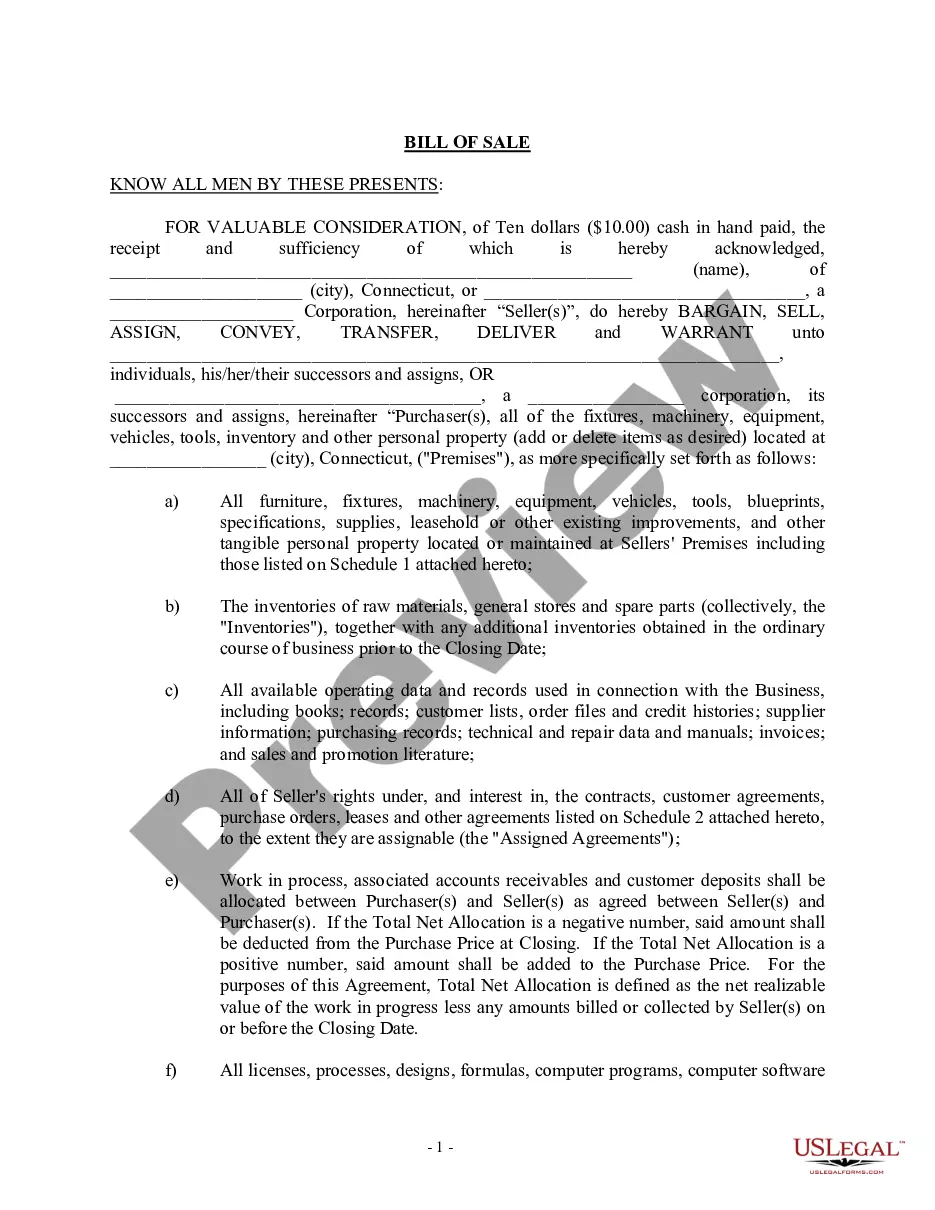

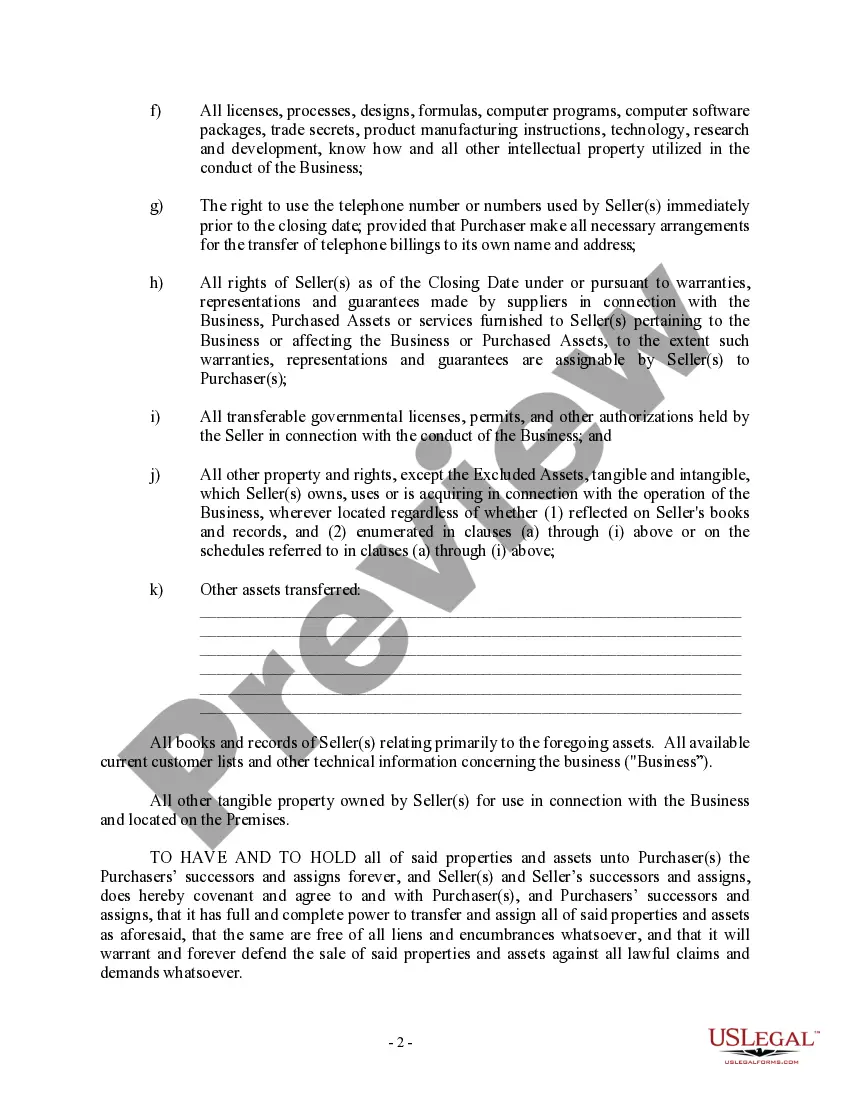

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

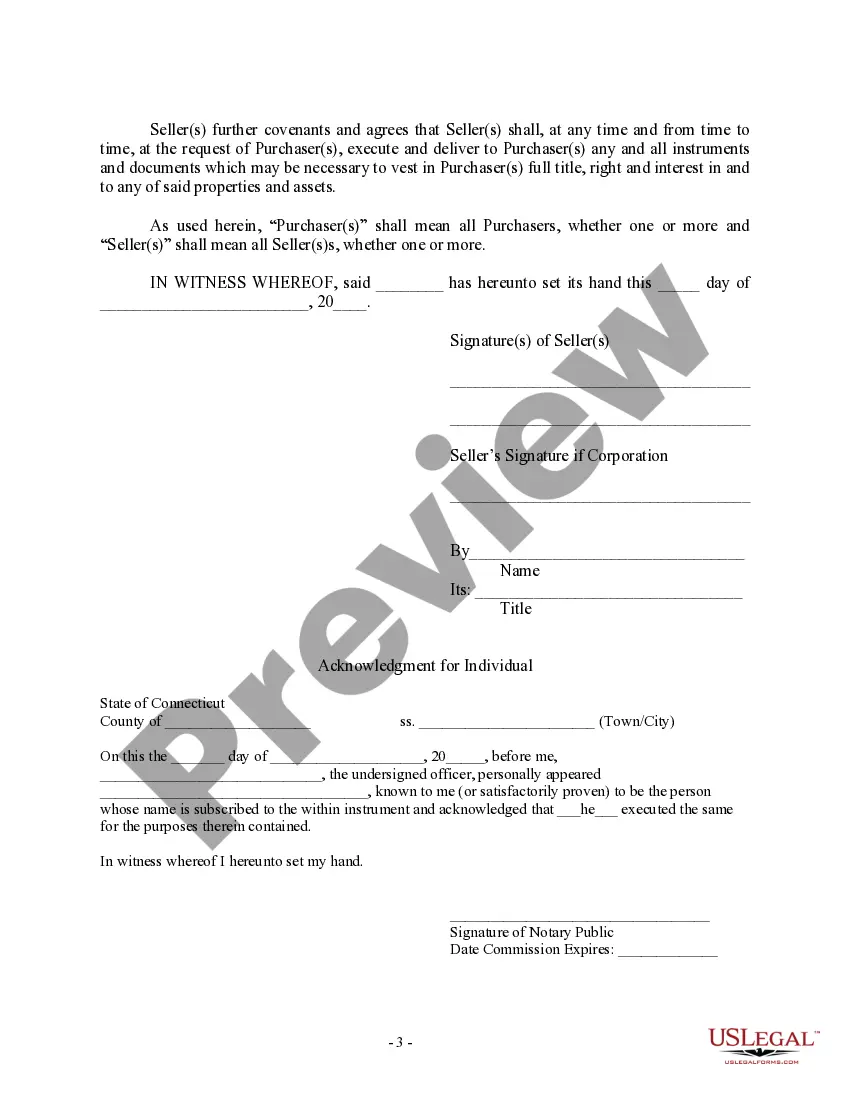

Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller A Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a legal document used to transfer ownership of a business from one party to another. This bill of sale outlines the terms and conditions of the sale, protects both the buyer and the seller, and serves as an official record of the transaction. There are several types of Stamford Connecticut Bills of Sale in Connection with Sale of Business by Individual or Corporate Seller, each designed for specific situations. Some of these variations include: 1. Asset Purchase Agreement: This type of bill of sale is used when the buyer only wishes to acquire certain assets of the business, such as equipment, inventory, or intellectual property. It specifies which assets are being transferred and may exclude liabilities from the sale. 2. Stock Purchase Agreement: In this case, the buyer purchases the stocks or shares of the company directly from the seller, thereby acquiring ownership and control of the entire business entity. This agreement outlines the number of shares being sold, the purchase price, and any conditions or restrictions that may apply. 3. Merger Agreement: This bill of sale is utilized when two companies decide to merge and form a new entity. It includes details on the terms of the merger, the valuation of the companies involved, and the rights and responsibilities of the new entity. 4. Assignment Agreement: This type of bill of sale is used when the business being sold has ongoing contracts or agreements that need to be transferred to the buyer. It ensures that all contractual obligations and liabilities are properly assigned to the new owner. Regardless of the specific type, a Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller typically includes the following essential information: 1. Identification of the buyer and seller: Names, addresses, and contact information of both parties involved in the transaction. 