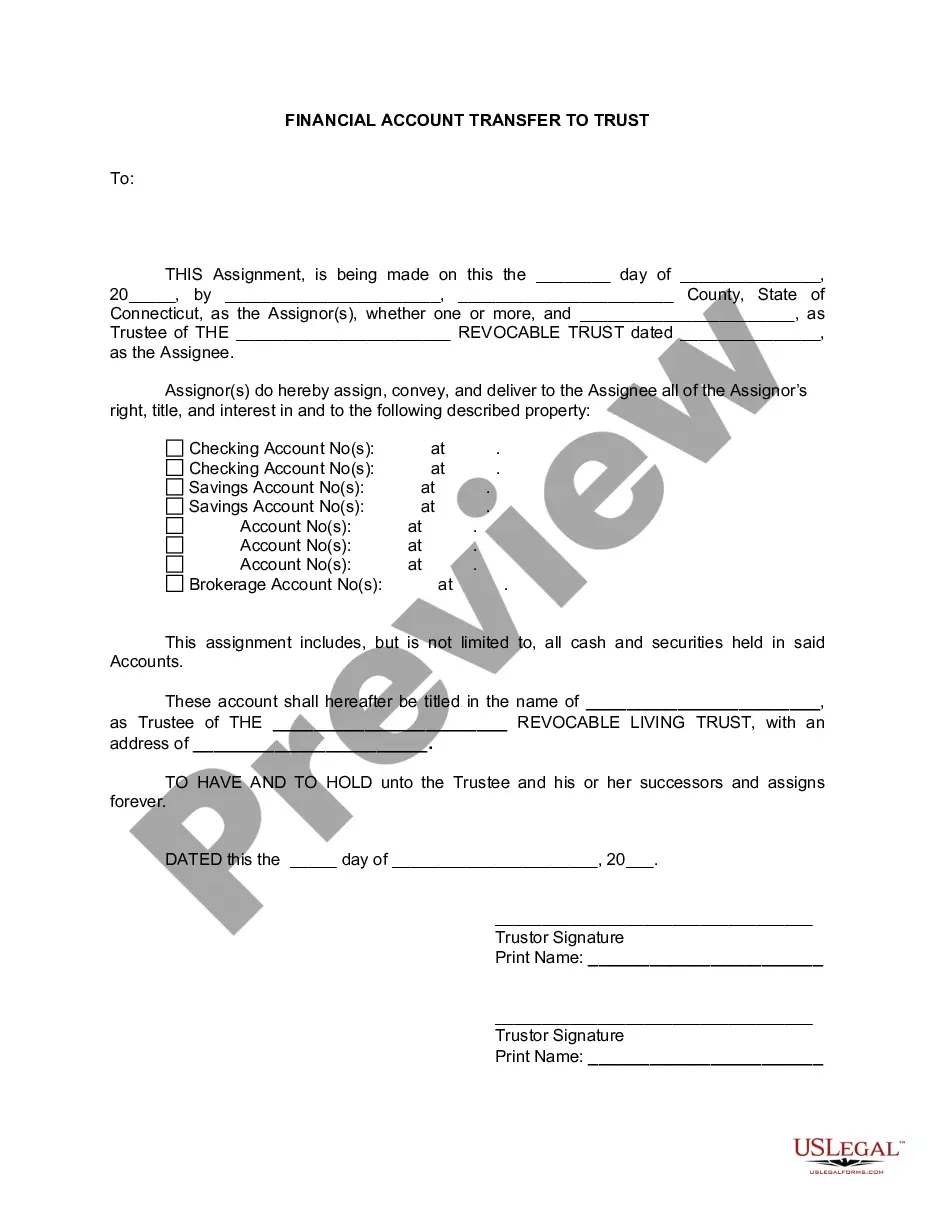

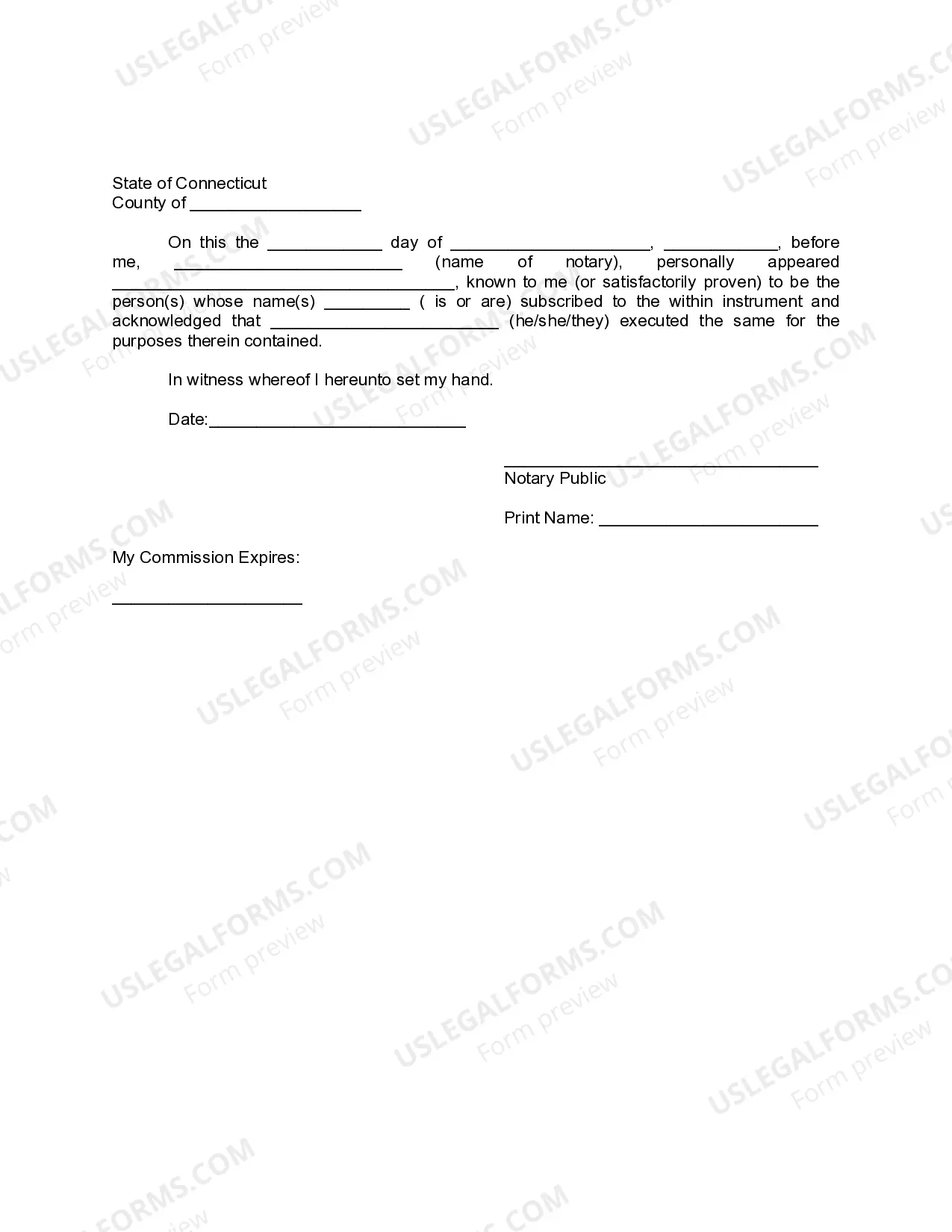

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Waterbury Connecticut Financial Account Transfer to Living Trust: A Comprehensive Guide In Waterbury, Connecticut, financial account transfer to a living trust is a crucial step in estate planning. It allows individuals to protect their assets, provide for their loved ones, and ensure the seamless transfer of their wealth after their passing. This detailed description will outline the essence of a Waterbury Connecticut Financial Account Transfer to Living Trust, highlighting its importance and various types. Waterbury Connecticut Financial Account Transfer to Living Trust Explained: At its core, a living trust is a legal entity created to hold and manage an individual's assets during their lifetime and distribute them upon their death, according to their instructions. By transferring financial accounts to a living trust in Waterbury, individuals are effectively transferring the account ownership from their name to the trust's name. This process ensures the assets are legally protected and can be efficiently distributed according to the individual's wishes, avoiding probate proceedings. The Importance of Financial Account Transfer to Living Trust: 1. Avoiding Probate: Probate can be time-consuming, expensive, and make the asset distribution process public. By transferring financial accounts to a living trust, individuals can bypass probate, ensuring a smoother transfer of assets and preserving their privacy. 2. Incapacity Planning: In the event of incapacitation due to illness or injury, a living trust ensures the seamless management of financial accounts by the designated successor trustee, removing the need for a court-appointed conservatorship. 3. Asset Protection: A living trust shields assets from potential creditors, lawsuits, or other claims, as the assets are owned by the trust rather than the individual directly. Types of Waterbury Connecticut Financial Account Transfer to Living Trust: 1. Bank Accounts: Transferring checking, savings, or money market accounts to a living trust ensures seamless transition and management of these funds for the trust's beneficiaries. 2. Investment Accounts: Stocks, bonds, mutual funds, and other investment accounts can also be transferred to a living trust. A trustee is assigned the responsibility of managing and distributing the investments according to the trust's terms. 