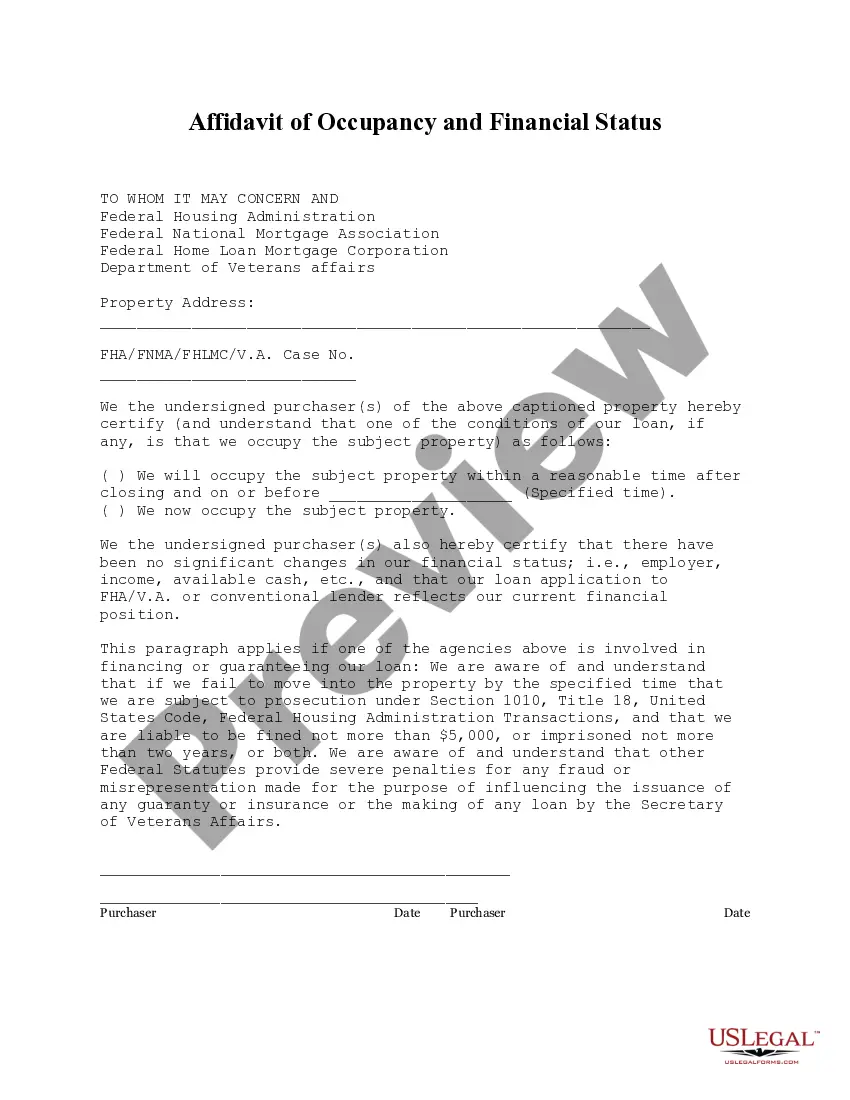

The Stamford Connecticut Affidavit of Occupancy and Financial Status plays an important role in the real estate sector. This legal document serves as an affirmation or sworn statement made by an individual or a property owner to assert several crucial details related to the property's occupancy and financial status. This affidavit serves as evidence of the information provided and is often required by lenders, landlords, or agencies involved in real estate transactions. The Stamford Connecticut Affidavit of Occupancy component outlines the factual details regarding the current state of occupancy of a property. It typically includes information about the property owner(s), tenants (if any), and the nature of their occupancy (rental, ownership, etc.). This section may also require details such as the duration of occupancy, the number of people occupying the property, and any lease or rental agreements involved. In contrast, the Financial Status segment of the Stamford Connecticut Affidavit focuses on the economic aspects related to the property. It requires the declaring to disclose various financial details such as outstanding mortgages, liens, loans, or other encumbrances on the property. This section may also demand documentation of the property's value, current market price, and any financial obligations or debts associated with it. Additionally, individuals may be required to disclose their income, assets, and liabilities for complete financial transparency. While the Stamford Connecticut Affidavit of Occupancy and Financial Status generally encompasses the aforementioned information, there may be different types or variations of this affidavit depending on the specific purpose or context. For instance: 1. Stamford Connecticut Affidavit of Owner-Occupancy: This specific type of affidavit is filled out by property owners who reside in the property they own. It verifies their current residency and serves as proof for various purposes like mortgage application, tax exemptions, or insurance. 2. Stamford Connecticut Affidavit of Rental Occupancy: This type of affidavit is submitted by property owners who lease their premises to tenants. It outlines the terms of the rental agreement, inventory of the property, and financial obligations between the parties involved. 3. Stamford Connecticut Affidavit of Financial Status for Financing: This affidavit is mainly used in mortgage or loan applications where potential borrowers provide comprehensive financial information about their income, assets, debts, and other relevant details to secure financing for a property. Regardless of the specific type, the Stamford Connecticut Affidavit of Occupancy and Financial Status plays a crucial role in ensuring transparency and legal compliance while dealing with real estate matters. It helps protect the rights of the parties involved and assists in making informed decisions during property transactions or loan applications.