2. Business description: A detailed description of the business being sold, including its assets, liabilities, intellectual property, and any other relevant details. 3. Purchase price: The agreed-upon amount that the buyer will pay to the seller for the business or its assets. 4. Terms and conditions: The specific terms and conditions that both parties have agreed upon, such as payment method, financing arrangements, non-compete agreements, or any contingencies that need to be met for the sale to be finalized. 5. Representations and warranties: Statements made by the seller regarding the accuracy and completeness of the information provided, ensuring that there are no hidden or undisclosed problems with the business. 6. Governing law and jurisdiction: The legal framework under which the bill of sale operates, usually indicating that Stamford, Connecticut laws govern the agreement. A Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a crucial document in any business sale transaction, protecting the rights of both the buyer and the seller. It is always recommended seeking the assistance of legal professionals to ensure that the bill of sale accurately reflects the terms of the transaction and complies with all relevant laws and regulations.Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller A Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a legal document used to transfer ownership of a business from one party to another. This bill of sale outlines the terms and conditions of the sale, protects both the buyer and the seller, and serves as an official record of the transaction. There are several types of Stamford Connecticut Bills of Sale in Connection with Sale of Business by Individual or Corporate Seller, each designed for specific situations. Some of these variations include: 1. Asset Purchase Agreement: This type of bill of sale is used when the buyer only wishes to acquire certain assets of the business, such as equipment, inventory, or intellectual property. It specifies which assets are being transferred and may exclude liabilities from the sale. 2. Stock Purchase Agreement: In this case, the buyer purchases the stocks or shares of the company directly from the seller, thereby acquiring ownership and control of the entire business entity. This agreement outlines the number of shares being sold, the purchase price, and any conditions or restrictions that may apply. 