3. Retirement Accounts: Certain retirement accounts, such as Individual Retirement Accounts (IRAs), can be transferred to a living trust. However, it's important to consult a financial advisor or attorney to ensure compliance with applicable tax laws. 4. Real Estate: While not a financial account, real estate properties can be transferred to a living trust in Waterbury, ensuring effective management and distribution of these assets to beneficiaries. 5. Business Interests: For individuals with business ownership or partnership interests, transferring these interests to a living trust can provide a seamless transition plan, protecting the value of the business and ensuring its continuation. In conclusion, a Waterbury Connecticut Financial Account Transfer to Living Trust plays a vital role in estate planning, allowing individuals to protect their assets, provide for their loved ones, and avoid the complexities of probate. By transferring different types of financial accounts such as bank accounts, investment accounts, retirement accounts, real estate, and business interests to a living trust, individuals can ensure their financial affairs are managed efficiently and according to their exact wishes. It is essential for anyone in Waterbury, Connecticut, who desires a comprehensive and seamless estate plan to consider a financial account transfer to a living trust.Waterbury Connecticut Financial Account Transfer to Living Trust: A Comprehensive Guide In Waterbury, Connecticut, financial account transfer to a living trust is a crucial step in estate planning. It allows individuals to protect their assets, provide for their loved ones, and ensure the seamless transfer of their wealth after their passing. This detailed description will outline the essence of a Waterbury Connecticut Financial Account Transfer to Living Trust, highlighting its importance and various types. Waterbury Connecticut Financial Account Transfer to Living Trust Explained: At its core, a living trust is a legal entity created to hold and manage an individual's assets during their lifetime and distribute them upon their death, according to their instructions. By transferring financial accounts to a living trust in Waterbury, individuals are effectively transferring the account ownership from their name to the trust's name. This process ensures the assets are legally protected and can be efficiently distributed according to the individual's wishes, avoiding probate proceedings. The Importance of Financial Account Transfer to Living Trust: 1. Avoiding Probate: Probate can be time-consuming, expensive, and make the asset distribution process public. By transferring financial accounts to a living trust, individuals can bypass probate, ensuring a smoother transfer of assets and preserving their privacy. 