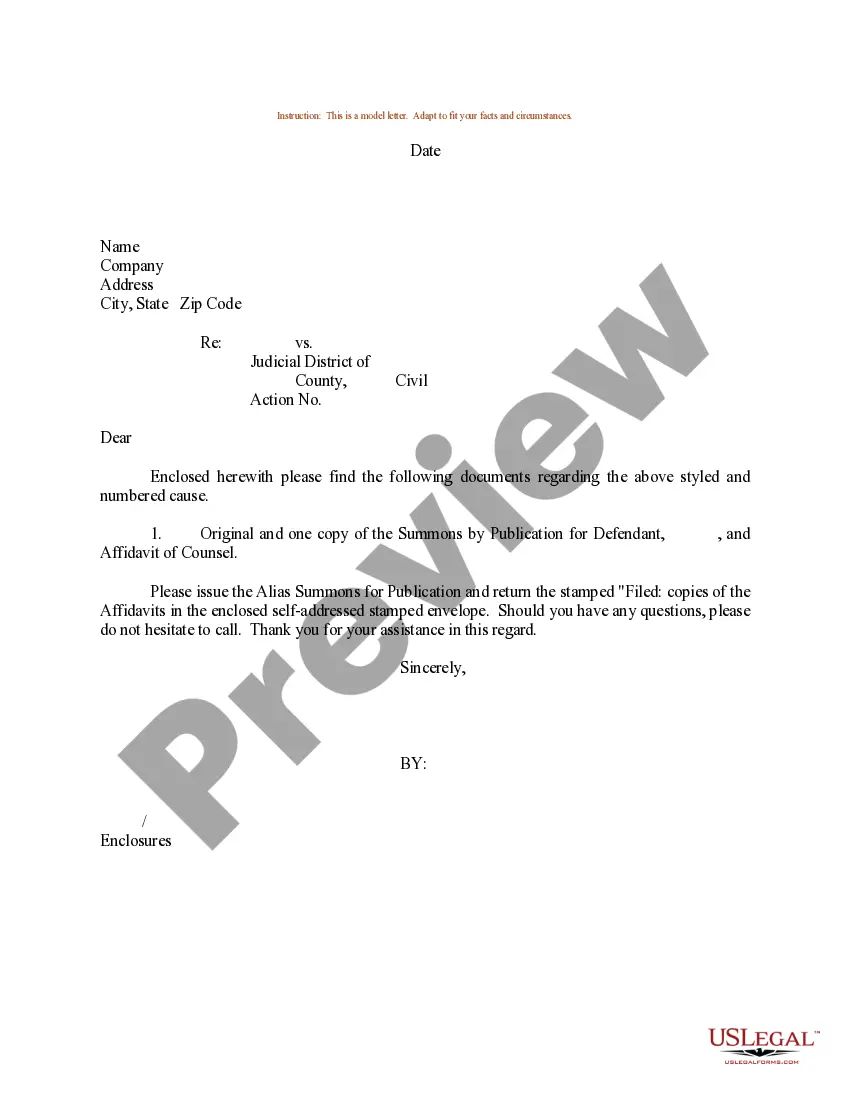

The dissolution of a corporation package contains all forms to dissolve a corporation in Connecticut, step by step instructions, addresses, transmittal letters, and other information.

Bridgeport Connecticut Dissolution Package to Dissolve Corporation

Description

How to fill out Connecticut Dissolution Package To Dissolve Corporation?

If you are looking for a legitimate form template, it’s challenging to select a superior service than the US Legal Forms site – one of the most extensive online repositories.

With this repository, you can discover numerous form examples for business and personal uses by categories and regions, or keywords.

Utilizing our enhanced search feature, locating the most up-to-date Bridgeport Connecticut Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Verify your selection. Click the Buy now option. Then, select the desired pricing plan and provide information to create an account.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

- Moreover, the pertinence of each document is confirmed by a team of expert attorneys who consistently review the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Bridgeport Connecticut Dissolution Package to Dissolve Corporation is to Log In to your user profile and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have selected the sample you need. Review its details and utilize the Preview feature to view its content.

- If it doesn’t satisfy your requirements, use the Search option at the top of the screen to find the suitable file.

Form popularity

FAQ

Dissolving an LLC is not hard, but it requires attention to detail. You must file a Certificate of Cancellation with the state and ensure you address any outstanding liabilities. Depending on your state's requirements, you might also need to obtain tax clearances. Using our Bridgeport Connecticut Dissolution Package to Dissolve Corporation simplifies this process, helping you navigate the necessary paperwork with ease.

