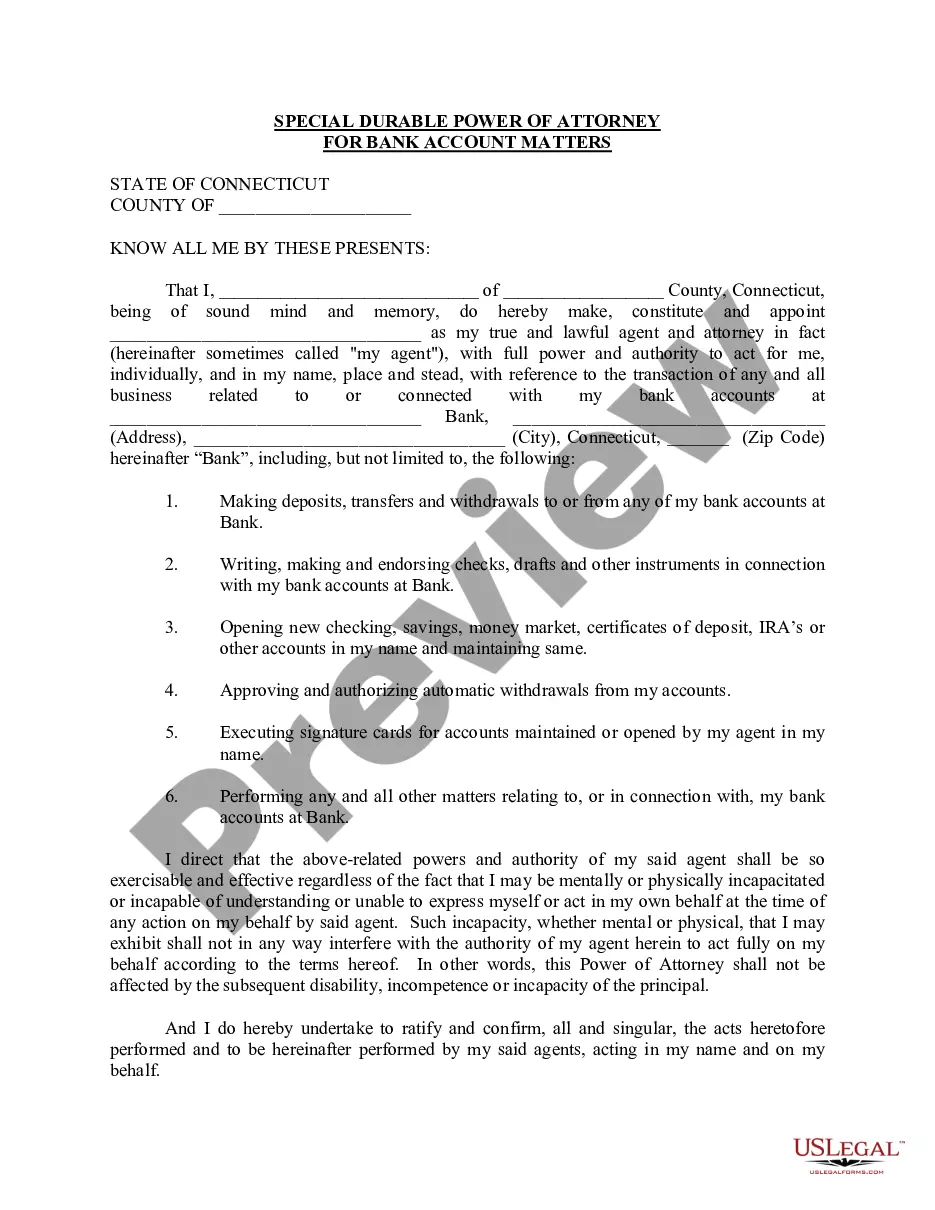

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

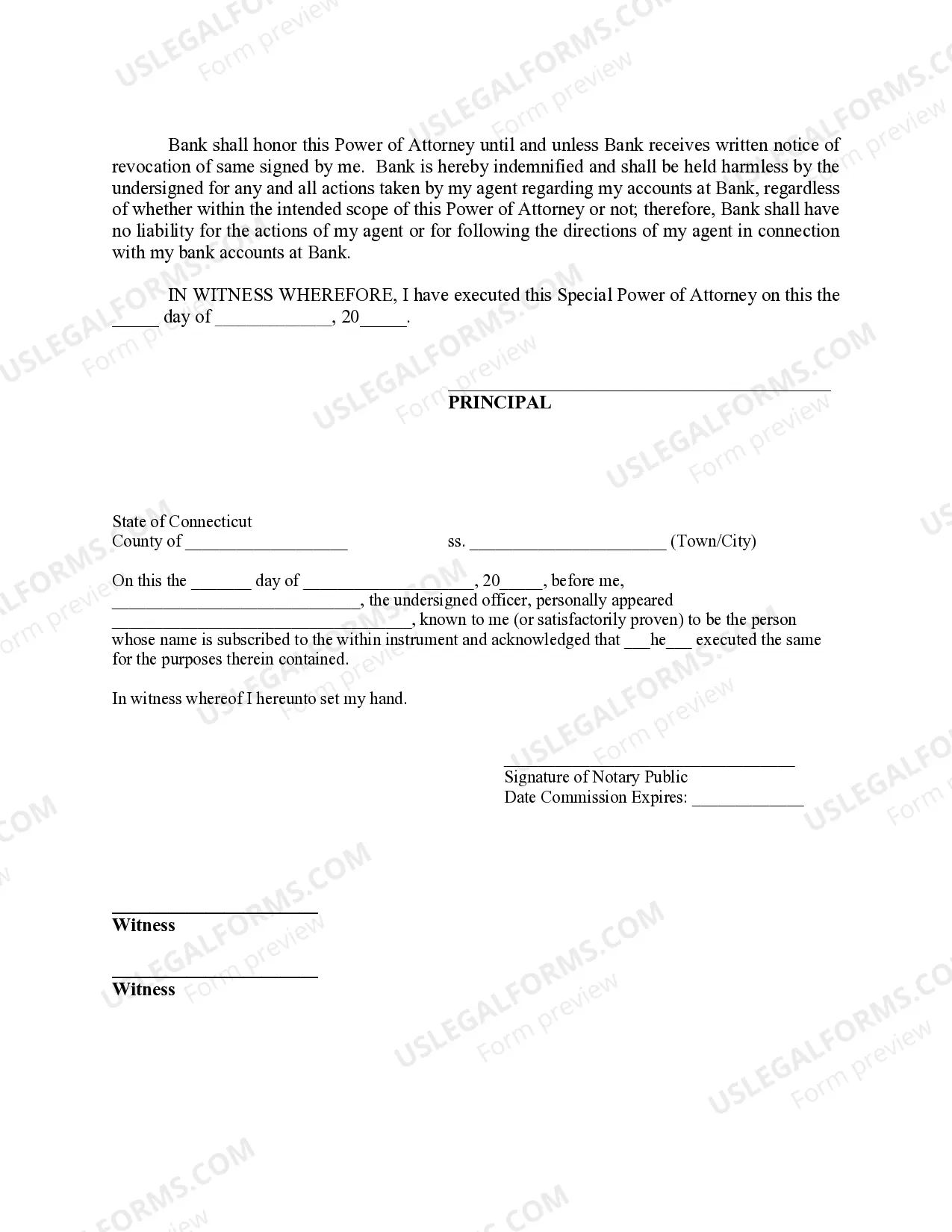

A Bridgeport Connecticut Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual, known as the "attorney-in-fact," the authority to handle specific banking matters on behalf of another person, known as the "principal." This power of attorney is specifically tailored to handle banking affairs and ensures that the attorney-in-fact can make decisions and perform actions regarding the principal's bank accounts, even in the event of the principal's incapacity or disability. The special durable power of attorney allows the attorney-in-fact to manage a wide range of bank account matters, including but not limited to: 1. Account Management: The attorney-in-fact is authorized to open, close, or modify the principal's bank accounts. This includes savings accounts, checking accounts, money market accounts, certificates of deposit (CDs), and other related financial instruments. 2. Deposits and Withdrawals: The attorney-in-fact can make deposits into the principal's accounts, such as receiving income, dividends, or any other form of payment. They can also withdraw funds for the principal's use or to pay bills, expenses, or debts on behalf of the principal. 3. Online Banking and Bill Payments: The power of attorney allows the attorney-in-fact to access the principal's online banking services, manage electronic transactions, and make bill payments online, ensuring the principal's financial affairs are properly managed even when they are unable to do so themselves. 4. Account Statements and Notices: The attorney-in-fact has the authority to receive and review bank statements, transaction records, and any other correspondence related to the principal's bank accounts. This ensures that the attorney-in-fact can closely monitor the principal's financial activities and detect any unauthorized actions swiftly. 5. Banking Transactions: The power of attorney allows the attorney-in-fact to execute banking transactions on behalf of the principal. These may include requesting wire transfers, issuing checks, obtaining cashier's checks, or initiating automated transactions. 