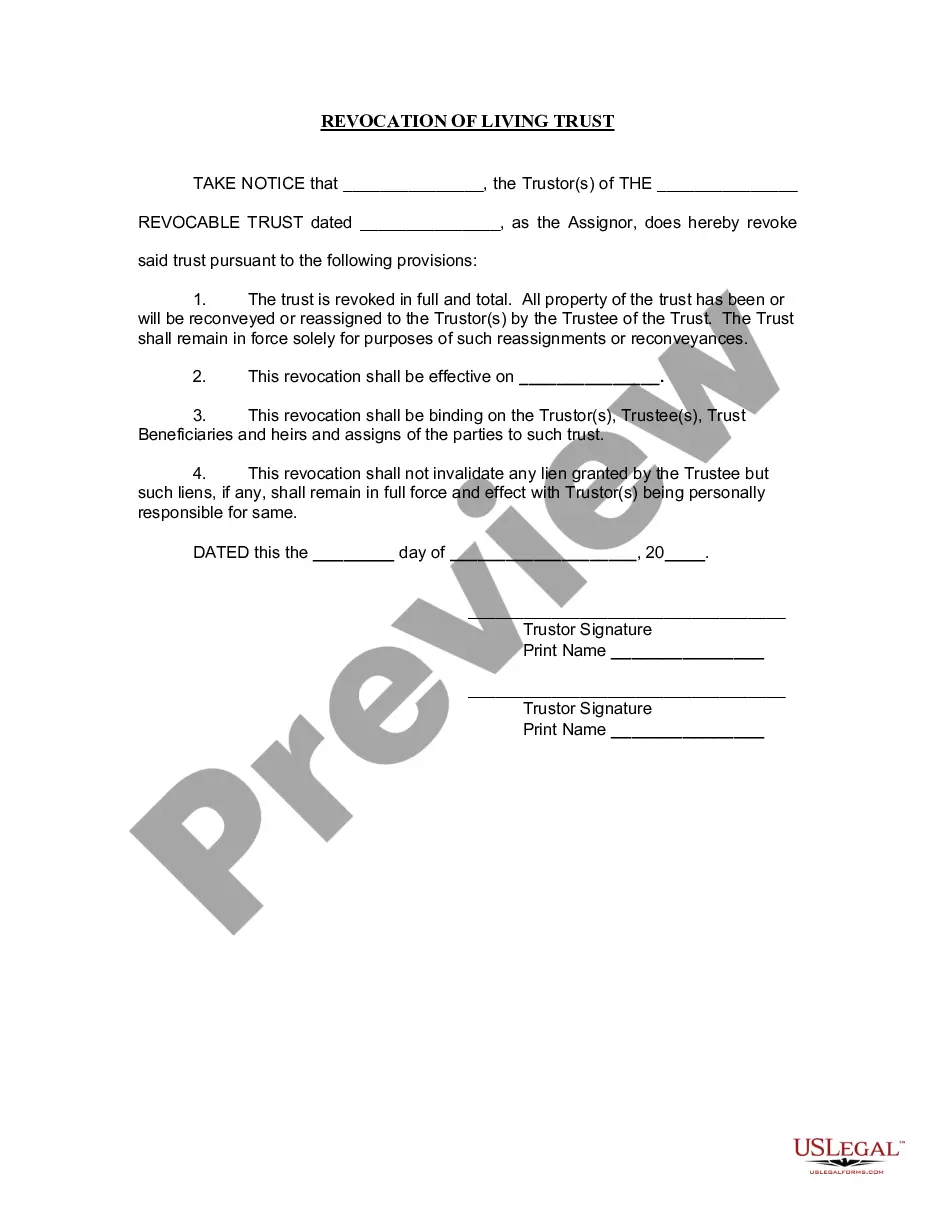

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Stamford Connecticut Revocation of Living Trust

Description

How to fill out Connecticut Revocation Of Living Trust?

