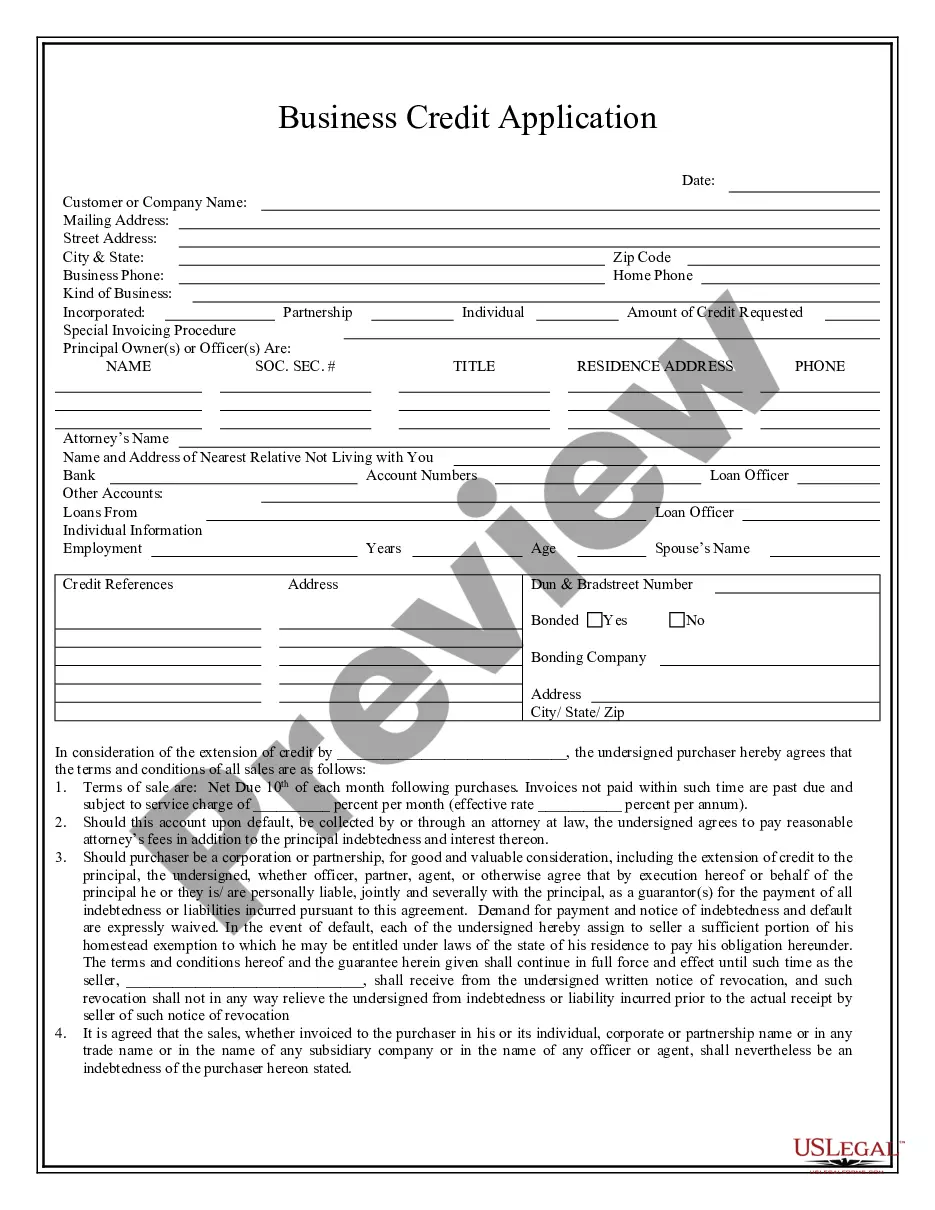

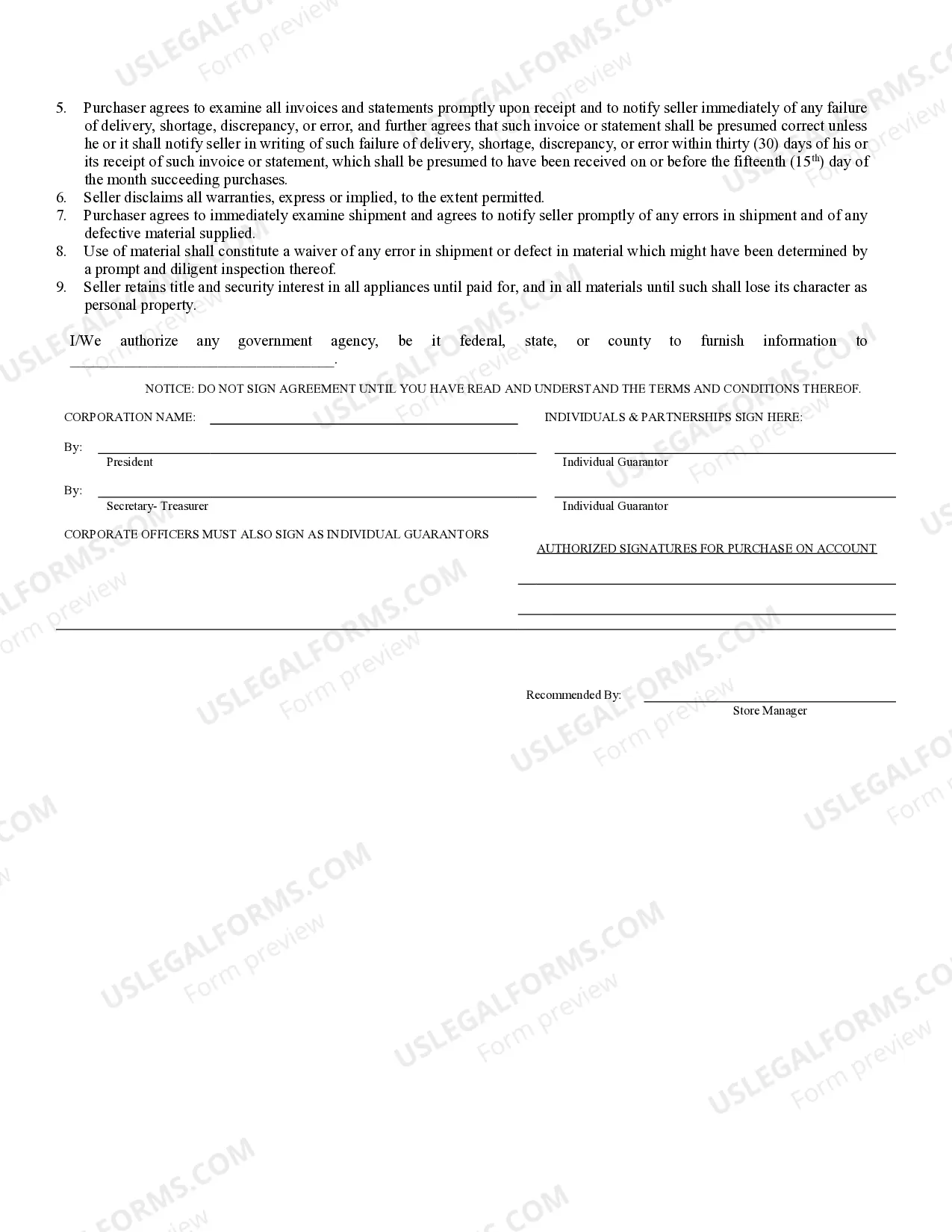

Title: Bridgeport Connecticut Business Credit Application: A Comprehensive Guide Introduction: Bridgeport, Connecticut, is a thriving business hub known for its diverse industries and entrepreneurial spirit. To ensure seamless financial transactions and optimal growth, businesses often rely on accessing credit facilities. The Bridgeport Connecticut Business Credit Application serves as an essential tool for businesses seeking financial assistance and credit options. This detailed description will provide valuable insights into what the application entails, its importance, and any possible variations available. Keywords: Bridgeport Connecticut, business credit application, financial transactions, credit facilities, entrepreneurial spirit. 1. Understanding the Bridgeport Connecticut Business Credit Application: The Bridgeport Connecticut Business Credit Application is a written document that businesses in Bridgeport, Connecticut, submit to financial institutions or lenders to request credit facilities. This application provides comprehensive information about the business, its financial history, and creditworthiness, enabling lenders to assess the risk associated with extending credit. 2. Importance of a Business Credit Application: a. Access to Capital: The credit application enables businesses to access the capital required for various purposes, including expansion, inventory procurement, equipment purchase, and operational needs. b. Establishing Creditworthiness: Submitting a credit application demonstrates a business's ability to meet financial obligations and builds trust with lenders, paving the way for future credit opportunities. c. Financial Planning: The credit application process often prompts businesses to analyze their financial health, identify areas for improvement, and develop effective financial strategies. 3. Key Components of a Bridgeport Connecticut Business Credit Application: a. Business Information: This section captures the legal name, physical address, contact details, and structure (sole proprietorship, partnership, corporation, etc.) of the business. b. Ownership and Management: Details regarding the business owner(s), partners, board members, and top-level executives are