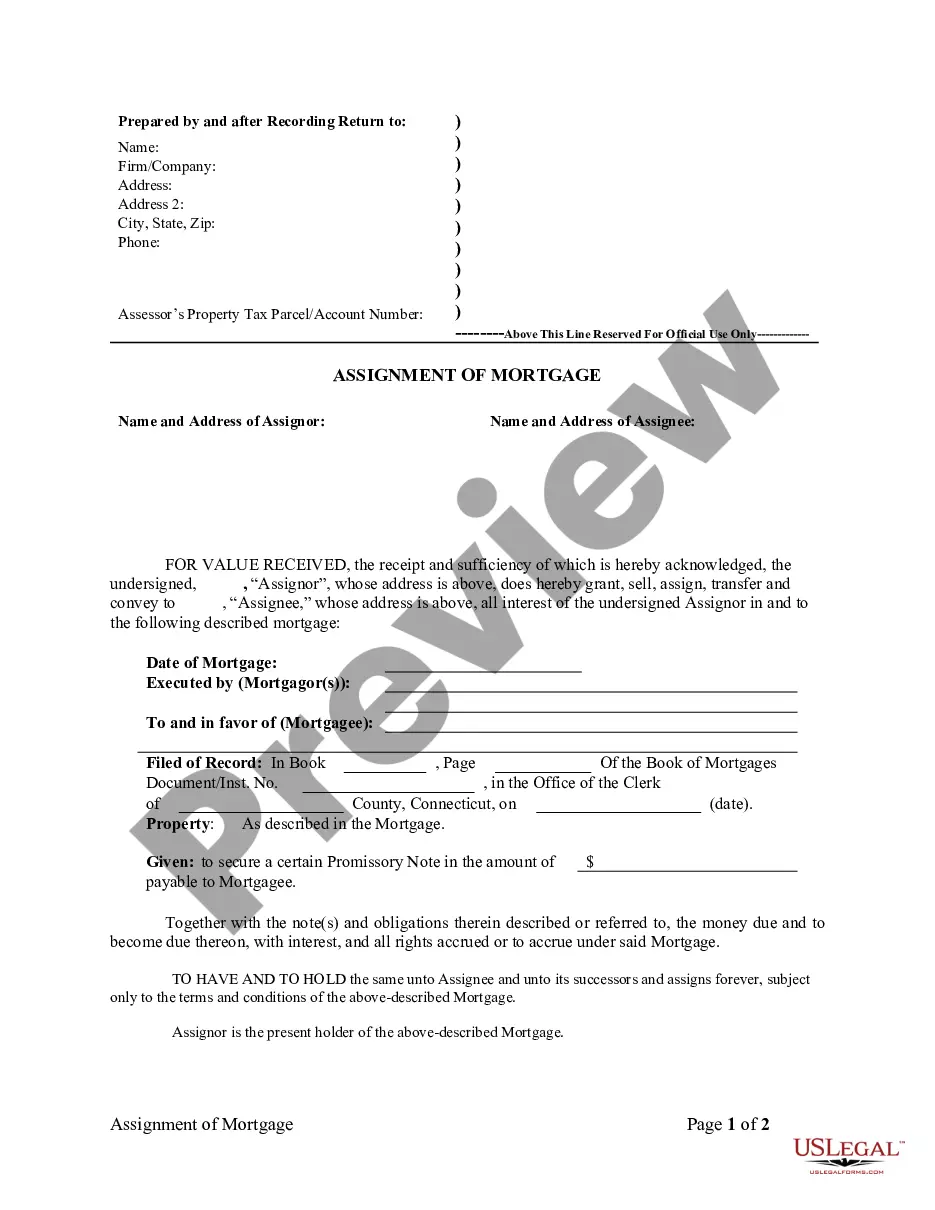

Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder is a legal document that transfers the ownership of a mortgage loan from one corporate mortgage holder to another. This assignment is commonly used when a mortgage lender decides to sell or transfer the rights to collect the mortgage payments, and potentially the mortgage itself, to another institution or entity. The assignment process involves the assignment of all rights, benefits, and interests associated with the mortgage loan. It ensures that the new mortgage holder has the legal authority to collect payments from the borrower and enforce the terms of the original mortgage agreement. Bridgeport, Connecticut, being a prominent city, witnesses various types of assignments of mortgage by corporate mortgage holders. Some common types include: 1. Standard Assignment of Mortgage: This is the most common type of assignment, where a corporate mortgage holder simply transfers the mortgage to another entity without any modifications to the terms or conditions of the original mortgage. 2. Assignment of Mortgage with Assumption: In this type of assignment, the corporate mortgage holder transfers the mortgage to another entity, and the new mortgage holder assumes the responsibility for the remaining payments and obligations outlined in the original mortgage agreement. 3. Assignment of Mortgage with Modification: Sometimes, the corporate mortgage holder may modify certain terms of the mortgage before assigning it to another entity. This could involve changes in interest rates, loan repayment periods, or other terms. 4. Assignment of Mortgage in Default: If a borrower defaults on the mortgage loan, the corporate mortgage holder may assign the mortgage to a specialized entity, such as a loan service or collection agency, to facilitate the collection of overdue payments or foreclosure proceedings. 5. Assignment of Mortgage in Pooling and Servicing Agreement: In certain cases, multiple mortgage loans are pooled together and assigned to a trust, which then issues mortgage-backed securities to investors. This type of assignment helps in the securitization process of mortgages. It is important to note that Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder must adhere to the regulations and guidelines set forth by the state and federal laws governing mortgage assignments. Overall, Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder is a crucial process for companies involved in the mortgage industry. It ensures smooth transfer of mortgage rights, allowing for effective management and enforcement of mortgage loans.

