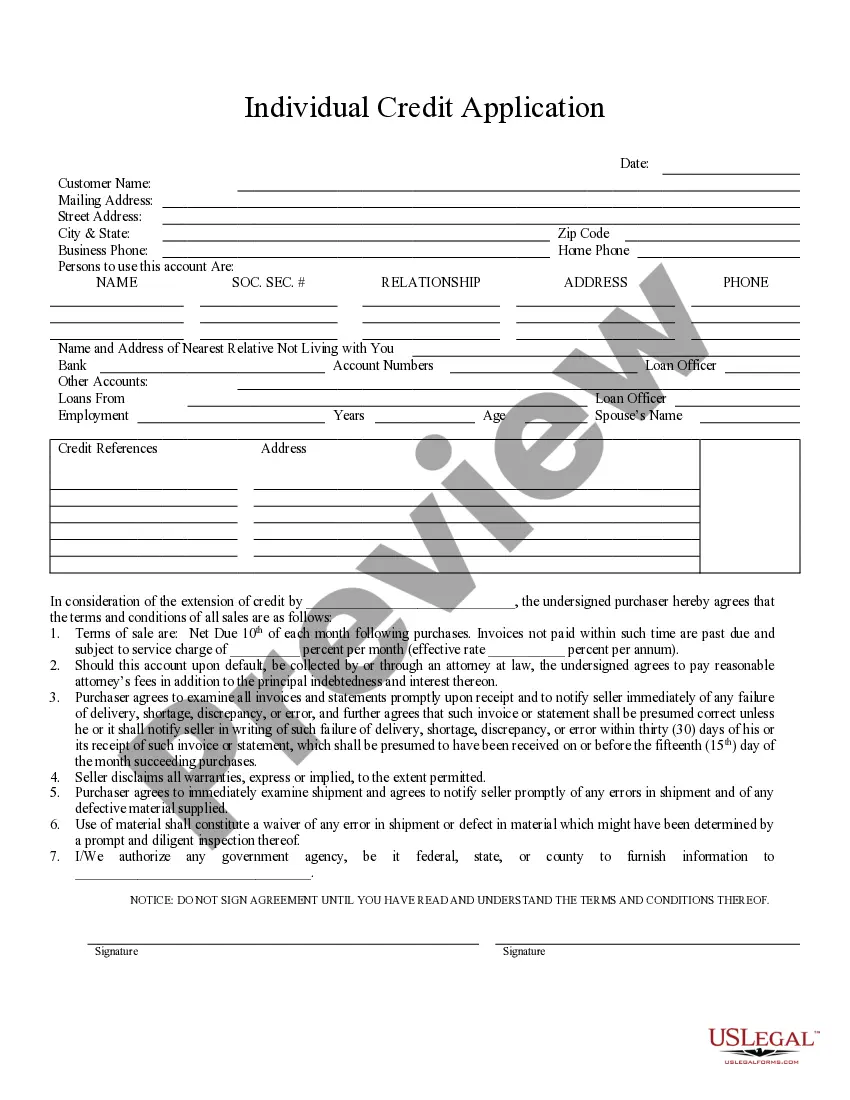

Bridgeport, Connecticut Individual Credit Application refers to the process by which individuals residing in Bridgeport, Connecticut, apply for credit from financial institutions or lenders. This application serves as a formal request for credit, allowing individuals to obtain various types of loans or credit facilities. The application process involves providing personal and financial information to lenders, enabling them to assess the individual's creditworthiness and determine whether to grant the requested credit. Keywords: Bridgeport, Connecticut, individual credit application, loans, credit facilities, applying for credit, personal information, financial information, creditworthiness, credit request, lenders. Types of Bridgeport, Connecticut Individual Credit Applications: 1. Personal Loan Application: This type of credit application is specifically tailored to individuals who require funds for personal expenses, such as medical bills, debt consolidation, education, or home improvements. Personal loan applications typically require details about income, employment, assets, liabilities, credit history, and other personal information. 2. Mortgage Loan Application: Bridgeport residents looking to purchase or refinance a home can apply for a mortgage loan. This application requires comprehensive financial information, including income, employment history, credit score, assets, liabilities, and details about the property being financed. 3. Auto Loan Application: Individuals in Bridgeport, Connecticut, seeking financing for a vehicle purchase can apply for an auto loan. Auto loan applications typically ask for details about income, employment, credit history, as well as information about the vehicle being purchased, such as make, model, and value. 4. Credit Card Application: Bridgeport residents can apply for various credit cards from different financial institutions. Credit card applications generally require personal and financial information, income details, employment history, credit score, and other factors that determine creditworthiness. 5. Student Loan Application: Students from Bridgeport pursuing higher education can apply for student loans to cover educational expenses. Student loan applications consider personal and financial information, academic standing, educational institution details, and expected future earning potential. 6. Small Business Loan Application: Bridgeport entrepreneurs seeking funding for their small businesses can submit small business loan applications. These applications require comprehensive financial information about the business, its owners, revenue, expenses, assets, liabilities, business plans, and credit history. Overall, Bridgeport, Connecticut Individual Credit Application involves the submission of detailed information necessary for lenders to evaluate an individual's creditworthiness and make informed decisions regarding credit approval. Different types of credit applications cater to specific purposes, including personal expenses, home purchasing, vehicle financing, credit card issuance, higher education, and small business funding.

Bridgeport Connecticut Individual Credit Application

Description

How to fill out Bridgeport Connecticut Individual Credit Application?

Make use of the US Legal Forms and get immediate access to any form sample you require. Our beneficial website with a huge number of document templates allows you to find and get virtually any document sample you require. It is possible to download, complete, and certify the Bridgeport Connecticut Individual Credit Application in a matter of minutes instead of surfing the Net for hours attempting to find a proper template.

Utilizing our collection is a great way to increase the safety of your form submissions. Our experienced attorneys on a regular basis review all the records to make sure that the templates are appropriate for a particular region and compliant with new acts and regulations.

How can you get the Bridgeport Connecticut Individual Credit Application? If you already have a profile, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

- Find the form you need. Make sure that it is the form you were looking for: examine its headline and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the saving process. Click Buy Now and select the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Choose the format to get the Bridgeport Connecticut Individual Credit Application and change and complete, or sign it for your needs.

US Legal Forms is one of the most extensive and trustworthy document libraries on the internet. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Bridgeport Connecticut Individual Credit Application.

Feel free to take advantage of our service and make your document experience as efficient as possible!