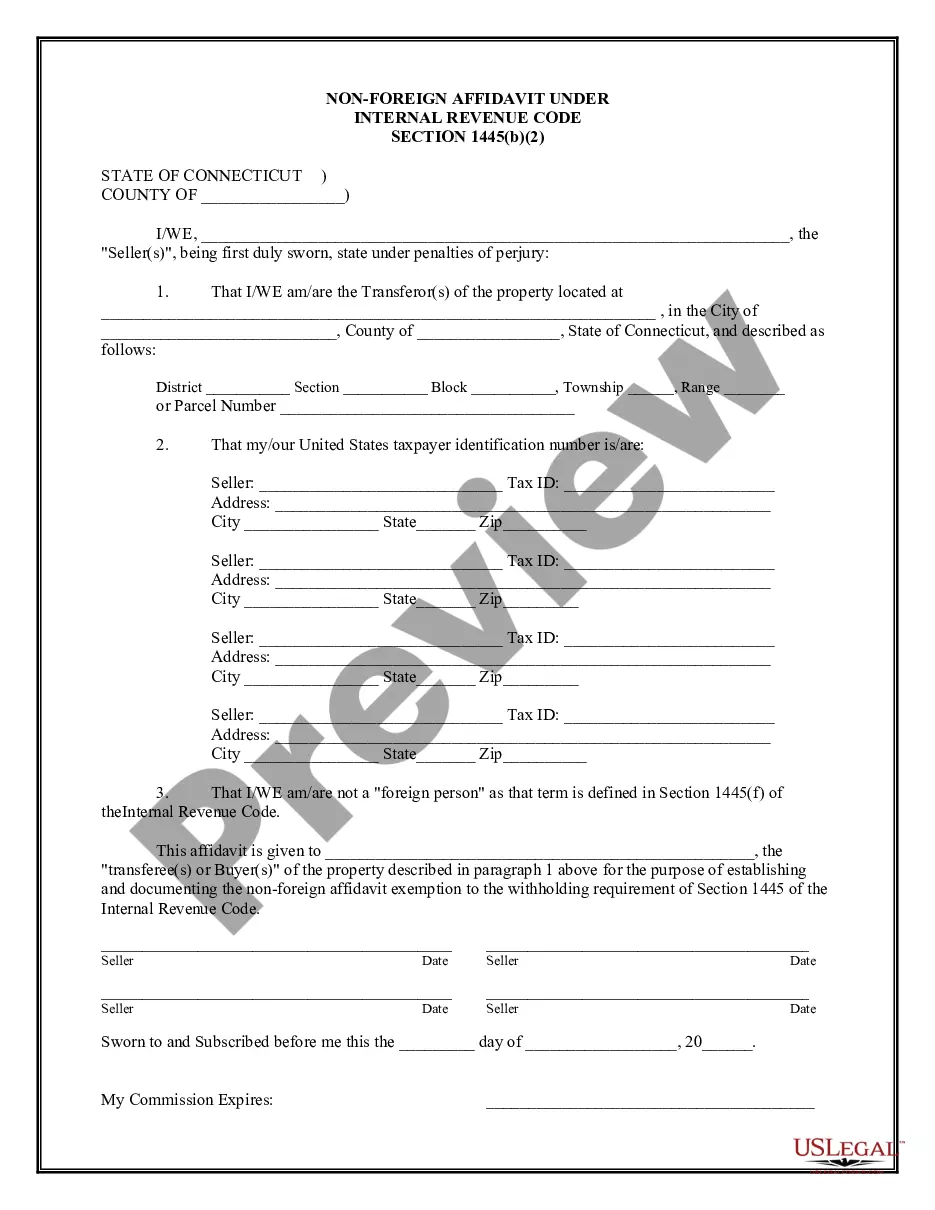

The Bridgeport Connecticut Non-Foreign Affidavit Under IRC 1445 is a legal document used in real estate transactions to determine the status of the seller as a non-foreign person for tax purposes. It is required by the Internal Revenue Code (IRC) Section 1445, which deals with withholding tax on dispositions of U.S. real property interests by foreign persons. Bridgeport, Connecticut, being a vibrant city known for its industrial history and waterfront attractions, has its specific regulations and forms for real estate transactions, including the Non-Foreign Affidavit Under IRC 1445. This affidavit ensures compliance with federal tax laws and provides reassurance to the buyer and relevant parties involved in a real estate transaction. The Non-Foreign Affidavit Under IRC 1445 is used when the seller of a property in Bridgeport is not considered a foreign person or entity under the IRC. The affidavit requires the seller to provide detailed information regarding their residency status, including their Social Security or Tax Identification Number, legal name, address, and citizenship details. Different types of Bridgeport Connecticut Non-Foreign Affidavit Under IRC 1445: 1. Individual Non-Foreign Affidavit: This affidavit is used when an individual seller is selling the property and is required to certify their non-foreign status under IRC 1445. The individual seller must provide their personal information and meet the eligibility criteria outlined by the IRC. 2. Corporate Non-Foreign Affidavit: This type of affidavit is utilized when the seller is a corporation or a business entity, and the transaction involves the disposition of U.S. real property interests. The corporation must provide its Federal Employer Identification Number (VEIN), legal name, and address, along with other required information. 3. Trust Non-Foreign Affidavit: In cases where the property is held in trust and the trust is the seller, a Trust Non-Foreign Affidavit is required. The trustee must provide their personal information and indicate that the trust is eligible for non-foreign status under IRC 1445. It is essential to complete the Bridgeport Connecticut Non-Foreign Affidavit accurately and truthfully, ensuring that all relevant information is provided. Failure to submit a proper affidavit or deliberate misrepresentation of foreign status may result in penalties or withholding taxes on the real estate transaction. Buyers and sellers in Bridgeport should consult with a qualified attorney or tax professional to ensure compliance with the IRC regulations and to properly complete the Non-Foreign Affidavit Under IRC 1445. Having a thorough understanding of the affidavit's requirements and carefully reviewing the form can help prevent delays or complications during the real estate transaction process and ensure a smooth closing.

