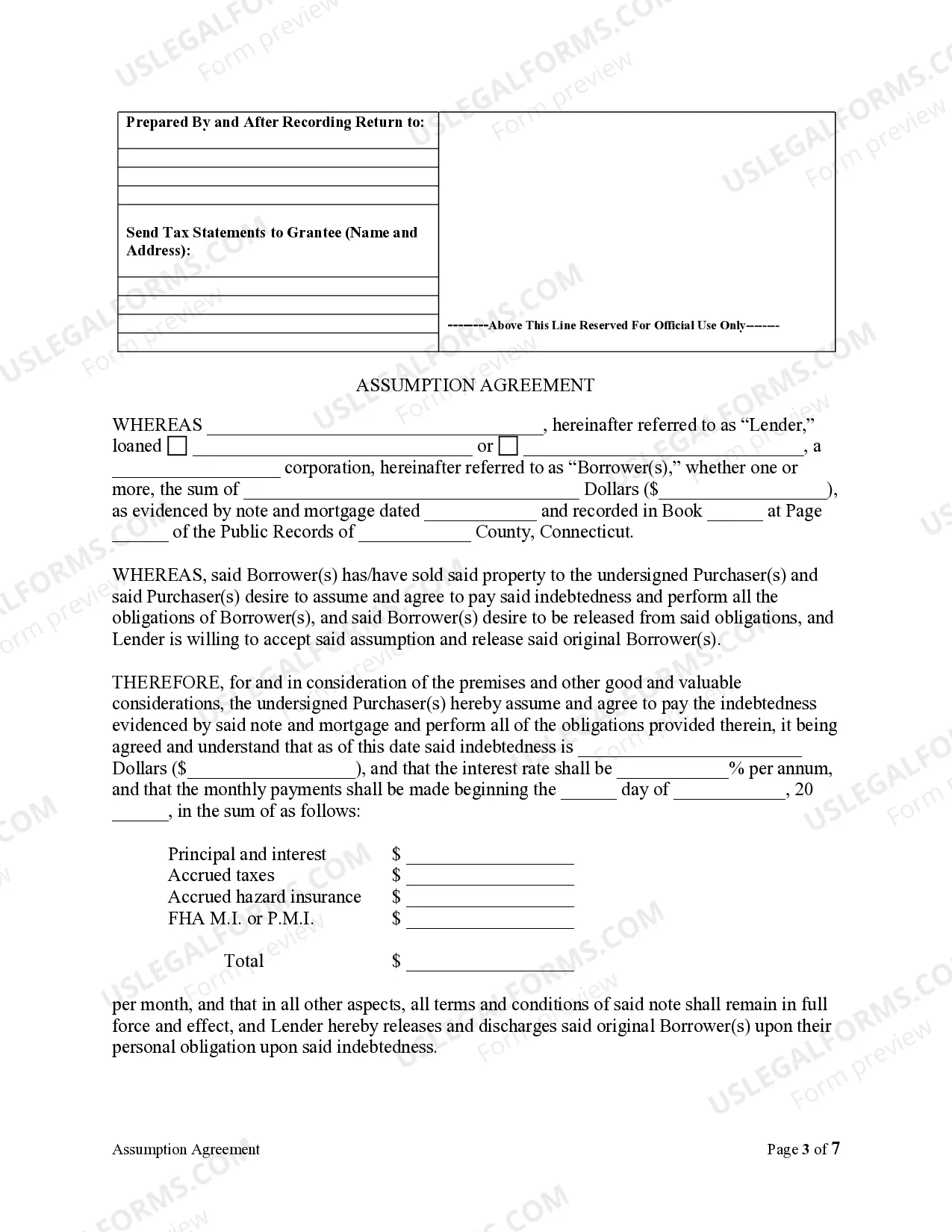

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Connecticut Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Are you searching for a reliable and budget-friendly supplier of legal documents to obtain the Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors? US Legal Forms is your ideal answer.