3. Merger Agreement: This bill of sale is utilized when two companies decide to merge and form a new entity. It includes details on the terms of the merger, the valuation of the companies involved, and the rights and responsibilities of the new entity. 4. Assignment Agreement: This type of bill of sale is used when the business being sold has ongoing contracts or agreements that need to be transferred to the buyer. It ensures that all contractual obligations and liabilities are properly assigned to the new owner. Regardless of the specific type, a Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller typically includes the following essential information: 1. Identification of the buyer and seller: Names, addresses, and contact information of both parties involved in the transaction. 2. Business description: A detailed description of the business being sold, including its assets, liabilities, intellectual property, and any other relevant details. 3. Purchase price: The agreed-upon amount that the buyer will pay to the seller for the business or its assets. 4. Terms and conditions: The specific terms and conditions that both parties have agreed upon, such as payment method, financing arrangements, non-compete agreements, or any contingencies that need to be met for the sale to be finalized. 5. Representations and warranties: Statements made by the seller regarding the accuracy and completeness of the information provided, ensuring that there are no hidden or undisclosed problems with the business. 6. Governing law and jurisdiction: The legal framework under which the bill of sale operates, usually indicating that Stamford, Connecticut laws govern the agreement. A Stamford Connecticut Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a crucial document in any business sale transaction, protecting the rights of both the buyer and the seller. It is always recommended seeking the assistance of legal professionals to ensure that the bill of sale accurately reflects the terms of the transaction and complies with all relevant laws and regulations.