This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

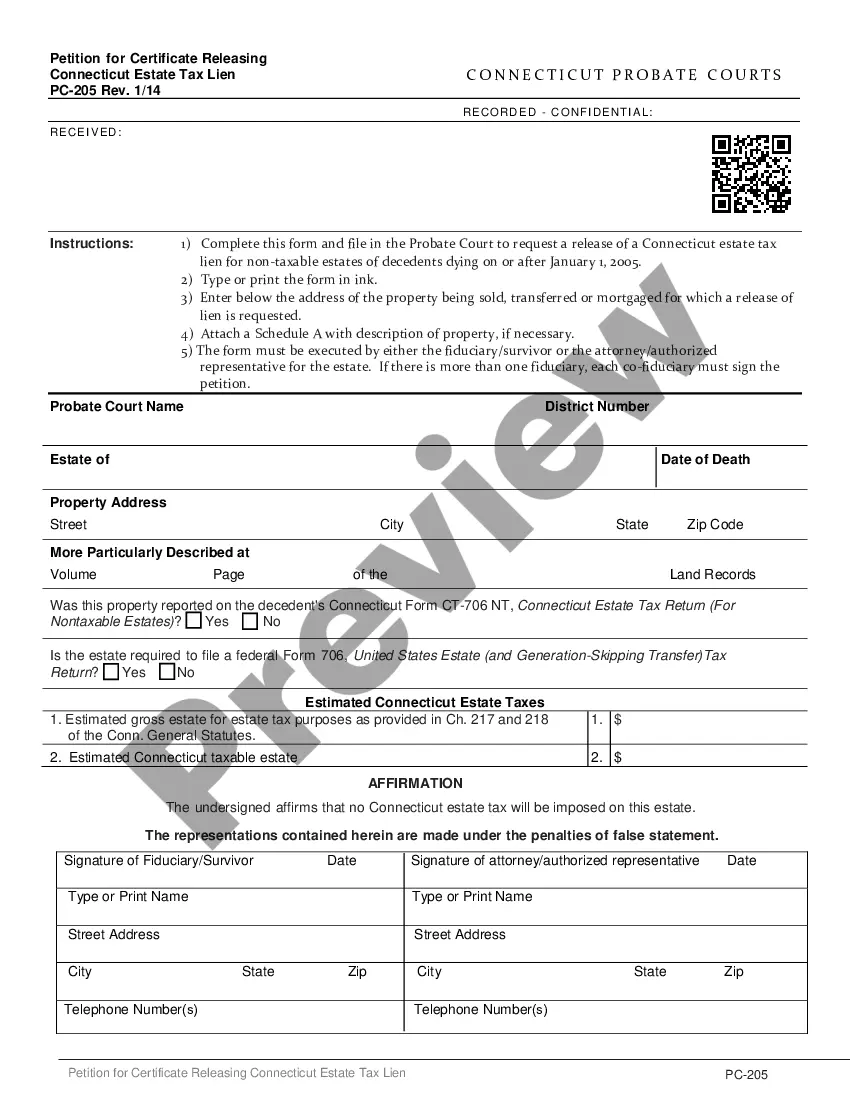

The Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien is a legal document used to request the removal or release of an estate tax lien placed on a property located in Waterbury, Connecticut. This detailed description will provide an overview of the application process while incorporating relevant keywords. 1. Purpose of the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien: The Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien is designed to facilitate the lawful release of estate tax liens imposed on properties within the Waterbury jurisdiction. This application serves as a formal request to the appropriate tax authorities, seeking the removal of the lien and restoring the clear title to the property. 2. Types of Waterbury Applications for Certificate Releasing Connecticut Estate Tax Lien: There are two primary scenarios where individuals or estate representatives would utilize this application: a. Full Payment of Outstanding Estate Taxes: If the estate taxes owed have been fully paid to the Waterbury tax authorities, the estate representative can submit this application to request the release of the tax lien on the property. This process enables the removal of the lien from public records and provides a certified certificate of lien release. b. Installment Agreement for Estate Taxes: In cases where the estate tax liability is being settled through a mutually agreed-upon installment agreement, the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien can be used to obtain the release of the lien. This application should be accompanied by supporting documents demonstrating compliance with the agreed-upon installment payment terms. 3. Required Information for the Application: To complete the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien, the following key details must be accurately provided: — Property Information: The complete address of the property subject to the estate tax lien. — Estate Representative Information: Name, address, contact details, and their relationship to the deceased or the estate. — Estate Details: Including the deceased's name, date of death, and the probate court responsible for the estate administration. — Proof of Estate Tax Payment or Installment Agreement: Documentation evidencing the full payment of estate taxes or the agreed installment agreement terms. — Supporting Documents: Any additional documents requested by the Waterbury tax authorities supporting the application, such as receipts, proof of payment, or official communication related to the lien. 4. Submission Process: The Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien can be obtained from the Waterbury tax authority office or their official website. Once completed, the application, along with the required supporting documents, should be meticulously organized and sent to the designated address. It is advisable to retain copies of all documents submitted for future reference. By following the detailed instructions provided in the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien, individuals can ensure a swift and accurate resolution of estate tax liens imposed on their Waterbury properties. Promptly fulfilling the application requirements will help expedite the release process, resulting in a clear title and increased marketability of the property.The Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien is a legal document used to request the removal or release of an estate tax lien placed on a property located in Waterbury, Connecticut. This detailed description will provide an overview of the application process while incorporating relevant keywords. 1. Purpose of the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien: The Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien is designed to facilitate the lawful release of estate tax liens imposed on properties within the Waterbury jurisdiction. This application serves as a formal request to the appropriate tax authorities, seeking the removal of the lien and restoring the clear title to the property. 2. Types of Waterbury Applications for Certificate Releasing Connecticut Estate Tax Lien: There are two primary scenarios where individuals or estate representatives would utilize this application: a. Full Payment of Outstanding Estate Taxes: If the estate taxes owed have been fully paid to the Waterbury tax authorities, the estate representative can submit this application to request the release of the tax lien on the property. This process enables the removal of the lien from public records and provides a certified certificate of lien release. b. Installment Agreement for Estate Taxes: In cases where the estate tax liability is being settled through a mutually agreed-upon installment agreement, the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien can be used to obtain the release of the lien. This application should be accompanied by supporting documents demonstrating compliance with the agreed-upon installment payment terms. 3. Required Information for the Application: To complete the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien, the following key details must be accurately provided: — Property Information: The complete address of the property subject to the estate tax lien. — Estate Representative Information: Name, address, contact details, and their relationship to the deceased or the estate. — Estate Details: Including the deceased's name, date of death, and the probate court responsible for the estate administration. — Proof of Estate Tax Payment or Installment Agreement: Documentation evidencing the full payment of estate taxes or the agreed installment agreement terms. — Supporting Documents: Any additional documents requested by the Waterbury tax authorities supporting the application, such as receipts, proof of payment, or official communication related to the lien. 4. Submission Process: The Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien can be obtained from the Waterbury tax authority office or their official website. Once completed, the application, along with the required supporting documents, should be meticulously organized and sent to the designated address. It is advisable to retain copies of all documents submitted for future reference. By following the detailed instructions provided in the Waterbury Application for Certificate Releasing Connecticut Estate Tax Lien, individuals can ensure a swift and accurate resolution of estate tax liens imposed on their Waterbury properties. Promptly fulfilling the application requirements will help expedite the release process, resulting in a clear title and increased marketability of the property.