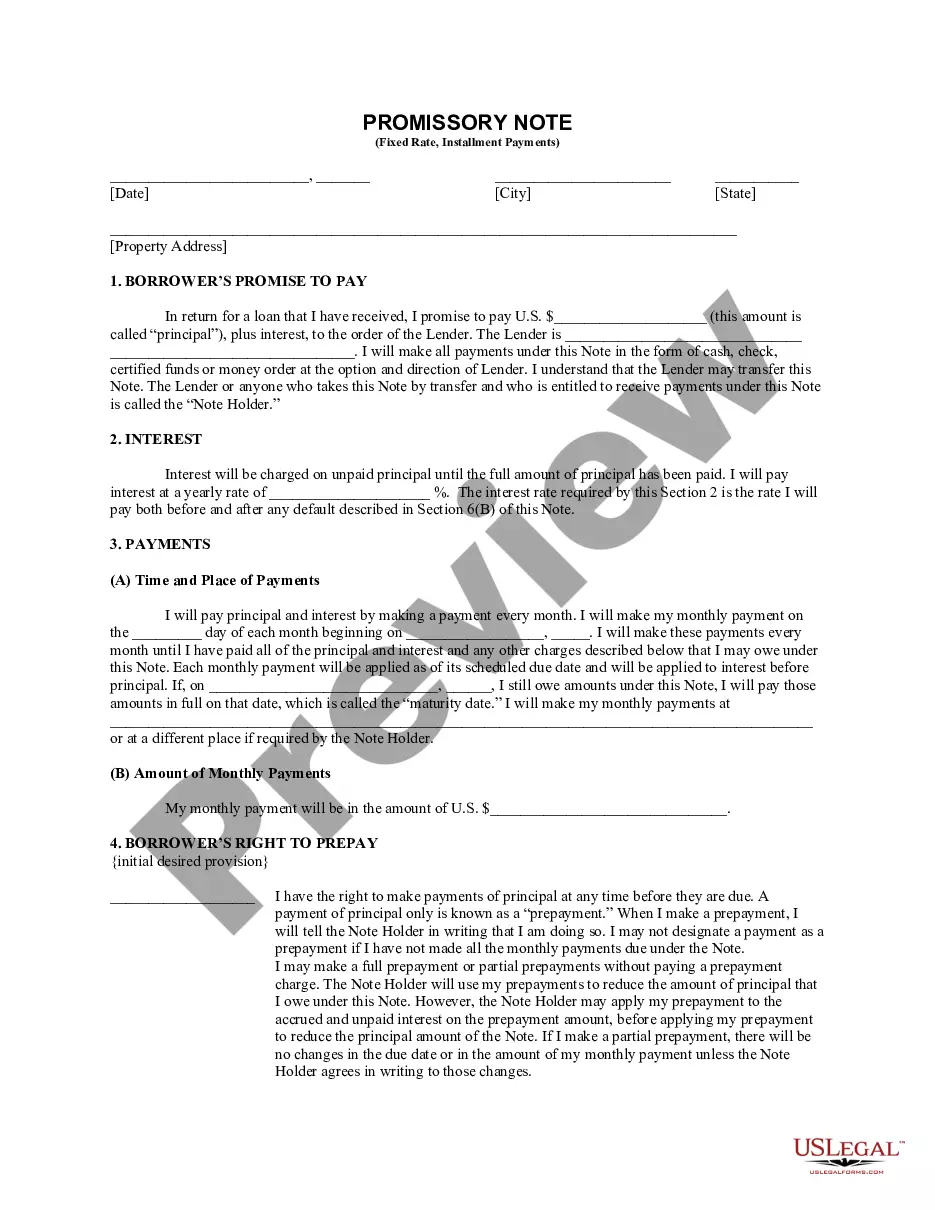

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

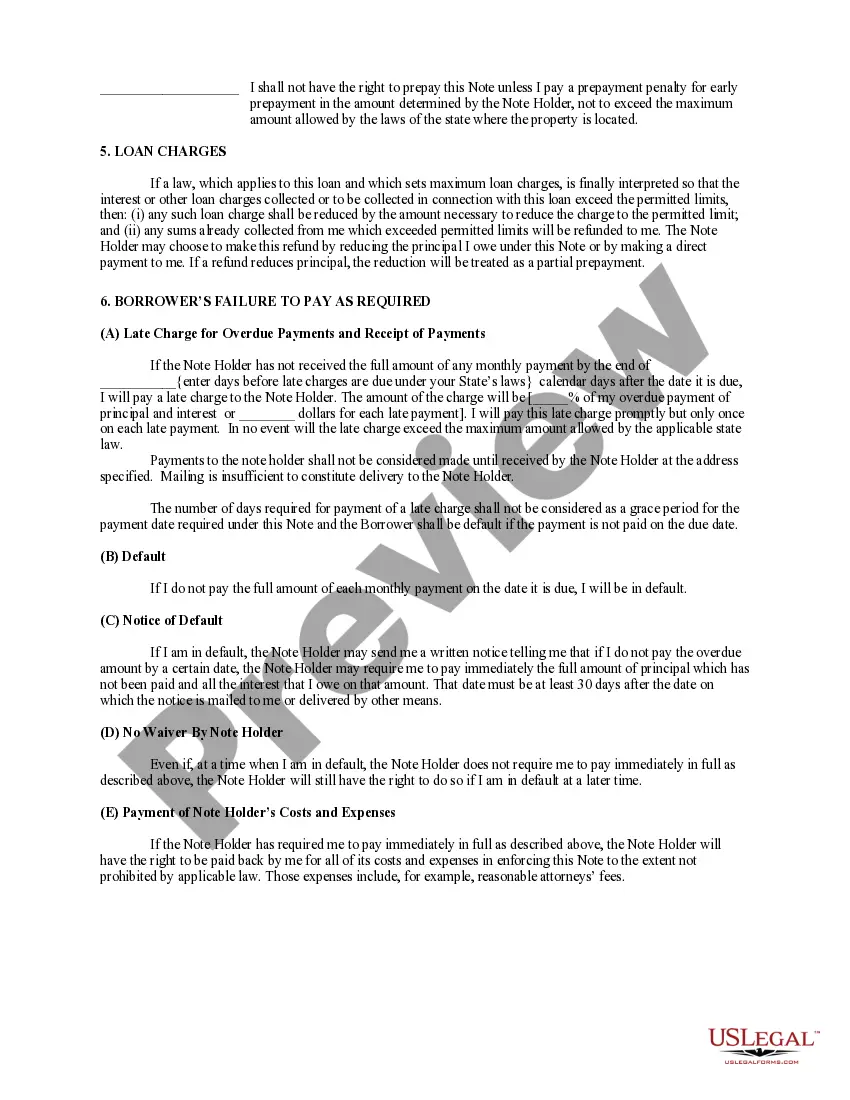

A Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan secured by residential real estate in Bridgeport, Connecticut. This type of promissory note is commonly used for mortgage loans and provides protections for both the borrower and the lender. The promissory note specifies the principal amount of the loan, the interest rate, and the repayment schedule. It also includes provisions related to late payments, default, and foreclosure procedures in case the borrower fails to repay the loan according to the agreed terms. There are several types of Bridgeport Connecticut Installments Fixed Rate Promissory Notes Secured by Residential Real Estate, each with their own characteristics and purposes. Here are a few examples: 1. Traditional Mortgage Note: This is the most common type of promissory note used for residential real estate purchases. It includes the details of the loan, such as the interest rate, monthly installments, and the term of the loan. 2. Balloon Payment Note: This type of promissory note includes a larger final payment, known as a balloon payment, that is due at the end of the loan term. It allows borrowers to have lower monthly installments throughout the loan term. 3. Adjustable Rate Mortgage (ARM) Note: An ARM note has an interest rate that can change over time. Typically, the rate is fixed for an initial period and then adjusts periodically, based on a specified index. This type of note offers borrowers the potential for lower interest rates initially, but also introduces uncertainty for future payments. 4. Interest-Only Note: With an interest-only note, the borrower is only required to make monthly interest payments for a specified period, usually between 5 and 10 years. After that, the borrower must begin making payments towards the principal in addition to interest. 5. Wraparound Note: A wraparound note is used when the borrower wants to consolidate multiple mortgages into one loan. It combines the existing loan(s) with the new loan, resulting in a single monthly payment to the lender. When securing a residential real estate loan in Bridgeport, Connecticut, it is crucial for both borrowers and lenders to thoroughly understand the terms outlined in the Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate. It is advisable to consult with a legal professional to ensure compliance with local