Stamford Connecticut Affidavit of Occupancy and Financial Status

Description

How to fill out Stamford Connecticut Affidavit Of Occupancy And Financial Status?

If you have previously utilized our service, sign in to your account and acquire the Stamford Connecticut Affidavit of Occupancy and Financial Status on your device by selecting the Download button. Ensure your subscription is active. If not, extend it per your payment plan.

If this is your initial usage of our service, adhere to these straightforward steps to obtain your document.

You have continuous access to each document you have acquired: you can find it in your profile in the My documents section whenever you need to utilize it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or business needs!

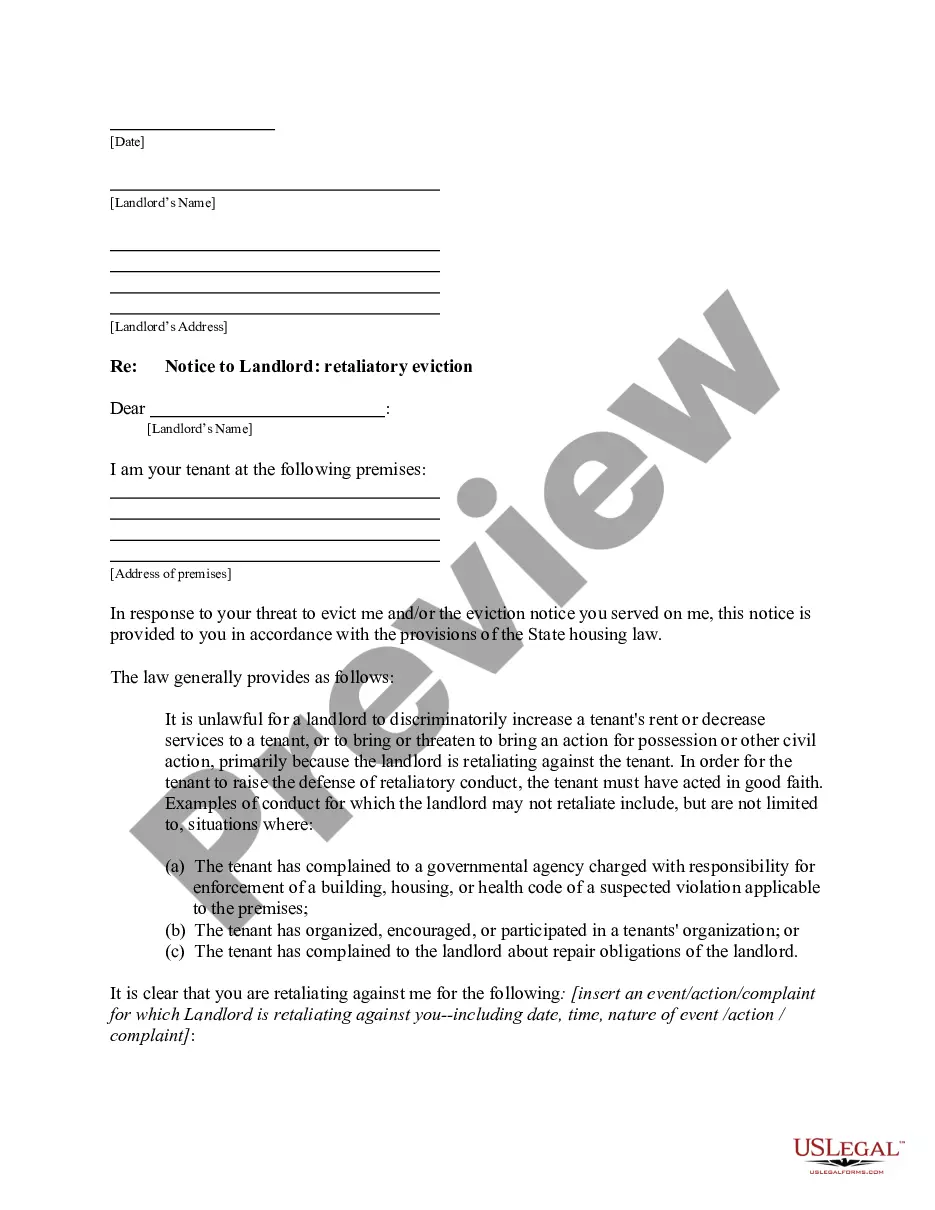

- Confirm you’ve found an appropriate document. Review the description and employ the Preview option, if available, to verify if it satisfies your requirements. If it doesn’t meet your criteria, utilize the Search tab above to discover the correct one.

