The Will you have found is for a divorced person, not remarried with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

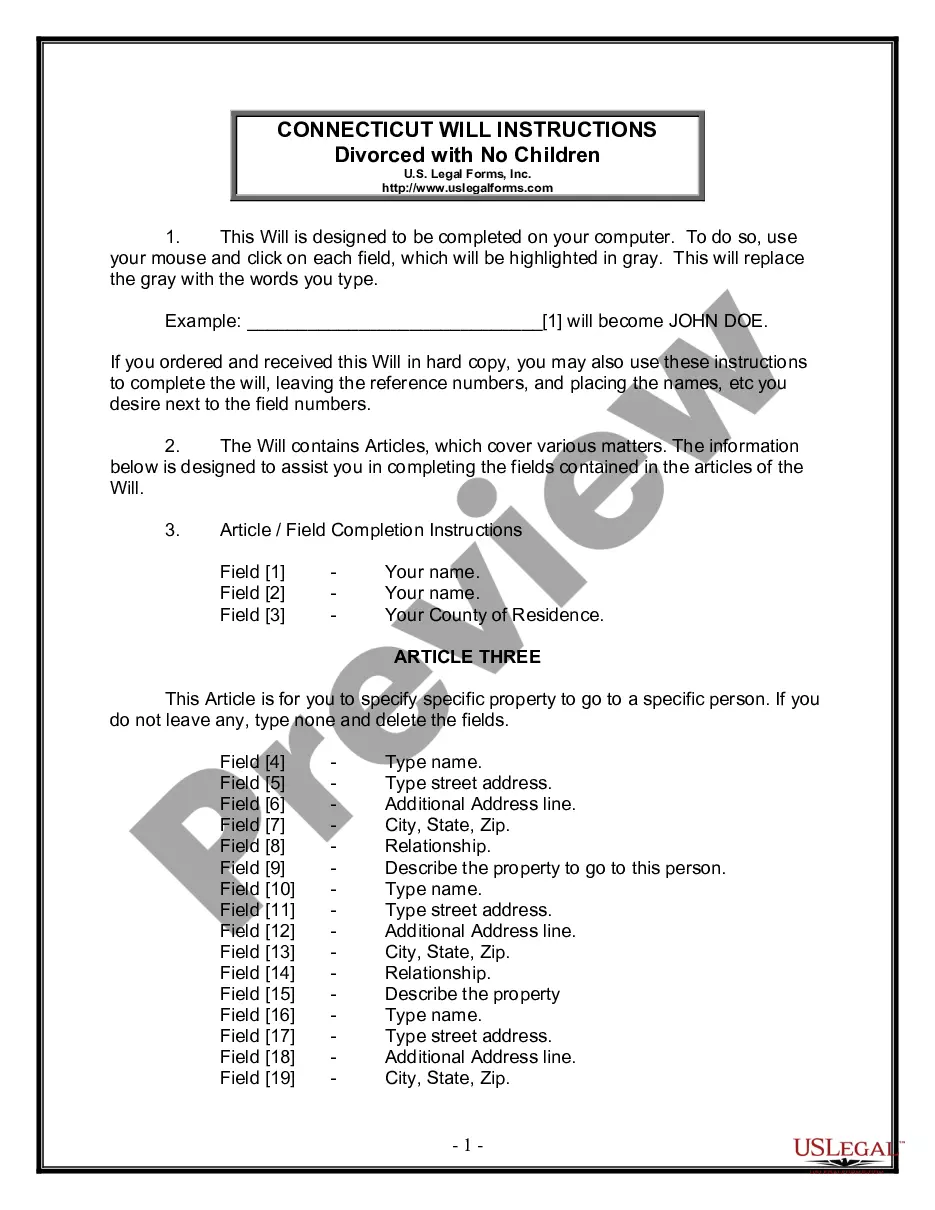

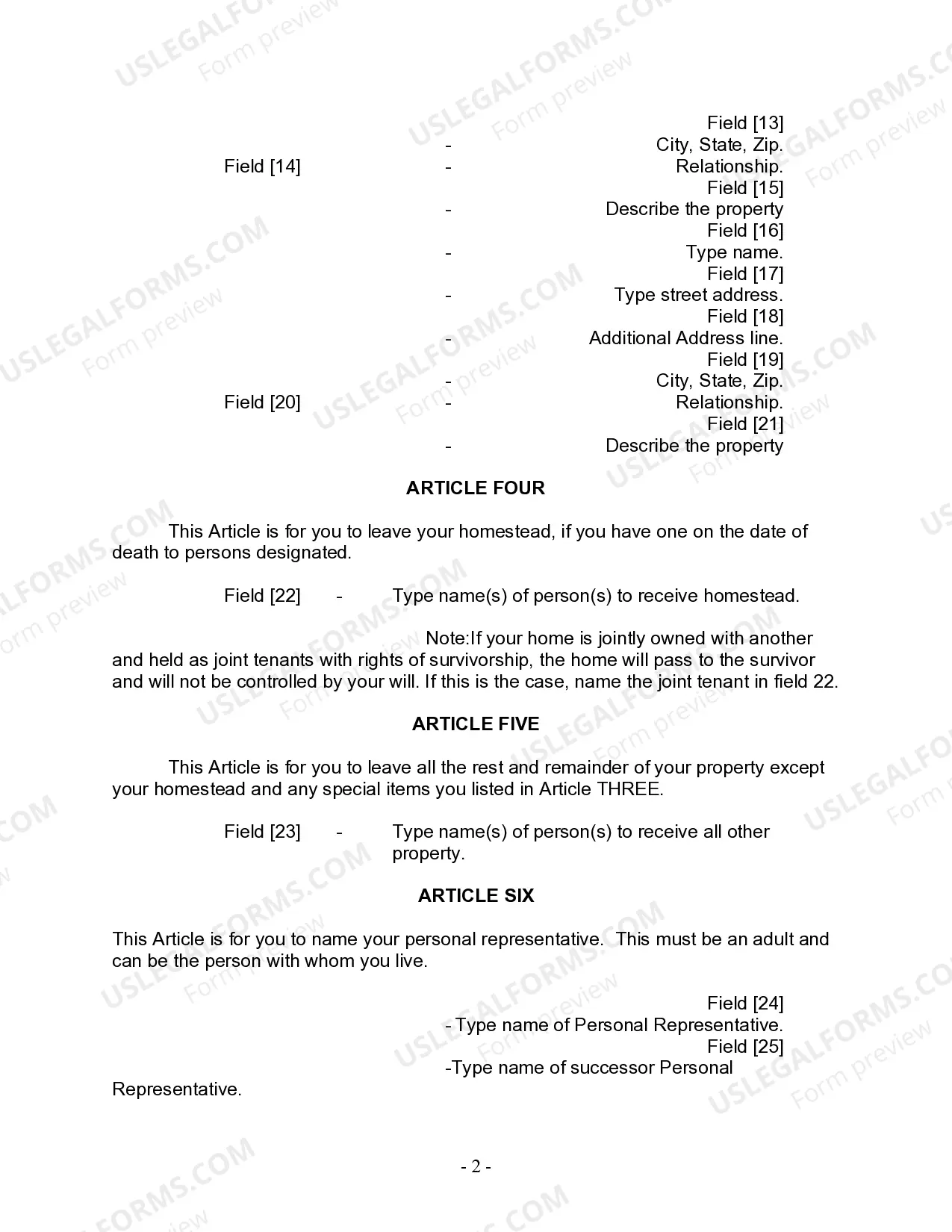

The Bridgeport Connecticut Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legal document specifically designed for individuals who have been divorced, have no intention of getting remarried, and do not have any children. This form allows individuals to outline their specific wishes and distribution of assets after their passing. This Bridgeport Connecticut Legal Last Will and Testament Form is ideal for divorced individuals with no children, as it provides a comprehensive way to ensure that their assets are distributed according to their personal preferences. It allows them to appoint an executor who will be responsible for carrying out their wishes and settling their affairs. The key elements that this form typically covers include: 1. Personal Information: The form begins by capturing the essential personal details of the testator, including their legal name, address, and contact information. 2. Executor Appointment: This section enables the testator to appoint an executor who will be responsible for managing and distributing the estate as per their wishes. The chosen executor should be someone trustworthy and capable of handling the responsibilities efficiently. 3. Asset Distribution: The form allows the testator to provide specific instructions regarding the distribution of their assets, such as real estate properties, bank accounts, investments, personal belongings, and other valuable possessions. Individuals can distribute their assets to charitable organizations, family members, friends, or any other beneficiaries they choose. 4. Beneficiary Designation: Here, the testator can designate beneficiaries for specific assets and include their names, relationships, and contact information to ensure clarity and smooth asset transfer. 