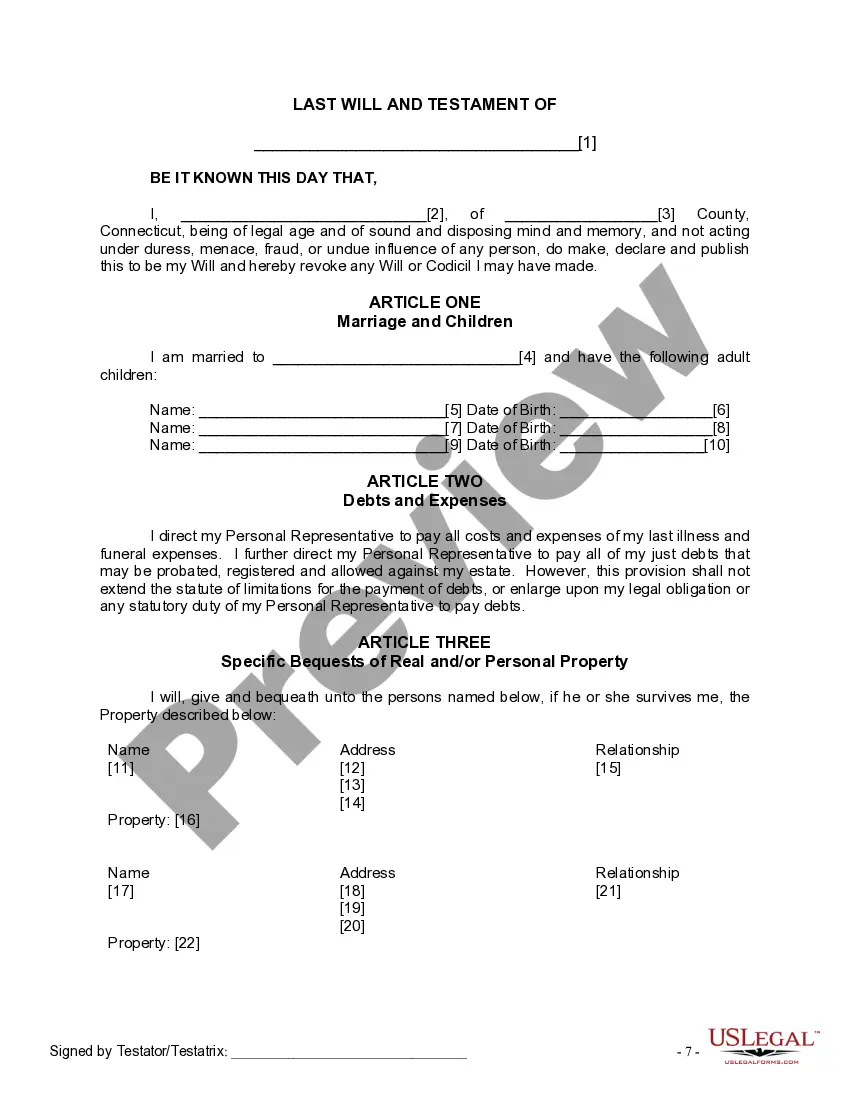

The Will you have found is for a married person with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children.