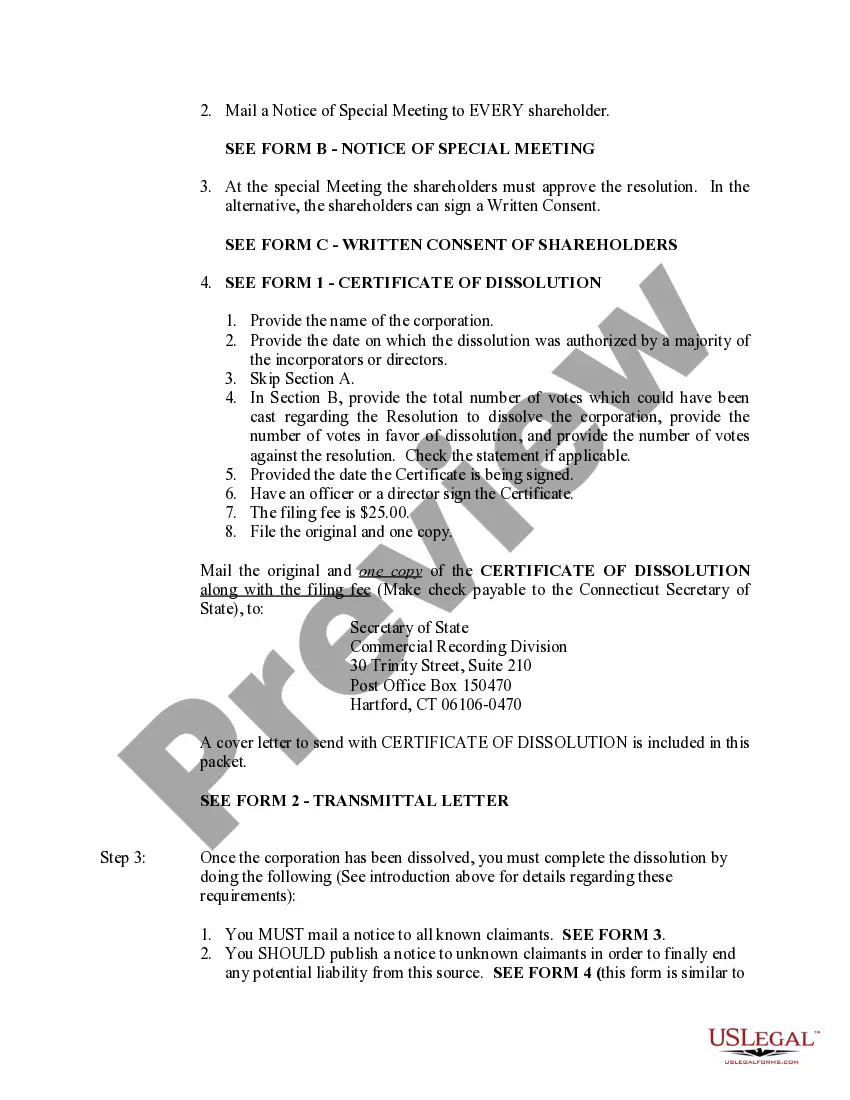

To dissolve a Connecticut corporation, you first need to complete a Certificate of Dissolution, which can be obtained from the Connecticut Secretary of State's website. After completing the form, ensure that all debts owed by the corporation are settled. Next, submit the Certificate along with any required fees. For a smooth process, consider using our Bridgeport Connecticut Dissolution Package to Dissolve Corporation, which guides you through each step efficiently.

Yes, notifying the IRS is essential when you close your LLC. You must file a final tax return indicating the closing of the business and report any income or deductions for the year. This step ensures that your tax responsibilities are settled and prevents future tax complications. A Bridgeport Connecticut Dissolution Package to Dissolve Corporation can assist you in understanding and completing this process correctly.

Closing an LLC can seem challenging, but it is a manageable process with proper guidance. It involves several steps, including settling debts, distributing assets, and filing necessary paperwork with your state. Often, confusion arises from unfamiliarity with required legal forms, which is why a Bridgeport Connecticut Dissolution Package to Dissolve Corporation can make this process smoother.

Dissolving an LLC can lead to loss of business identity and may affect relationships with clients and vendors. The remaining members may also face challenges in distributing assets, along with potential legal disputes. Additionally, certain legal obligations, such as final tax filings, still apply even after dissolution. To navigate these complexities, a Bridgeport Connecticut Dissolution Package to Dissolve Corporation can provide necessary guidance.