- US Legal Forms

- Localized Forms

- Connecticut

- Bridgeport

-

Connecticut Assignment of Mortgage by Corporate Mortgage Holder

Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder

Description

Related Forms

Assignment of Mortgage by Individual Mortgage Holder

View Hennepin

View Hennepin

View Hennepin

View Hennepin

View Hennepin

Viewed forms

How to fill out Bridgeport Connecticut Assignment Of Mortgage By Corporate Mortgage Holder?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for legal solutions that, as a rule, are very expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder is suitable for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!

Form Rating

Form popularity

FAQ

An award-winning writer with more than two decades of experience in real estate. The bank or other mortgage lender that provides a borrower with the funds to purchase a home often later transfers or assigns its interest in the mortgage to another firm.

A corporate assignment is simply an assignment of the deed of trust between different businesses. Since the majority of mortgages are created by banks and lending institutions and not private lenders, most assignments of deeds of trust are corporate by nature.

Start Deed of Trust StateMortgage allowedDeed of trust allowedCaliforniaYColoradoYConnecticutYDelawareY47 more rows

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

What is a mortgage assignment? - YouTube YouTube Start of suggested clip End of suggested clip In real estate there are documents filed on a property known as mortgage assignments a mortgageMoreIn real estate there are documents filed on a property known as mortgage assignments a mortgage assignment is a transfer of mortgage II rights on a loan to a property.

Home buyers will sign many papers as part of the closing process on the purchase of a piece of property. However, the two most important include the mortgage note (which includes all of the terms regarding the repayment of the debt) and a mortgage.

Bridgeport Connecticut Assignment of Mortgage by Corporate Mortgage Holder Related Searches