laws and to address any specific requirements related to the property.A Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan secured by residential real estate in Bridgeport, Connecticut. This type of promissory note is commonly used for mortgage loans and provides protections for both the borrower and the lender. The promissory note specifies the principal amount of the loan, the interest rate, and the repayment schedule. It also includes provisions related to late payments, default, and foreclosure procedures in case the borrower fails to repay the loan according to the agreed terms. There are several types of Bridgeport Connecticut Installments Fixed Rate Promissory Notes Secured by Residential Real Estate, each with their own characteristics and purposes. Here are a few examples: 1. Traditional Mortgage Note: This is the most common type of promissory note used for residential real estate purchases. It includes the details of the loan, such as the interest rate, monthly installments, and the term of the loan. 2. Balloon Payment Note: This type of promissory note includes a larger final payment, known as a balloon payment, that is due at the end of the loan term. It allows borrowers to have lower monthly installments throughout the loan term. 3. Adjustable Rate Mortgage (ARM) Note: An ARM note has an interest rate that can change over time. Typically, the rate is fixed for an initial period and then adjusts periodically, based on a specified index. This type of note offers borrowers the potential for lower interest rates initially, but also introduces uncertainty for future payments. 4. Interest-Only Note: With an interest-only note, the borrower is only required to make monthly interest payments for a specified period, usually between 5 and 10 years. After that, the borrower must begin making payments towards the principal in addition to interest. 5. Wraparound Note: A wraparound note is used when the borrower wants to consolidate multiple mortgages into one loan. It combines the existing loan(s) with the new loan, resulting in a single monthly payment to the lender. When securing a residential real estate loan in Bridgeport, Connecticut, it is crucial for both borrowers and lenders to thoroughly understand the terms outlined in the Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate. It is advisable to consult with a legal professional to ensure compliance with local laws and to address any specific requirements related to the property.