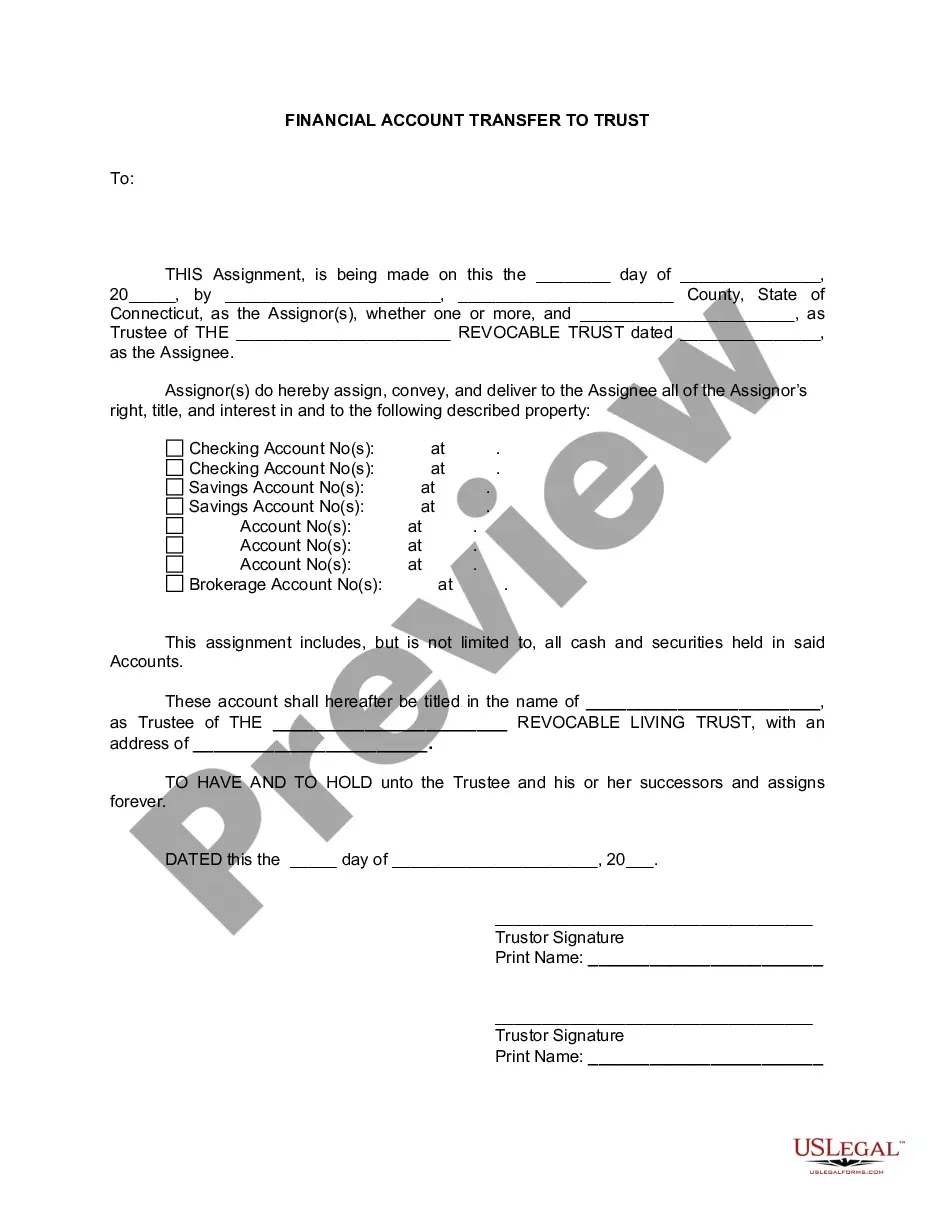

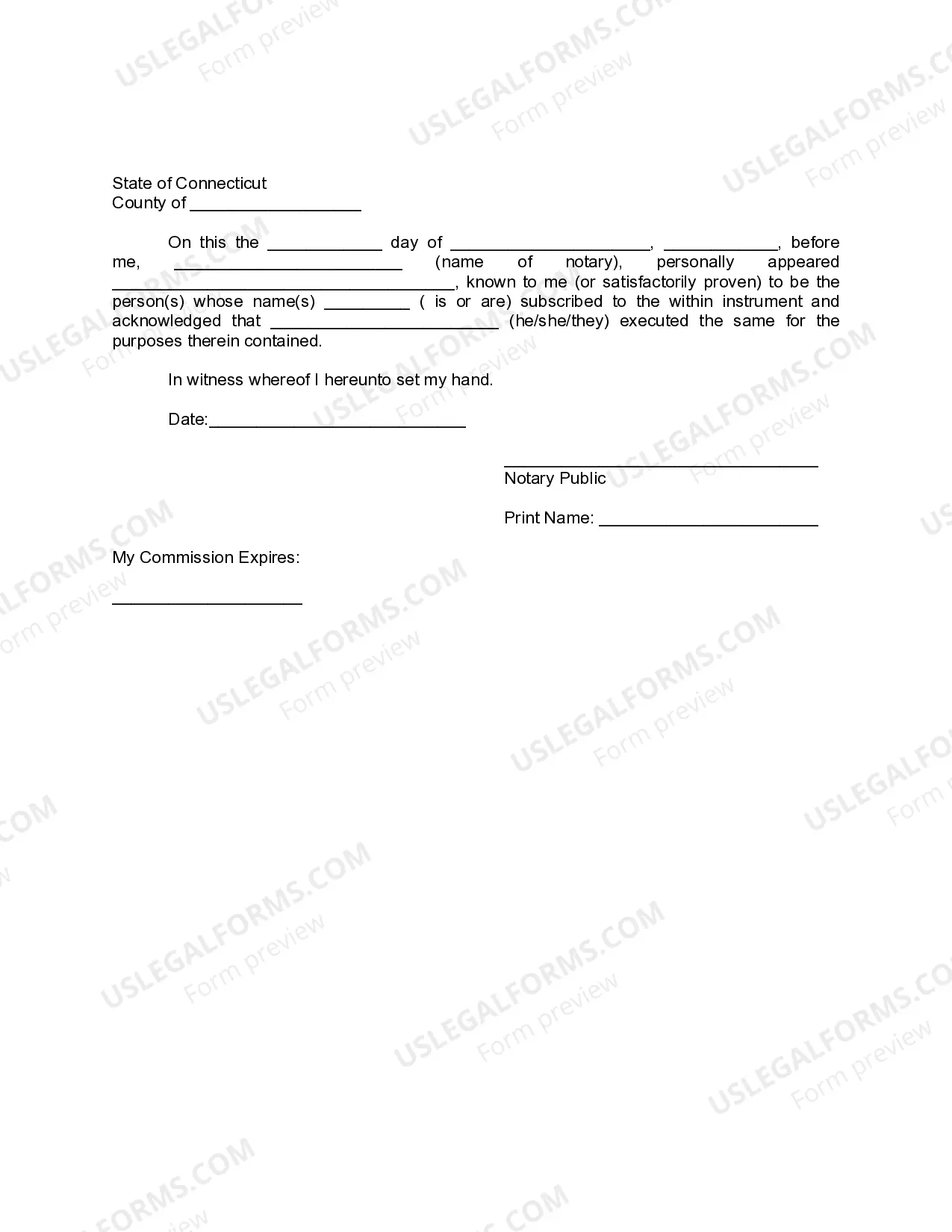

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Stamford, Connecticut Financial Account Transfer to Living Trust: Detailed Description and Types In Stamford, Connecticut, a financial account transfer to a living trust is a crucial estate planning mechanism that can help individuals ensure seamless management and distribution of their assets upon incapacity or death. By establishing a living trust, individuals can protect their financial accounts, allow for efficient asset distribution, and potentially avoid the costly and time-consuming probate process. A financial account transfer to a living trust involves re-titling various accounts, such as bank accounts, investment portfolios, retirement accounts, and other assets, into the name of the living trust. This process typically requires the assistance of an experienced estate planning attorney who can guide individuals through the legal steps involved. By transferring financial accounts to a living trust, individuals can benefit from various advantages. These include: 1. Asset Protection: A living trust safeguards financial accounts from potential creditors, lawsuits, or any other unforeseen liabilities. It creates a protective shield around the assets, thus preserving their value for the beneficiaries. 2. Disability Planning: In the event of incapacity, a living trust ensures a smooth transition of financial management. The designated successor trustee can step in, manage the trust's assets, and utilize them for the granter's well-being without the need for court intervention. 3. Avoiding Probate: One significant advantage of a financial account transfer to a living trust is the potential avoidance of probate. Probate is a legal process that validates a deceased person's will and oversees asset distribution. By transferring accounts to a living trust, individuals can bypass probate, saving time, costs, and maintaining the privacy of their estate. Different types of Stamford, Connecticut Financial Account Transfers to Living Trusts: 1. Revocable Living Trust: This is the most common type of living trust, allowing individuals to retain full control over their assets during their lifetime. They can modify or revoke the trust at any time, ensuring flexibility and adaptability to changing circumstances. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be altered or revoked once established. This type of trust offers enhanced asset protection since the granter relinquishes control over the assets transferred. Irrevocable trusts are often utilized for tax planning and Medicaid qualification. 3. Testamentary Trust: Unlike a revocable or irrevocable living trust, a testamentary trust is established through a will and comes into effect after the individual's death. Stamford's residents can include provisions in their wills to specify the creation of a trust and transfer financial accounts to it upon their passing. This type of trust allows individuals to have control over their assets during their lifetime while ensuring a well-planned distribution after death. In conclusion, a financial account transfer to a living trust in Stamford, Connecticut is an essential step for effective estate planning. By re-titling financial accounts into a trust, individuals can protect their assets, ensure seamless administration during incapacity, and potentially avoid probate. The types of Stamford Connecticut Financial Account Transfers to Living Trusts include revocable living trusts, irrevocable living trusts, and testamentary trusts. Seeking professional guidance from an estate planning attorney can help individuals navigate the intricacies of this process and tailor it to their unique needs.Stamford, Connecticut Financial Account Transfer to Living Trust: Detailed Description and Types In Stamford, Connecticut, a financial account transfer to a living trust is a crucial estate planning mechanism that can help individuals ensure seamless management and distribution of their assets upon incapacity or death. By establishing a living trust, individuals can protect their financial accounts, allow for efficient asset distribution, and potentially avoid the costly and time-consuming probate process. A financial account transfer to a living trust involves re-titling various accounts, such as bank accounts, investment portfolios, retirement accounts, and other assets, into the name of the living trust. This process typically requires the assistance of an experienced estate planning attorney who can guide individuals through the legal steps involved. By transferring financial accounts to a living trust, individuals can benefit from various advantages. These include: 1. Asset Protection: A living trust safeguards financial accounts from potential creditors, lawsuits, or any other unforeseen liabilities. It creates a protective shield around the assets, thus preserving their value for the beneficiaries. 