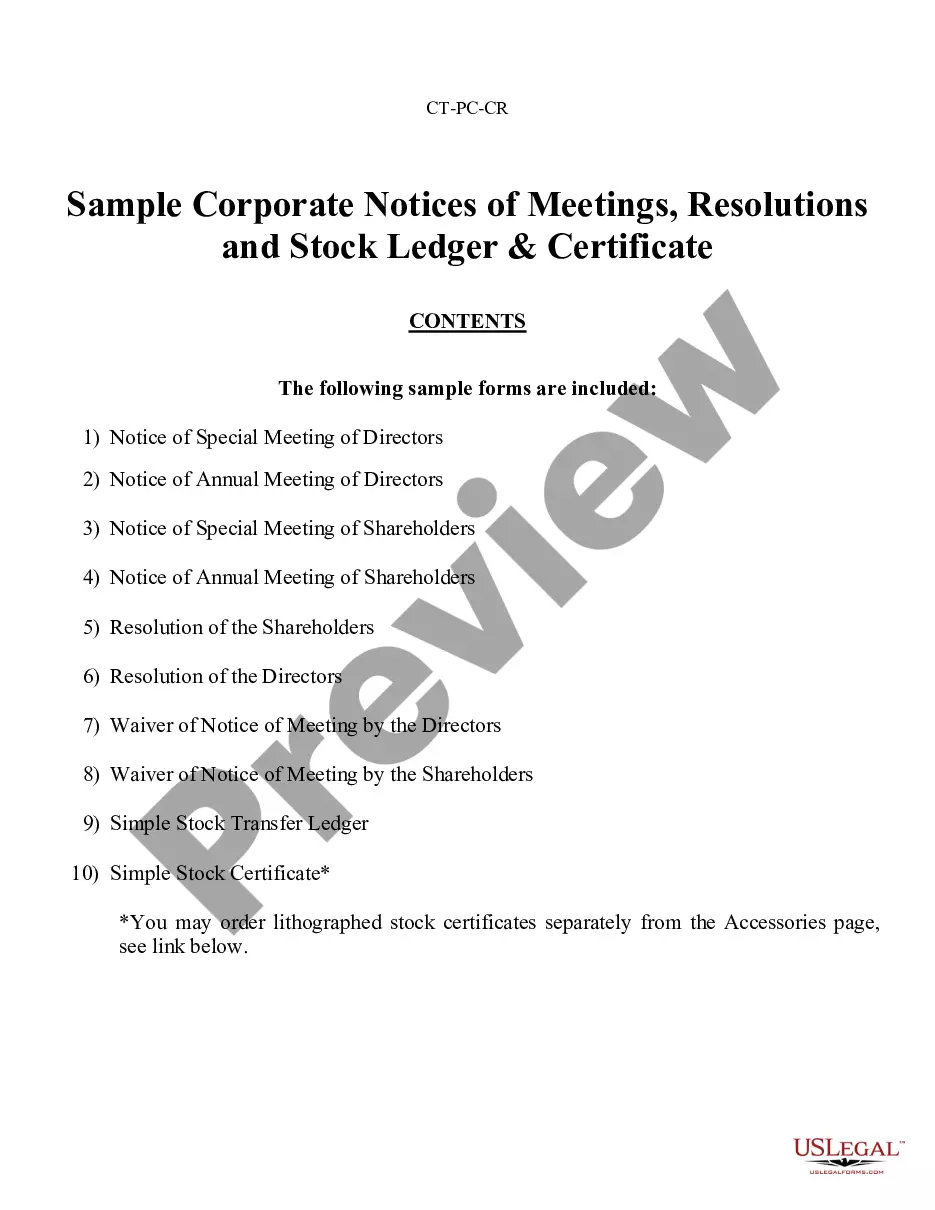

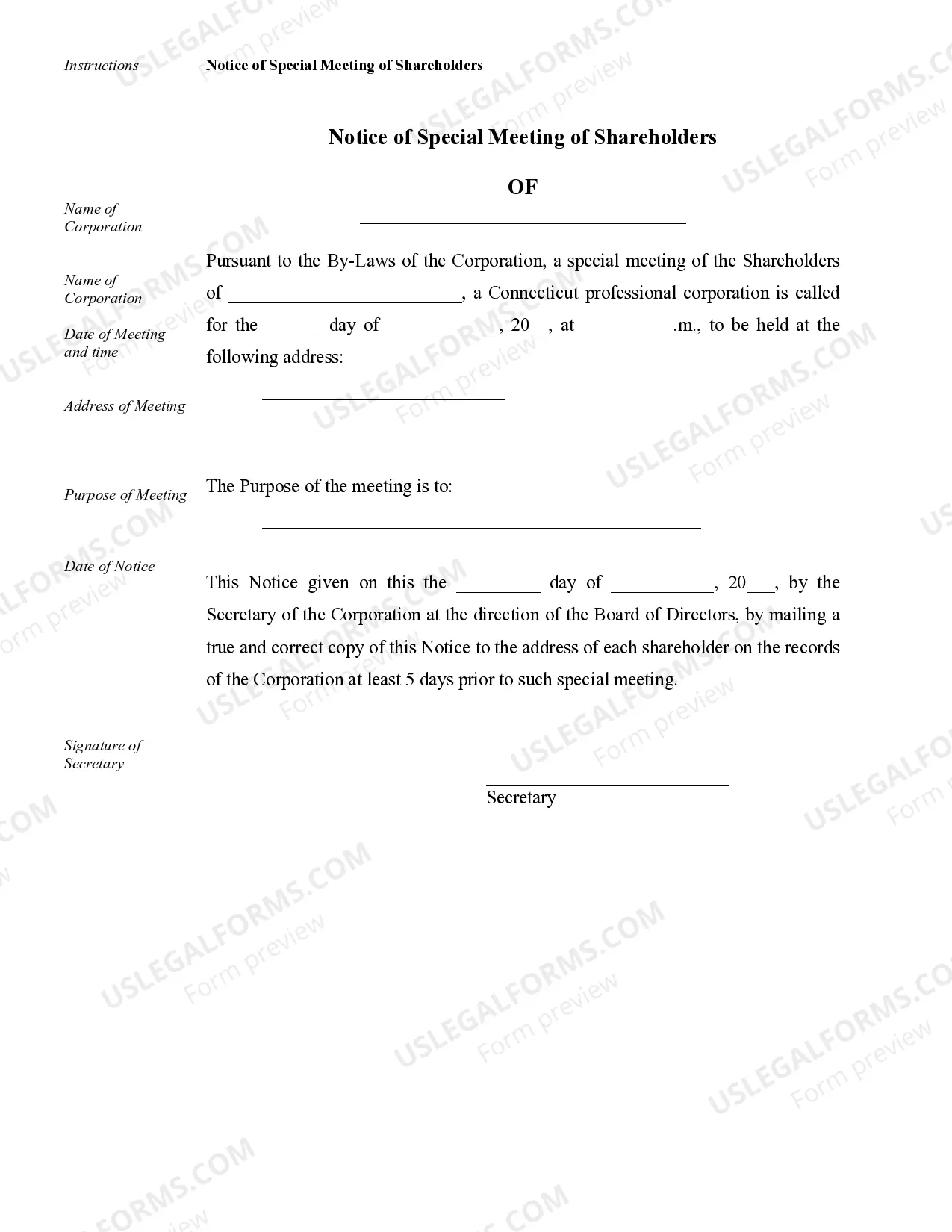

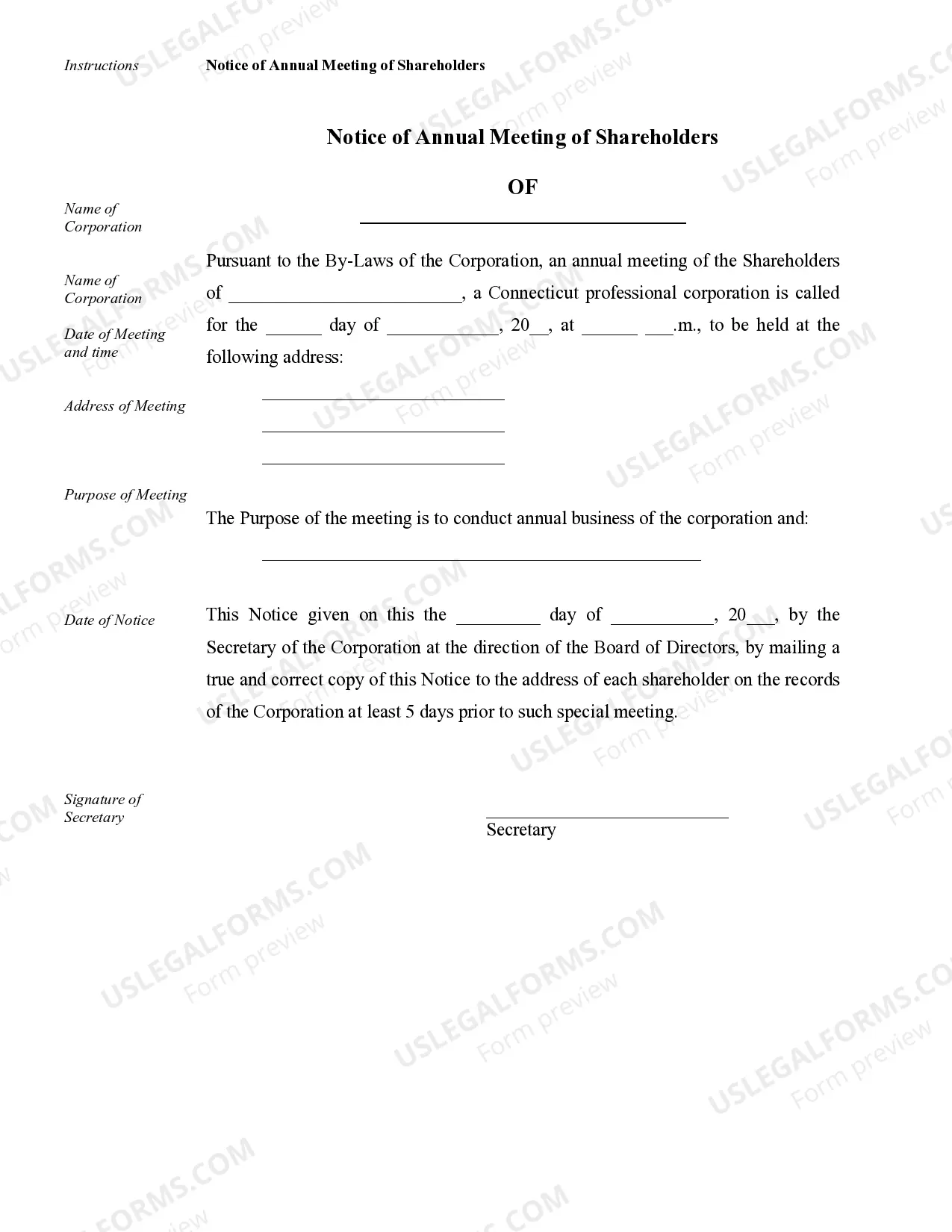

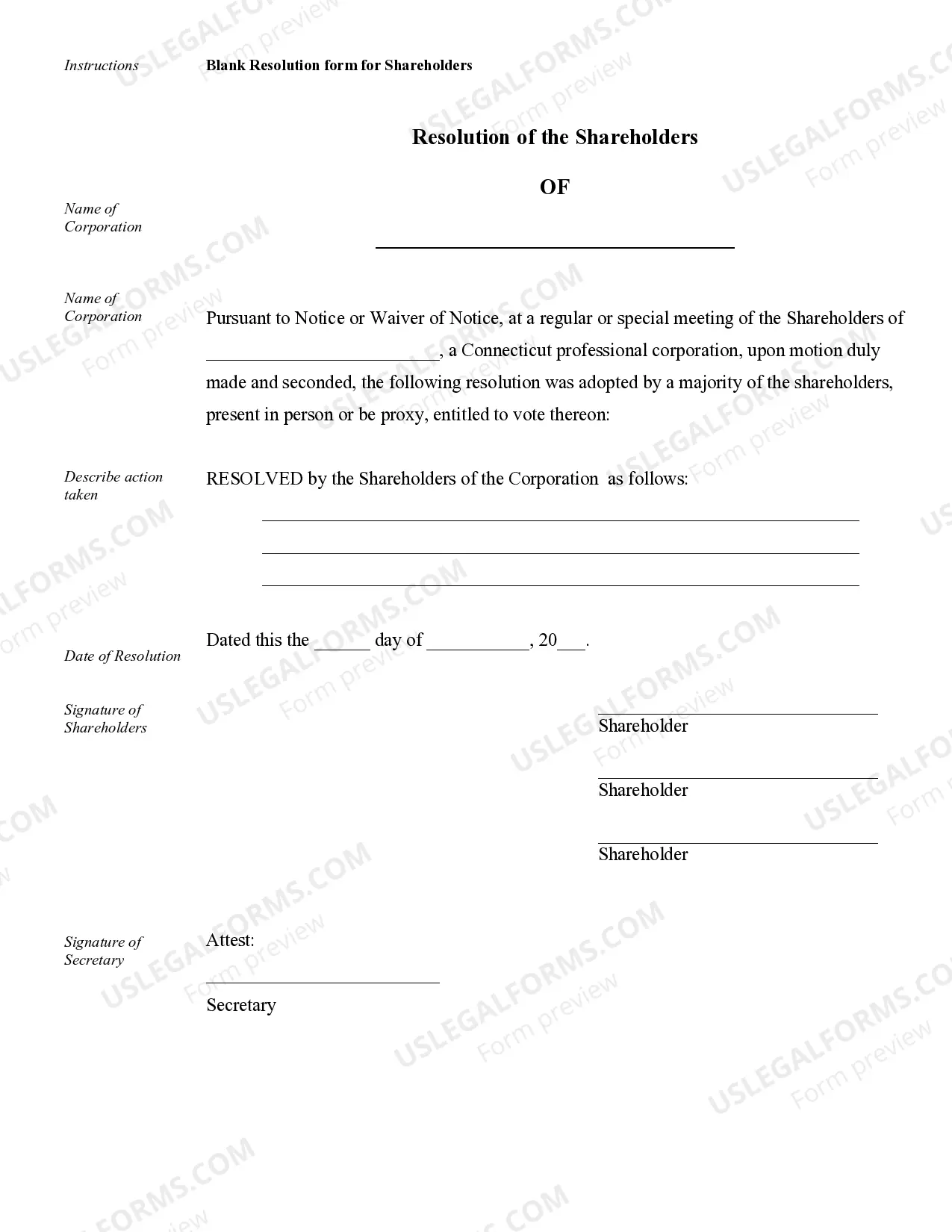

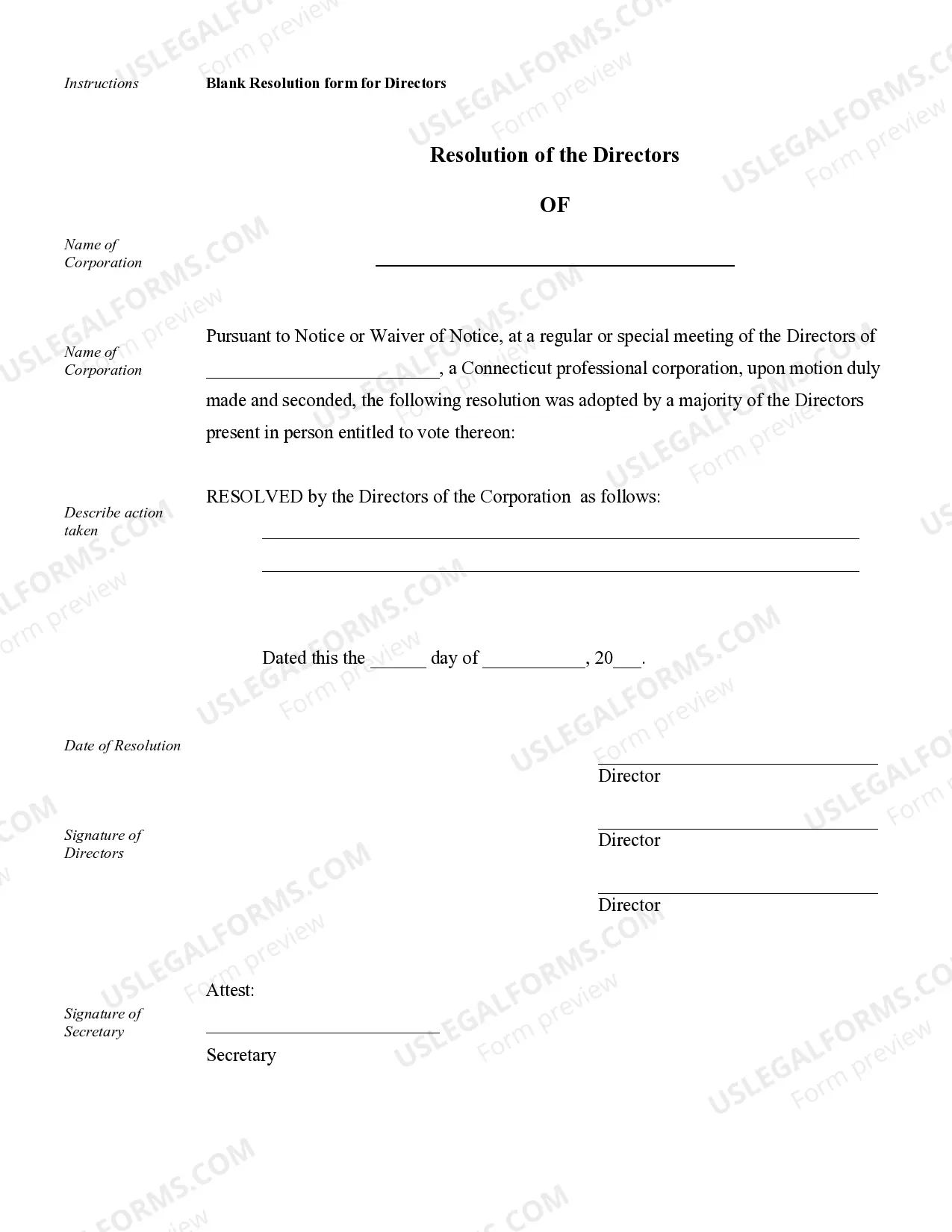

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

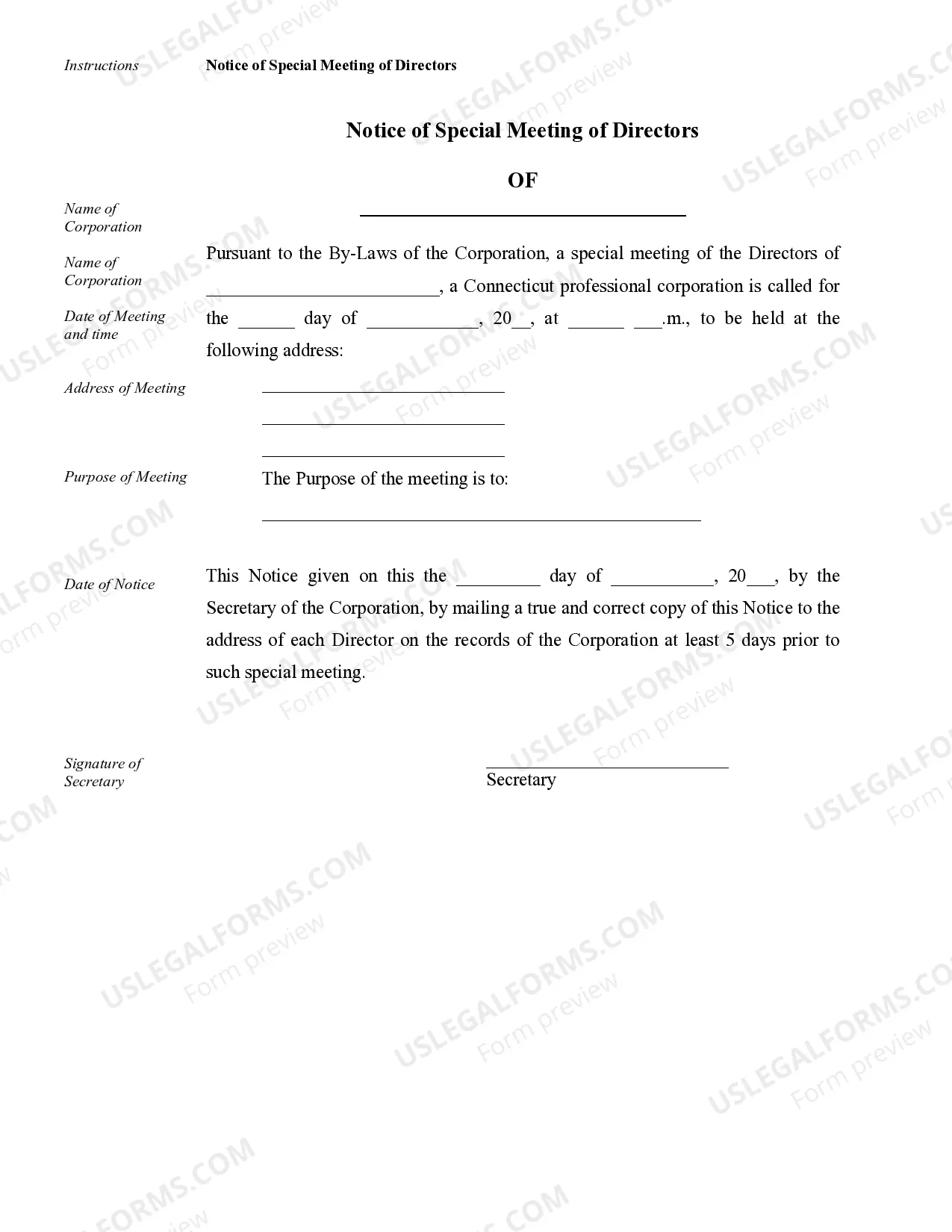

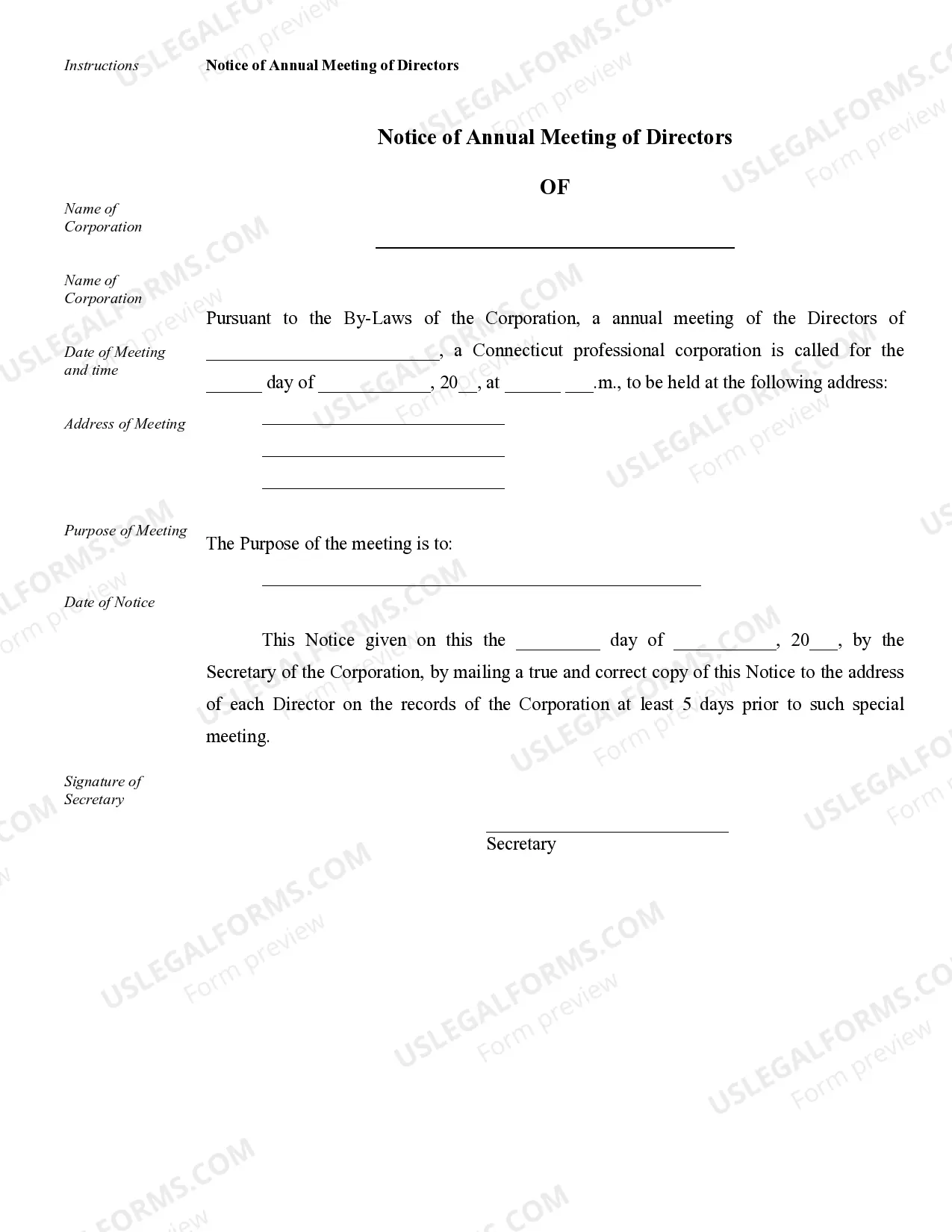

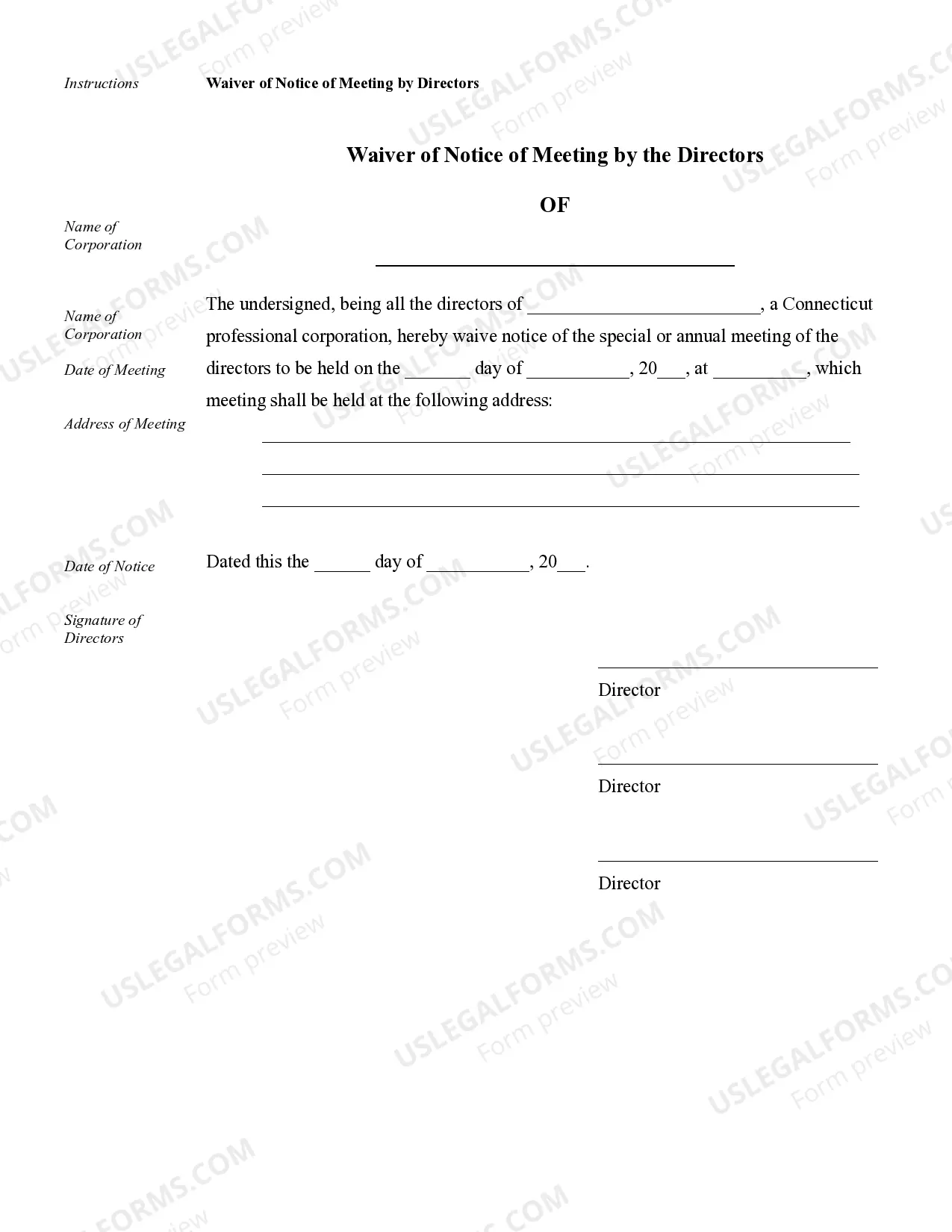

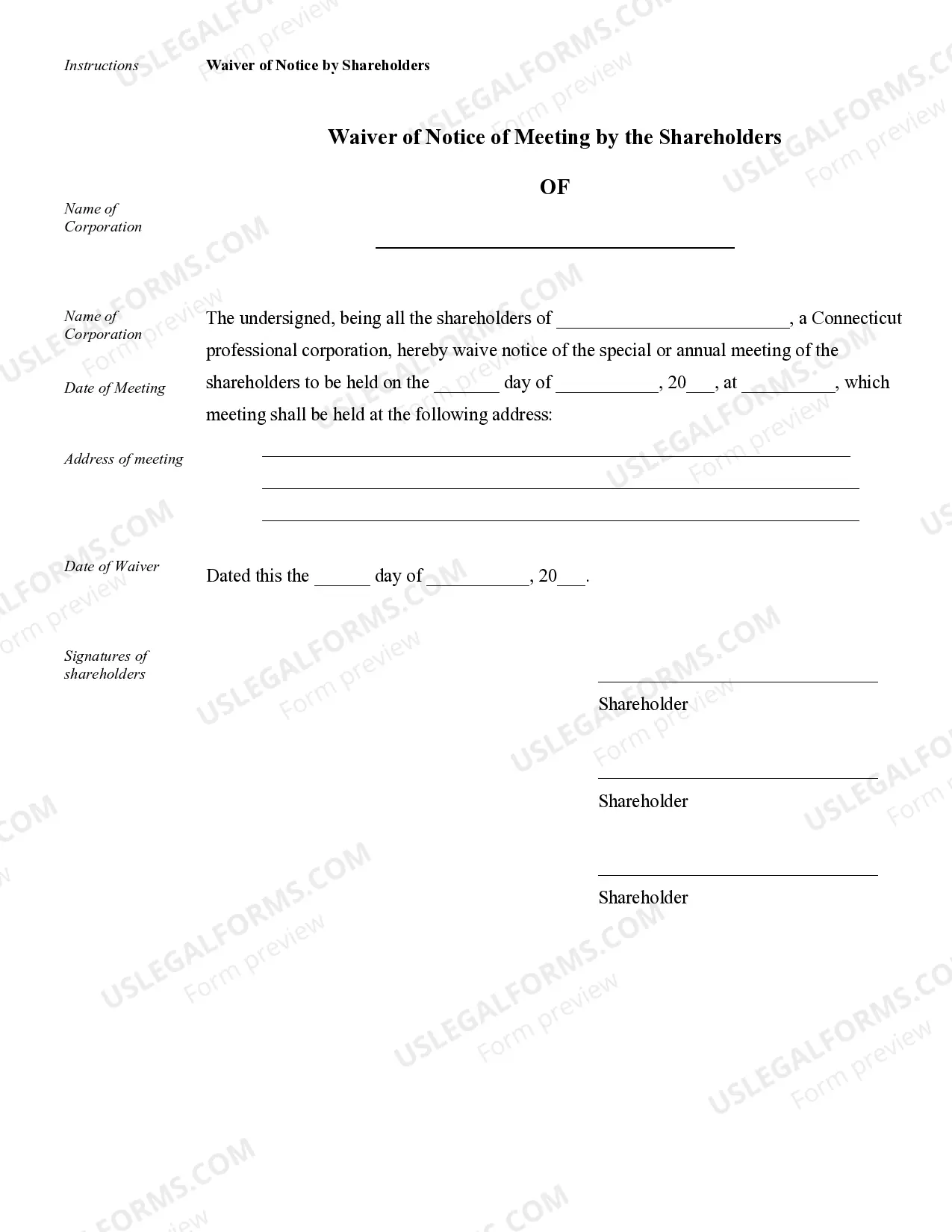

Bridgeport Sample Corporate Records for a Connecticut Professional Corporation are essential documents that provide a comprehensive record of a company's activities and transactions. These records are significant not only for legal purposes but also for maintaining transparency and accountability within the organization. Bridgeport, being a prominent city in Connecticut, offers various types of sample corporate records for professional corporations. Let us explore some of these records and their importance. 