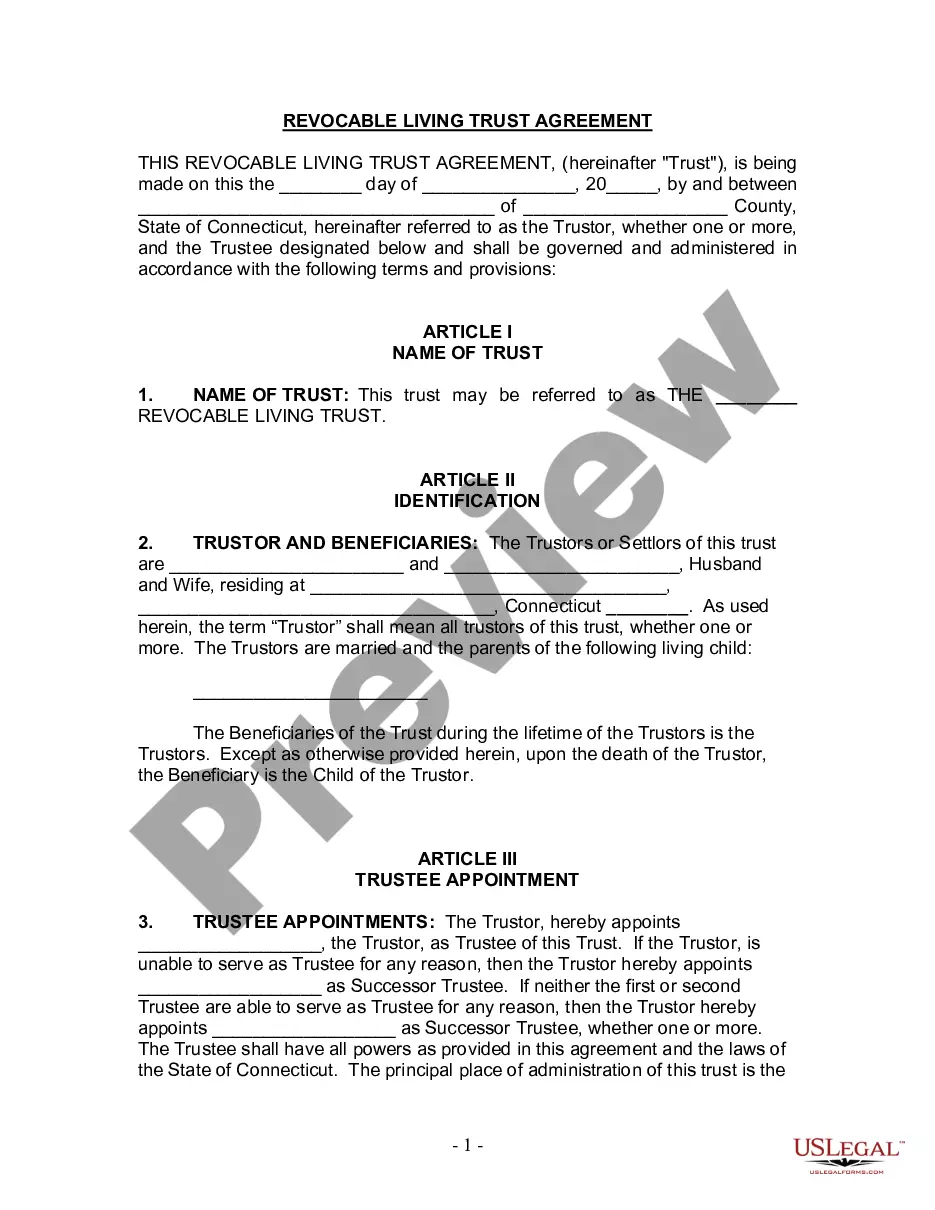

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Waterbury Connecticut Living Trust for Husband and Wife with One Child is a legal document that allows married couples residing in Waterbury, Connecticut, to protect their assets and ensure their child's financial security in the event of their incapacitation or passing. This type of living trust is specifically designed for couples who have one child and wish to avoid probate and simplify the distribution of their estate. The main purpose of a Waterbury Connecticut Living Trust for Husband and Wife with One Child is to establish a comprehensive plan for the management and allocation of the couple's assets, including real estate, investments, bank accounts, and personal property. By creating this trust, the couple can have more control over the distribution of their assets, ensure privacy, and potentially minimize estate taxes. There are several variations or types of Waterbury Connecticut Living Trust for Husband and Wife with One Child, including: 1. Revocable Living Trust: This is the most common type of living trust, allowing the couple to retain control and make changes to the trust during their lifetime. It protects assets from probate, provides flexibility, and allows for the easy transfer of assets to the surviving spouse or child. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be altered or revoked without the consent of the beneficiaries. It offers more extensive asset protection, reduces estate taxes, and safeguards the child's inheritance by ensuring it cannot be misused or diminished. 3. Testamentary Trust: This type of trust is established within a will and only takes effect upon the death of both spouses. It allows for the distribution of assets to the child in a structured manner, usually through appointed trustees or guardians until the child reaches a specific age or milestone. 4. Special Needs Trust: If the couple's child has special needs or disabilities, a special needs trust can be created within the living trust. This ensures that the child will receive necessary care, support, and financial resources without jeopardizing their eligibility for public assistance programs. 5. Charitable Trust: For couples with philanthropic goals, a charitable trust can be incorporated into their living trust. This enables them to make donations to charitable organizations, receive potential tax benefits, and leave a legacy of giving. Creating a Waterbury Connecticut Living Trust for Husband and Wife with One Child usually involves consulting an experienced estate planning attorney who can customize the trust to meet the individual needs, desires, and financial circumstances of the couple. The attorney will draft the necessary legal documents, including a declaration of trust, appoint trustees, and provide guidance on properly titling assets