2. Disability Planning: In the event of incapacity, a living trust ensures a smooth transition of financial management. The designated successor trustee can step in, manage the trust's assets, and utilize them for the granter's well-being without the need for court intervention. 3. Avoiding Probate: One significant advantage of a financial account transfer to a living trust is the potential avoidance of probate. Probate is a legal process that validates a deceased person's will and oversees asset distribution. By transferring accounts to a living trust, individuals can bypass probate, saving time, costs, and maintaining the privacy of their estate. Different types of Stamford, Connecticut Financial Account Transfers to Living Trusts: 1. Revocable Living Trust: This is the most common type of living trust, allowing individuals to retain full control over their assets during their lifetime. They can modify or revoke the trust at any time, ensuring flexibility and adaptability to changing circumstances. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be altered or revoked once established. This type of trust offers enhanced asset protection since the granter relinquishes control over the assets transferred. Irrevocable trusts are often utilized for tax planning and Medicaid qualification. 3. Testamentary Trust: Unlike a revocable or irrevocable living trust, a testamentary trust is established through a will and comes into effect after the individual's death. Stamford's residents can include provisions in their wills to specify the creation of a trust and transfer financial accounts to it upon their passing. This type of trust allows individuals to have control over their assets during their lifetime while ensuring a well-planned distribution after death. In conclusion, a financial account transfer to a living trust in Stamford, Connecticut is an essential step for effective estate planning. By re-titling financial accounts into a trust, individuals can protect their assets, ensure seamless administration during incapacity, and potentially avoid probate. The types of Stamford Connecticut Financial Account Transfers to Living Trusts include revocable living trusts, irrevocable living trusts, and testamentary trusts. Seeking professional guidance from an estate planning attorney can help individuals navigate the intricacies of this process and tailor it to their unique needs.