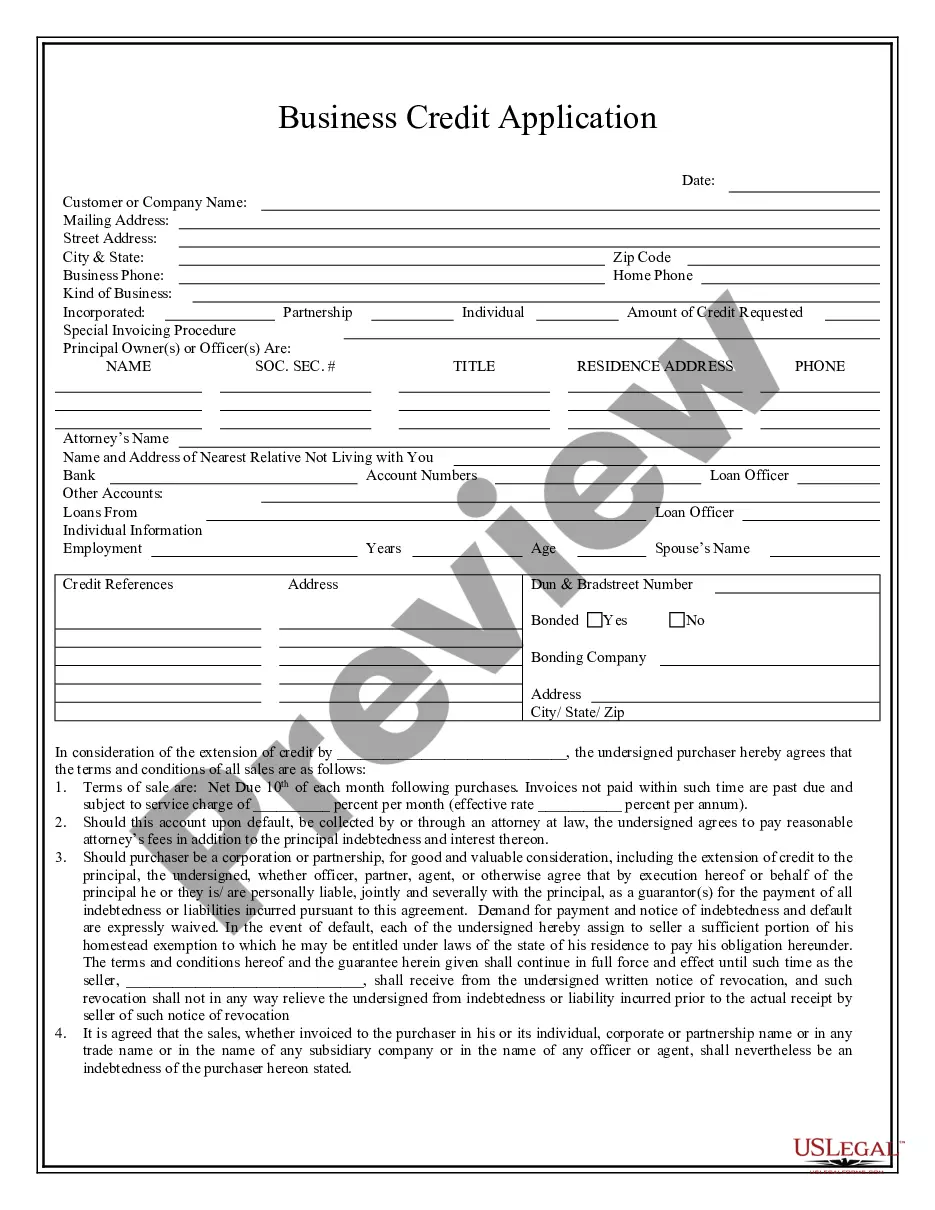

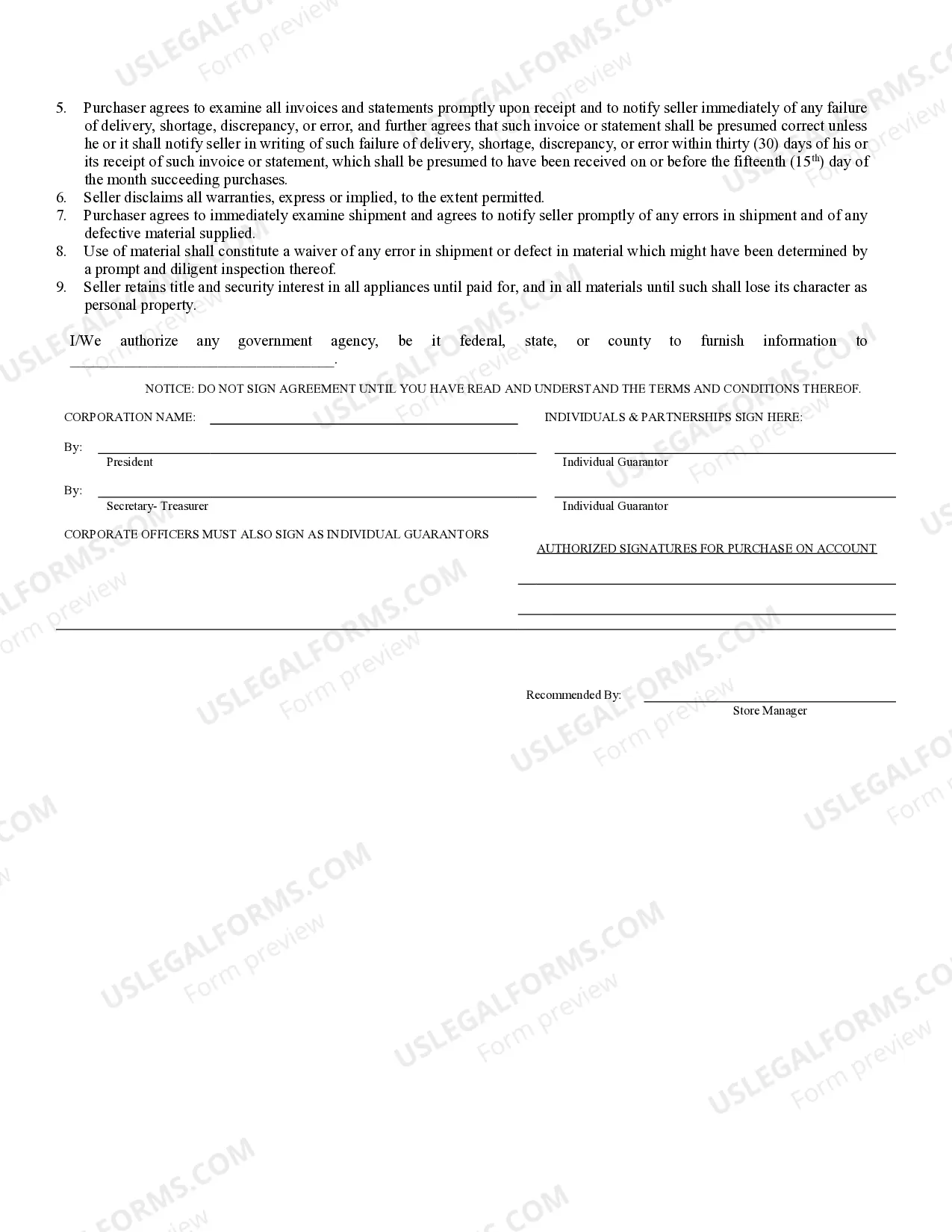

Waterbury, Connecticut Business Credit Application is a comprehensive form utilized by local businesses in Waterbury, Connecticut to apply for credit from various financial institutions or lenders. This application carries significant importance as it serves as a formal request for credit and aids in establishing a business's financial credibility and trustworthiness. The Waterbury, Connecticut Business Credit Application is designed to gather all the necessary information about the business applying for credit. It typically includes sections such as company details, contact information, ownership structure, and business history. The application may also require the business to provide financial statements, tax returns, and bank statements to assess its financial health. This credit application enables businesses to specify the amount of credit they are seeking and provide details on how the funds will be utilized. By doing so, it helps financial institutions evaluate the creditworthiness and repayment capacity of the business. Lenders review the application thoroughly, considering factors like the business's credit history, debt-to-income ratio, industry performance, and market conditions, to make an informed decision. There are various types of Waterbury, Connecticut Business Credit Applications catering to different credit needs. Some common types include: 1. Small Business Line of Credit Application: This application is tailored for small businesses looking for a flexible source of funds to cover their working capital needs. It allows businesses to borrow funds on an as-needed basis up to a predetermined credit limit. 2. Business Term Loan Application: This application targets businesses seeking a specific amount of funds for a planned investment or expansion. These loans typically have fixed interest rates and a structured repayment schedule. 3. Business Credit Card Application: This type of application is used when a business wishes to obtain a revolving credit card specific to their business needs. It offers convenience and flexibility for various expenses while allowing the business to build its credit. 4. Commercial Real Estate Loan Application: This application serves businesses looking to purchase or refinance commercial properties. It involves detailed financial information, property details, and an appraisal of the property to determine loan eligibility. In conclusion, the Waterbury, Connecticut Business Credit Application is an essential document that businesses in Waterbury used to seek credit from financial institutions. It allows businesses to present their financial position and credit needs while aiding lenders in evaluating the creditworthiness and repayment capacity of the applicant. Different types of credit applications cater to specific credit requirements, including small business lines of credit, business term loans, business credit cards, and commercial real estate loans.

Waterbury Connecticut Business Credit Application

Description

How to fill out Waterbury Connecticut Business Credit Application?

Are you looking for a trustworthy and affordable legal forms provider to buy the Waterbury Connecticut Business Credit Application? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and county.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Waterbury Connecticut Business Credit Application conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is intended for.

- Start the search over if the form isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Waterbury Connecticut Business Credit Application in any provided format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online for good.