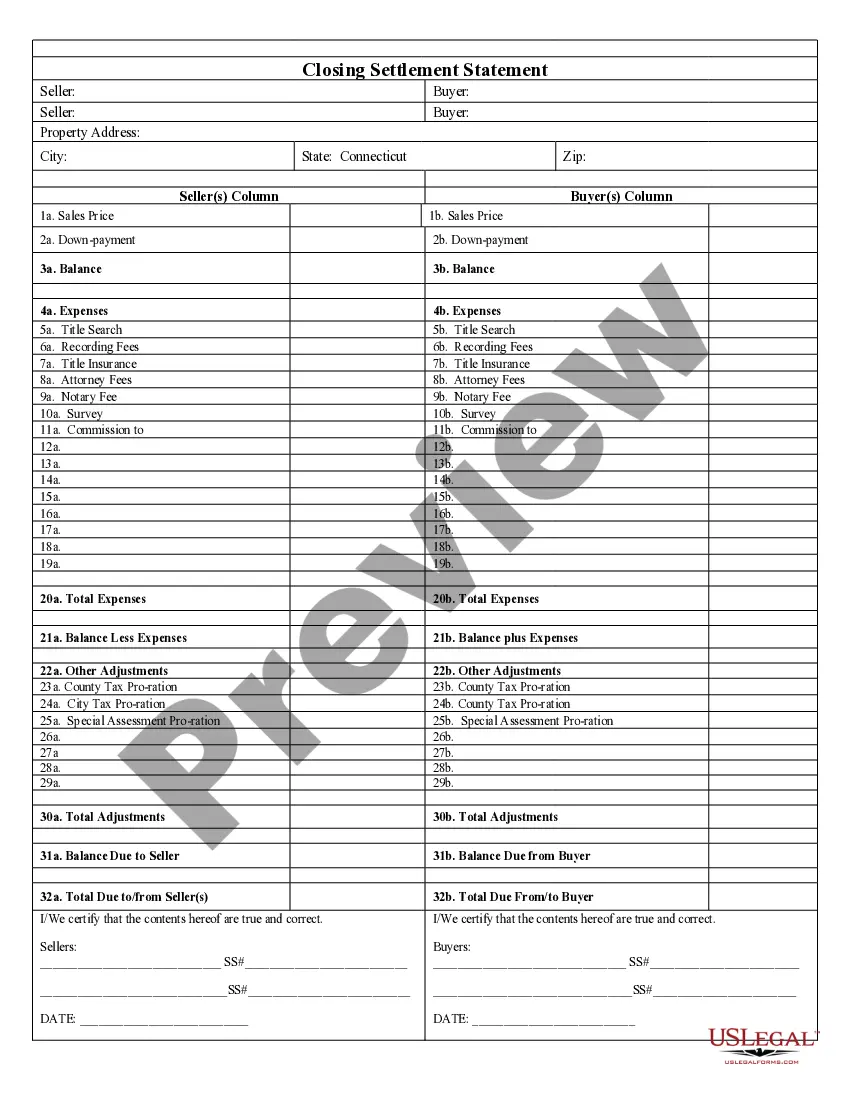

Stamford Connecticut Closing Statement is a legal document used in real estate transactions to officially conclude the buying or selling of a property in Stamford, Connecticut. It is also known as the "Settlement Statement" or "HUD-1" (referring to the form used in the past). This document outlines the financial details of the transaction and serves as a comprehensive record of the final costs incurred by both the buyer and seller. The Stamford Connecticut Closing Statement consolidates various financial aspects related to the property sale, including the purchase price, loan details, closing costs, prorated taxes and insurance, and any additional costs or fees incurred during the settlement process. This statement plays a crucial role in ensuring transparency and accuracy between all parties involved in the transaction. The closing statement typically includes key information, such as the names of the buyer, seller, and their respective legal representatives, the property address, and the closing date. It provides a breakdown of the total funds due from the buyer, including the down payment, loan amount, and any adjustments or credits. Likewise, it summarizes the proceeds payable to the seller after deducting any outstanding mortgage balances, real estate agent commissions, and other fees. Different types of Stamford Connecticut Closing Statements may exist based on the specific nature of the transaction. For example: 1. Residential Closing Statement: This type of closing statement relates to the sale or purchase of residential properties, such as houses, condos, or townhouses, in Stamford, Connecticut. It encompasses all the necessary financial information related to the residential real estate transaction. 2. Commercial Closing Statement: This variant is used for commercial property transactions, including office buildings, retail spaces, or industrial properties. The commercial closing statement may have additional sections and considerations specific to complex commercial real estate deals. 3. Refinance Closing Statement: In cases where an existing mortgage loan is being refinanced, a refinancing closing statement is prepared. This statement reflects the changes in loan terms, including revised interest rates, loan amounts, and any adjustments in closing costs associated with the refinancing process. Overall, the Stamford Connecticut Closing Statement is an essential legal document that finalizes real estate transactions by summarizing the financial aspects of the deal. It acts as a comprehensive record for all parties involved, ensuring transparency, accuracy, and compliance with applicable laws and regulations.

Stamford Connecticut Closing Statement

Description

How to fill out Stamford Connecticut Closing Statement?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any law education to draft such paperwork from scratch, mostly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our service offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Stamford Connecticut Closing Statement or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Stamford Connecticut Closing Statement quickly employing our reliable service. If you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

However, if you are new to our platform, make sure to follow these steps prior to obtaining the Stamford Connecticut Closing Statement:

- Ensure the template you have found is good for your location since the regulations of one state or area do not work for another state or area.

- Review the form and read a brief outline (if available) of scenarios the paper can be used for.

- If the form you selected doesn’t suit your needs, you can start over and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Stamford Connecticut Closing Statement once the payment is completed.

You’re all set! Now you can go ahead and print out the form or fill it out online. In case you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.