1. Bylaws: Bridgeport Sample Corporate Records for a Connecticut Professional Corporation include the company's bylaws, which outline the rules and regulations governing its internal operations. Bylaws typically cover areas such as shareholder rights, board member responsibilities, voting procedures, and meeting protocols. Adhering to these bylaws ensures smooth functioning and consistent decision-making processes within the corporation. 2. Articles of Incorporation: These records serve as the foundation for forming a professional corporation in Connecticut. The Articles of Incorporation outline vital details such as the company's name, purpose, registered agent, and the number of authorized shares. These records must be filed with the Secretary of the State to establish the legal existence of the corporation. 3. Shareholder Agreements: Bridgeport Sample Corporate Records may include shareholder agreements that outline the rights and responsibilities of the company's shareholders. These agreements cover matters like stock transfers, voting rights, dividend distributions, and procedures for handling disputes among shareholders. Such records help ensure a clear understanding among shareholders, fostering a cooperative and harmonious business environment. 4. Financial Statements: Keeping track of a company's financial health is crucial, and Bridgeport Sample Corporate Records often contain financial statements such as balance sheets, income statements, and cash flow statements. These records provide an overview of the company's assets, liabilities, revenue, and expenses. Accurate financial record-keeping helps measure performance, analyze trends, and make informed business decisions. 