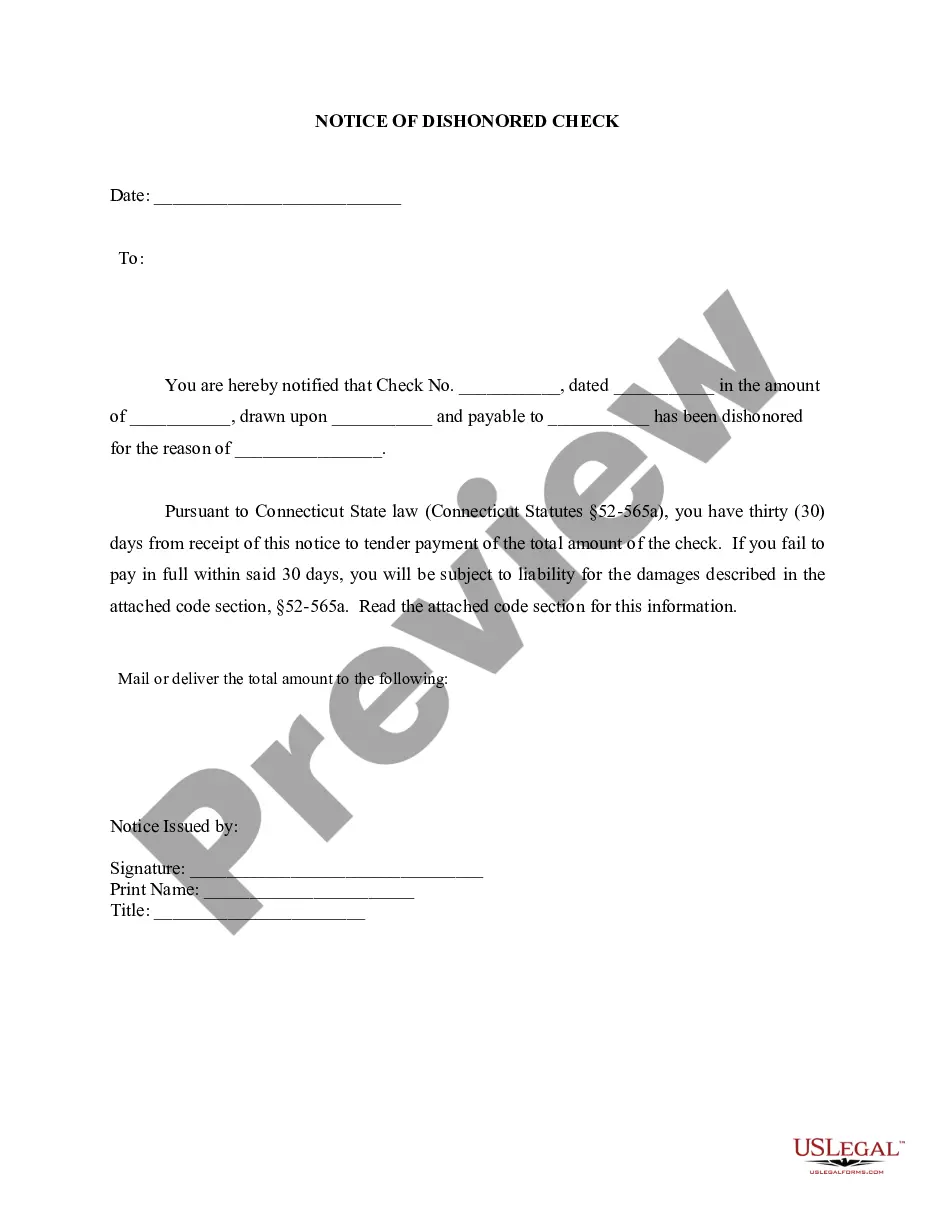

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

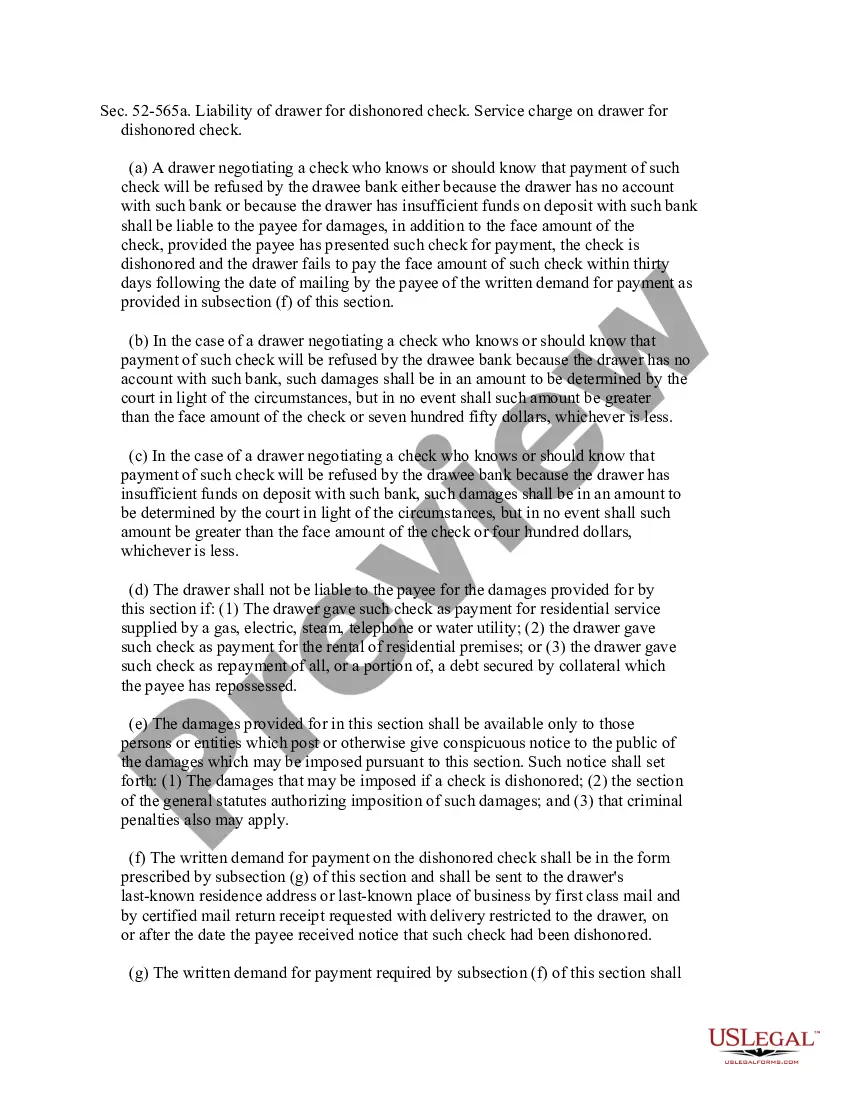

Stamford Connecticut Notice of Dishonored Check — Civil A Stamford Connecticut Notice of Dishonored Check — Civil is a legal document that notifies an individual or entity when a check they issued has been returned unpaid by their bank due to insufficient funds or account closed. This notice serves as a warning to the check writer that legal action may be pursued if the payment is not immediately remedied. Bad Check: A bad check, also known as a bounced check, refers to a check that is returned unpaid by the bank due to insufficient funds or the account being closed. Writing a bad check is considered illegal and can lead to severe consequences for the individual responsible. The Stamford Connecticut Notice of Dishonored Check — Civil is typically sent to the check writer informing them of the bad check and demanding immediate payment to rectify the situation. Failure to comply can result in legal action being taken against the check writer. Bounced Check: A bounced check, synonymous with a bad check, is a check that has been returned unpaid by the bank due to insufficient funds or a closed account. This situation can occur unintentionally, when the check writer has inadequate funds to cover the amount written on the check. When a check bounces, it causes inconvenience and financial loss to the recipient who expected to receive payment. To resolve the matter, the recipient may issue a Stamford Connecticut Notice of Dishonored Check — Civil to the check writer, alerting them to the situation and requesting immediate payment. The consequences of issuing a bad or bounced check can range from penalties and fees imposed by the bank to potential legal actions taken by the recipient. It is important to promptly address such situations to avoid further complications and maintain a positive financial reputation. If you have recently received a Stamford Connecticut Notice of Dishonored Check — Civil, it is crucial to take immediate action to rectify the issue. Contact your bank to understand the reason for the check's dishonor and the steps required to resolve the matter. Additionally, communicate with the recipient to discuss payment options and work towards an amicable resolution. Remember, writing a bad or bounced check can have serious legal and financial consequences. Always ensure that your bank account has sufficient