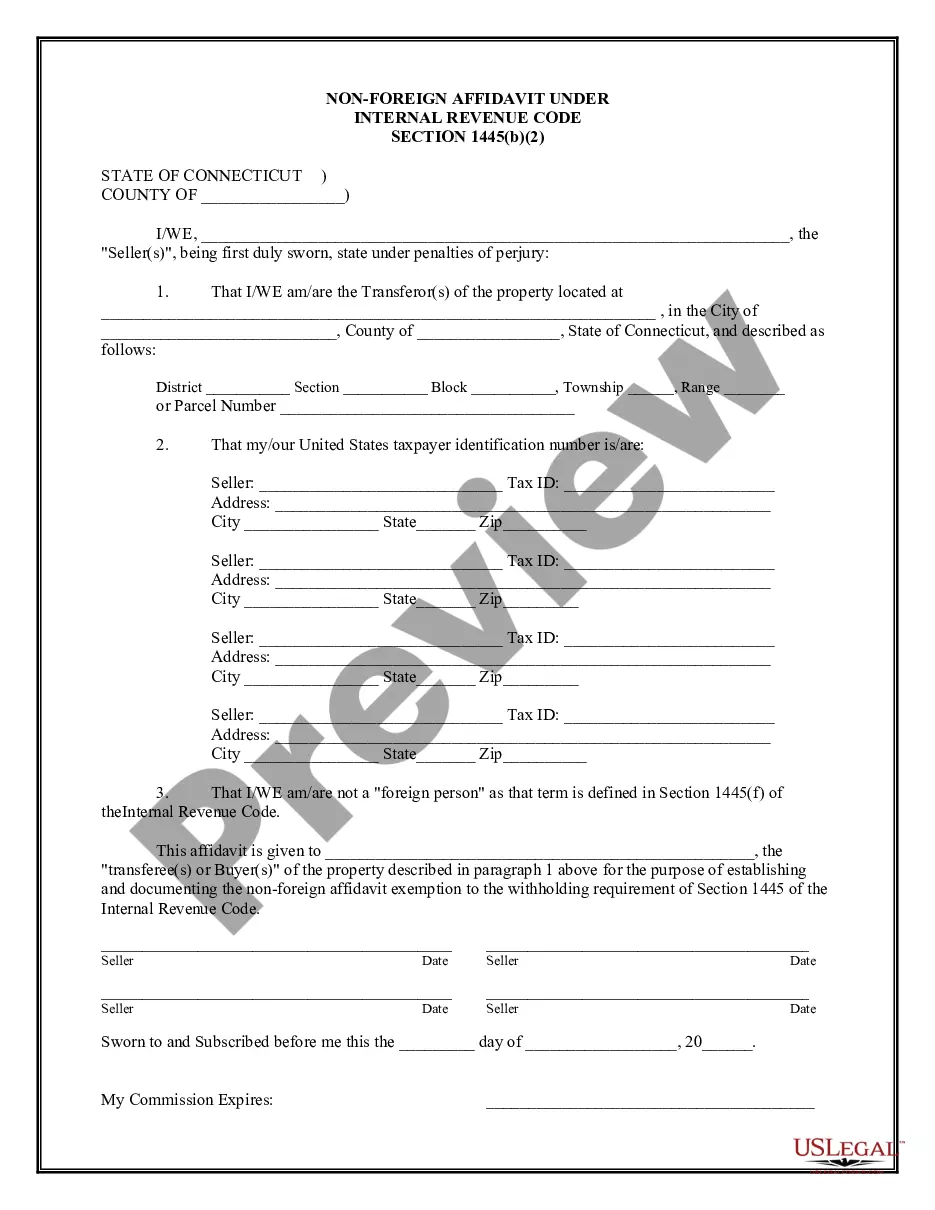

A Waterbury Connecticut Non-Foreign Affidavit under IRC 1445 is a legal document that is required in certain real estate transactions involving non-U.S. citizens or non-resident aliens in Waterbury, Connecticut. This affidavit is necessary to comply with the provisions of the Internal Revenue Code (IRC) Section 1445, which deals with the withholding of tax on dispositions of U.S. real property interests by foreign persons. The Waterbury Connecticut Non-Foreign Affidavit is designed to certify an individual's status as a non-foreign person for tax purposes. It is typically required when a non-U.S. citizen or non-resident alien sells or transfers a U.S. real property interest subject to tax under Section 1445. This affidavit serves as a declaration by the seller or transferor that they are not considered a foreign person under the IRC and are therefore exempt from tax withholding obligations. By submitting this document, the seller is affirming that they are a U.S. citizen, a U.S. resident alien, or a domestic corporation or partnership. It is important to note that the Waterbury Connecticut Non-Foreign Affidavit under IRC 1445 is required by the IRS to ensure compliance with tax regulations. Failure to provide this affidavit may result in the buyer or the withholding agent being held liable for any tax that should have been withheld. Different types of Waterbury Connecticut Non-Foreign Affidavits under IRC 1445 may include variations based on the specific nature of the real estate transaction and the parties involved. Some variations could include: 1. Individual Non-Foreign Affidavit: Used when the seller is an individual who is not a U.S. citizen or a U.S. resident alien. 2. Corporate Non-Foreign Affidavit: Applicable when the seller is a domestic corporation that certifies its status as a non-foreign entity for tax purposes. 3. Partnership Non-Foreign Affidavit: Used when the seller is a domestic partnership that declares its non-foreign status under IRC 1445. 4. Trust Non-Foreign Affidavit: If the seller is a trust, this variation certifies its non-foreign status and compliance with tax regulations. 5. Joint Non-Foreign Affidavit: If multiple individuals are selling the property together, this affidavit verifies their non-foreign status collectively. Given the critical role of the Waterbury Connecticut Non-Foreign Affidavit under IRC 1445 in real estate transactions involving non-U.S. citizens or non-resident aliens, it is essential to consult with legal professionals or tax experts to ensure the accurate completion and submission of the required affidavit.

Waterbury Connecticut Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Waterbury Connecticut Non-Foreign Affidavit Under IRC 1445?

Are you looking for a reliable and inexpensive legal forms provider to buy the Waterbury Connecticut Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your go-to choice.

Whether you need a simple agreement to set rules for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Waterbury Connecticut Non-Foreign Affidavit Under IRC 1445 conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Restart the search in case the template isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Waterbury Connecticut Non-Foreign Affidavit Under IRC 1445 in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal paperwork online once and for all.