-

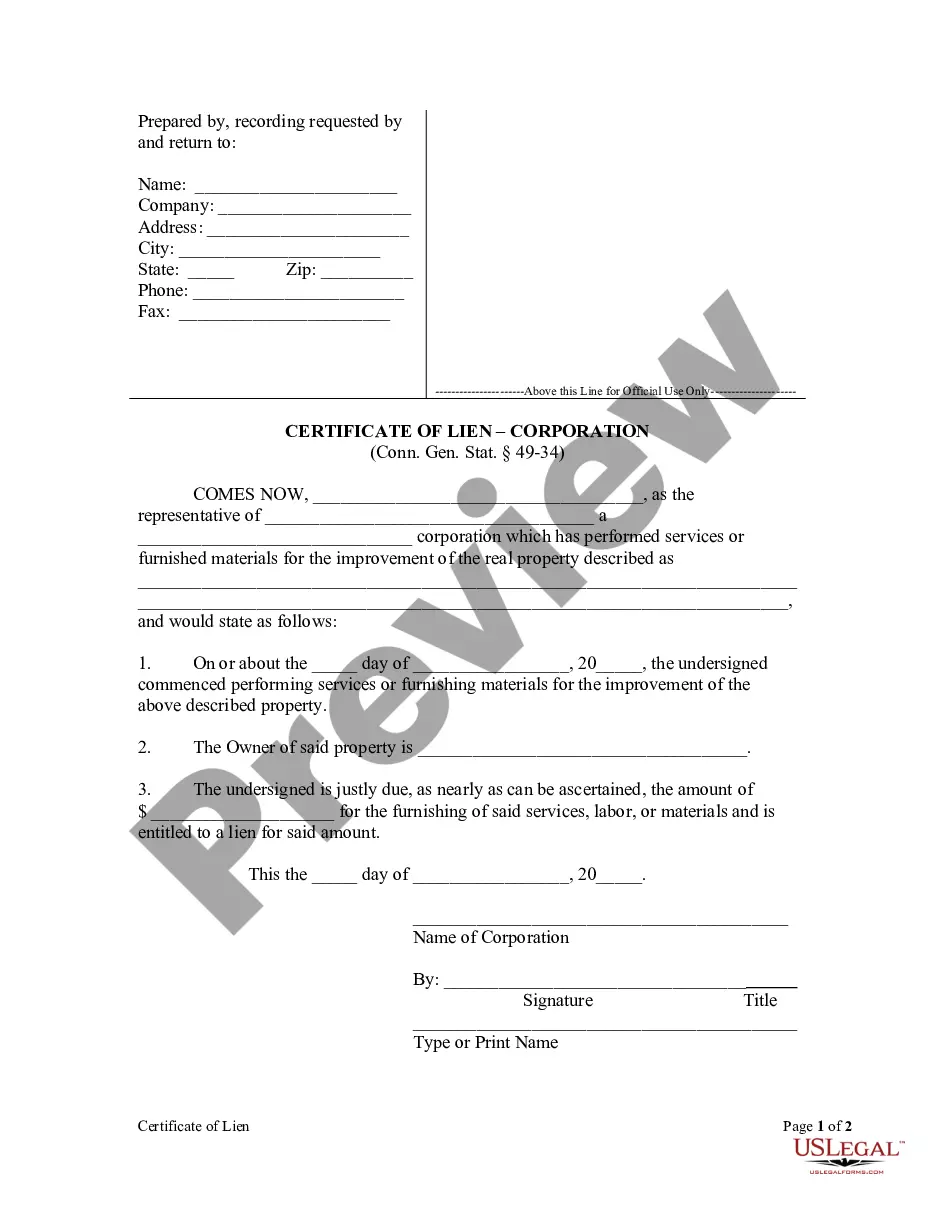

cgs 49 92a

-

cgs 49-35

-

connecticut deed forms

-

connecticut general statutes definitions

-

conn gen stat ann 47 5

-

ct lis pendens statute

-

cgs 21

-

quiet title action ct

-

bridgeport clerk's office

-

litchfield, ct property records

Interesting Questions

An assignment of mortgage is when the rights and obligations of a mortgage are transferred from one party to another.

A corporate mortgage holder might choose to assign a mortgage if they want to transfer the ownership or investment in that mortgage to another party.

The Bridgeport Assignment of Mortgage refers to the assignment of a mortgage held by a corporate mortgage holder based in Bridgeport. It involves the transfer of the rights and benefits of the mortgage to another entity.

The corporate mortgage holder in Bridgeport and the party acquiring the mortgage rights can be involved in the Bridgeport Assignment of Mortgage.

The borrower's obligations and terms of the mortgage generally remain the same even after an assignment of mortgage takes place. They continue making payments to the new mortgage holder.

No, the borrower is not directly involved in the decision to assign a mortgage. It is solely between the corporate mortgage holder and the acquiring party.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Connecticut

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Connecticut Law

Assignment: It is not necessary that an assignment be recorded. When the assignment instrument is executed, attested and acknowledged as required by law, it vests in the assignee. However, it is recommended that the assignment be recorded to avoid complications that might arise.

Demand to Satisfy: Following payoff, the demand to satisfy should be by registered or certified mail to the mortgagee, who then has 60 days to record satisfaction.

Recording Satisfaction: A mortgage may be released by an instrument in writing executed, attested and acknowledged, setting forth that the mortgage is discharged.

Penalty: If mortgagee fails to record satisfaction of mortgage within 60 days of receipt of demand from mortgagor, mortgagee shall be liable for damages at the rate of two hundred dollars for each week after the expiration of such sixty days up to a maximum of five thousand dollars or in an amount equal to the loss sustained, plus costs and reasonable attorney's fees.

Acknowledgment: An assignment or satisfaction must contain a proper Connecticut acknowledgment, or other acknowledgment approved by Statute.

Connecticut Statutes

Sec. 49-8. Release of satisfied or partially satisfied mortgage or ineffective attachment, lis pendens or lien.

Damages. (a) The mortgagee or a person authorized by law to release the mortgage shall execute and deliver a release to the extent of the satisfaction tendered before or against receipt of the release:

(1) Upon the satisfaction of the mortgage or (2) upon a bona fide offer to satisfy the same in accordance with the terms of the mortgage deed upon the execution of a release, or (3) when the parties in interest have agreed in writing to a partial release of the mortgage where that part of the property securing the partially satisfied mortgage is sufficiently definite and certain, or (4) when the mortgagor has made a bona fide offer in accordance with the terms of the mortgage deed for such partial satisfaction on the execution of such partial release.

(b) The plaintiff or the plaintiff's attorney shall execute and deliver a release when an attachment has become of no effect pursuant to section 52-322 or section 52-324 or when a lis pendens or other lien has become of no effect pursuant to section 52-326.