funds before issuing a check to prevent any unwanted complications.Stamford Connecticut Notice of Dishonored Check — Civil A Stamford Connecticut Notice of Dishonored Check — Civil is a legal document that notifies an individual or entity when a check they issued has been returned unpaid by their bank due to insufficient funds or account closed. This notice serves as a warning to the check writer that legal action may be pursued if the payment is not immediately remedied. Bad Check: A bad check, also known as a bounced check, refers to a check that is returned unpaid by the bank due to insufficient funds or the account being closed. Writing a bad check is considered illegal and can lead to severe consequences for the individual responsible. The Stamford Connecticut Notice of Dishonored Check — Civil is typically sent to the check writer informing them of the bad check and demanding immediate payment to rectify the situation. Failure to comply can result in legal action being taken against the check writer. Bounced Check: A bounced check, synonymous with a bad check, is a check that has been returned unpaid by the bank due to insufficient funds or a closed account. This situation can occur unintentionally, when the check writer has inadequate funds to cover the amount written on the check. When a check bounces, it causes inconvenience and financial loss to the recipient who expected to receive payment. To resolve the matter, the recipient may issue a Stamford Connecticut Notice of Dishonored Check — Civil to the check writer, alerting them to the situation and requesting immediate payment. The consequences of issuing a bad or bounced check can range from penalties and fees imposed by the bank to potential legal actions taken by the recipient. It is important to promptly address such situations to avoid further complications and maintain a positive financial reputation. If you have recently received a Stamford Connecticut Notice of Dishonored Check — Civil, it is crucial to take immediate action to rectify the issue. Contact your bank to understand the reason for the check's dishonor and the steps required to resolve the matter. Additionally, communicate with the recipient to discuss payment options and work towards an amicable resolution. Remember, writing a bad or bounced check can have serious legal and financial consequences. Always ensure that your bank account has sufficient funds before issuing a check to prevent any unwanted complications.