To dissolve a corporation with the IRS, you must notify them of your decision to dissolve the business. This entails filing the final tax returns for your corporation and checking the box indicating the corporation is closed. Using the Bridgeport Connecticut Dissolution Package to Dissolve Corporation can help ensure you complete all necessary IRS forms accurately.

The modes of dissolution include voluntary, involuntary, and administrative dissolution. Each mode has unique implications and processes. It is vital to choose the right mode based on your corporation's situation – a decision that can be guided effectively through the Bridgeport Connecticut Dissolution Package to Dissolve Corporation.

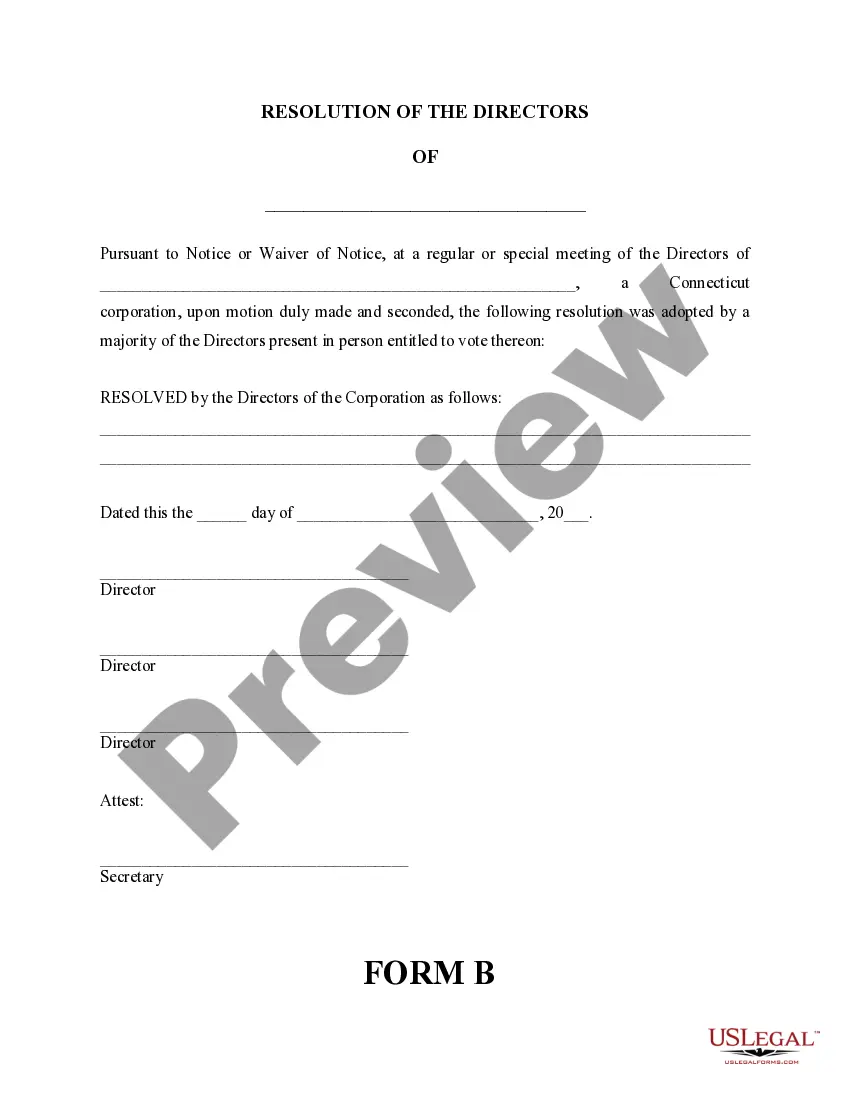

A corporation consists of three primary parts: the shareholders, the board of directors, and the officers. Shareholders own the corporation, while the board of directors makes major decisions and oversees management. Officers run the day-to-day operations. Understanding these roles is critical when considering dissolution and the responsibilities involved.

Dissolving a company involves several critical steps: obtaining board approval, filing a Certificate of Dissolution, settling debts, and notifying creditors. Next, ensure you distribute assets to shareholders appropriately. The Bridgeport Connecticut Dissolution Package to Dissolve Corporation offers a comprehensive solution that streamlines this process for you.

The three modes of dissolving a corporation are voluntary dissolution, judicial dissolution, and administrative dissolution. Voluntary dissolution occurs at the will of the shareholders, while judicial dissolution is determined by a court when necessary. Administrative dissolution is initiated by the state for failure to comply with regulations, emphasizing the importance of following the correct procedures.