This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Connecticut Living Trust For Husband And Wife With Minor And Or Adult Children?

If you’ve previously employed our service, sign in to your account and retrieve the Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children onto your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it per your payment option.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You will have continual access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to efficiently locate and store any template for your personal or professional requirements!

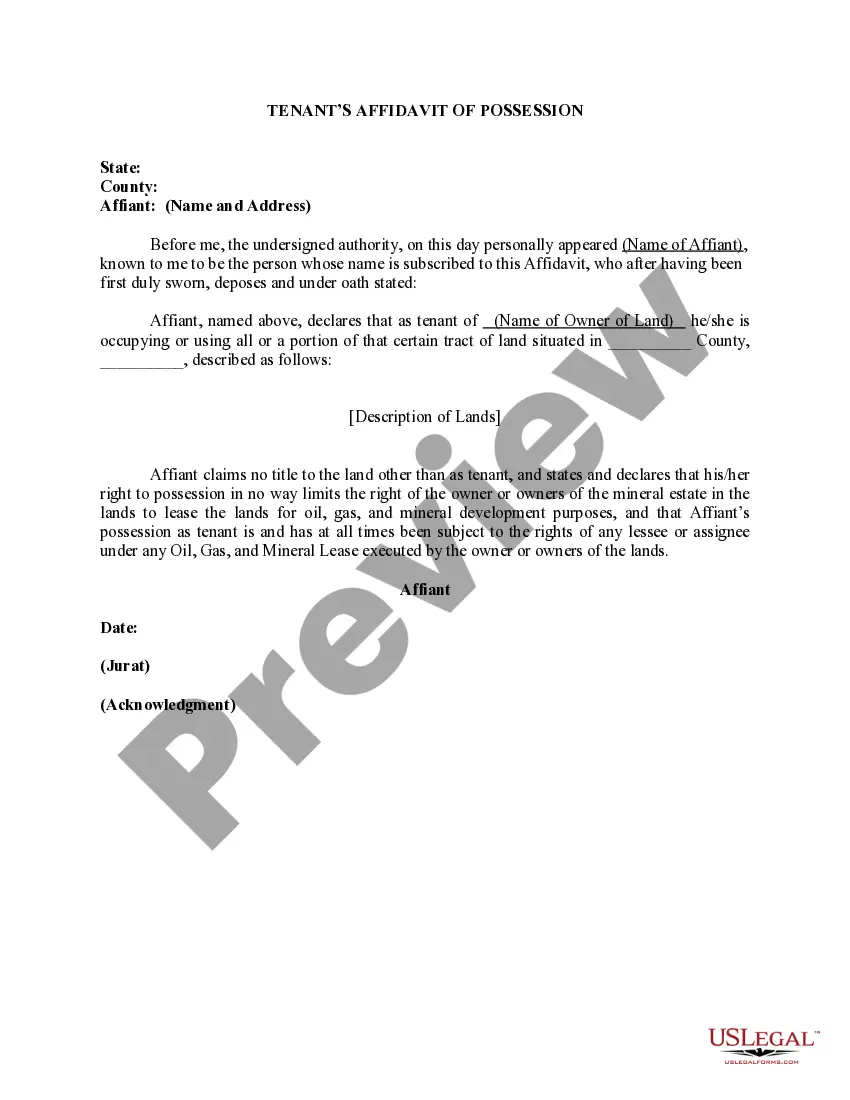

- Confirm you've located an appropriate document. Review the description and utilize the Preview feature, if available, to verify if it fits your requirements. If it’s unsuitable, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and finalize the payment. Use your credit card information or the PayPal option to complete the transaction.

- Retrieve your Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children. Choose the file format for your document and save it to your device.

- Finalize your document. Print it out or utilize professional online editors to complete it and sign it digitally.

Form popularity

FAQ

Setting up a Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children involves a few key steps. First, you need to define your assets and decide how you want to distribute them among your beneficiaries. Next, choose a trustee to manage the trust—this can be one of you or a trusted person. Finally, consider using platforms like US Legal Forms to simplify the process, ensuring all necessary documents are correctly prepared and filed.

Deciding whether your parents should establish a Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children hinges on their specific circumstances. A trust can protect their assets, ensure smooth transfer of wealth, and provide for minor children if necessary. It can also help avoid probate, making the process easier for loved ones. Consulting with an estate planning expert can clarify the benefits and assist in making an informed choice.

When considering a Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children, it’s essential to understand the risks involved. Trust funds can be complex, and if not set up correctly, they may lead to unintended tax consequences or legal disputes. Additionally, improper management can result in the misallocation of assets, creating challenges for beneficiaries. Therefore, it's wise to consult professionals who specialize in estate planning to navigate these risks effectively.

One of the biggest mistakes parents frequently make when establishing a trust fund, such as a Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children, is failing to clearly define the terms of the trust. Without clear instructions and guidelines, your children may face confusion regarding the distribution of assets. Additionally, many overlook the importance of updating the trust as circumstances change, such as the birth of additional children or changes in financial situations. A well-structured trust can prevent misunderstandings and ensure your wishes are honored.

Setting up a trust in Connecticut, specifically a Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children, involves a few clear steps. First, you need to choose the right type of trust that fits your family's needs, whether for minor children or adult heirs. After that, complete the necessary legal documents to create the trust. Using platforms like uslegalforms can streamline this process, providing templates and guidance tailored for Connecticut residents.

For married couples, a revocable living trust is often the most appropriate choice as it offers control and ease of access to assets during their lifetime. A Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children is an ideal example, allowing couples to structure their estate plans thoughtfully. This trust helps address the needs of both minor and adult children while streamlining the transfer of assets upon death.

Whether a married couple should have a joint trust or separate trusts largely depends on their individual financial situations and needs. A Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children can serve as a joint trust, allowing for unified asset management and simpler administration. However, separate trusts might provide more personalized control and flexibility, so discussing these options with an estate planner is wise.

Suze Orman often recommends revocable living trusts as essential tools for estate planning, especially for married couples. A Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children aligns well with her advice, as it allows couples to maintain control over their assets during their lifetime while providing directives for after their passing. This type of trust ensures that their children are cared for according to their specific wishes.

The most popular form of marital trust is the A/B trust, also known as a marital and bypass trust. This arrangement allows for effective estate tax reduction while ensuring that the couple’s wishes are honored. A Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children can also incorporate elements of the A/B trust, providing added protection and flexibility for the family.

The best trust for a married couple often depends on their unique financial situation. However, a Bridgeport Connecticut Living Trust for Husband and Wife with Minor and or Adult Children is frequently recommended, as it simplifies the management of assets and provides clear directives for guardianship and distribution. This trust allows couples to work together in creating a comprehensive estate plan that serves their family's needs.