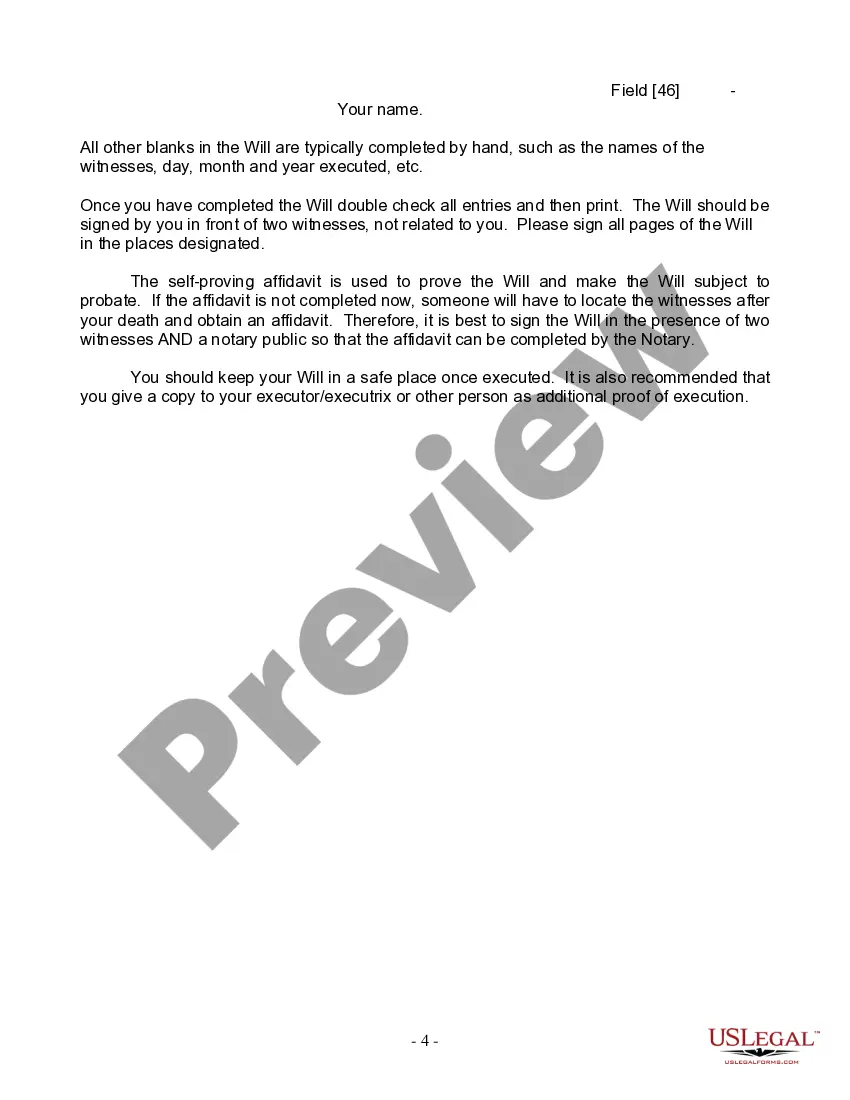

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Bridgeport Connecticut Legal Last Will and Testament Form for Married Person with Adult Children is a legally binding document that allows married individuals to outline their final wishes regarding the distribution of their assets and the care of their children after their passing. This comprehensive form ensures that their estate is properly managed and divided among their adult children according to their preferences. Key features of this Bridgeport Connecticut Legal Last Will and Testament Form for Married Person with Adult Children include: 1. Distribution of Assets: This form enables individuals to specify how their assets, such as property, finances, investments, and personal belongings, should be distributed among their adult children. It allows the testator (the person creating the will) to allocate specific items or percentages of their estate to each adult child. 2. Appointment of Executor: A crucial aspect of this legal document is the appointment of an executor, the person responsible for administering the estate and ensuring that the wishes stated in the will are carried out. The testator can name their spouse as the primary executor or choose an alternative executor if preferred. 3. Guardianship of Minor Children: In cases where there are minor children, this form grants the opportunity to designate a guardian who will be responsible for their care until they reach adulthood. However, since this specific form pertains to married individuals with adult children, the appointment of guardianship is not necessary. 4. Residuary Clause: This clause is included in the will to account for any assets or property that were not explicitly addressed in the distribution section. It ensures that any remaining assets are properly allocated among the adult children. Different types or variations of this Bridgeport Connecticut Legal Last Will and Testament Form for Married Person with Adult Children may exist, reflecting individual preferences and specific circumstances. These could include: 1. Simple Last Will and Testament Form: A basic form that covers the fundamental elements of a will, such as asset distribution and executor appointment. 2. Living Will and Testament Form: This type of will includes provisions for healthcare decisions and end-of-life wishes, allowing individuals to state their preferences regarding medical treatment in case they become incapacitated. 3. Joint Last Will and Testament Form: A will created jointly by both spouses, which details their combined wishes regarding asset distribution and guardianship of minor children. 4. Testamentary Trust Will Form: This form establishes a trust to safeguard assets and ensures their appropriate management and distribution to adult children. It is important to note that consulting an attorney is advisable when creating a will to ensure accuracy, compliance with legal requirements, and alignment with individual circumstances.Bridgeport Connecticut Legal Last Will and Testament Form for Married Person with Adult Children is a legally binding document that allows married individuals to outline their final wishes regarding the distribution of their assets and the care of their children after their passing. This comprehensive form ensures that their estate is properly managed and divided among their adult children according to their preferences. Key features of this Bridgeport Connecticut Legal Last Will and Testament Form for Married Person with Adult Children include: 1. Distribution of Assets: This form enables individuals to specify how their assets, such as property, finances, investments, and personal belongings, should be distributed among their adult children. It allows the testator (the person creating the will) to allocate specific items or percentages of their estate to each adult child. 2. Appointment of Executor: A crucial aspect of this legal document is the appointment of an executor, the person responsible for administering the estate and ensuring that the wishes stated in the will are carried out. The testator can name their spouse as the primary executor or choose an alternative executor if preferred. 3. Guardianship of Minor Children: In cases where there are minor children, this form grants the opportunity to designate a guardian who will be responsible for their care until they reach adulthood. However, since this specific form pertains to married individuals with adult children, the appointment of guardianship is not necessary. 4. Residuary Clause: This clause is included in the will to account for any assets or property that were not explicitly addressed in the distribution section. It ensures that any remaining assets are properly allocated among the adult children. Different types or variations of this Bridgeport Connecticut Legal Last Will and Testament Form for Married Person with Adult Children may exist, reflecting individual preferences and specific circumstances. These could include: 1. Simple Last Will and Testament Form: A basic form that covers the fundamental elements of a will, such as asset distribution and executor appointment. 2. Living Will and Testament Form: This type of will includes provisions for healthcare decisions and end-of-life wishes, allowing individuals to state their preferences regarding medical treatment in case they become incapacitated. 3. Joint Last Will and Testament Form: A will created jointly by both spouses, which details their combined wishes regarding asset distribution and guardianship of minor children. 4. Testamentary Trust Will Form: This form establishes a trust to safeguard assets and ensures their appropriate management and distribution to adult children. It is important to note that consulting an attorney is advisable when creating a will to ensure accuracy, compliance with legal requirements, and alignment with individual circumstances.