Finding validated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms collection.

It’s an online resource of over 85,000 legal forms for both personal and professional purposes and a variety of real-life situations.

All documents are correctly sorted by usage area and jurisdiction categories, so finding the Stamford Connecticut Revocation of Living Trust becomes as straightforward as one-two-three.

Maintain organized paperwork and ensure compliance with the law's requirements is of utmost importance. Take advantage of the US Legal Forms library to always have necessary document templates for any requirements conveniently accessible!

- Examine the Preview mode and form description.

- Ensure that you have selected the correct one that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you discover any discrepancies, use the Search tab above to locate the right one.

- If it meets your expectations, proceed to the next step.

Form popularity

FAQ

You don’t necessarily need a lawyer to dissolve a trust, but having one can be advantageous. A legal professional can help you navigate the specific requirements of the Stamford Connecticut Revocation of Living Trust. While some individuals are able to manage the process themselves, expert help ensures that nothing is overlooked and that all legal documentation is properly handled.

Dissolving a trust can vary in difficulty based on the trust's complexity and the assets involved. While some trusts are straightforward, others may require a thorough understanding of legal obligations and beneficiary rights. For those navigating this process, resources like uslegalforms can simplify the steps necessary for the Stamford Connecticut Revocation of Living Trust.

Typically, the trust itself is responsible for paying any taxes that arise during its existence. If the Stamford Connecticut Revocation of Living Trust generates income, that income may be taxed before dissolution. Once dissolved, beneficiaries may also be responsible for taxes on any distributions they receive, so it's wise to consult with a tax professional for clear guidance.

While it is not strictly necessary to have an attorney to execute a trust, consulting one can be beneficial. An attorney can provide guidance on the intricacies of the Stamford Connecticut Revocation of Living Trust process, ensuring that all legal requirements are met. Having professional assistance can help avoid complications and make the trust execution smoother.

When closing a trust, it is essential to follow specific steps to ensure a smooth transition. First, identify the assets held in the trust and determine how they will be distributed. Next, settle any outstanding debts or taxes associated with the Stamford Connecticut Revocation of Living Trust. Finally, prepare the necessary documents, possibly with help from uslegalforms, to officially dissolve the trust.

A trust can be terminated in three main ways: by completion of its purpose, by agreement among the beneficiaries, or through a court decision. When dealing with the Stamford Connecticut Revocation of Living Trust, it’s essential to recognize that revocation is a common method if the trust no longer serves its intended purpose. Each method of termination has specific legal requirements, so consulting with a professional can ensure everything is handled correctly.

The 5 year rule for trusts relates to the treatment of assets for Medicaid eligibility. In Stamford Connecticut Revocation of Living Trust, if a person transfers assets into a trust, they must wait five years before those assets are not counted for Medicaid purposes. This rule aims to prevent individuals from rapidly transferring assets to qualify for benefits. If you're considering changes to your trust, consult a legal expert to navigate these regulations.

To invalidate a living trust in Stamford, Connecticut, you must follow specific steps. Typically, this process involves formally drafting a revocation document that clearly states your intention to revoke the trust. It's essential to sign this document in front of a witness or a notary public to ensure its validity. Using USLegalForms can simplify this process by providing the necessary templates and guidance on the Stamford Connecticut Revocation of Living Trust.

A dissolution form for a revocable trust is a legal document used to formally terminate the trust. This form generally includes details about the trust and the reasons for its dissolution. You can find templates that fit Stamford Connecticut requirements on platforms like US Legal Forms. Utilizing these resources can streamline your process and ensure that your trust is correctly dissolved.

To modify a revocable living trust, you should draft an amendment. This amendment must articulate the changes in clear language and must be signed and dated. It's crucial to properly execute the amendment per state laws to ensure its validity. For ease, US Legal Forms offers templates for modifying a Stamford Connecticut Revocation of Living Trust, which can help you navigate this task.