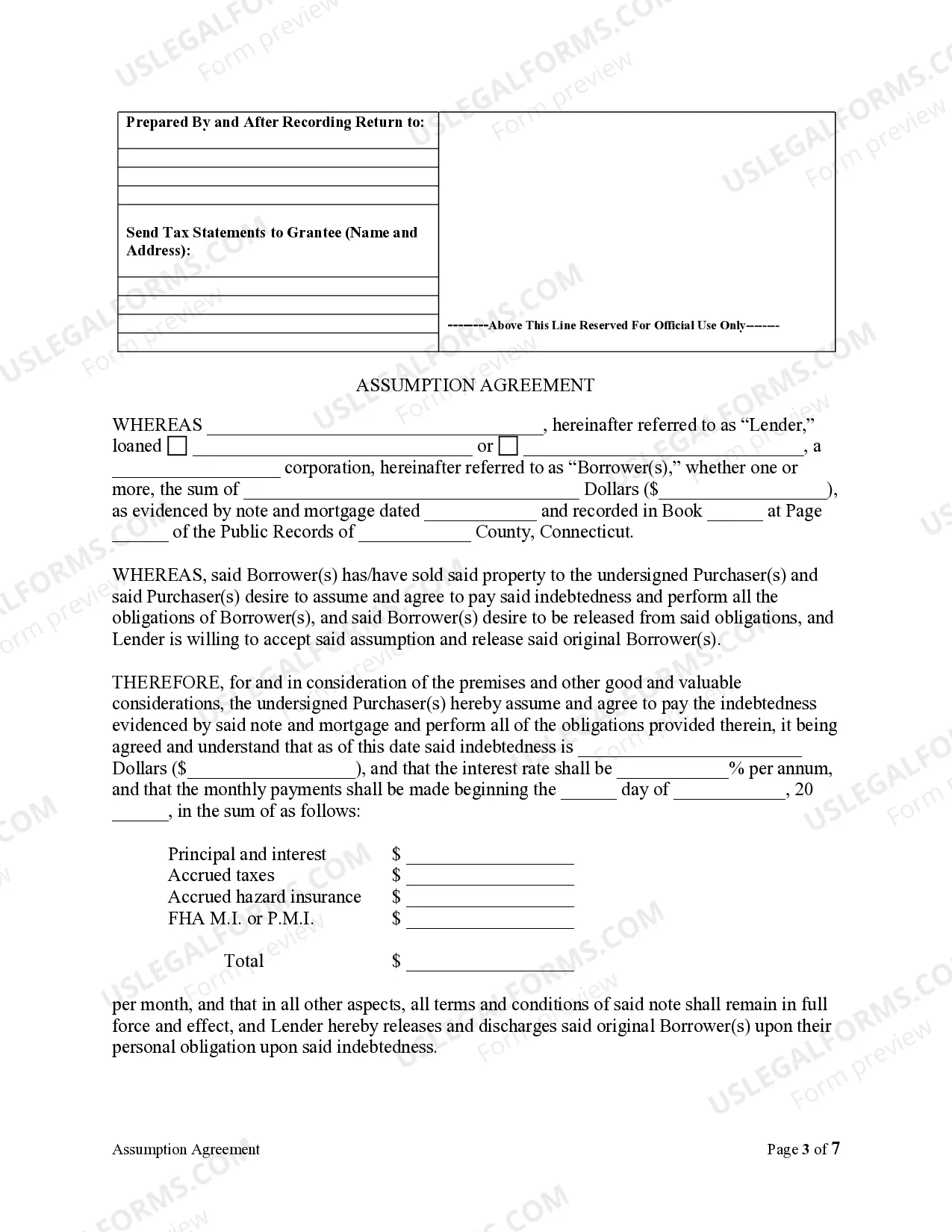

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Waterbury Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors refers to a legal document that involves the transfer of a mortgage from the original borrower to a subsequent buyer or individual who assumes responsibility for the mortgage debt. This agreement is commonly used in real estate transactions in Waterbury, Connecticut, where the original mortgagors are released from their liability for the mortgage by the lender. In instances where the original borrower is unable to fulfill the mortgage terms or wishes to sell the property, the Assumption Agreement allows a new borrower to take over the existing mortgage, assuming both the benefits and obligations associated with it. This process typically involves obtaining lender approval, a credit assessment, and potential renegotiation of terms. The Assumption Agreement ensures a smooth transition of the mortgage responsibility and safeguards the interests of all involved parties. Waterbury, Connecticut offers various types of Assumption Agreement of Mortgage and Release of Original Mortgagors, including: 1. Assumption with Due-on-Sale Provision: This type of agreement allows for the assumption of the mortgage, but includes a clause where the lender may demand full repayment of the loan upon the subsequent sale of the property. This protects the lender's ability to receive the full outstanding balance. 2. Assumption without Due-on-Sale Provision: In contrast to the previous type, this agreement omits the due-on-sale provision, allowing the new borrower to assume the mortgage without the risk of immediate repayment upon property sale. 3. Assumption with Qualification: This variant involves the new borrower's qualification process, reviewing their creditworthiness and ability to meet the mortgage payments. If approved, they assume the mortgage and release the original mortgagors from their obligations. 4. Assumption with Novation: This type of Assumption Agreement involves the complete substitution of the original mortgage and promissory note with a new mortgage contract that only includes the subsequent buyer's name. The original borrowers are entirely released from the mortgage liability. It is essential to consult with legal professionals or mortgage experts in Waterbury, Connecticut, when considering an Assumption Agreement of Mortgage and Release of Original Mortgagors. They can provide guidance on which type of agreement best suits the specific circumstances and ensure compliance with state and local regulations.The Waterbury Connecticut Assumption Agreement of Mortgage and Release of Original Mortgagors refers to a legal document that involves the transfer of a mortgage from the original borrower to a subsequent buyer or individual who assumes responsibility for the mortgage debt. This agreement is commonly used in real estate transactions in Waterbury, Connecticut, where the original mortgagors are released from their liability for the mortgage by the lender. In instances where the original borrower is unable to fulfill the mortgage terms or wishes to sell the property, the Assumption Agreement allows a new borrower to take over the existing mortgage, assuming both the benefits and obligations associated with it. This process typically involves obtaining lender approval, a credit assessment, and potential renegotiation of terms. The Assumption Agreement ensures a smooth transition of the mortgage responsibility and safeguards the interests of all involved parties. Waterbury, Connecticut offers various types of Assumption Agreement of Mortgage and Release of Original Mortgagors, including: 1. Assumption with Due-on-Sale Provision: This type of agreement allows for the assumption of the mortgage, but includes a clause where the lender may demand full repayment of the loan upon the subsequent sale of the property. This protects the lender's ability to receive the full outstanding balance. 2. Assumption without Due-on-Sale Provision: In contrast to the previous type, this agreement omits the due-on-sale provision, allowing the new borrower to assume the mortgage without the risk of immediate repayment upon property sale. 3. Assumption with Qualification: This variant involves the new borrower's qualification process, reviewing their creditworthiness and ability to meet the mortgage payments. If approved, they assume the mortgage and release the original mortgagors from their obligations. 4. Assumption with Novation: This type of Assumption Agreement involves the complete substitution of the original mortgage and promissory note with a new mortgage contract that only includes the subsequent buyer's name. The original borrowers are entirely released from the mortgage liability. It is essential to consult with legal professionals or mortgage experts in Waterbury, Connecticut, when considering an Assumption Agreement of Mortgage and Release of Original Mortgagors. They can provide guidance on which type of agreement best suits the specific circumstances and ensure compliance with state and local regulations.