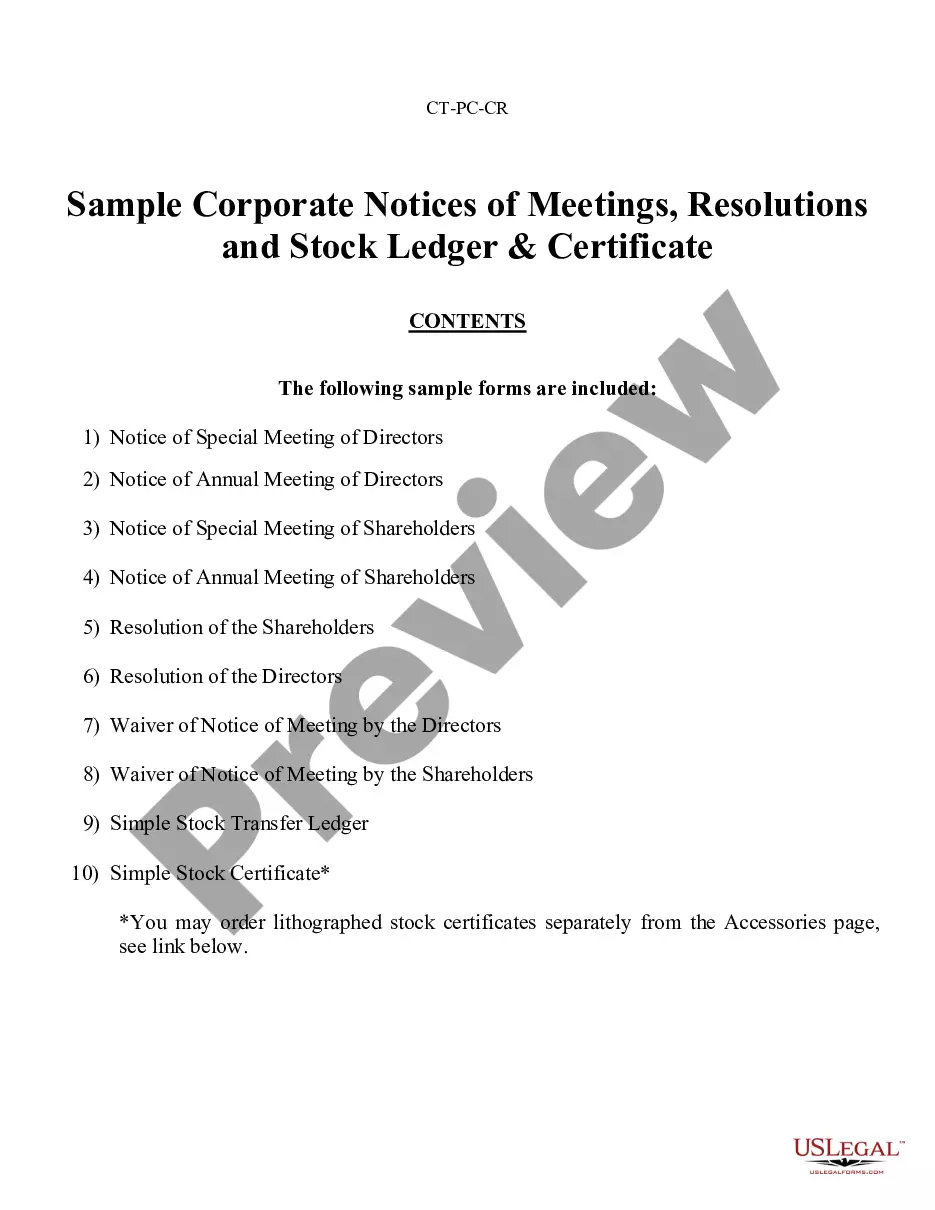

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

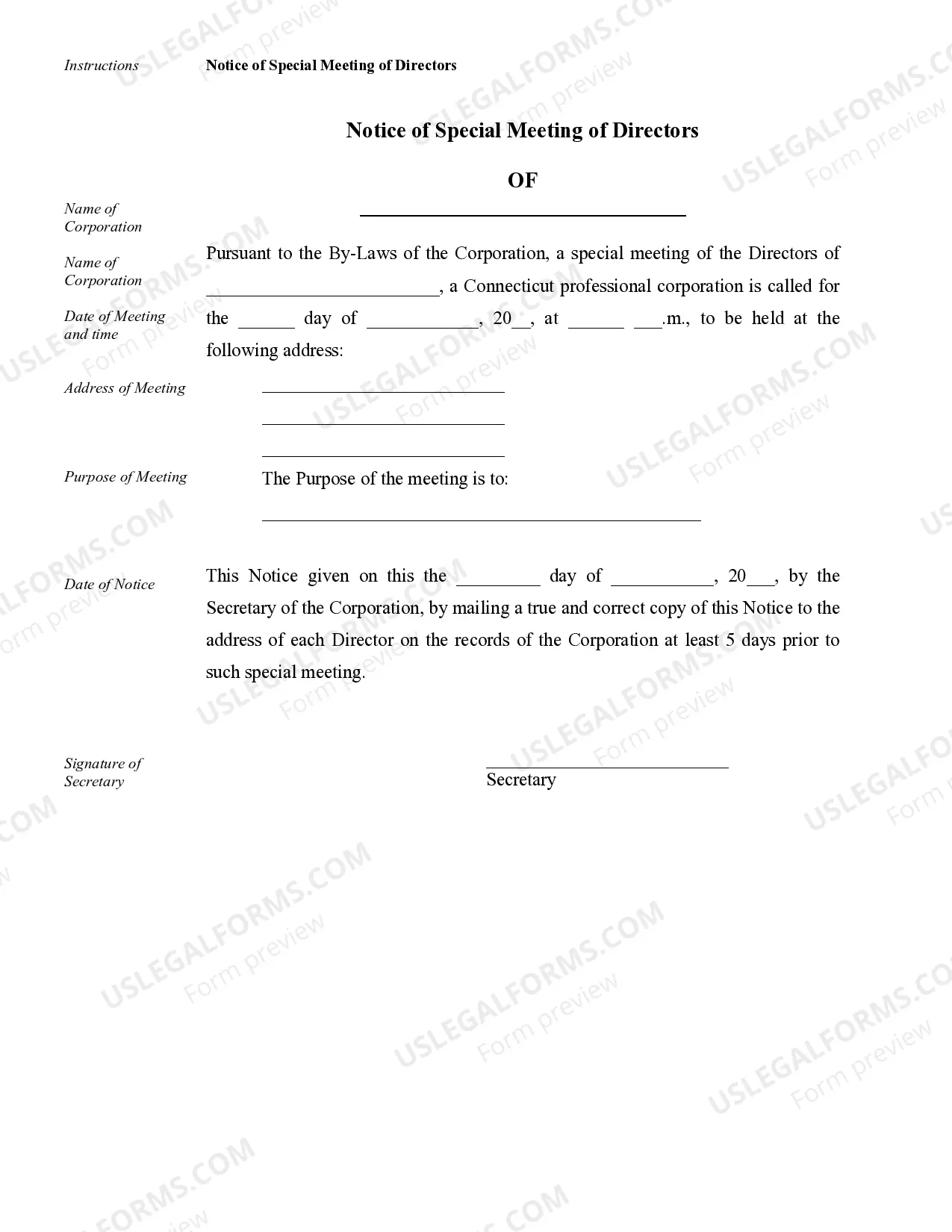

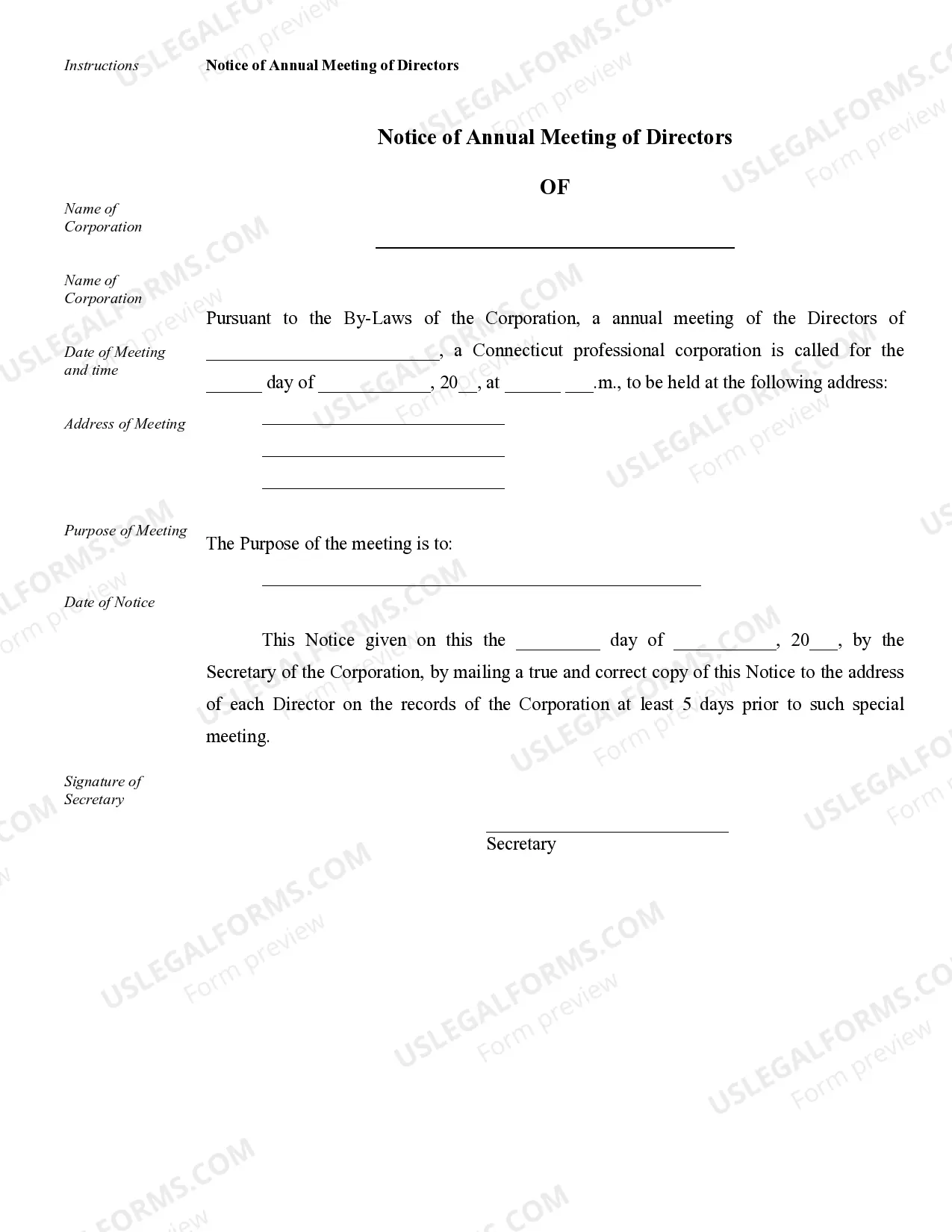

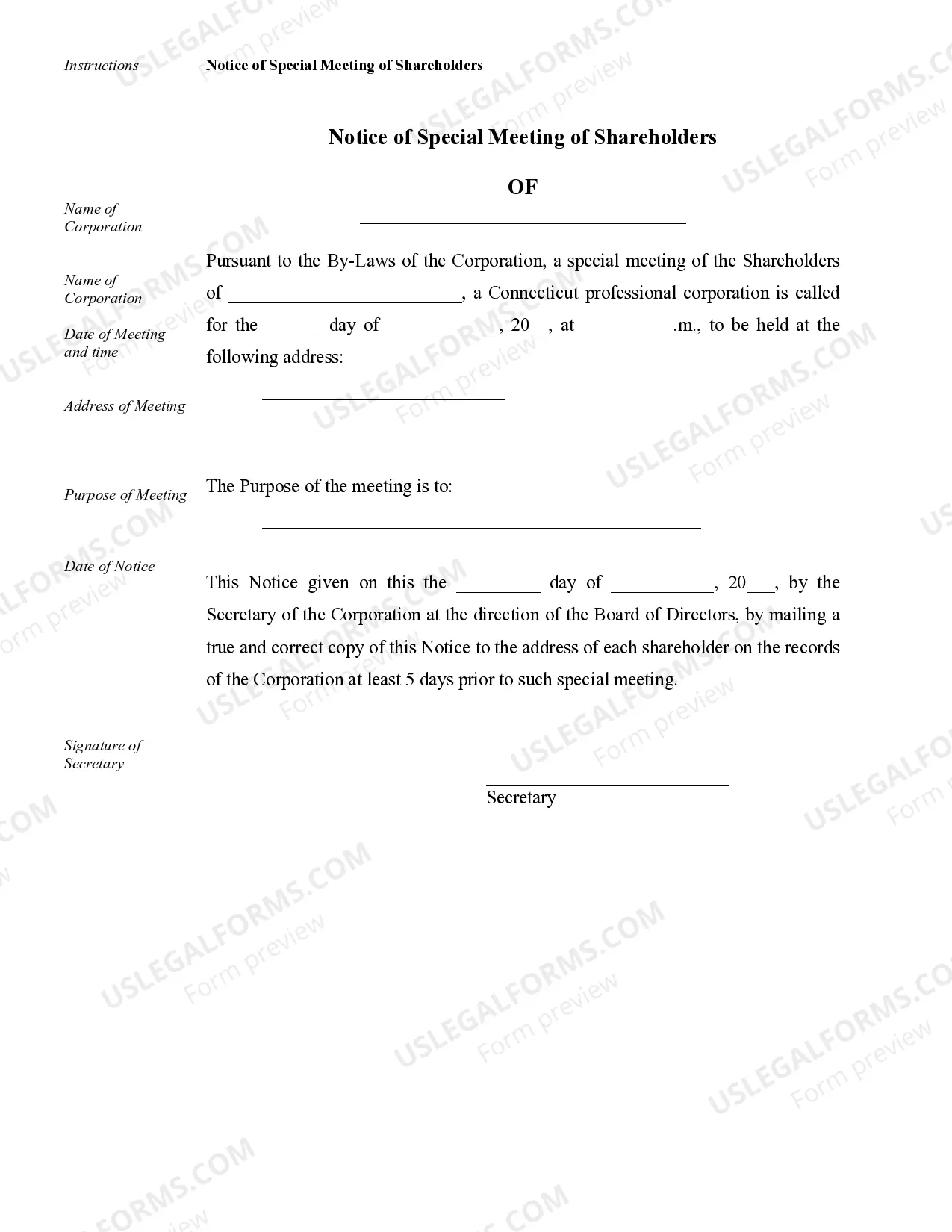

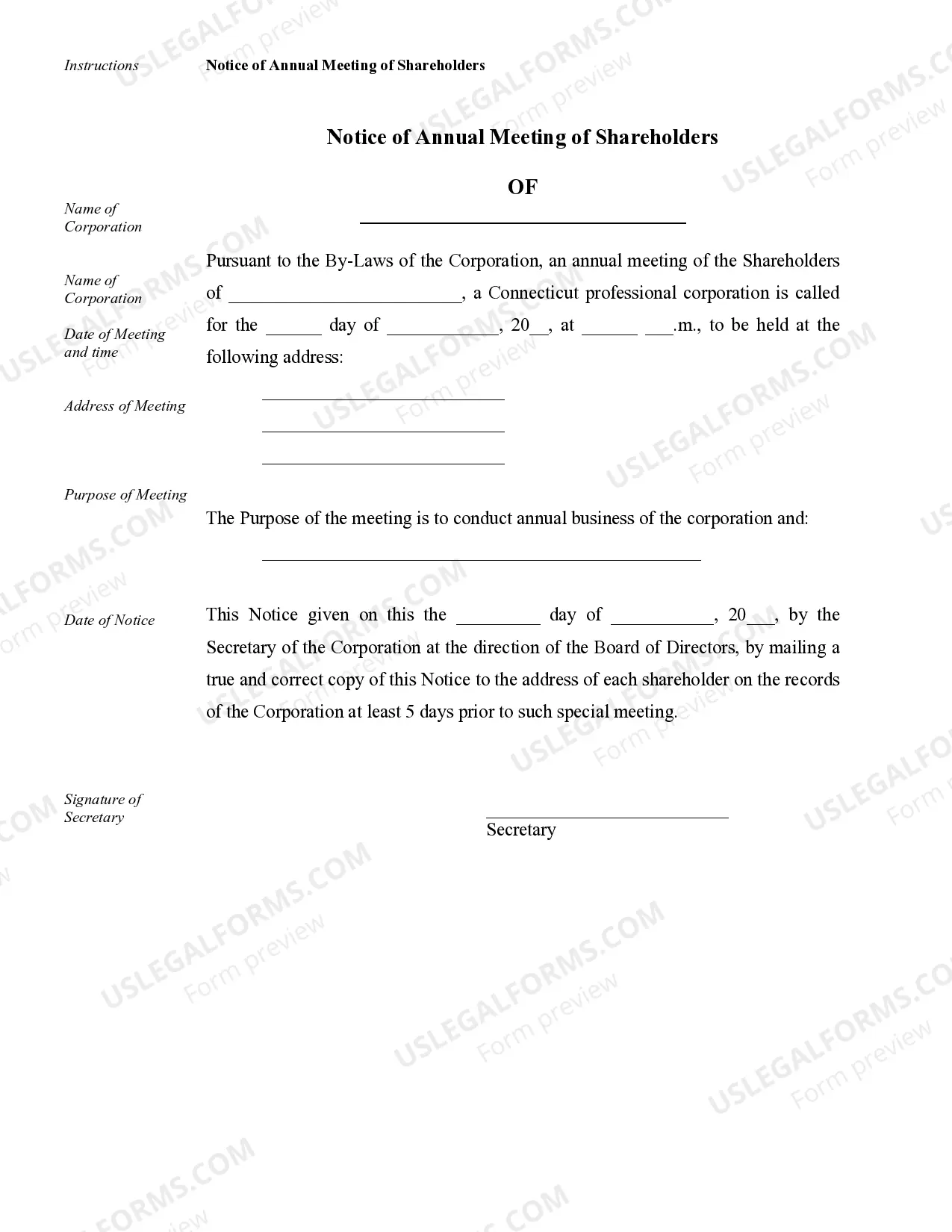

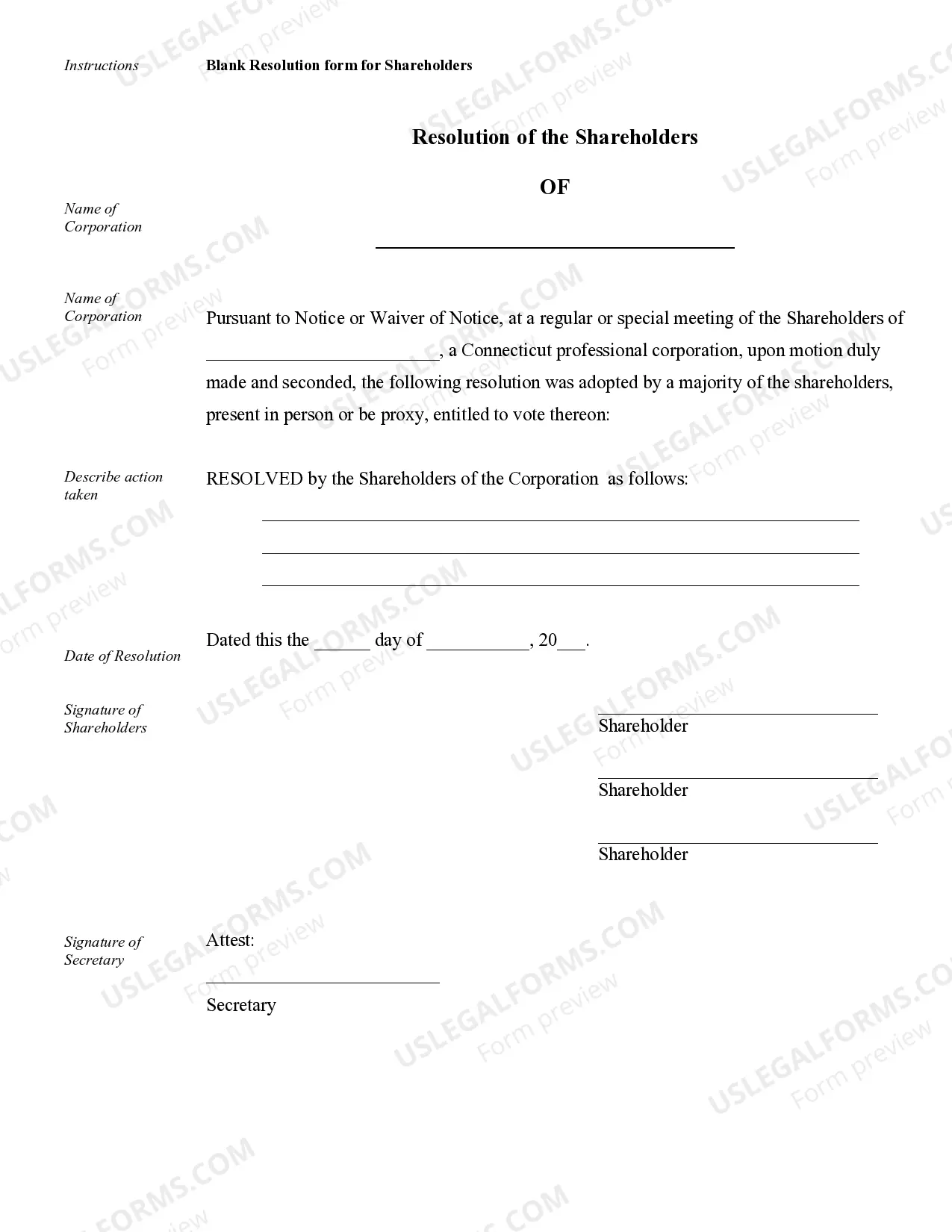

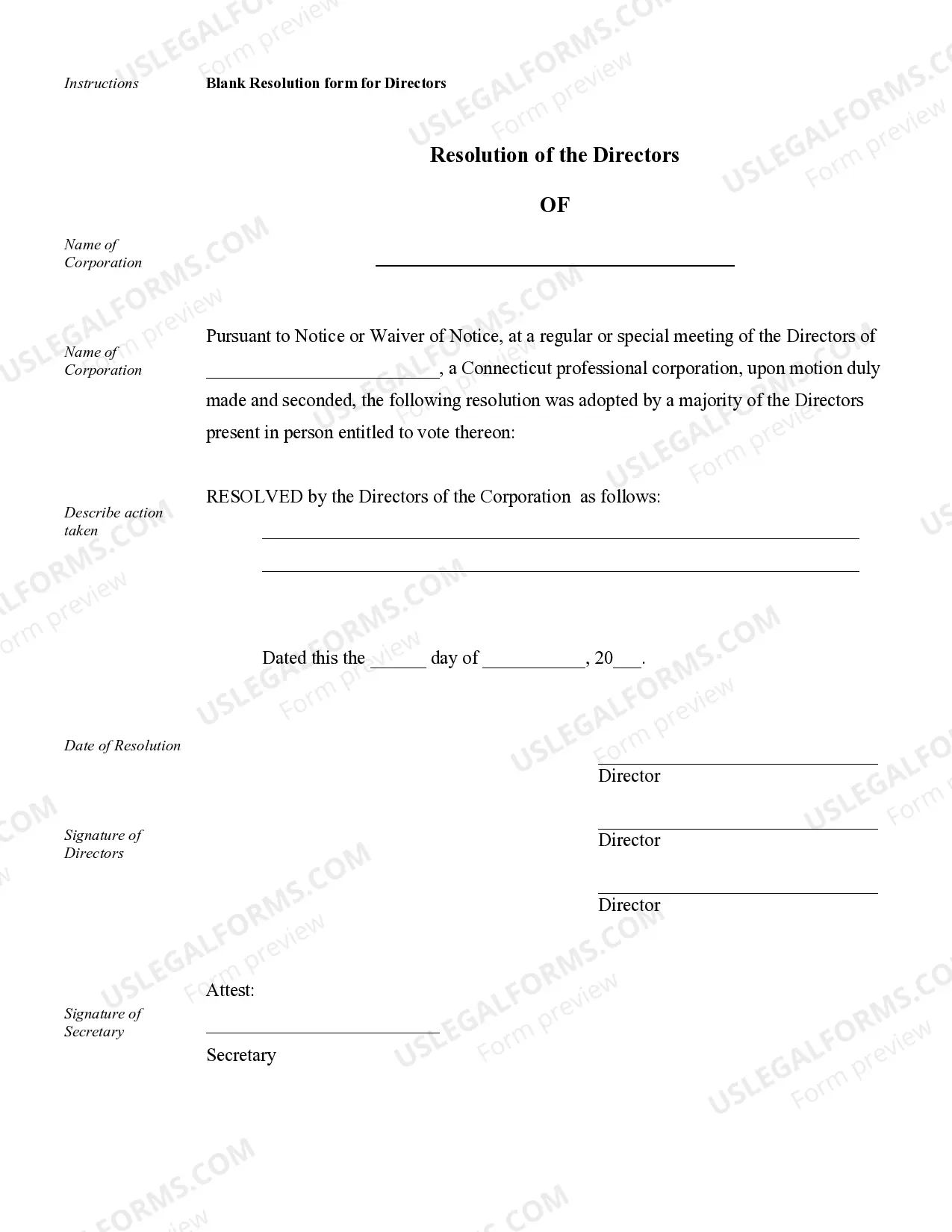

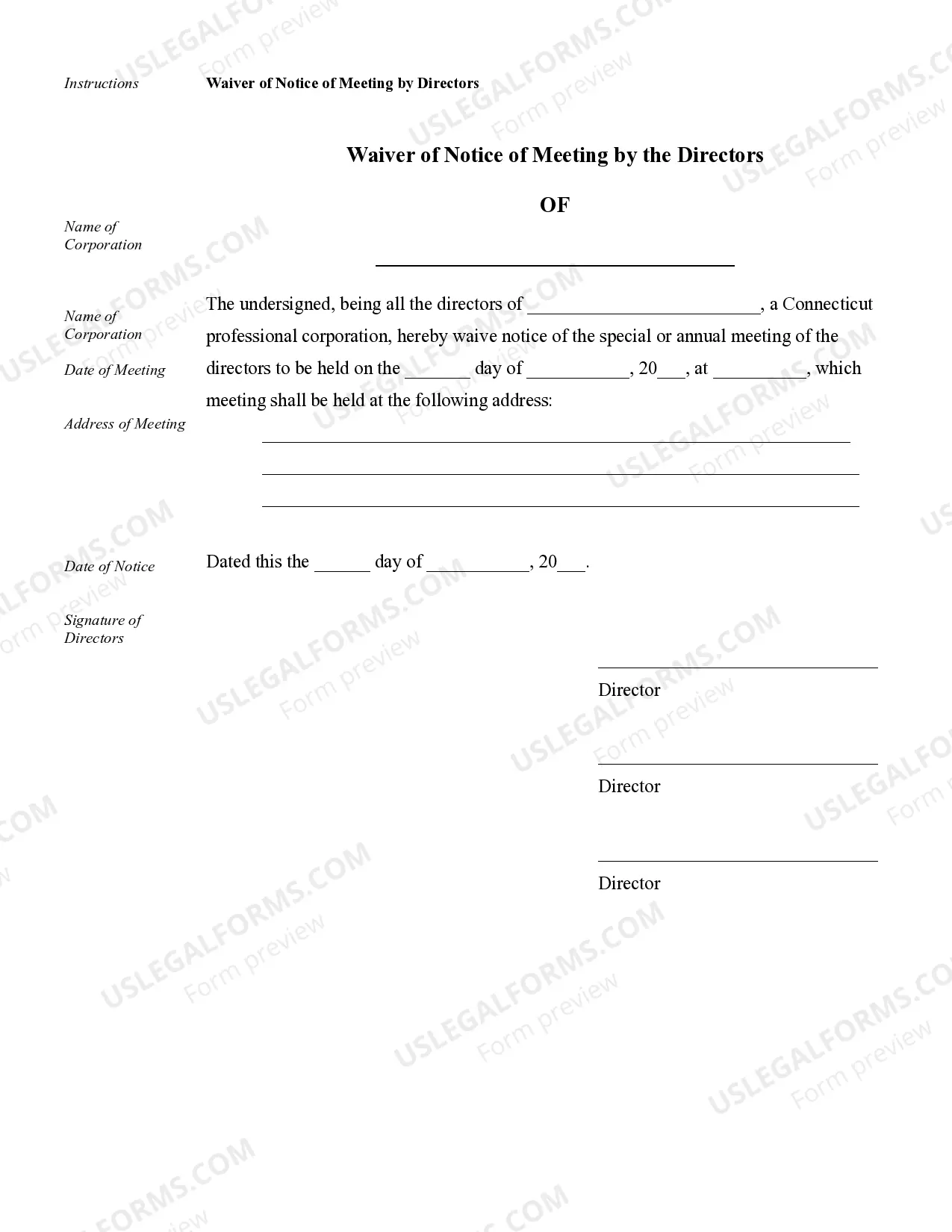

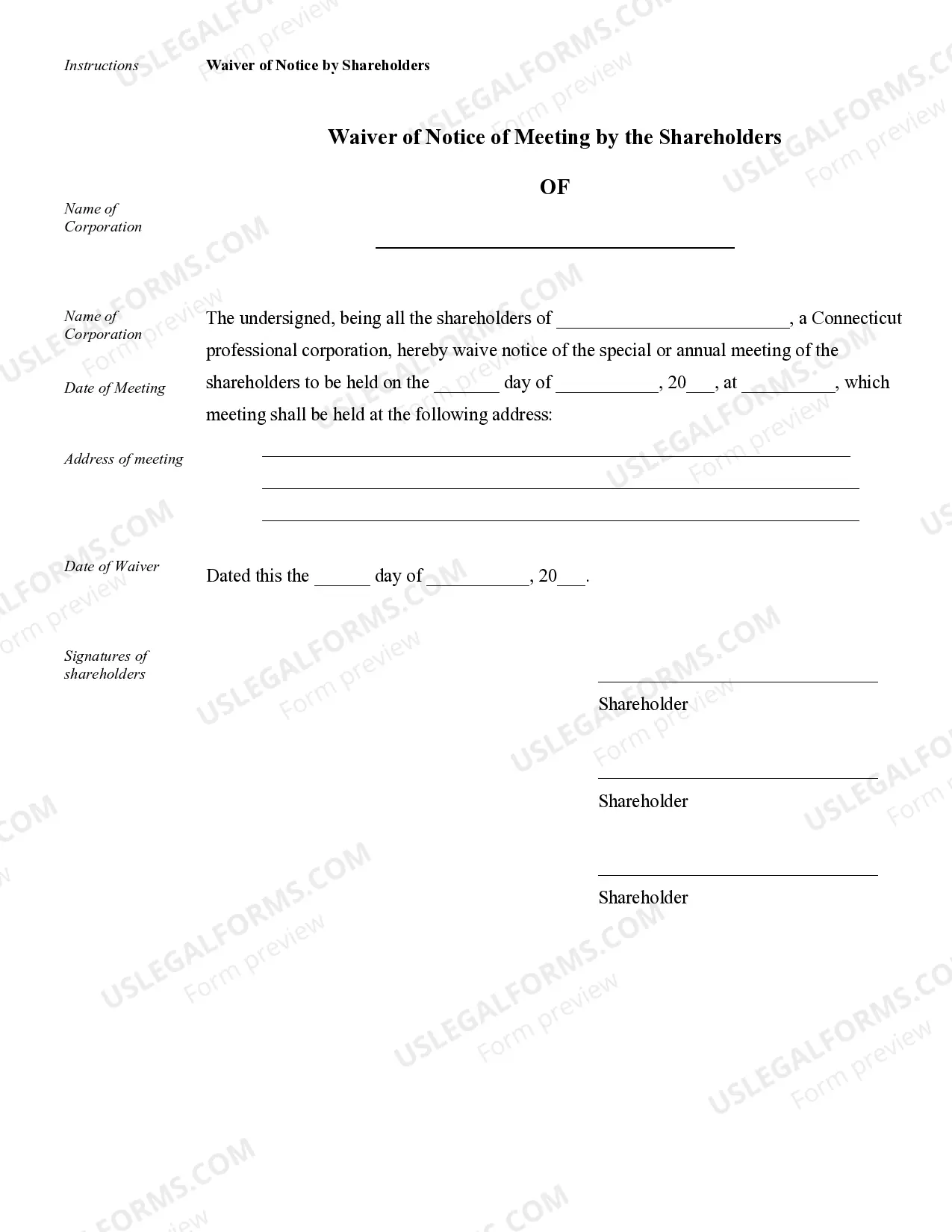

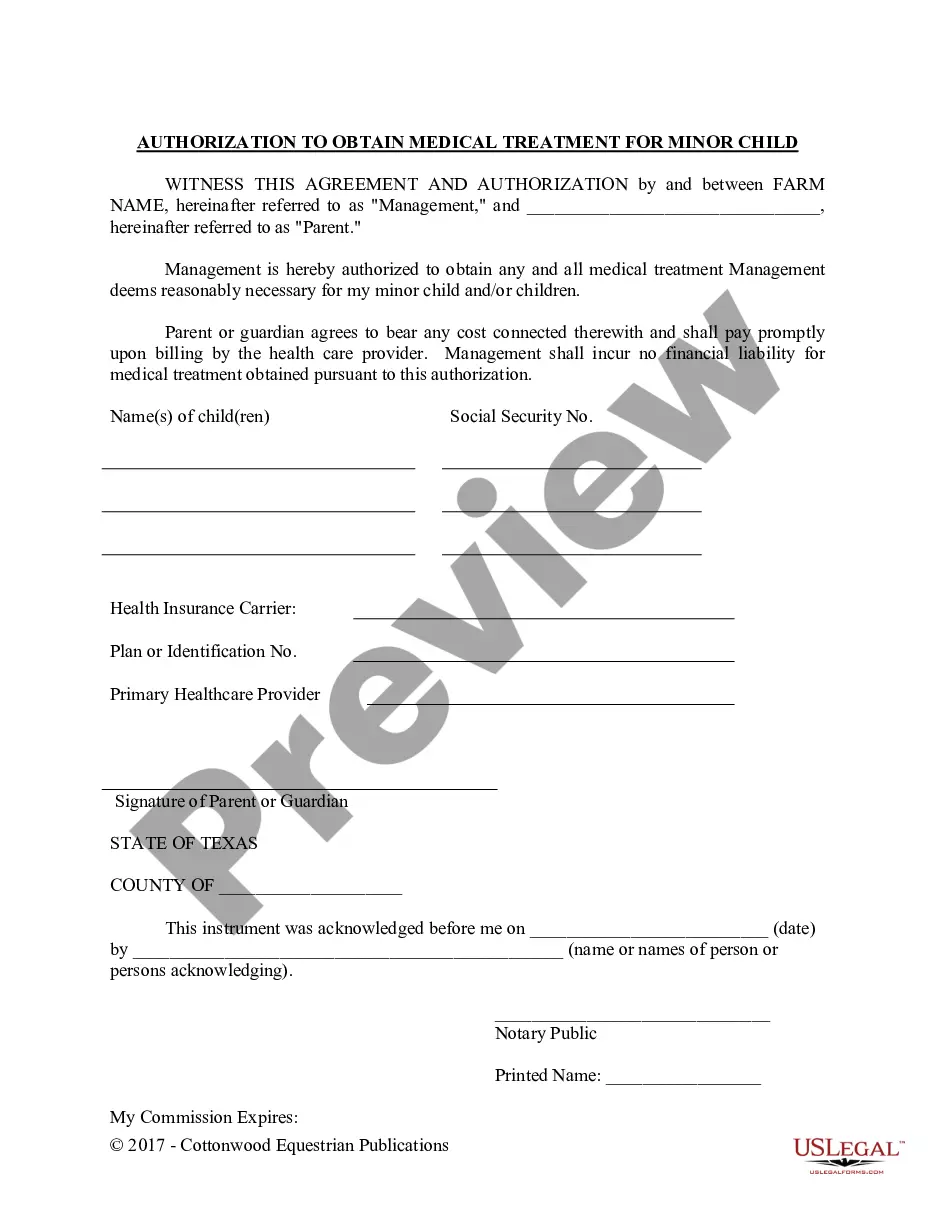

Stamford Sample Corporate Records for a Connecticut Professional Corporation play a crucial role in maintaining accurate and organized documentation related to the company's operations, activities, and legal compliance. These records serve as a comprehensive record keeping system, ensuring transparency and enabling easy reference when necessary. Various types of corporate records are essential for a Connecticut Professional Corporation based in Stamford in order to meet legal requirements and professional standards. 