5. Board Meeting Minutes: Proper record-keeping of board meetings is essential for a corporation's governance. Bridgeport Sample Corporate Records may include board meeting minutes that document the discussions, decisions, and actions taken during these meetings. Minutes should include details such as attendees, agenda items, voting outcomes, and any important resolutions or amendments made during the meeting. 6. Stock Ledger: A stock ledger is a record of all shares issued by the corporation, including details such as share numbers, ownership transfers, dates of issuance, and distinct shareholders' names. It is crucial to maintain an accurate stock ledger to ensure compliance with regulations and facilitate a transparent ownership structure. Bridgeport Sample Corporate Records for a Connecticut Professional Corporation play a pivotal role in maintaining a well-organized and legally compliant business entity. Professionals in Bridgeport can refer to these various types of records to understand the requirements, regulations, and best practices necessary for the smooth functioning of their corporations. Thorough and diligent record-keeping enhances corporate transparency, fosters stakeholder confidence, and facilitates efficient decision-making processes.Bridgeport Sample Corporate Records for a Connecticut Professional Corporation are essential documents that provide a comprehensive record of a company's activities and transactions. These records are significant not only for legal purposes but also for maintaining transparency and accountability within the organization. Bridgeport, being a prominent city in Connecticut, offers various types of sample corporate records for professional corporations. Let us explore some of these records and their importance. 1. Bylaws: Bridgeport Sample Corporate Records for a Connecticut Professional Corporation include the company's bylaws, which outline the rules and regulations governing its internal operations. Bylaws