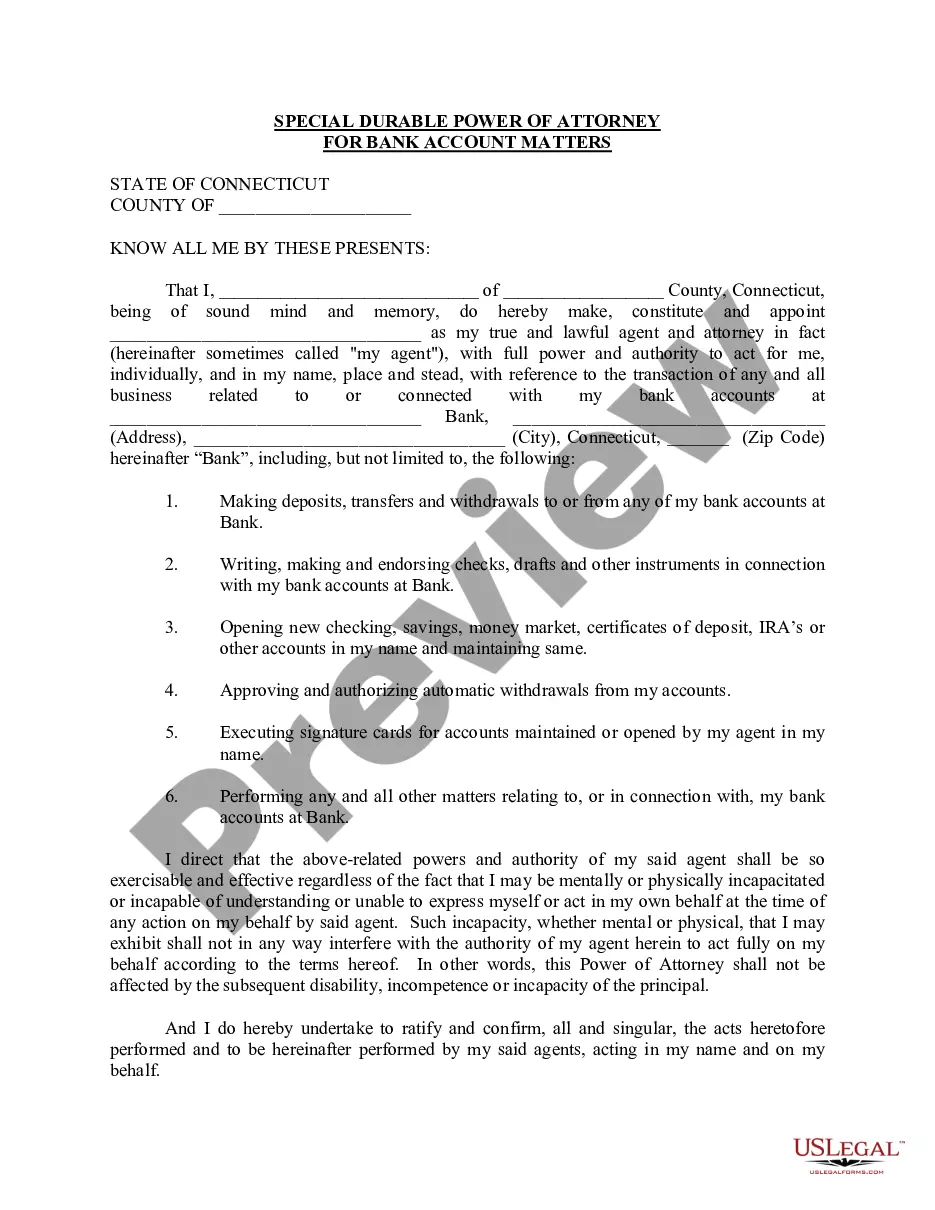

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Stamford Connecticut Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual the authority to manage and make decisions regarding the bank accounts of another individual in Stamford, Connecticut. This power of attorney is specifically tailored to address financial matters related to bank accounts and provides detailed instructions for the appointed agent or attorney-in-fact. The Stamford Connecticut Special Durable Power of Attorney for Bank Account Matters enables the appointed individual, commonly referred to as the attorney-in-fact, to handle various bank account transactions on behalf of the principal (the person who grants the power of attorney). This authority allows the attorney-in-fact to deposit or withdraw funds, write checks, transfer funds between accounts, manage online banking, pay bills, and perform other banking-related tasks. In Stamford, Connecticut, there are various types of Special Durable Power of Attorney for Bank Account Matters that can be established based on individual needs and preferences. Some common variations may include: 1. Limited Power of Attorney for Bank Account Matters: This type of power of attorney grants specific authority to the attorney-in-fact for particular bank account matters, such as handling deposits or paying bills, while excluding other financial responsibilities. 2. General Power of Attorney for Bank Account Matters: This grants the attorney-in-fact broad powers to manage all aspects of the principal's bank accounts, including making investment decisions, accessing safety deposit boxes, and administering loans. 3. Springing Power of Attorney for Bank Account Matters: This power of attorney becomes effective at a future predetermined event or date specified in the document. For example, it may come into effect if the principal becomes mentally incapacitated. 4. Co-Agents Power of Attorney for Bank Account Matters: This allows the principal to appoint multiple individuals as attorneys-in-fact, who can simultaneously manage the bank accounts or act independently when necessary. The Stamford Connecticut Special Durable Power of Attorney for Bank Account Matters document must comply with the specific legal requirements outlined in the Connecticut Statutes and should be notarized to ensure its validity. It is crucial to consult with an attorney experienced in estate planning or power of attorney matters to create a tailored document that meets individual needs while adhering to all the legal requirements specific to Stamford, Connecticut.