provided, including their personal information and roles within the organization. c. Financial Statement: Businesses present their financial records, including income statements, balance sheets, and cash flow statements, to help lenders assess their financial stability and creditworthiness. d. Purpose and Loan Amount Requested: The application specifies the intended use of the requested credit and the specific loan amount required. e. Collateral and Guarantees: If applicable, businesses may include information about the collateral offered as security for the credit or any personal guarantees provided by the owners. f. Legal Documents: Supporting legal documents, such as licenses, permits, tax returns, and articles of incorporation, may be required to validate the business's legal status. g. References: Businesses may include references from suppliers, customers, or other financial institutions to enhance their credit application. 4. Types of Bridgeport Connecticut Business Credit Applications: a. Small Business Credit Application: Designed for small businesses, this application typically emphasizes the owner's personal credit history and the business's financial performance. b. Commercial Credit Application: This application is tailored for larger, established businesses and requires more detailed financial documentation, including audited financial statements. c. Start-up Credit Application: Aimed at newly established businesses, this application focuses on the business plan, projections, and owner's personal financial history. Conclusion: Obtaining credit facilities is crucial for businesses in Bridgeport, Connecticut, to sustain growth and meet their financial needs. The Bridgeport Connecticut Business Credit Application is a comprehensive document that enables businesses to communicate their credit requirements, financial status, and intentions effectively. By satisfying the lender's requirements through a well-prepared credit application, businesses can access capital and build their creditworthiness, fostering long-term success in the competitive business landscape of Bridgeport, Connecticut. Keywords: credit facilities, financial institutions, lenders, credit options, business hub, financial transactions, optimal growth, access to capital, creditworthiness, financial history, risk assessment, capital requirements, financial planning, business information, ownership, management, financial statements, loan amount, collateral, personal guarantees, legal documents, small business, commercial credit, start-up credit, sustaining growth, financial needs, competitive business landscape.