5. Alternate Beneficiaries: In case the primary beneficiaries predecease the testator or are unable to receive the designated assets, the form allows for the appointment of alternate beneficiaries. This ensures that assets will be distributed to desired individuals or organizations. 6. Specific Bequests: The testator may include any specific gifts or bequests they want to allocate to individuals or organizations, such as sentimental items or financial donations. 7. Guardianship Nomination: If the testator has any minor children from a previous marriage, this section allows them to nominate a guardian(s) who will take care of the children in the event of their passing. It's important to note that while this form is specifically designed for divorced individuals with no children, there may be additional variations available depending on the specific requirements of each individual. It is always recommended consulting with a qualified attorney or legal professional familiar with Bridgeport, Connecticut laws to ensure the completion of the appropriate legal last will and testament form tailored to your circumstances.The Bridgeport Connecticut Legal Last Will and Testament Form for Divorced Person Not Remarried with No Children is a legal document specifically designed for individuals who have been divorced, have no intention of getting remarried, and do not have any children. This form allows individuals to outline their specific wishes and distribution of assets after their passing. This Bridgeport Connecticut Legal Last Will and Testament Form is ideal for divorced individuals with no children, as it provides a comprehensive way to ensure that their assets are distributed according to their personal preferences. It allows them to appoint an executor who will be responsible for carrying out their wishes and settling their affairs. The key elements that this form typically covers include: 1. Personal Information: The form begins by capturing the essential personal details of the testator, including their legal name, address, and contact information. 