(c) The mortgagee or plaintiff or the plaintiff's attorney, as the case may be, shall execute and deliver a release within sixty days from the date a written request for a release of such encumbrance (1) was sent to such mortgagee, plaintiff or plaintiff's attorney at the person's last-known address by registered or certified mail, postage prepaid, return receipt requested or (2) was received by such mortgagee, plaintiff or plaintiff's attorney from a private messenger or courier service or through any means of communication, including electronic communication, reasonably calculated to give the person the written request or a copy of it. The mortgagee or plaintiff shall be liable for damages to any person aggrieved at the rate of two hundred dollars for each week after the expiration of such sixty days up to a maximum of five thousand dollars or in an amount equal to the loss sustained by such aggrieved person as a result of the failure of the mortgagee or plaintiff or the plaintiff's attorney to execute and deliver a release, whichever is greater, plus costs and reasonable attorney's fees.

Sec. 49-8a. Release of mortgage. Affidavit. Recording of affidavit with town clerk. Penalty for recording false information. (a) For purposes of this section and section 49-10a:

(1) "Mortgage loan" means a loan secured by a mortgage on one, two, three or four family residential real property located in the state of Connecticut, including but not limited to, a residential unit in any common interest community as defined in section 47-202.

(2) "Person" means an individual, corporation, limited liability company, business trust, estate, trust, partnership, association, joint venture, government, governmental subdivision or agency, or other legal or commercial entity.

(3) "Mortgagor" means the grantor of a mortgage.

(4) "Mortgagee" means the grantee of a mortgage; provided, if the mortgage has been assigned of record, "mortgagee" means the last person to whom the mortgage has been assigned of record; provided further, if the mortgage has been serviced by a mortgage servicer, "mortgagee" means the mortgage servicer.

(5) "Mortgage servicer" means the last person to whom the mortgagor has been instructed by the mortgagee to send payments of the mortgage loan. The person who has transmitted a payoff statement shall be deemed to be the mortgage servicer with respect to the mortgage loan described in that payoff statement.

(6) "Attorney-at-law" means any person admitted to practice law in this state and in good standing.

(7) "Title insurance company" means any corporation or other business entity authorized and licensed to transact the business of insuring titles to interests in real property in this state.

(8) "Payoff statement" means a statement of the amount of the unpaid balance on a mortgage loan, including principal, interest and other charges properly assessed pursuant to the loan documentation of such mortgage and a statement of the interest on a per diem basis with respect to the unpaid principal balance of the mortgage loan.

(b) If a mortgagee fails to execute and deliver a release of mortgage to the mortgagor or to the mortgagor's esignated agent within sixty days from receipt by the mortgagee of payment of the mortgage loan (1) in accordance with the payoff statement furnished by the mortgagee or (2) if no payoff statement was provided pursuant to a request made under section 49-10a, in accordance with a good faith estimate by the mortgagor of the amount of the unpaid balance on the mortgage loan using (A) a statement from the mortgagee indicating the outstanding balance due as of a date certain and (B) a reasonable estimate of the per diem interest and other charges due, any attorney-at-law or duly authorized officer of a title insurance company may, on behalf of the mortgagor or any successor in interest to the mortgagor who has acquired title to the premises described in the mortgage or any portion thereof, execute and cause to be recorded in the land records of each town where the mortgage was recorded, an affidavit which complies with the requirements of this section.

(c) An affidavit pursuant to this section shall state that:

(1) The affiant is an attorney-at-law or the authorized officer of a title insurance company, and that the affidavit is made in behalf of and at the request of the mortgagor or the current owner of the interest encumbered by the mortgage;

(2) The mortgagee has provided a payoff statement with respect to the mortgage loan or the mortgagee has failed to provide a payoff statement requested pursuant to section 49-10a;

(3) The affiant has ascertained that the mortgagee has received payment of the mortgage loan

(A) in accordance with the payoff statement or (B) in the absence of a payoff statement requested pursuant to section 49-10a, in accordance with a good faith estimate by the mortgagor of the amount of the unpaid balance on the mortgage loan calculated in accordance with subdivision (2) of subsection (b) of this section, as evidenced by a bank check, certified check, attorney's clients' funds account check or title insurance company check, which has been negotiated by the mortgagee or by other documentary evidence of such receipt of payment by the mortgagee, including a confirmation of a wire transfer;

(4) More than sixty days have elapsed since payment was received by the mortgagee; and

(5) At least fifteen days prior to the date of the affidavit, the affiant has given the mortgagee written notice by registered or certified mail, postage prepaid, return receipt requested of intention to execute and cause to be recorded an affidavit in accordance with this section, with a copy of the proposed affidavit attached to such written notice; and that the mortgagee has not responded in writing to such notification, or that any request for additional payment made by the mortgagee has been complied with at least fifteen days prior to the date of the affidavit.

(d) Such affidavit shall state the names of the mortgagor and the mortgagee, the date of the mortgage, and the volume and page of the land records where the mortgage is recorded. The affidavit shall provide similar information with respect to every recorded assignment of the mortgage.