Bridgeport Connecticut Business Credit Application

Description

How to fill out Bridgeport Connecticut Business Credit Application?

If you are looking for a valid form template, it’s extremely hard to find a more convenient platform than the US Legal Forms site – one of the most extensive libraries on the web. With this library, you can get thousands of templates for company and individual purposes by types and regions, or key phrases. With the high-quality search option, getting the most recent Bridgeport Connecticut Business Credit Application is as easy as 1-2-3. Furthermore, the relevance of each and every record is verified by a group of expert lawyers that regularly review the templates on our platform and revise them based on the latest state and county regulations.

If you already know about our platform and have an account, all you should do to get the Bridgeport Connecticut Business Credit Application is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have found the form you want. Look at its information and utilize the Preview option (if available) to see its content. If it doesn’t meet your needs, use the Search field at the top of the screen to find the needed document.

- Confirm your decision. Select the Buy now option. Next, pick the preferred subscription plan and provide credentials to register an account.

- Process the transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Pick the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the obtained Bridgeport Connecticut Business Credit Application.

Each form you add to your account does not have an expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you need to get an additional copy for editing or printing, feel free to come back and export it once again at any moment.

Make use of the US Legal Forms professional catalogue to gain access to the Bridgeport Connecticut Business Credit Application you were looking for and thousands of other professional and state-specific templates on a single platform!