Whether you require a straightforward arrangement to establish guidelines for living together with your partner or a collection of forms to expedite your divorce process in court, we have you covered. Our platform offers over 85,000 current legal document templates for individual and business purposes. All templates we provide are not generic and tailored to meet the specifications of particular states and counties.

To acquire the form, you need to Log In to your account, find the required form, and click the Download button adjacent to it. Please note that you can retrieve your previously purchased document templates at any time from the My documents tab.

Is this your first time visiting our site? No problem. You can create an account in minutes, but before that, ensure you do the following.

Now you can establish your account. Then select your subscription plan and proceed to payment. Once the payment is finalized, download the Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors in any available file format. You can return to the website whenever necessary and download the form again without any additional fees.

Acquiring current legal forms has never been more straightforward. Try US Legal Forms today, and stop wasting your precious time trying to understand legal documents online once and for all.

- Verify if the Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors complies with your state and local laws.

- Review the details of the form (if available) to understand its intended use.

- Restart your search if the form does not suit your legal circumstances.

Form popularity

FAQ

The official document from a mortgage holder that releases the debtor from the mortgage is known as a 'discharge of mortgage' or 'release deed.' In Bridgeport, Connecticut, this document must be filed with the local land records to officially clear the mortgage from the debtor's financial obligations. It is an integral part of the Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors. For accuracy and completeness, consulting a legal professional or using platforms like uslegalforms can ensure proper handling.

To obtain a release of liability from a mortgage company in Bridgeport, Connecticut, you must formally request a release document. This process often requires demonstrating that all payments have been made or that a property has been sold to another party. The Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors contains provisions that might facilitate this request. Engaging with a legal service can streamline obtaining the necessary documents.

To release a seller from mortgage liability in Bridgeport, Connecticut, the use of a release document is essential. This document formally absolves the seller of future financial obligations associated with the mortgage after the property has been sold. Often, this process is included in the Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors, which protects all parties involved. Consulting a legal expert ensures you follow the proper protocols during this transition.

Removing someone from a mortgage without refinancing can be complex but is possible through a process called assumption. In Bridgeport, Connecticut, this involves the remaining borrower assuming full responsibility for the mortgage under the Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors. It's crucial to communicate directly with your lender, as they may require specific documentation to proceed without refinancing. Legal advice can help ensure compliance with state regulations.

In Bridgeport, Connecticut, the discharge of a mortgage typically involves a specific clause known as the 'discharge clause.' This clause specifies the conditions under which the lender must release their rights to the mortgage. When all payment obligations are fulfilled, the lender must provide a release document. Understanding these terms is essential for anyone navigating the Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors.

A bank is typically required to release a mortgage within a reasonable time frame after the borrower has fulfilled all obligations. This timeframe can vary by state, but in Bridgeport, Connecticut, it usually takes a few weeks to a couple of months. Timely processing of a release is essential in any Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors, ensuring that you have clear title to your property.

To record a release of your mortgage, you need to file the mortgage release document with your local Town Clerk’s office. Make sure to check for any specific requirements that may apply in Bridgeport, Connecticut, especially in the case of a Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors. If you need assistance, platforms like US Legal Forms can guide you through the paperwork process to ensure everything is handled correctly.

A mortgage release document is a legal paperwork that indicates a lender has released the borrower from their mortgage obligations. This document is essential in situations involving a Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors since it helps establish clear property ownership. Keeping this document safe is crucial for any future property transactions or legal matters.

After a mortgage release, you will receive documentation that confirms your release from the mortgage obligations. This documentation is vital for proving ownership of the property without encumbrances. In the context of a Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors, it ensures that new owners can step in without any outstanding debts. Take the time to file these documents with the appropriate office.

In Connecticut, you typically record deeds at the Town Clerk's office in the municipality where the property is located. For example, if you're dealing with a Bridgeport Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors, you would visit the Bridgeport Town Clerk's office. This process ensures that property records are maintained and accessible to the public. It is essential for protecting ownership rights.