The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them. The total of all of these items is your "Gross Estate." The includible property may consist of cash and securities, real estate, insurance, trusts, annuities, business interests and other assets.

Once you have accounted for the Gross Estate, certain deductions are allowed in arriving at your "Taxable Estate." These deductions may include mortgages and other debts, estate administration expenses, property that passes to surviving spouses and qualified charities. The value of some operating business interests or farms may be reduced for estates that qualify.

After the net amount is computed, the value of lifetime taxable gifts (beginning with gifts made in 1977) is added to this number and the tax is computed. The tax is then reduced by the available unified credit. Presently, the amount of this credit reduces the computed tax so that only total taxable estates and lifetime gifts that exceed $1,000,000 will actually have to pay tax. A credit shelter trust is a trust for the benefit of a surviving spouse, created to avoid estate taxes at a first spouse's death and which takes advantage of the available federal estate tax credit.

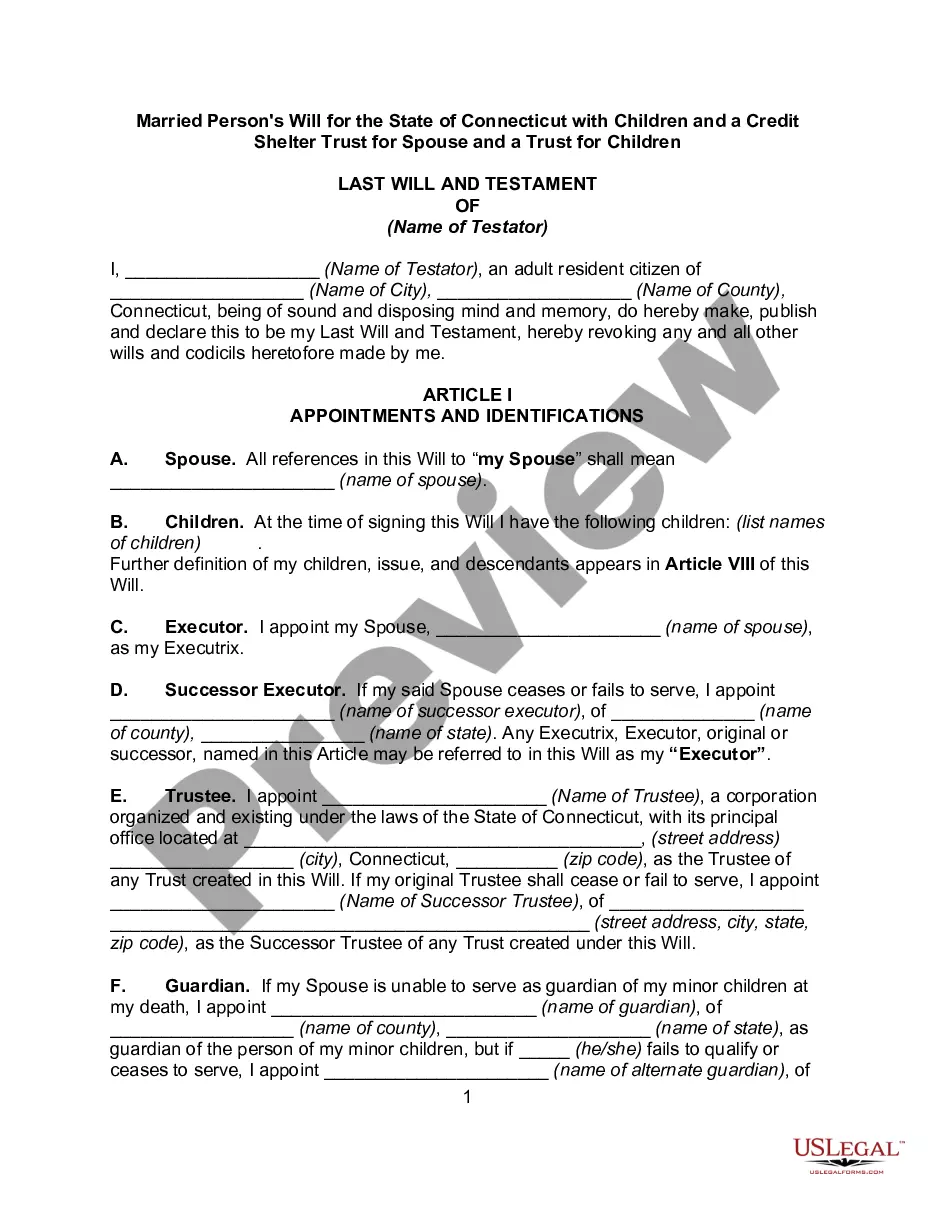

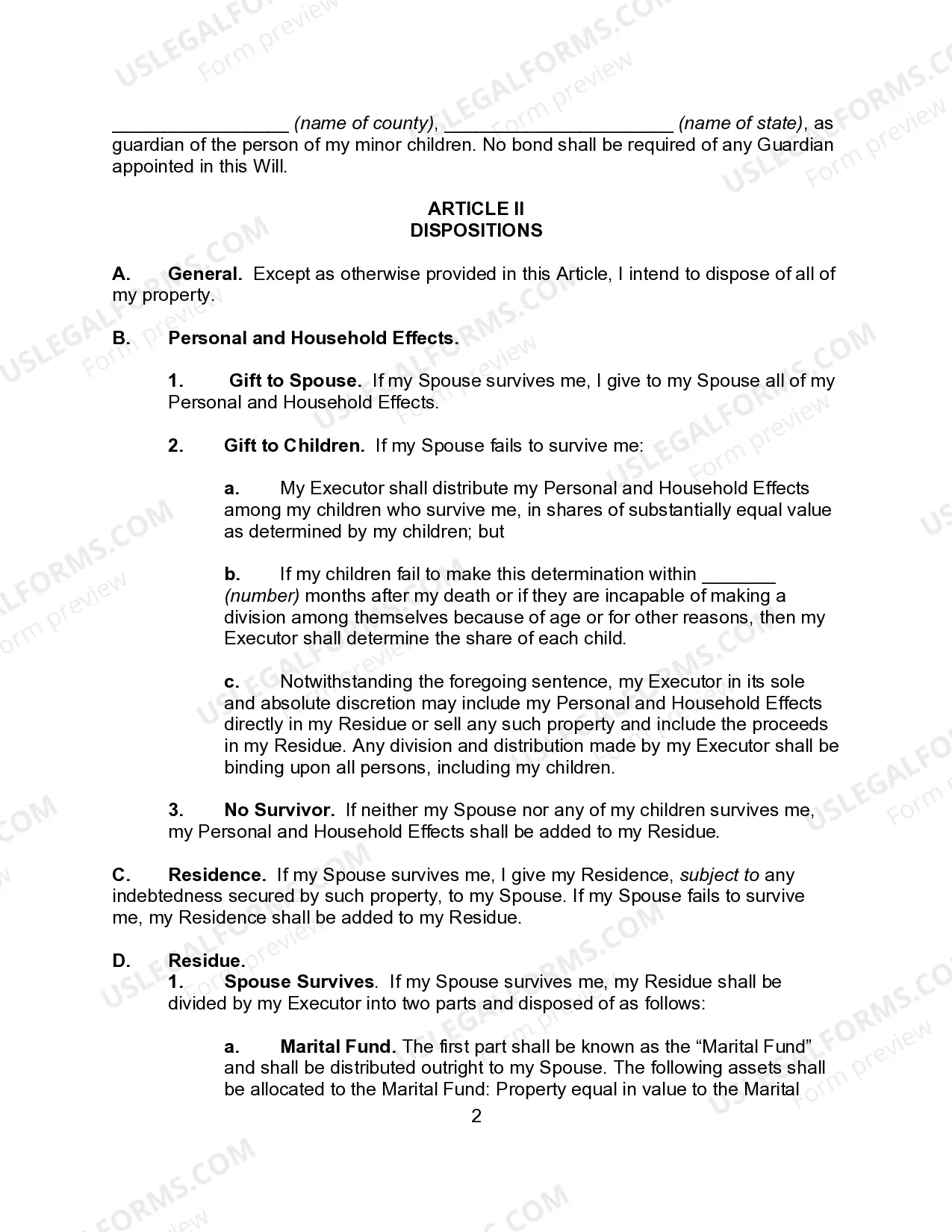

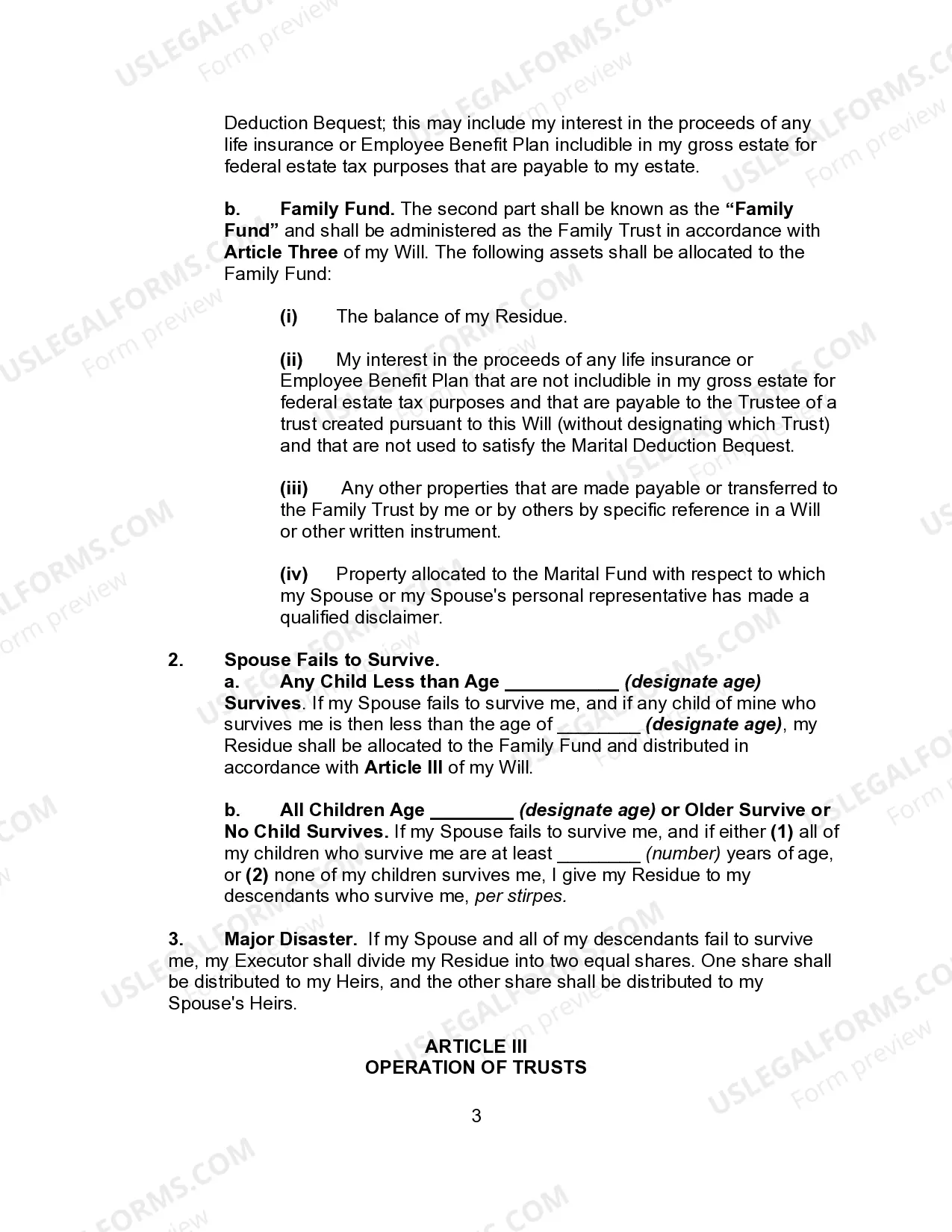

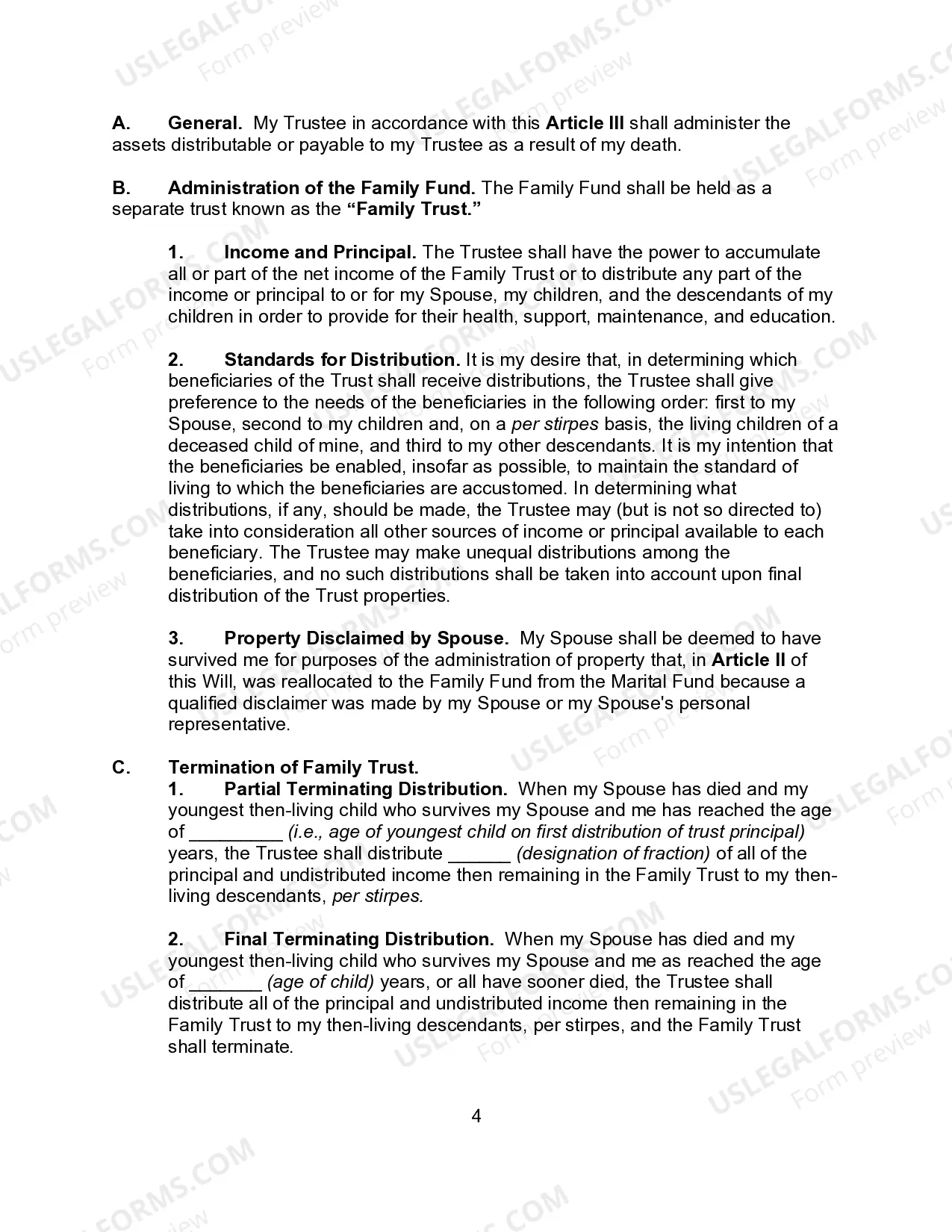

