This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

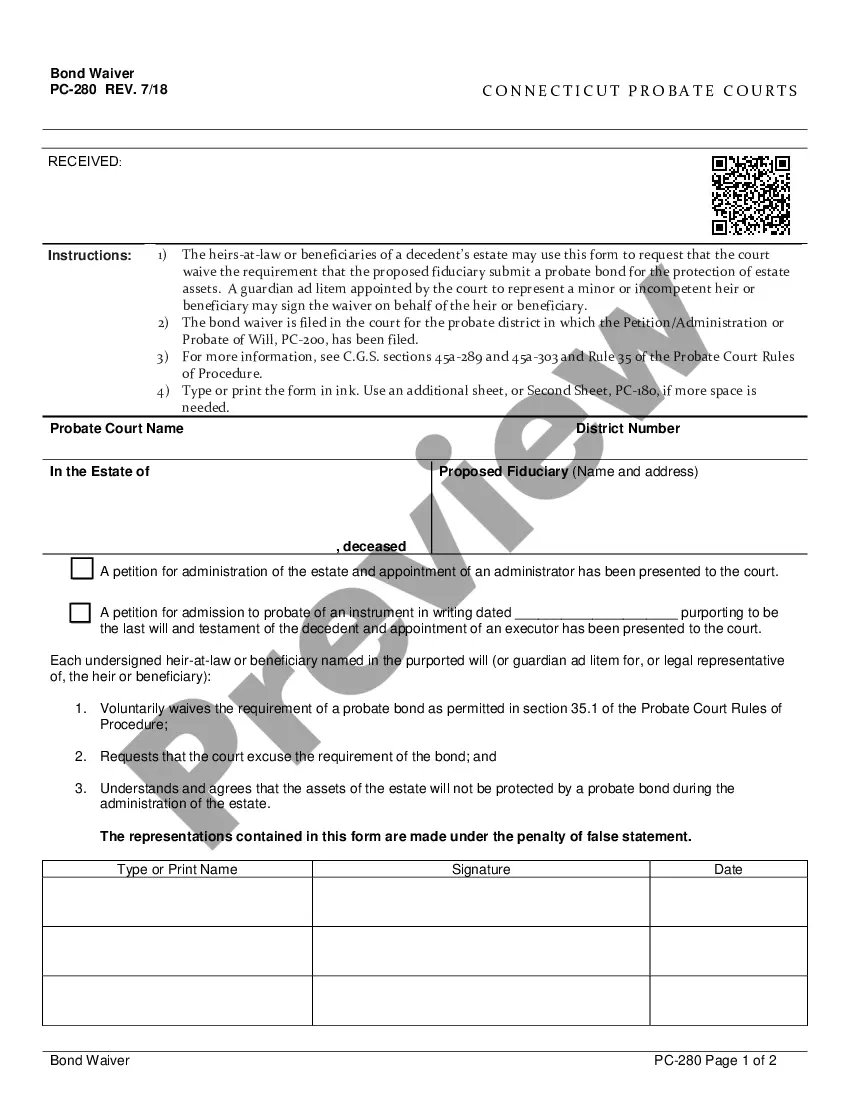

Bridgeport Connecticut Probate Bond

Description

How to fill out Connecticut Probate Bond?

If you are looking for an authentic document, it’s hard to find a superior location than the US Legal Forms platform – one of the most extensive collections online.

Here you can obtain thousands of forms for commercial and personal needs by categories and areas, or keywords.

Utilizing our premium search option, finding the latest Bridgeport Connecticut Probate - Bond is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the signup process.

Obtain the document. Choose the file format and download it to your device.

- Additionally, the authenticity of each document is validated by a team of experienced lawyers who consistently review the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to access the Bridgeport Connecticut Probate - Bond is to sign in to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have located the form you require. Review its description and utilize the Preview function (if available) to view its content. If it doesn’t satisfy your needs, employ the Search feature at the top of the page to find the necessary document.

- Verify your choice. Click the Buy now button. After that, select your desired payment plan and provide your information to register for an account.

Form popularity

FAQ

Yes, the bond is typically processed during probate. The court reviews the bond to ensure its appropriateness for the estate's needs. The probate court appoints the executor, who obtains the bond before proceeding with their duties. Familiarizing yourself with the Bridgeport Connecticut Probate Bond process can help you navigate the probate journey more smoothly.

Whether an executor must post a bond depends on the estate's circumstances and local laws. In some situations, the court may mandate a bond to protect the estate. Alternatively, if all heirs agree, they can waive this requirement. Therefore, understanding the need for a Bridgeport Connecticut Probate Bond plays a critical role in estate administration.

In many cases, an executor must be bonded to ensure they handle the estate responsibly. The bond protects the estate from potential fraud or mismanagement by the executor. However, specific circumstances may allow for an exemption if all heirs agree. Evaluating your situation regarding the Bridgeport Connecticut Probate Bond can provide clarity.

When an executor serves without a bond, they take on the responsibility of managing the estate without any financial assurance for the beneficiaries. This can lead to concerns about potential mismanagement or loss of assets. However, some estates allow executors to waive the bond requirement if all interested parties consent. Understanding the implications of this decision in the context of your Bridgeport Connecticut Probate Bond is essential.

Securing a Bridgeport Connecticut Probate Bond can take anywhere from a few days to a couple of weeks, influenced by the nature of the estate and the responsiveness of involved parties. Having your documents in order can significantly speed up the bonding process. To streamline this, consider utilizing resources from US Legal Forms for efficient handling.

In New Jersey, whether a probate bond is required depends on the specifics of the case. If the will does not expressly waive the bond requirement, the court usually mandates it. If you are navigating these requirements in relation to a Bridgeport Connecticut Probate Bond, US Legal Forms can help make the process clearer and more manageable.

In Connecticut, an estate must generally be worth at least $40,000 to require probate proceedings. This applies whether the estate includes personal property, real estate, or a combination of both. Knowing this threshold is crucial if you're considering a Bridgeport Connecticut Probate Bond as part of your estate planning.

The time it takes to obtain a Bridgeport Connecticut Probate Bond typically ranges from a few days to a couple of weeks. This duration depends on various factors, including the complexity of the estate and the completeness of your application. To simplify the process, consider using US Legal Forms, which provides resources and forms to expedite your bonding process.

The time to obtain a probate bond in Bridgeport can vary, but it typically takes a few days to a couple of weeks. This process involves applying for the bond and having it underwritten by a surety company. When you use platforms like US Legal Forms, you can simplify this process and expedite your application for the Bridgeport Connecticut Probate Bond.

In Connecticut, there is no strict time limit to probate a will, but it's wise to begin the process promptly. The sooner you start, the easier it will be to navigate any challenges that may arise. If you require a Bridgeport Connecticut Probate Bond to move forward, acting quickly will help you avoid any potential delays.