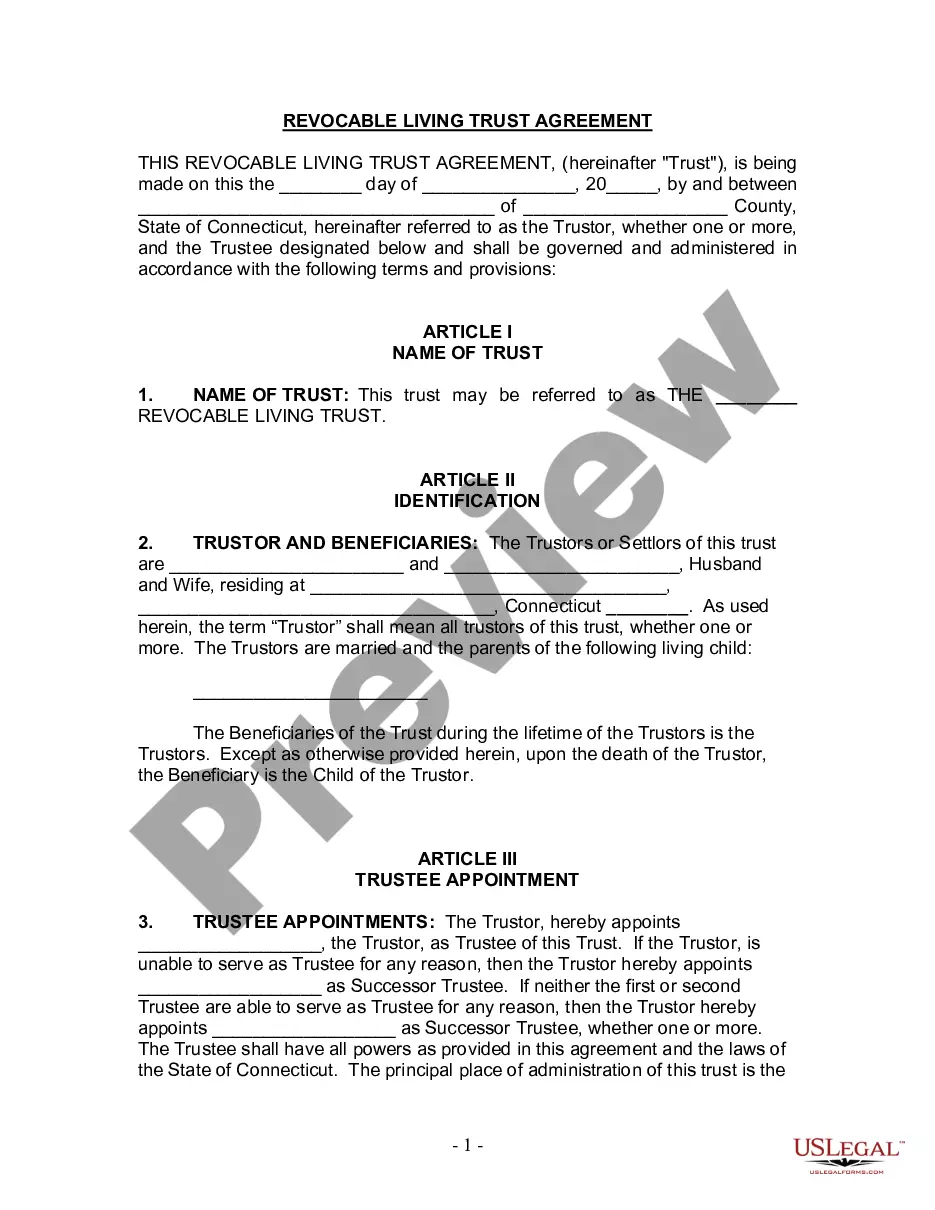

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Bridgeport Connecticut Living Trust for Husband and Wife with One Child is an estate planning tool that enables couples to protect their assets, minimize probate costs, and ensure the smooth transfer of property to their child upon their passing. This legal document allows individuals to maintain control over their assets while providing financial security for their family. There are various types of Bridgeport Connecticut Living Trusts for Husband and Wife with One Child, depending on the specific needs and preferences of the couple. The most common types include: 1. Revocable Living Trust: A revocable living trust gives the couple the flexibility to modify or revoke the trust at any time during their lifetime. They can freely move assets in and out of the trust, change beneficiaries, or amend the terms of the trust as circumstances change. 2. Irrevocable Living Trust: An irrevocable living trust cannot be modified or revoked once it is established. This type of trust provides increased asset protection, as the assets transferred into the trust are no longer considered part of the individual's estate. It can be an effective tool to minimize estate taxes and protect assets from potential creditors. 3. Testamentary Trust: A testamentary trust is created within a will and comes into effect after the death of both spouses. This trust allows the couple to specify how their assets will be managed and distributed for the benefit of their child. Unlike a revocable living trust, a testamentary trust does not avoid probate, but it can provide guidelines for the future administration of the estate. 4. Special Needs Trust: If a couple has a child with special needs, they may choose to create a special needs trust within their living trust. This trust ensures that a child with disabilities continues to receive necessary public benefits while also providing additional resources for their care and well-being. In summary, a Bridgeport Connecticut Living Trust for Husband and Wife with One Child empowers couples to protect their assets and streamline the transfer of property to their child. Whether they opt for a revocable, irrevocable, testamentary, or special needs trust, this legal arrangement offers numerous benefits in terms of asset protection, probate avoidance, and providing for the financial security of their family.A Bridgeport Connecticut Living Trust for Husband and Wife with One Child is an estate planning tool that enables couples to protect their assets, minimize probate costs, and ensure the smooth transfer of property to their child upon their passing. This legal document allows individuals to maintain control over their assets while providing financial security for their family. There are various types of Bridgeport Connecticut Living Trusts for Husband and Wife with One Child, depending on the specific needs and preferences of the couple. The most common types include: 1. Revocable Living Trust: A revocable living trust gives the couple the flexibility to modify or revoke the trust at any time during their lifetime. They can freely move assets in and out of the trust, change beneficiaries, or amend the terms of the trust as circumstances change. 2. Irrevocable Living Trust: An irrevocable living trust cannot be modified or revoked once it is established. This type of trust provides increased asset protection, as the assets transferred into the trust are no longer considered part of the individual's estate. It can be an effective tool to minimize estate taxes and protect assets from potential creditors. 3. Testamentary Trust: A testamentary trust is created within a will and comes into effect after the death of both spouses. This trust allows the couple to specify how their assets will be managed and distributed for the benefit of their child. Unlike a revocable living trust, a testamentary trust does not avoid probate, but it can provide guidelines for the future administration of the estate. 4. Special Needs Trust: If a couple has a child with special needs, they may choose to create a special needs trust within their living trust. This trust ensures that a child with disabilities continues to receive necessary public benefits while also providing additional resources for their care and well-being. In summary, a Bridgeport Connecticut Living Trust for Husband and Wife with One Child empowers couples to protect their assets and streamline the transfer of property to their child. Whether they opt for a revocable, irrevocable, testamentary, or special needs trust, this legal arrangement offers numerous benefits in terms of asset protection, probate avoidance, and providing for the financial security of their family.