1. Articles of Incorporation: This document marks the foundation of the Connecticut Professional Corporation and contains essential information such as the company's name, purpose, registered agent, principal office address, and the names and addresses of initial directors. 2. Bylaws: Bylaws outline the internal rules and regulations that govern the corporation's operations, including procedures for meetings, election of directors, officer roles and responsibilities, voting procedures, and other aspects of corporate governance. These records ensure consistency and clarity in decision-making processes. 3. Meeting Minutes: Detailed minutes of corporate meetings, such as board of directors' meetings and annual shareholders' meetings, are crucial records that document important discussions, resolutions, and actions taken during these meetings. They provide a comprehensive account of the corporation's decision-making process and demonstrate adherence to legal requirements. 4. Shareholder Agreements: If applicable, shareholder agreements outline the rights, responsibilities, and obligations of the shareholders, as well as provisions for share transfers, dispute resolution, and other matters relevant to the corporation's ownership structure. 5. Stock Certificates and Stock Transfer Ledger: Stock certificates represent ownership interests in the corporation and should be issued to shareholders upon purchase. The stock transfer ledger maintains a record of all stock issuance, transfers, and shareholder details, ensuring accurate ownership information. 6. Board Resolutions: These records document the decisions made by the board of directors in various matters concerning the corporation, such as approval of financial transactions, major contractual agreements, employment decisions, and strategic initiatives. Board resolutions serve as legal evidence of the corporation's actions. 