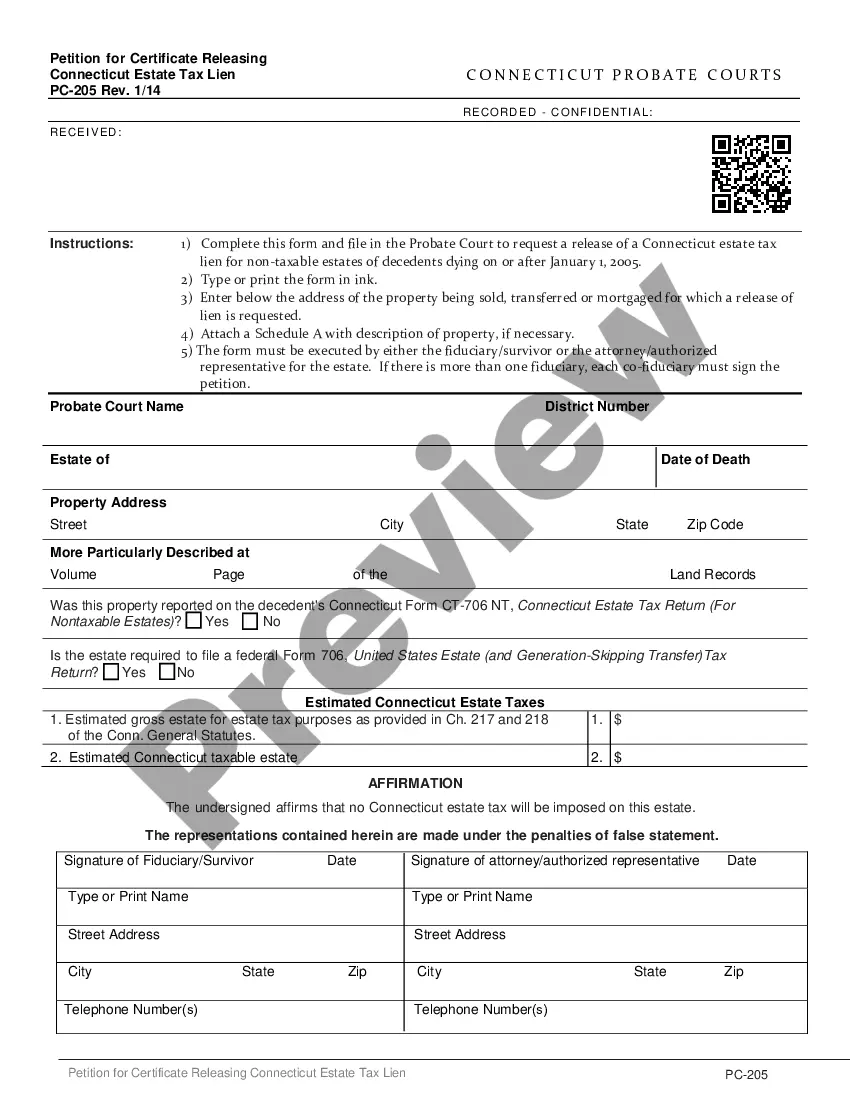

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

The Bridgeport Application for Certificate Releasing Connecticut Estate Tax Lien is a crucial document used in the state of Connecticut during estate tax processes. This application serves to release a tax lien on a property or estate and is specifically designed for use in the city of Bridgeport. The application is required in cases where a deceased person's estate is subject to unpaid taxes, and a tax lien has been placed on their property. By submitting this application, the estate executor or representative seeks to remove the lien, allowing for the proper transfer of assets or sale of the estate. The Bridgeport Application for Certificate Releasing Connecticut Estate Tax Lien can also be referred to as the "Bridgeport Certificate Release Application" or "Connecticut Estate Tax Lien Certificate Release Application." To successfully complete the application process, individuals must provide essential information and supporting documentation. This may include the estate tax lien number, the name of the deceased, their Social Security number, the property address, and the executor or representative's contact information. Additionally, the completed application should include details regarding the estate's financial standing, such as the outstanding tax balance, the date of the tax warrant, and any relevant payment history. It is important to gather and attach all necessary supporting documentation, such as tax payment receipts, to ensure a smooth application process. Once the application is submitted, it undergoes a review process by the relevant authorities. This may involve verification of the provided information, including cross-checking with existing tax records. If the application meets all requirements and the estate's tax liability has been satisfied, a Certificate Releasing Connecticut Estate Tax Lien will be issued. This certificate serves as an official document indicating the lien's release and acts as evidence of the estate's compliance with tax obligations. In conclusion, the Bridgeport Application for Certificate Releasing Connecticut Estate Tax Lien is a critical document for individuals facing estate tax liens in the city of Bridgeport. By providing accurate information and necessary documentation, individuals can successfully apply for the release of these liens, ensuring a smooth transfer of assets and compliance with Connecticut's estate tax laws.