- Purchase the template. Press the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Obtain your Stamford Connecticut Affidavit of Occupancy and Financial Status. Choose the file format for your document and save it onto your device.

- Fill out your sample. Print it or take advantage of professional online editors to complete it and sign it digitally.

Form popularity

FAQ

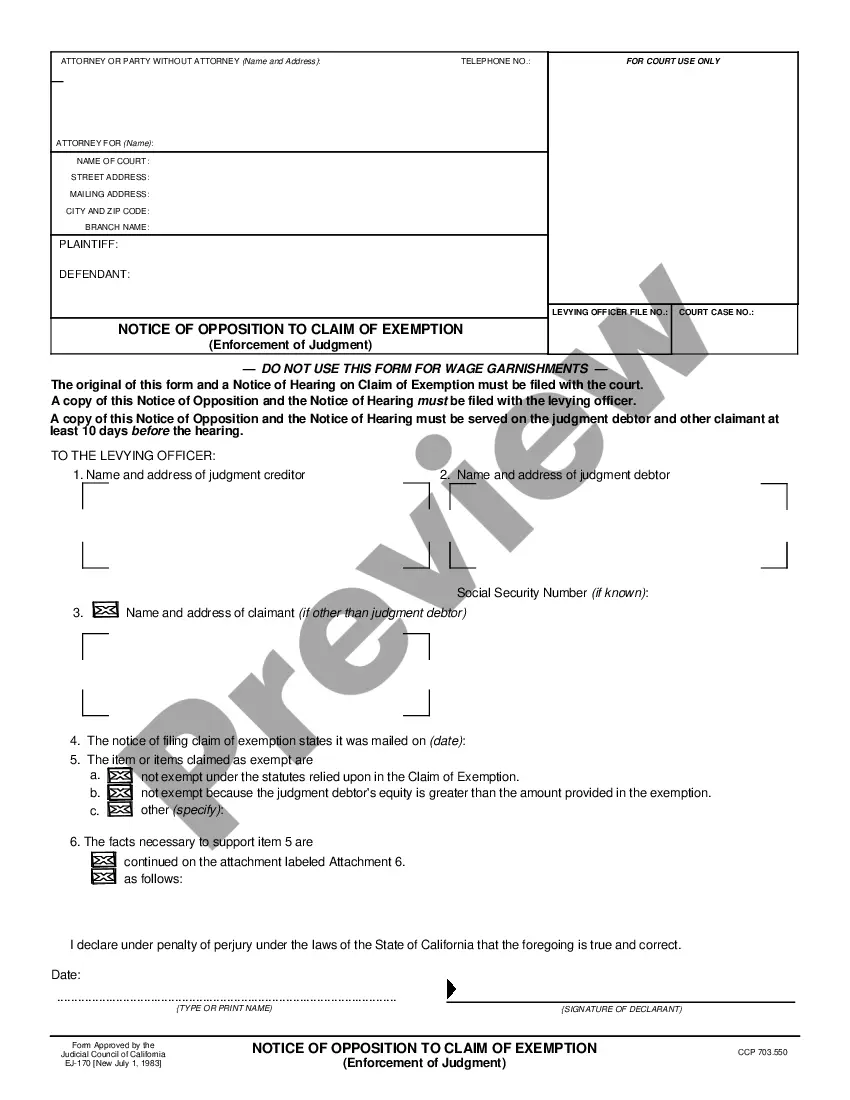

Indeed, building permits in Connecticut are public records. You can view these documents at your local building department's office or website. If you are dealing with the Stamford Connecticut Affidavit of Occupancy and Financial Status, accessing these public records can be crucial for your documentation needs.

Yes, building permits should be displayed prominently at the construction site. This visibility ensures that inspectors and the public are aware of approved work. For projects related to a Stamford Connecticut Affidavit of Occupancy and Financial Status, having your permit visible can help facilitate smoother inspections.

To obtain a certificate of occupancy in Connecticut, you must first complete your construction project according to local building codes. Afterward, request an inspection from your building department. Once they approve your work, you will receive the certificate, which is vital for your Stamford Connecticut Affidavit of Occupancy and Financial Status.

In Connecticut, various projects require a building permit, including new constructions, renovations, and some electrical or plumbing work. It's crucial to check with your local authority to understand the specific requirements for your project. Securing the proper permits is essential to obtaining your Stamford Connecticut Affidavit of Occupancy and Financial Status.