2. Executor Appointment: This section enables the testator to appoint an executor who will be responsible for managing and distributing the estate as per their wishes. The chosen executor should be someone trustworthy and capable of handling the responsibilities efficiently. 3. Asset Distribution: The form allows the testator to provide specific instructions regarding the distribution of their assets, such as real estate properties, bank accounts, investments, personal belongings, and other valuable possessions. Individuals can distribute their assets to charitable organizations, family members, friends, or any other beneficiaries they choose. 4. Beneficiary Designation: Here, the testator can designate beneficiaries for specific assets and include their names, relationships, and contact information to ensure clarity and smooth asset transfer. 5. Alternate Beneficiaries: In case the primary beneficiaries predecease the testator or are unable to receive the designated assets, the form allows for the appointment of alternate beneficiaries. This ensures that assets will be distributed to desired individuals or organizations. 6. Specific Bequests: The testator may include any specific gifts or bequests they want to allocate to individuals or organizations, such as sentimental items or financial donations. 7. Guardianship Nomination: If the testator has any minor children from a previous marriage, this section allows them to nominate a guardian(s) who will take care of the children in the event of their passing. It's important to note that while this form is specifically designed for divorced individuals with no children, there may be additional variations available depending on the specific requirements of each individual. It is always recommended consulting with a qualified attorney or legal professional familiar with Bridgeport, Connecticut laws to ensure the completion of the appropriate legal last will and testament form tailored to your circumstances.