6. Investment Management: Depending on the specific powers granted within the power of attorney document, the attorney-in-fact may have the authority to manage the principal's investment accounts, buy or sell securities, and make investment decisions related to the principal's bank accounts. It is important to note that there are no specific subtypes of the Bridgeport Connecticut Special Durable Power of Attorney for Bank Account Matters. However, the specific powers, restrictions, and limitations granted within the document can vary based on the principal's preferences and the attorney-in-fact's capabilities. It is crucial for both parties to thoroughly understand the implications and scope of the power of attorney before execution. In summary, the Bridgeport Connecticut Special Durable Power of Attorney for Bank Account Matters grants the attorney-in-fact the authority to manage the principal's bank accounts, including transactions, statements, investments, and other related financial matters. The document ensures that the attorney-in-fact can act in the best interest of the principal, both in the present and in the case of any future incapacity or disability.A Bridgeport Connecticut Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual, known as the "attorney-in-fact," the authority to handle specific banking matters on behalf of another person, known as the "principal." This power of attorney is specifically tailored to handle banking affairs and ensures that the attorney-in-fact can make decisions and perform actions regarding the principal's bank accounts, even in the event of the principal's incapacity or disability. The special durable power of attorney allows the attorney-in-fact to manage a wide range of bank account matters, including but not limited to: 1. Account Management: The attorney-in-fact is authorized to open, close, or modify the principal's bank accounts. This includes savings accounts, checking accounts, money market accounts, certificates of deposit (CDs), and other related financial instruments. 2. Deposits and Withdrawals: The attorney-in-fact can make deposits into the principal's accounts, such as receiving income, dividends, or any other form of payment. They can also withdraw funds for the principal's use or to pay bills, expenses, or debts on behalf of the principal. 