Bridgeport Married Person's Will for the State of Connecticut with Children with a Credit Shelter Trust for Spouse and a Trust for Children is a legal document that outlines the distribution of assets and provides for the care and well-being of a married couple's children in case of their untimely demise. This type of will ensures that the surviving spouse and children are provided for, while also minimizing estate taxes through the establishment of a credit shelter trust. A Bridgeport Married Person's Will typically includes the following key elements: 1. Distribution of Assets: The will outlines how the couple's assets, including property, bank accounts, investments, and personal belongings, will be distributed upon their deaths. 2. Credit Shelter Trust: This will establish a trust mechanism to utilize each spouse's estate tax exemption fully. By creating a credit shelter trust (also known as a bypass or A-B trust), the assets in this trust will not be subject to estate taxes upon the surviving spouse's death, thereby preserving wealth for future generations. 3. Trust for Spouse: A trust is created specifically for the surviving spouse, ensuring financial support during their lifetime. This trust contains detailed instructions on how the trust assets should be managed and allocated to meet the spouse's needs. 4. Trust for Children: To secure the financial future of their children, the will includes provisions for a trust to be established on behalf of the children. This trust ensures that the children's inheritance is protected, managed responsibly, and distributed in accordance with the parents' wishes. Different variations or types of Bridgeport Married Person's Wills for the State of Connecticut with Children with