(e) The affiant shall attach to the affidavit (1) photostatic copies of the documentary evidence that payment has been received by the mortgagee, including the mortgagee's endorsement of any bank check, certified check, attorney's clients' funds account check, title insurance company check, or confirmation of a wire transfer and (2)

(A) a photostatic copy of the payoff statement, or (B) in the absence of a payoff statement requested pursuant to section 49-10a, a copy of a statement from the mortgagee that is in the possession of the mortgagor indicating the outstanding balance due on the mortgage loan as of a date certain and a statement setting out the mortgagor's basis for the estimate of the amount due, and shall certify on each that it is a true copy of the original document.

(f) Such affidavit, when recorded, shall constitute a release of the lien of such mortgage or the property described therein.

(g) The town clerk shall index the affidavit in the name of the original mortgagee and the last assignee of the mortgage appearing of record as the grantors, and in the name of the mortgagors and the current record owner of the property as grantees.

(h) Any person who causes an affidavit to be recorded in the land records of any town in accordance with this section having actual knowledge that the information and statements therein contained are false shall be fined not more than five thousand dollars or imprisoned not less than one year nor more than five years or both. (P.A. 86-341, S. 1; P.A. 95-79, S. 173, 189; 95-102, S. 2.) History: P.A. 95-79 amended Subsec. (a) to redefine "person" to include a limited liability company, effective May 31, 1995; P.A. 95-102 amended Subsec. (a) to replace definition of "mortgage" with "mortgage loan", amended Subsec. (b) by changing time for release from thirty to sixty days and adding Subdiv. (2) re remedy if no payoff statement was provided pursuant to request made under Sec. 49-10a, amended Subsec. (c) to include current owner of interest encumbered by mortgage as person who may request affidavit, to include provision re failure to provide payoff statement requested pursuant to Sec. 49-10a, to change time for release from thirty to sixty days and require that written notice by affiant be sent to mortgagee by registered or certified mail, postage prepaid, return receipt requested, amended Subsec. (e) re requirements re affidavit and amended Subsec. (h) changing "knowing" to "having actual knowledge that" and increasing penalty for false statements from five hundred to five thousand dollars or imprisonment of not less than one nor more than five years or both fine and imprisonment.

Sec. 49-9. Form of release of mortgage, mechanic's lien or power of attorney. Index.

(a) A mortgage of real or personal property, a mechanic's lien or a power of attorney for the conveyance of land may be released by an instrument in writing executed, attested and acknowledged in the same manner as deeds of land, setting forth that the mortgage, mechanic's lien or power of attorney for the conveyance of land is discharged or that the indebtedness or other obligation secured thereby has been satisfied. That instrument vests in the person or persons entitled thereto such legal title as is held by virtue of the mortgage, or mechanic's lien. ...

(b) In the case of partial releases of mortgages as provided for in section 49-8, the instrument shall state the extent to which the mortgage is partially released and a sufficiently definite and certain description of that part of the property securing the mortgage which is being released therefrom.

(c) Town clerks shall note the discharge or partial release as by law provided and shall index the record of each such instrument under the name of the releasor and of the mortgagor.

Sec. 49-10. Requirements for assignments of obligations. Form of instrument. Sufficient notice required. (a) As used in this section, "mortgage debt" means a debt or other obligation secured by mortgage, assignment of rent or assignment of interest in a lease.

(b) Whenever any mortgage debt is assigned by an instrument in writing containing a sufficient description to identify the mortgage, assignment of rent or assignment of interest in a lease, given as security for the mortgage debt, and that assignment has been executed, attested and acknowledged in the manner prescribed by law for the execution, attestation and acknowledgment of deeds of land, the title held by virtue of the mortgage, assignment of rent or assignment of interest in a lease, shall vest in the assignee. ...

(c) In addition to the requirements of subsection (b) of this section, whenever an assignment of any residential mortgage loan (1) made by a lending institution organized under the laws of or having its principal office in any other state, and (2) secured by mortgage on residential real estate located in this state is made in writing, the instrument shall contain the name and business or mailing address of all parties to such assignment.

(d) If a mortgage debt is assigned, a party obliged to pay such mortgage debt may discharge it, to the extent of the payment, by paying the assignor until the party obliged to pay receives sufficient notice in accordance with subsection (f) of this section that the mortgage debt has been assigned and that payment is to be made to the assignee. In addition to such notice, if requested by the party obliged to pay, the assignee shall furnish reasonable proof that the assignment has been made, and until the assignee does so, the party obliged to pay may pay the assignor. For purposes of this subsection, "reasonable proof" means (1) written notice of assignment signed by both the assignor and the assignee, (2) a copy of the assignment instrument, or (3) other proof of the assignment as agreed to by the party obliged to pay such mortgage debt.