7. Financial Records: Comprehensive financial records including financial statements, tax returns, bank statements, and accounting records are essential for maintaining the corporation's financial health, ensuring compliance with tax regulations, and demonstrating financial transparency to stakeholders. 8. Annual Reports: Connecticut Professional Corporations are required to file annual reports with the Connecticut Secretary of State. These reports contain updated information about the corporation's leadership, contact details, business activities, and other relevant information to keep the state authorities informed. Accurate and well-organized Stamford Sample Corporate Records for a Connecticut Professional Corporation are vital to maintaining legal compliance, facilitating business operations, and ensuring transparency. Proper documentation of these different types of records allows the corporation to demonstrate professionalism, enhance credibility, mitigate legal risks, and facilitate smooth communication and decision-making.Stamford Sample Corporate Records for a Connecticut Professional Corporation play a crucial role in maintaining accurate and organized documentation related to the company's operations, activities, and legal compliance. These records serve as a comprehensive record keeping system, ensuring transparency and enabling easy reference when necessary. Various types of corporate records are essential for a Connecticut Professional Corporation based in Stamford in order to meet legal requirements and professional standards. 1. Articles of Incorporation: This document marks the foundation of the Connecticut Professional Corporation and contains essential information such as the company's name, purpose, registered agent, principal office address, and the names and addresses of initial directors. 