This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

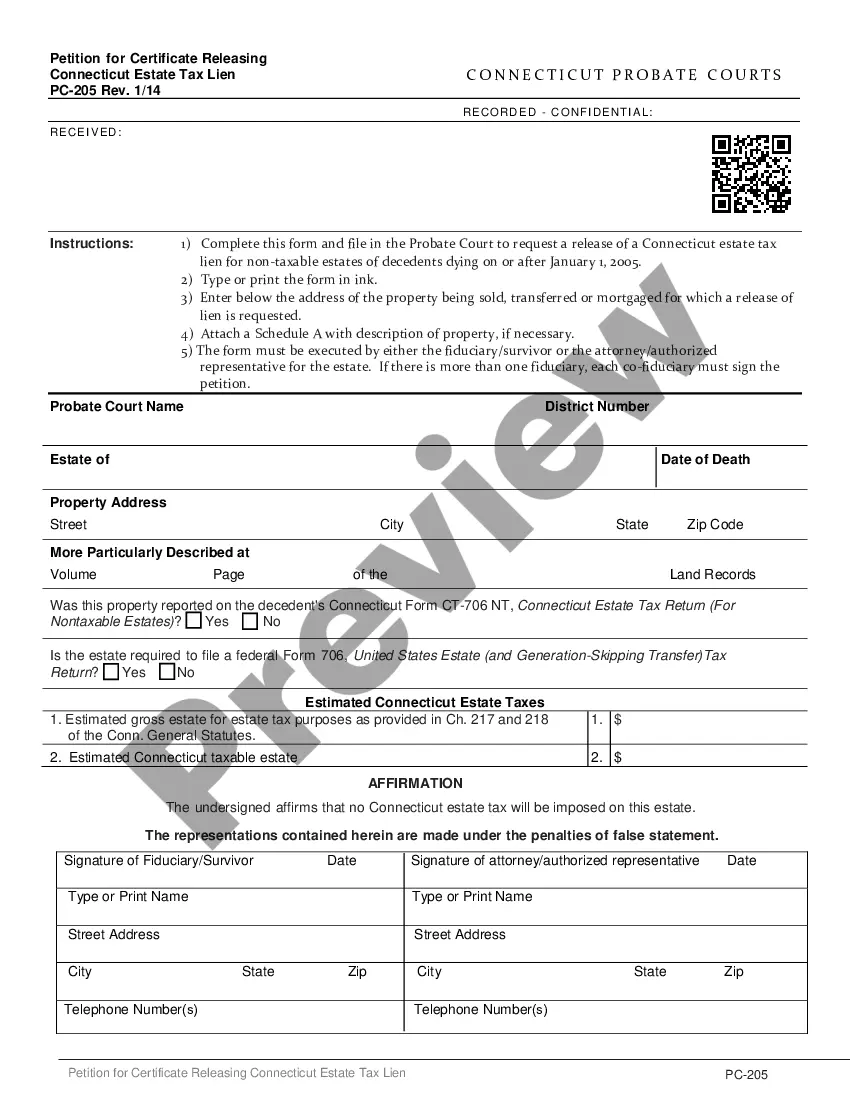

The Stamford Application for Certificate Releasing Connecticut Estate Tax Lien is a crucial legal document used in the state of Connecticut for the purpose of releasing an estate tax lien on a property. This detailed description aims to provide relevant information about this application and its various types. The Application for Certificate Releasing Connecticut Estate Tax Lien in Stamford is a legal process initiated by the executor or administrator of an estate to release the tax lien placed on a property due to outstanding estate tax obligations. This application is primarily filed with the Connecticut Department of Revenue Services (DRS) to request the release of the lien. Keywords: Stamford, Application for Certificate Releasing, Connecticut Estate Tax Lien, legal document, executor, administrator, property, outstanding estate tax obligations, Connecticut Department of Revenue Services, release, lien. There are two main types of Stamford Applications for Certificate Releasing Connecticut Estate Tax Lien: 1. Voluntary Release Application: This type of application is submitted willingly by the executor or administrator of an estate to release the estate tax lien on a property. It typically occurs when all outstanding estate tax obligations have been fulfilled or when an agreement for payment has been reached with the Connecticut DRS. 2. Involuntary Release Application: This type of application is filed when there is a dispute or disagreement between the executor or administrator of an estate and the Connecticut DRS regarding the validity or amount of the estate tax lien. The executor or administrator seeks to release the lien by challenging its imposition or the accuracy of the tax assessment. Keywords: Voluntary Release Application, Involuntary Release Application, executor, administrator, dispute, disagreement, validity, amount, tax assessment. Both types of applications require the completion of specific forms and documentation to support the request for the release of the estate tax lien. These documents may include: 1. Stamford Application for Certificate Releasing Connecticut Estate Tax Lien Form: This form serves as the primary application document. It requires detailed information about the estate, the property, the executor or administrator, and the outstanding tax obligations. The form must be completed accurately and signed by the executor or administrator. 2. Proof of Payment: If the estate tax obligations have been fulfilled, documentary evidence of the payment needs to be included with the application. This can be in the form of bank statements, receipts, or any other relevant financial records. 3. Supporting Documentation: In certain cases, additional documents might be required to support the application, such as copies of estate tax returns, appraisals of the property, or any communication exchanged with the Connecticut DRS regarding the estate tax lien. Keywords: Application Form, Proof of Payment, Supporting Documentation, estate tax obligations, bank statements, receipts, estate tax returns, appraisals, communication. It is important to ensure the completeness and accuracy of the Stamford Application for Certificate Releasing Connecticut Estate Tax Lien to facilitate a smooth and efficient process for the release