To determine if you have a certificate of occupancy, you can contact your local building department. They maintain records that include your certificate status. If you are pursuing a Stamford Connecticut Affidavit of Occupancy and Financial Status, having a valid certificate is often a prerequisite.

Yes, building permits are public records in Connecticut. You can access these records through your local building department. It's essential to check this information, especially if you need to obtain a Stamford Connecticut Affidavit of Occupancy and Financial Status, as such documents may reference previous permits.

In Connecticut, the size of a shed that can be built without a permit mostly depends on local regulations, which can vary. Generally, a shed must be less than 200 square feet to avoid requiring permits. To ensure your planned shed complies with Stamford’s local laws, it's wise to review guidelines or consult resources like US Legal Forms concerning the Stamford Connecticut Affidavit of Occupancy and Financial Status.

Yes, permits are generally required for building a shed in Stamford, CT. This requirement is in place to ensure that all constructions meet local building codes and zoning regulations. To ease the permit application process, refer to resources available on platforms like US Legal Forms, which can assist you in understanding both the permits and the Stamford Connecticut Affidavit of Occupancy and Financial Status.

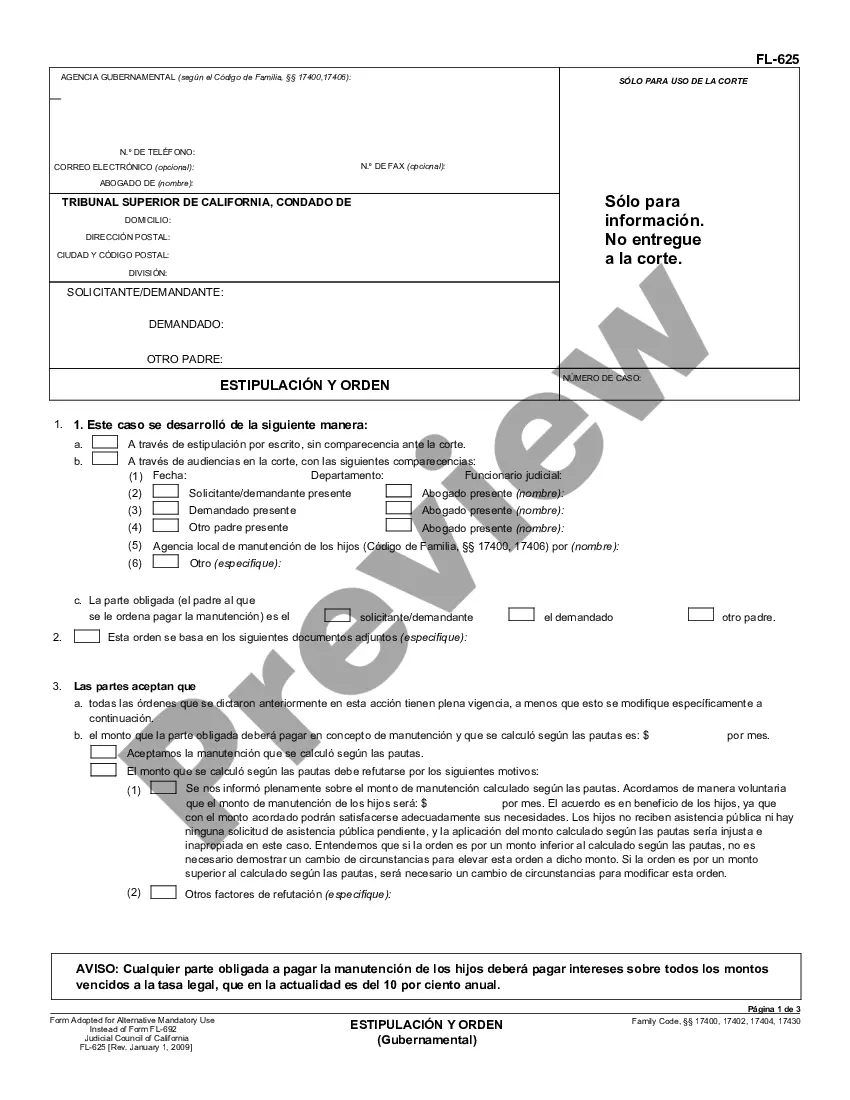

A financial affidavit for child support is a formal document that outlines a parent's financial status to determine the appropriate level of support. It includes crucial information about income, expenses, and any financial obligations. Creating this affidavit is essential in legal contexts, especially in Stamford, Connecticut, for accurately assessing child support amounts.

Writing a financial affidavit involves detailing your income, expenses, assets, and liabilities clearly and accurately. Start by collecting relevant financial documents and structuring your affidavit with clear sections. Resources like US Legal Forms offer templates that can guide you in constructing an effective affidavit aligned with the requirements of the Stamford Connecticut Affidavit of Occupancy and Financial Status.