a Credit Shelter Trust for Spouse and a Trust for Children may include: 1. Simple Will with a Credit Shelter Trust and Children's Trust: This variation is a straightforward will that incorporates both the credit shelter trust for the spouse and a trust for the children's financial support. 2. Joint Will with Credit Shelter Trust and Children's Trust: A joint will is a single document that covers both spouses, reflecting their mutual decisions regarding asset distribution, trust establishment, and guardianship of their children. 3. Testamentary Will with Credit Shelter Trust and Children's Trust: A testamentary will goes into effect upon the death of the second spouse, and it structures the creation of both a credit shelter trust and a separate trust for children. 4. Revocable Living Trust with a Credit Shelter Trust and Children's Trust: This type of will replaces a traditional will and involves the creation of a living trust during the couple's lifetime, allowing them to manage and control their assets while providing for their spouse and children through credit shelter and children's trusts. In summary, a Bridgeport Married Person's Will for the State of Connecticut with Children with a Credit Shelter Trust for Spouse and a Trust for Children is a comprehensive legal document that ensures a couple's assets are distributed according to their wishes, while also protecting their surviving spouse and children through the establishment of trusts.Bridgeport Married Person's Will for the State of Connecticut with Children with a Credit Shelter Trust for Spouse and a Trust for Children is a legal document that outlines the distribution of assets and provides for the care and well-being of a married couple's children in case of their untimely demise. This type of will ensures that the surviving spouse and children are provided for, while also minimizing estate taxes through the establishment of a credit shelter trust. A Bridgeport Married Person's Will typically includes the following key elements: 1. Distribution of Assets: The will outlines how the couple's assets, including property, bank accounts, investments, and personal belongings, will be distributed upon their deaths. 2. Credit Shelter Trust: This will establish a trust mechanism to utilize each spouse's estate tax exemption fully. By creating a credit shelter trust (also known as a bypass or A-B trust), the assets in this trust will not be subject to estate taxes upon the surviving spouse's death, thereby preserving wealth for future generations. 3. Trust for Spouse: A trust is created specifically for the surviving spouse, ensuring financial support during their lifetime. This trust contains detailed instructions on how the trust assets should be managed and allocated to meet the spouse's needs. 4. Trust for Children: To secure the financial future of their children, the will includes provisions for a trust to be established on behalf of the children. This trust ensures that the children's inheritance is protected, managed responsibly, and distributed in accordance with the parents' wishes. Different variations or types of Bridgeport Married Person's Wills for the State of Connecticut with Children with a Credit Shelter Trust for Spouse and a Trust for Children may include: 1. Simple Will with a Credit Shelter Trust and Children's Trust: This variation is a straightforward will that incorporates both the credit shelter trust for the spouse and a trust for the children's financial support. 2. Joint Will with Credit Shelter Trust and Children's Trust: A joint will is a single document that covers both spouses, reflecting their mutual decisions regarding asset distribution, trust establishment, and guardianship of their children. 3. Testamentary Will with Credit Shelter Trust and Children's Trust: A testamentary will goes into effect upon the death of the second spouse, and it structures the creation of both a credit shelter trust and a separate trust for children. 4. Revocable Living Trust with a Credit Shelter Trust and Children's Trust: This type of will replaces a traditional will and involves the creation of a living trust during the couple's lifetime, allowing them to manage and control their assets while providing for their spouse and children through credit shelter and children's trusts. In summary, a Bridgeport Married Person's Will for the State of Connecticut with Children with a Credit Shelter Trust for Spouse and a Trust for Children is a comprehensive legal document that ensures a couple's assets are distributed according to their wishes, while also protecting their surviving spouse and children through the establishment of trusts.