Bridgeport Connecticut Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Bridgeport Connecticut Non-Foreign Affidavit Under IRC 1445?

If you’ve already utilized our service before, log in to your account and save the Bridgeport Connecticut Non-Foreign Affidavit Under IRC 1445 on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Bridgeport Connecticut Non-Foreign Affidavit Under IRC 1445. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!

Form popularity

FAQ

The FIRPTA affidavit for the seller is a declaration that provides the seller’s tax status regarding foreign investments in real property. This affidavit asserts that the seller is not a foreign individual, thus exempting them from FIRPTA withholding. If you are selling property in Bridgeport, Connecticut, completing this affidavit correctly is vital to facilitating the sale process. Consider using resources from USLegalForms to ensure that your affidavit meets all legal requirements and protects your interests.

A FIRPTA statement is a document required under the Foreign Investment in Real Property Tax Act. It certifies whether a seller is a foreign person or not, affecting tax withholding on the sale of real property. For those involved in real estate transactions in Bridgeport, Connecticut, submitting a non-foreign affidavit under IRC 1445 helps ensure compliance and protect against unforeseen tax liabilities. Utilizing platforms like USLegalForms can simplify the process of preparing and filing this important document.

IRC code 1445 refers to the section of the Internal Revenue Code that governs the withholding tax obligations for U.S. sellers of real property interests owned by foreign entities. Understanding IRC 1445 is essential for real estate transactions in Bridgeport, Connecticut, as it outlines the tax responsibilities of both buyers and sellers. This code ensures compliance with federal tax laws. For more information, consulting with experts can shed light on your obligations.

To acquire a FIRPTA withholding certificate, you need to file Form 8288-B with the IRS before the closing of your property sale. This form requests a reduced withholding rate based on the seller's circumstances. In Bridgeport, Connecticut, having this certificate can significantly impact the financial aspects of your sale. Engaging with a knowledgeable service like UsLegalForms can streamline this process for you.

A Section 1445 affidavit is a declaration that states whether the seller of property is a foreign or non-foreign person. This affidavit is important for transactions in Bridgeport, Connecticut, as it determines the withholding obligations under FIRPTA. Sellers must accurately complete this affidavit to avoid complications. For assistance, consider using UsLegalForms to generate the required documentation.

A FIRPTA affidavit generally does not require notarization to be valid. However, having it notarized can sometimes add an extra layer of authenticity, especially in Bridgeport, Connecticut. It is advisable to check local requirements before finalizing your documents. Ensuring all paperwork is in order can help prevent issues during the sale process.

To get around FIRPTA, one must often seek an exemption or a reduced withholding certificate from the IRS. This process can be complex, but working with professionals familiar with Bridgeport, Connecticut processes ensures you achieve compliance. Using resources such as UsLegalForms may help you understand your options clearly. Proper guidance can simplify your real estate transaction.

The FIRPTA affidavit is typically provided by the seller of the property, confirming their foreign or non-foreign status. In Bridgeport, Connecticut, this affidavit plays a vital role in clarifying tax obligations for real estate transactions. Using the right documentation is essential, and platforms like UsLegalForms can help you generate the necessary affidavits efficiently. Correctly filed affidavits streamline the closing process.

The seller of the property is responsible for signing the FIRPTA certificate. This document indicates whether they are a foreign person or entity under the Foreign Investment in Real Property Tax Act. If you are involved in a real estate transaction in Bridgeport, Connecticut, it's crucial to ensure that this signature is correctly completed. Proper processing can prevent potential delays in your transaction.

A FIRPTA affidavit must include specific details, such as the seller's name, address, taxpayer identification number, and a statement confirming that the seller is not a foreign person. In the context of the Bridgeport Connecticut Non-Foreign Affidavit Under IRC 1445, it is essential to provide accurate information to facilitate a smooth transaction. Additionally, proper signatures and date are necessary for the affidavit's legality. Using platforms like uslegalforms can simplify this process by providing ready-made templates tailored to your needs.