(e) If a mortgage debt is assigned, a party obliged to pay such mortgage debt who, in good faith and without sufficient notice of the assignment in accordance with subsection (f) of this section, executes with the assignor a modification or extension of the mortgage, assignment of rent or assignment of interest in a lease, shall have the benefit of such modification or extension, provided, the assignee shall acquire corresponding rights under the modified or extended mortgage, assignment of rent or assignment of interest in a lease. The assignment may provide that modification or extension of the mortgage, assignment of rent or assignment of interest in a lease, signed by the assignor after execution of the assignment, is a breach by the assignor of the assignor's contract with the assignee.

(f) Notice of assignment is sufficient for purposes of subsections (d) and (e) of this section if the assignee notifies a party obliged to pay the mortgage debt (1) by mailing to the party obliged to pay, at the party's last billing address, a notice of the assignment identifying the instrument and mortgage debt assigned, the party obliged to pay such debt, the names of the assignor and assignee, the date of the assignment, and the name and address of the person to whom payments should be made, (2) by giving notice of the assignment pursuant to 12 USC Section 2605, Section 6 of the federal Real Estate Settlement Procedures Act of 1974 and the regulations promulgated pursuant to said section, as from time to time amended, or (3) by giving actual notice of the assignment, reasonably identifying the rights assigned, in any other manner. No signature on any such notice is necessary to give sufficient notice of the assignment under this subsection and such notice may include any other information.

(g) Recordation of an assignment of mortgage debt is not sufficient notice of the assignment to the party obliged to pay for purposes of subsection (d) or (e) of this section.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Connecticut Law

Assignment: It is not necessary that an assignment be recorded. When the assignment instrument is executed, attested and acknowledged as required by law, it vests in the assignee. However, it is recommended that the assignment be recorded to avoid complications that might arise.

Demand to Satisfy: Following payoff, the demand to satisfy should be by registered or certified mail to the mortgagee, who then has 60 days to record satisfaction.

Recording Satisfaction: A mortgage may be released by an instrument in writing executed, attested and acknowledged, setting forth that the mortgage is discharged.

Penalty: If mortgagee fails to record satisfaction of mortgage within 60 days of receipt of demand from mortgagor, mortgagee shall be liable for damages at the rate of two hundred dollars for each week after the expiration of such sixty days up to a maximum of five thousand dollars or in an amount equal to the loss sustained, plus costs and reasonable attorney's fees.

Acknowledgment: An assignment or satisfaction must contain a proper Connecticut acknowledgment, or other acknowledgment approved by Statute.

Connecticut Statutes

Sec. 49-8. Release of satisfied or partially satisfied mortgage or ineffective attachment, lis pendens or lien.

Damages. (a) The mortgagee or a person authorized by law to release the mortgage shall execute and deliver a release to the extent of the satisfaction tendered before or against receipt of the release:

(1) Upon the satisfaction of the mortgage or (2) upon a bona fide offer to satisfy the same in accordance with the terms of the mortgage deed upon the execution of a release, or (3) when the parties in interest have agreed in writing to a partial release of the mortgage where that part of the property securing the partially satisfied mortgage is sufficiently definite and certain, or (4) when the mortgagor has made a bona fide offer in accordance with the terms of the mortgage deed for such partial satisfaction on the execution of such partial release.

(b) The plaintiff or the plaintiff's attorney shall execute and deliver a release when an attachment has become of no effect pursuant to section 52-322 or section 52-324 or when a lis pendens or other lien has become of no effect pursuant to section 52-326.

(c) The mortgagee or plaintiff or the plaintiff's attorney, as the case may be, shall execute and deliver a release within sixty days from the date a written request for a release of such encumbrance (1) was sent to such mortgagee, plaintiff or plaintiff's attorney at the person's last-known address by registered or certified mail, postage prepaid, return receipt requested or (2) was received by such mortgagee, plaintiff or plaintiff's attorney from a private messenger or courier service or through any means of communication, including electronic communication, reasonably calculated to give the person the written request or a copy of it. The mortgagee or plaintiff shall be liable for damages to any person aggrieved at the rate of two hundred dollars for each week after the expiration of such sixty days up to a maximum of five thousand dollars or in an amount equal to the loss sustained by such aggrieved person as a result of the failure of the mortgagee or plaintiff or the plaintiff's attorney to execute and deliver a release, whichever is greater, plus costs and reasonable attorney's fees.

Sec. 49-8a. Release of mortgage. Affidavit. Recording of affidavit with town clerk. Penalty for recording false information. (a) For purposes of this section and section 49-10a:

(1) "Mortgage loan" means a loan secured by a mortgage on one, two, three or four family residential real property located in the state of Connecticut, including but not limited to, a residential unit in any common interest community as defined in section 47-202.

(2) "Person" means an individual, corporation, limited liability company, business trust, estate, trust, partnership, association, joint venture, government, governmental subdivision or agency, or other legal or commercial entity.

(3) "Mortgagor" means the grantor of a mortgage.

(4) "Mortgagee" means the grantee of a mortgage; provided, if the mortgage has been assigned of record, "mortgagee" means the last person to whom the mortgage has been assigned of record; provided further, if the mortgage has been serviced by a mortgage servicer, "mortgagee" means the mortgage servicer.