typically cover areas such as shareholder rights, board member responsibilities, voting procedures, and meeting protocols. Adhering to these bylaws ensures smooth functioning and consistent decision-making processes within the corporation. 2. Articles of Incorporation: These records serve as the foundation for forming a professional corporation in Connecticut. The Articles of Incorporation outline vital details such as the company's name, purpose, registered agent, and the number of authorized shares. These records must be filed with the Secretary of the State to establish the legal existence of the corporation. 3. Shareholder Agreements: Bridgeport Sample Corporate Records may include shareholder agreements that outline the rights and responsibilities of the company's shareholders. These agreements cover matters like stock transfers, voting rights, dividend distributions, and procedures for handling disputes among shareholders. Such records help ensure a clear understanding among shareholders, fostering a cooperative and harmonious business environment. 4. Financial Statements: Keeping track of a company's financial health is crucial, and Bridgeport Sample Corporate Records often contain financial statements such as balance sheets, income statements, and cash flow statements. These records provide an overview of the company's assets, liabilities, revenue, and expenses. Accurate financial record-keeping helps measure performance, analyze trends, and make informed business decisions. 5. Board Meeting Minutes: Proper record-keeping of board meetings is essential for a corporation's governance. Bridgeport Sample Corporate Records may include board meeting minutes that document the discussions, decisions, and actions taken during these meetings. Minutes should include details such as attendees, agenda items, voting outcomes, and any important resolutions or amendments made during the meeting. 6. Stock Ledger: A stock ledger is a record of all shares issued by the corporation, including details such as share numbers, ownership transfers, dates of issuance, and distinct shareholders' names. It is crucial to maintain an accurate stock ledger to ensure compliance with regulations and facilitate a transparent ownership structure. Bridgeport Sample Corporate Records for a Connecticut Professional Corporation play a pivotal role in maintaining a well-organized and legally compliant business entity. Professionals in Bridgeport can refer to these various types of records to understand the requirements, regulations, and best practices necessary for the smooth functioning of their corporations. Thorough and diligent record-keeping enhances corporate transparency, fosters stakeholder confidence, and facilitates efficient decision-making processes.