A Stamford Connecticut Reaffirmation Agreement is a legal document that allows a debtor to continue repaying a debt despite filing for bankruptcy. This agreement is commonly used in the context of Chapter 7 bankruptcy cases, where the debtor wishes to retain possession of certain secured property, such as a car or house, by agreeing to continue fulfilling the terms of the debt. The purpose of a Stamford Connecticut Reaffirmation Agreement is to create a legally binding contract between the debtor and the creditor, ensuring that the debt will not be discharged through bankruptcy proceedings. By reaffirming the debt, the debtor acknowledges their obligation to repay it and agrees to stay liable for any future payments. The agreement typically outlines the specific terms of the debt, including the outstanding balance, interest rate, payment schedule, and any other relevant provisions. It is crucial for debtors to carefully review and understand these terms before signing the agreement, as they are effectively waiving their bankruptcy discharge rights for that particular debt. While the concept of a Stamford Connecticut Reaffirmation Agreement remains relatively consistent, there may be variations depending on the type of debt being reaffirmed. Common types of reaffirmation agreements include: 1. Car Loan Reaffirmation Agreement: This type of agreement is used when the debtor wants to keep their vehicle and continue making payments on an outstanding car loan. It establishes the terms of the loan reaffirmation and ensures that the debtor will be able to retain possession of the car as long as they continue fulfilling their obligations. 2. Mortgage Reaffirmation Agreement: When a debtor owns a property with a mortgage and seeks to keep the property despite bankruptcy, a mortgage reaffirmation agreement is utilized. This agreement allows the debtor to reaffirm the mortgage debt, ensuring that they can retain ownership of the property if they continue making timely payments. 3. Personal Loan Reaffirmation Agreement: This type of agreement is used when the debtor wants to preserve a personal loan or unsecured debt during bankruptcy. It lays out the terms of the reaffirmation and details how the debtor will pay back the loan while still availing the protections of bankruptcy for other debts. In conclusion, a Stamford Connecticut Reaffirmation Agreement is a legal document employed in bankruptcy cases to enable debtors to retain and continue repaying specific debts. It is vital for debtors to understand the terms of the agreement before signing, as they are effectively waiving their bankruptcy discharge rights for the specified debt. Various types of reaffirmation agreements exist, such as car loan reaffirmation agreements, mortgage reaffirmation agreements, and personal loan reaffirmation agreements, each tailored to reaffirming specific types of debts.

Stamford Connecticut Reaffirmation Agreement

Description

How to fill out Stamford Connecticut Reaffirmation Agreement?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Stamford Connecticut Reaffirmation Agreement becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Stamford Connecticut Reaffirmation Agreement takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

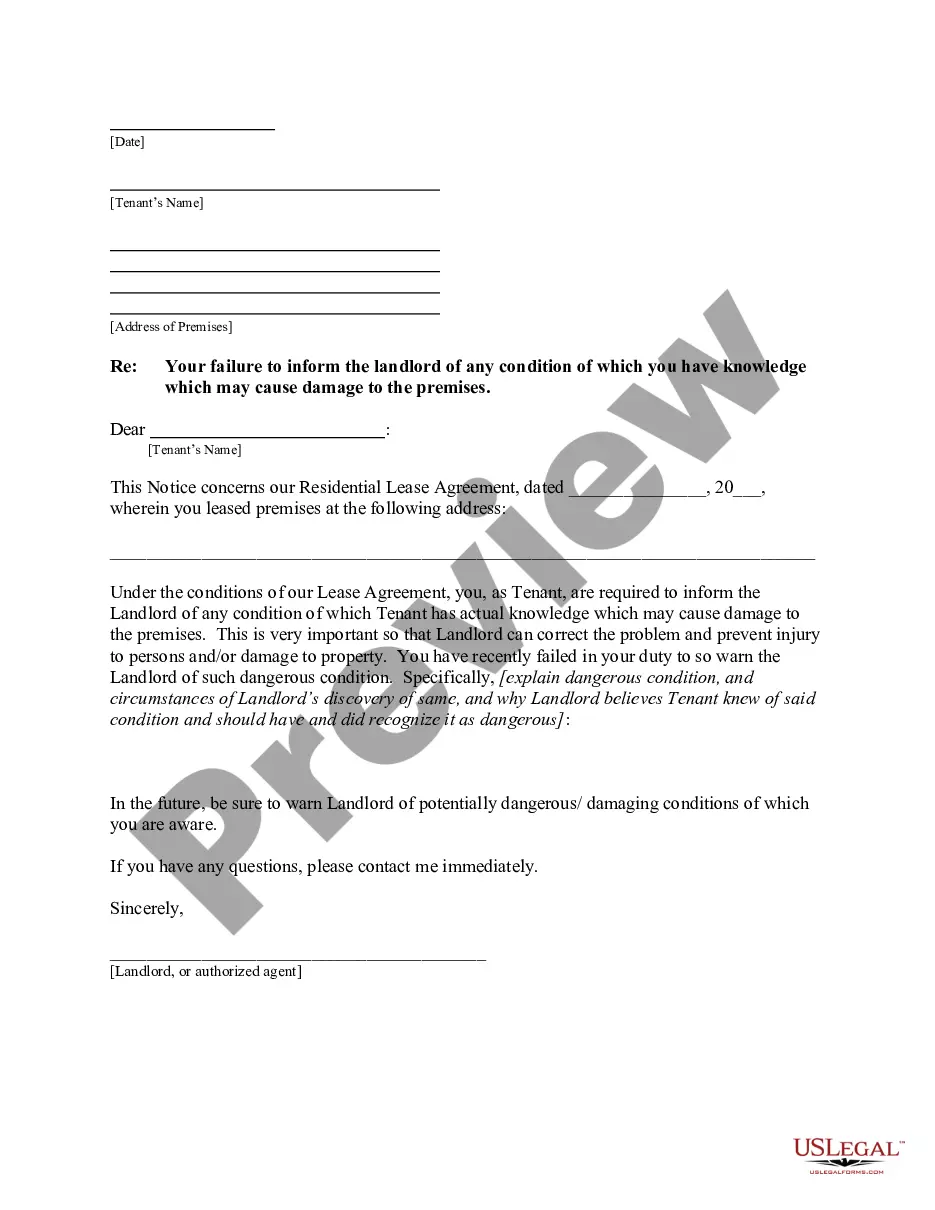

- Check the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Stamford Connecticut Reaffirmation Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!