3. Online Banking and Bill Payments: The power of attorney allows the attorney-in-fact to access the principal's online banking services, manage electronic transactions, and make bill payments online, ensuring the principal's financial affairs are properly managed even when they are unable to do so themselves. 4. Account Statements and Notices: The attorney-in-fact has the authority to receive and review bank statements, transaction records, and any other correspondence related to the principal's bank accounts. This ensures that the attorney-in-fact can closely monitor the principal's financial activities and detect any unauthorized actions swiftly. 5. Banking Transactions: The power of attorney allows the attorney-in-fact to execute banking transactions on behalf of the principal. These may include requesting wire transfers, issuing checks, obtaining cashier's checks, or initiating automated transactions. 6. Investment Management: Depending on the specific powers granted within the power of attorney document, the attorney-in-fact may have the authority to manage the principal's investment accounts, buy or sell securities, and make investment decisions related to the principal's bank accounts. It is important to note that there are no specific subtypes of the Bridgeport Connecticut Special Durable Power of Attorney for Bank Account Matters. However, the specific powers, restrictions, and limitations granted within the document can vary based on the principal's preferences and the attorney-in-fact's capabilities. It is crucial for both parties to thoroughly understand the implications and scope of the power of attorney before execution. In summary, the Bridgeport Connecticut Special Durable Power of Attorney for Bank Account Matters grants the attorney-in-fact the authority to manage the principal's bank accounts, including transactions, statements, investments, and other related financial matters. The document ensures that the attorney-in-fact can act in the best interest of the principal, both in the present and in the case of any future incapacity or disability.