to ensure they are included in the living trust.A Waterbury Connecticut Living Trust for Husband and Wife with One Child is a legal document that allows married couples residing in Waterbury, Connecticut, to protect their assets and ensure their child's financial security in the event of their incapacitation or passing. This type of living trust is specifically designed for couples who have one child and wish to avoid probate and simplify the distribution of their estate. The main purpose of a Waterbury Connecticut Living Trust for Husband and Wife with One Child is to establish a comprehensive plan for the management and allocation of the couple's assets, including real estate, investments, bank accounts, and personal property. By creating this trust, the couple can have more control over the distribution of their assets, ensure privacy, and potentially minimize estate taxes. There are several variations or types of Waterbury Connecticut Living Trust for Husband and Wife with One Child, including: 1. Revocable Living Trust: This is the most common type of living trust, allowing the couple to retain control and make changes to the trust during their lifetime. It protects assets from probate, provides flexibility, and allows for the easy transfer of assets to the surviving spouse or child. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be altered or revoked without the consent of the beneficiaries. It offers more extensive asset protection, reduces estate taxes, and safeguards the child's inheritance by ensuring it cannot be misused or diminished. 3. Testamentary Trust: This type of trust is established within a will and only takes effect upon the death of both spouses. It allows for the distribution of assets to the child in a structured manner, usually through appointed trustees or guardians until the child reaches a specific age or milestone. 4. Special Needs Trust: If the couple's child has special needs or disabilities, a special needs trust can be created within the living trust. This ensures that the child will receive necessary care, support, and financial resources without jeopardizing their eligibility for public assistance programs. 5. Charitable Trust: For couples with philanthropic goals, a charitable trust can be incorporated into their living trust. This enables them to make donations to charitable organizations, receive potential tax benefits, and leave a legacy of giving. Creating a Waterbury Connecticut Living Trust for Husband and Wife with One Child usually involves consulting an experienced estate planning attorney who can customize the trust to meet the individual needs, desires, and financial circumstances of the couple. The attorney will draft the necessary legal documents, including a declaration of trust, appoint trustees, and provide guidance on properly titling assets to ensure they are included in the living trust.