(5) "Mortgage servicer" means the last person to whom the mortgagor has been instructed by the mortgagee to send payments of the mortgage loan. The person who has transmitted a payoff statement shall be deemed to be the mortgage servicer with respect to the mortgage loan described in that payoff statement.

(6) "Attorney-at-law" means any person admitted to practice law in this state and in good standing.

(7) "Title insurance company" means any corporation or other business entity authorized and licensed to transact the business of insuring titles to interests in real property in this state.

(8) "Payoff statement" means a statement of the amount of the unpaid balance on a mortgage loan, including principal, interest and other charges properly assessed pursuant to the loan documentation of such mortgage and a statement of the interest on a per diem basis with respect to the unpaid principal balance of the mortgage loan.

(b) If a mortgagee fails to execute and deliver a release of mortgage to the mortgagor or to the mortgagor's esignated agent within sixty days from receipt by the mortgagee of payment of the mortgage loan (1) in accordance with the payoff statement furnished by the mortgagee or (2) if no payoff statement was provided pursuant to a request made under section 49-10a, in accordance with a good faith estimate by the mortgagor of the amount of the unpaid balance on the mortgage loan using (A) a statement from the mortgagee indicating the outstanding balance due as of a date certain and (B) a reasonable estimate of the per diem interest and other charges due, any attorney-at-law or duly authorized officer of a title insurance company may, on behalf of the mortgagor or any successor in interest to the mortgagor who has acquired title to the premises described in the mortgage or any portion thereof, execute and cause to be recorded in the land records of each town where the mortgage was recorded, an affidavit which complies with the requirements of this section.

(c) An affidavit pursuant to this section shall state that:

(1) The affiant is an attorney-at-law or the authorized officer of a title insurance company, and that the affidavit is made in behalf of and at the request of the mortgagor or the current owner of the interest encumbered by the mortgage;

(2) The mortgagee has provided a payoff statement with respect to the mortgage loan or the mortgagee has failed to provide a payoff statement requested pursuant to section 49-10a;

(3) The affiant has ascertained that the mortgagee has received payment of the mortgage loan

(A) in accordance with the payoff statement or (B) in the absence of a payoff statement requested pursuant to section 49-10a, in accordance with a good faith estimate by the mortgagor of the amount of the unpaid balance on the mortgage loan calculated in accordance with subdivision (2) of subsection (b) of this section, as evidenced by a bank check, certified check, attorney's clients' funds account check or title insurance company check, which has been negotiated by the mortgagee or by other documentary evidence of such receipt of payment by the mortgagee, including a confirmation of a wire transfer;

(4) More than sixty days have elapsed since payment was received by the mortgagee; and

(5) At least fifteen days prior to the date of the affidavit, the affiant has given the mortgagee written notice by registered or certified mail, postage prepaid, return receipt requested of intention to execute and cause to be recorded an affidavit in accordance with this section, with a copy of the proposed affidavit attached to such written notice; and that the mortgagee has not responded in writing to such notification, or that any request for additional payment made by the mortgagee has been complied with at least fifteen days prior to the date of the affidavit.

(d) Such affidavit shall state the names of the mortgagor and the mortgagee, the date of the mortgage, and the volume and page of the land records where the mortgage is recorded. The affidavit shall provide similar information with respect to every recorded assignment of the mortgage.

(e) The affiant shall attach to the affidavit (1) photostatic copies of the documentary evidence that payment has been received by the mortgagee, including the mortgagee's endorsement of any bank check, certified check, attorney's clients' funds account check, title insurance company check, or confirmation of a wire transfer and (2)

(A) a photostatic copy of the payoff statement, or (B) in the absence of a payoff statement requested pursuant to section 49-10a, a copy of a statement from the mortgagee that is in the possession of the mortgagor indicating the outstanding balance due on the mortgage loan as of a date certain and a statement setting out the mortgagor's basis for the estimate of the amount due, and shall certify on each that it is a true copy of the original document.

(f) Such affidavit, when recorded, shall constitute a release of the lien of such mortgage or the property described therein.

(g) The town clerk shall index the affidavit in the name of the original mortgagee and the last assignee of the mortgage appearing of record as the grantors, and in the name of the mortgagors and the current record owner of the property as grantees.