2. Incapacity Planning: In the event of incapacitation due to illness or injury, a living trust ensures the seamless management of financial accounts by the designated successor trustee, removing the need for a court-appointed conservatorship. 3. Asset Protection: A living trust shields assets from potential creditors, lawsuits, or other claims, as the assets are owned by the trust rather than the individual directly. Types of Waterbury Connecticut Financial Account Transfer to Living Trust: 1. Bank Accounts: Transferring checking, savings, or money market accounts to a living trust ensures seamless transition and management of these funds for the trust's beneficiaries. 2. Investment Accounts: Stocks, bonds, mutual funds, and other investment accounts can also be transferred to a living trust. A trustee is assigned the responsibility of managing and distributing the investments according to the trust's terms. 3. Retirement Accounts: Certain retirement accounts, such as Individual Retirement Accounts (IRAs), can be transferred to a living trust. However, it's important to consult a financial advisor or attorney to ensure compliance with applicable tax laws. 4. Real Estate: While not a financial account, real estate properties can be transferred to a living trust in Waterbury, ensuring effective management and distribution of these assets to beneficiaries. 5. Business Interests: For individuals with business ownership or partnership interests, transferring these interests to a living trust can provide a seamless transition plan, protecting the value of the business and ensuring its continuation. In conclusion, a Waterbury Connecticut Financial Account Transfer to Living Trust plays a vital role in estate planning, allowing individuals to protect their assets, provide for their loved ones, and avoid the complexities of probate. By transferring different types of financial accounts such as bank accounts, investment accounts, retirement accounts, real estate, and business interests to a living trust, individuals can ensure their financial affairs are managed efficiently and according to their exact wishes. It is essential for anyone in Waterbury, Connecticut, who desires a comprehensive and seamless estate plan to consider a financial account transfer to a living trust.