of the estate tax lien on the property in question.The Stamford Application for Certificate Releasing Connecticut Estate Tax Lien is a crucial legal document used in the state of Connecticut for the purpose of releasing an estate tax lien on a property. This detailed description aims to provide relevant information about this application and its various types. The Application for Certificate Releasing Connecticut Estate Tax Lien in Stamford is a legal process initiated by the executor or administrator of an estate to release the tax lien placed on a property due to outstanding estate tax obligations. This application is primarily filed with the Connecticut Department of Revenue Services (DRS) to request the release of the lien. Keywords: Stamford, Application for Certificate Releasing, Connecticut Estate Tax Lien, legal document, executor, administrator, property, outstanding estate tax obligations, Connecticut Department of Revenue Services, release, lien. There are two main types of Stamford Applications for Certificate Releasing Connecticut Estate Tax Lien: 1. Voluntary Release Application: This type of application is submitted willingly by the executor or administrator of an estate to release the estate tax lien on a property. It typically occurs when all outstanding estate tax obligations have been fulfilled or when an agreement for payment has been reached with the Connecticut DRS. 2. Involuntary Release Application: This type of application is filed when there is a dispute or disagreement between the executor or administrator of an estate and the Connecticut DRS regarding the validity or amount of the estate tax lien. The executor or administrator seeks to release the lien by challenging its imposition or the accuracy of the tax assessment. Keywords: Voluntary Release Application, Involuntary Release Application, executor, administrator, dispute, disagreement, validity, amount, tax assessment. Both types of applications require the completion of specific forms and documentation to support the request for the release of the estate tax lien. These documents may include: 1. Stamford Application for Certificate Releasing Connecticut Estate Tax Lien Form: This form serves as the primary application document. It requires detailed information about the estate, the property, the executor or administrator, and the outstanding tax obligations. The form must be completed accurately and signed by the executor or administrator. 2. Proof of Payment: If the estate tax obligations have been fulfilled, documentary evidence of the payment needs to be included with the application. This can be in the form of bank statements, receipts, or any other relevant financial records. 3. Supporting Documentation: In certain cases, additional documents might be required to support the application, such as copies of estate tax returns, appraisals of the property, or any communication exchanged with the Connecticut DRS regarding the estate tax lien. Keywords: Application Form, Proof of Payment, Supporting Documentation, estate tax obligations, bank statements, receipts, estate tax returns, appraisals, communication. It is important to ensure the completeness and accuracy of the Stamford Application for Certificate Releasing Connecticut Estate Tax Lien to facilitate a smooth and efficient process for the release of the estate tax lien on the property in question.