(h) Any person who causes an affidavit to be recorded in the land records of any town in accordance with this section having actual knowledge that the information and statements therein contained are false shall be fined not more than five thousand dollars or imprisoned not less than one year nor more than five years or both. (P.A. 86-341, S. 1; P.A. 95-79, S. 173, 189; 95-102, S. 2.) History: P.A. 95-79 amended Subsec. (a) to redefine "person" to include a limited liability company, effective May 31, 1995; P.A. 95-102 amended Subsec. (a) to replace definition of "mortgage" with "mortgage loan", amended Subsec. (b) by changing time for release from thirty to sixty days and adding Subdiv. (2) re remedy if no payoff statement was provided pursuant to request made under Sec. 49-10a, amended Subsec. (c) to include current owner of interest encumbered by mortgage as person who may request affidavit, to include provision re failure to provide payoff statement requested pursuant to Sec. 49-10a, to change time for release from thirty to sixty days and require that written notice by affiant be sent to mortgagee by registered or certified mail, postage prepaid, return receipt requested, amended Subsec. (e) re requirements re affidavit and amended Subsec. (h) changing "knowing" to "having actual knowledge that" and increasing penalty for false statements from five hundred to five thousand dollars or imprisonment of not less than one nor more than five years or both fine and imprisonment.

Sec. 49-9. Form of release of mortgage, mechanic's lien or power of attorney. Index.

(a) A mortgage of real or personal property, a mechanic's lien or a power of attorney for the conveyance of land may be released by an instrument in writing executed, attested and acknowledged in the same manner as deeds of land, setting forth that the mortgage, mechanic's lien or power of attorney for the conveyance of land is discharged or that the indebtedness or other obligation secured thereby has been satisfied. That instrument vests in the person or persons entitled thereto such legal title as is held by virtue of the mortgage, or mechanic's lien. ...

(b) In the case of partial releases of mortgages as provided for in section 49-8, the instrument shall state the extent to which the mortgage is partially released and a sufficiently definite and certain description of that part of the property securing the mortgage which is being released therefrom.

(c) Town clerks shall note the discharge or partial release as by law provided and shall index the record of each such instrument under the name of the releasor and of the mortgagor.

Sec. 49-10. Requirements for assignments of obligations. Form of instrument. Sufficient notice required. (a) As used in this section, "mortgage debt" means a debt or other obligation secured by mortgage, assignment of rent or assignment of interest in a lease.

(b) Whenever any mortgage debt is assigned by an instrument in writing containing a sufficient description to identify the mortgage, assignment of rent or assignment of interest in a lease, given as security for the mortgage debt, and that assignment has been executed, attested and acknowledged in the manner prescribed by law for the execution, attestation and acknowledgment of deeds of land, the title held by virtue of the mortgage, assignment of rent or assignment of interest in a lease, shall vest in the assignee. ...

(c) In addition to the requirements of subsection (b) of this section, whenever an assignment of any residential mortgage loan (1) made by a lending institution organized under the laws of or having its principal office in any other state, and (2) secured by mortgage on residential real estate located in this state is made in writing, the instrument shall contain the name and business or mailing address of all parties to such assignment.

(d) If a mortgage debt is assigned, a party obliged to pay such mortgage debt may discharge it, to the extent of the payment, by paying the assignor until the party obliged to pay receives sufficient notice in accordance with subsection (f) of this section that the mortgage debt has been assigned and that payment is to be made to the assignee. In addition to such notice, if requested by the party obliged to pay, the assignee shall furnish reasonable proof that the assignment has been made, and until the assignee does so, the party obliged to pay may pay the assignor. For purposes of this subsection, "reasonable proof" means (1) written notice of assignment signed by both the assignor and the assignee, (2) a copy of the assignment instrument, or (3) other proof of the assignment as agreed to by the party obliged to pay such mortgage debt.

(e) If a mortgage debt is assigned, a party obliged to pay such mortgage debt who, in good faith and without sufficient notice of the assignment in accordance with subsection (f) of this section, executes with the assignor a modification or extension of the mortgage, assignment of rent or assignment of interest in a lease, shall have the benefit of such modification or extension, provided, the assignee shall acquire corresponding rights under the modified or extended mortgage, assignment of rent or assignment of interest in a lease. The assignment may provide that modification or extension of the mortgage, assignment of rent or assignment of interest in a lease, signed by the assignor after execution of the assignment, is a breach by the assignor of the assignor's contract with the assignee.

(f) Notice of assignment is sufficient for purposes of subsections (d) and (e) of this section if the assignee notifies a party obliged to pay the mortgage debt (1) by mailing to the party obliged to pay, at the party's last billing address, a notice of the assignment identifying the instrument and mortgage debt assigned, the party obliged to pay such debt, the names of the assignor and assignee, the date of the assignment, and the name and address of the person to whom payments should be made, (2) by giving notice of the assignment pursuant to 12 USC Section 2605, Section 6 of the federal Real Estate Settlement Procedures Act of 1974 and the regulations promulgated pursuant to said section, as from time to time amended, or (3) by giving actual notice of the assignment, reasonably identifying the rights assigned, in any other manner. No signature on any such notice is necessary to give sufficient notice of the assignment under this subsection and such notice may include any other information.

(g) Recordation of an assignment of mortgage debt is not sufficient notice of the assignment to the party obliged to pay for purposes of subsection (d) or (e) of this section.