2. Bylaws: Bylaws outline the internal rules and regulations that govern the corporation's operations, including procedures for meetings, election of directors, officer roles and responsibilities, voting procedures, and other aspects of corporate governance. These records ensure consistency and clarity in decision-making processes. 3. Meeting Minutes: Detailed minutes of corporate meetings, such as board of directors' meetings and annual shareholders' meetings, are crucial records that document important discussions, resolutions, and actions taken during these meetings. They provide a comprehensive account of the corporation's decision-making process and demonstrate adherence to legal requirements. 4. Shareholder Agreements: If applicable, shareholder agreements outline the rights, responsibilities, and obligations of the shareholders, as well as provisions for share transfers, dispute resolution, and other matters relevant to the corporation's ownership structure. 5. Stock Certificates and Stock Transfer Ledger: Stock certificates represent ownership interests in the corporation and should be issued to shareholders upon purchase. The stock transfer ledger maintains a record of all stock issuance, transfers, and shareholder details, ensuring accurate ownership information. 6. Board Resolutions: These records document the decisions made by the board of directors in various matters concerning the corporation, such as approval of financial transactions, major contractual agreements, employment decisions, and strategic initiatives. Board resolutions serve as legal evidence of the corporation's actions. 7. Financial Records: Comprehensive financial records including financial statements, tax returns, bank statements, and accounting records are essential for maintaining the corporation's financial health, ensuring compliance with tax regulations, and demonstrating financial transparency to stakeholders. 8. Annual Reports: Connecticut Professional Corporations are required to file annual reports with the Connecticut Secretary of State. These reports contain updated information about the corporation's leadership, contact details, business activities, and other relevant information to keep the state authorities informed. Accurate and well-organized Stamford Sample Corporate Records for a Connecticut Professional Corporation are vital to maintaining legal compliance, facilitating business operations, and ensuring transparency. Proper documentation of these different types of records allows the corporation to demonstrate professionalism, enhance credibility, mitigate legal risks, and facilitate smooth communication and decision-making.